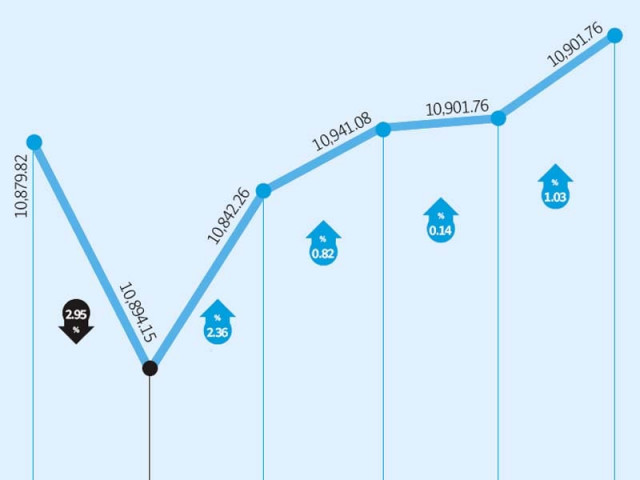

Investors chose to put aside concerns surrounding deteriorating ties between Pakistan and the United States as the stock market continued to make solid gains. The benchmark KSE-100 index rose 1.3 per cent (156 points) during the week ended September 30.

The index had risen by 2.2 per cent (253 points) in the prior week, following revelation of surprisingly low inflation numbers for August. Low inflation numbers have led to speculation that the State Bank of Pakistan will reduce the discount rate in its upcoming monetary policy announcement on October 8.

The SBP, in July, had cut the discount rate by 50 basis points to 13.5 per cent, citing that inflation numbers were expected to remain close to 12 per cent. However, inflation for August stood at 11.56 per cent and is expected to be even lower for September, raising hopes for a further easing by the central bank.

Relations between the US and Pakistan remained tense, but investors were somewhat soothed by diplomatic engagements of the country with neighbours including China and Iran. US senators also toned down their rhetoric towards the end of the week, which provided a boost to the market. Foreigners were highly active as they were gross buyers of Rs890 million and gross sellers of Rs1.5 billion worth of shares during the week, according to data maintained by the National Clearing Company of Pakistan Limited

Earlier in the week, the market opened on a negative note and fell sharply by 341 points in the first trading session. However, a recovery was witnessed in the remaining four sessions and the index managed to claw back the losses and close on a positive note.

The announcement at the end of the week that National Savings Scheme rates had been reduced, affirmed investor belief of a rate cut and provided momentum to the market.

Fertiliser offtake rose by 84 per cent in August and even higher numbers are expected for September. The fertiliser sector, as a result, outperformed the market by 2.7 per cent as Engro Corporation grew by 6.8 per cent during the week. Furthermore, the FBR reported that provisional tax collection numbers for the first quarter of FY12 stood at Rs352 billion against the target of around Rs362 billion.

Average volumes stood at 83 million shares per day, up 16 per cent from the previous week.

What to expect?

The market’s focus will now shift to the upcoming monetary policy announcement, where it is expected that a rate cut of 50 basis points will be announced. However, a rate cut of 100 basis points cannot be ruled out, owing to low inflation numbers after the change of base year of the Consumer Price Index (CPI).

Improvements in ties between Pakistan and the US should also provide a boost to the market, after having a negative impact in the past two weeks.

Monday, September 26

The stock market took a nosedive on panic selling as investor sentiments dropped on the back of heightened tensions with the US and falling global markets.

Tuesday, September 27

The local bourse duly followed global markets again to recover from the massive fall witnessed the preceding day.

Wednesday, September 28

The local bourse continued the bull-run with investors focusing on local triggers and ignoring US tensions. News that US lawmakers are seeking to cut all aid to Pakistan did not surpass the Karachi Stock Exchange walls.

Thursday,

September 29

The stock market wandered around the neutral line before closing up as mixed investor sentiments prevailed. Investors carefully watched the gathering of all political parties along with senior army officials to discuss tensions with the US.

Friday, September 30

The stock market continued its upward trend on Friday, making it four days straight the market ended on a positive note. Oil marketing companies led the bull-run as petroleum prices are expected to be increase by 2.5% to 6% in its monthly review later on Friday.

Published in The Express Tribune, October 2nd, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ