Tax collection increases 28% to Rs640b

FBR needs 25.5% growth to achieve target for this fiscal year.

Tax authorities have netted Rs640 billion in the first five months of fiscal 2011, depicting 28% growth in revenue generation and allaying the International Monetary Fund’s concerns that tax collection may fall due to slowdown in economic growth.

The provisional tax figures also provide proved to be an encouraging development for the economic managers who are struggling to control the budget deficit. For the current fiscal year, the targeted deficit is 4% of the total national output of Rs850 billion, a goalpost the IMF believes would be hard to hit by end June.

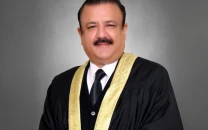

The Federal Board of Revenue has so far collected Rs640 billion taxes from July through November 2011, Board Chairman Salman Siddique told The Express Tribune while adding that the figure may go up as the final numbers become available in the next few days.

The break-up of the total taxes was not available as the FBR reported figures on the online bank reporting system. The FBR collected Rs131 billion in November alone, said the FBR official.

The IMF had argued in recently held talks that the FBR may not be able to sustain healthy growth and may opt to either revise the target or raise new taxes. The government has set Rs1,952 billion collection target for the current fiscal year. To achieve this target, FBR needs to have 25.5% growth rate over the collection of last year which remained at Rs1,558 billion.

Due to FBR’s belief that it could achieve the target without additional measures the authorities have deferred a decision on either revising the target or levying new taxes until March 2012.

Independent tax experts have termed Rs1,952 billion target unrealistic and over ambitious but the first five months collection results have so far proven them wrong as the growth rate is much higher than required rate.

The numbers are quite good and provide the much-needed relief, said former FBR chairman and member of Tax Reforms Coordination Group Abdullah Yousaf. He, however, said that it was yet to be determined the extent of FBR’s efforts in achieving the monthly targets and the impact of the revenue measures that the government took in mid of last March.

On March 15, the FBR had withdrawn exemption of sales tax on fertiliser, pesticides and tractors. The facility of zero-rating on plant, machinery and equipment including parts also was taken away for unregistered importers. Moreover, it had net domestic sales of five major-export oriented sectors –textiles, carpets, leather, sporting goods and surgical goods – at rates between 4 and 6 per cent.

It is widely believed and evident from the first four months detailed data of collection that these new sectors have helped pull the growth upwards at a time when the economy is passing through a difficult time.

The FBR’s detailed data available up to November 21 showed that sales tax remained the main driver behind the unprecedented growth in revenue collection, particularly at the import stage. During the period under review, a phenomenal growth of 48% was recorded in sales tax collection.

Published in The Express Tribune, December 1st, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ