Weekly review: KSE-100 recovery continues despite global economic concerns

Volumes fall sharply as results season culminates and monsoons hit Karachi.

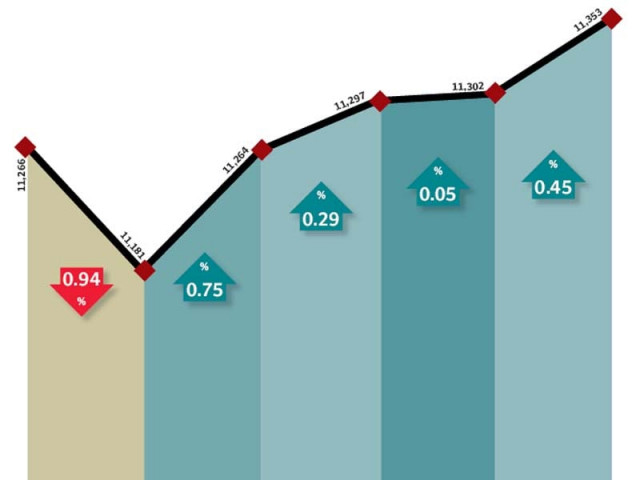

Global economic concerns had little bearing on the Karachi Stock Exchange (KSE) as it continued to recover from the bear onslaught witnessed in August. The benchmark KSE-100 index closed the week in the green, climbing 0.6% (67 points) during the week ended September 16.

The KSE-100 index managed to outperform regional indices by 1.8% during the week, as global markets remained fragile on news of the intensifying European financial crisis and the ratings downgrade of French banks by Moody’s.

The index received a hammering in the month of August and fell almost 10% amidst the US debt and European financial crises. However, attractive valuations and strong fiscal year 2011 earnings have resulted in a cautious recovery for the index despite the ongoing issues in the global economy.

Although the index continued to climb, trade volumes declined as the corporate earnings season drew to a close during the week. Monsoons also hit Karachi hard, leaving the city’s transport network crippled, which resulted in subdued market participation.

Foreigners also became net sellers of equity, and sold around $1 million worth of equity during the week. The change in direction of foreign flows may indicate further selling of equity by foreigners in the coming weeks and should be looked upon carefully by investors.

All in all, it was a rather uneventful week for the KSE, with the highlight of the week being the results of the Attock Group companies. The group comprises of Attock Petroleum (APL), Pakistan Oilfields (POL), National Refinery (NRL) and Attock Refinery (ATRL) and is a major played in the all-important oil sector.

APL’s earnings rose by 18%, while POL’s earnings shot up by 45% for the year. Both companies announced a dividend of Rs30 and Rs25 year-end dividend respectively. As a result APL’s share price rose by 4.2%. However, POL’s result left investors unimpressed and fell slightly during the week.

NRL’s dividend of Rs25 per share was below expectations and resulted in its share price falling by 3%, while a lack of dividend payout in ATRL resulted in its share price falling drastically by 10% during the week.

Volumes stood at 50 million shares traded per day, down 40% from the previous week. Similarly, average trade value also dropped by 41% and stood at Rs2.24 billion traded per day. The Karachi Stock Exchange’s market capitalisation rose 0.8% and crossed the Rs3 trillion mark during the week.

What to expect?

With the results season concluded, investors should look forward to the upcoming monetary policy announcement, which is due in the end of September. The latest PIB auction also indicated that a discount rate cut is on the cards, which should provide a boost to the market.

Furthermore, the political situation in the country should also be monitored closely, as the PPP and MQM have showed signs of reconciliation, which could lead to the latter rejoining the government, potentially bringing an end to tensions in Karachi.

Monday, September 12

After a bullish performance last week, the stock market followed its regional peers and fell on the first trading session of the week. Fears of a Greek default and credit contagion ripped through global markets as MSCI’s all-country world equity index – comprising top companies around the world - fell 1.9 per cent.

Tuesday, September 13

After a bearish first session of the week, the stock market managed to gain 83.79 points and seemed unaffected by the torrential rains in the city. The bourse management reversed an earlier decision to end trading early and the market closed at the scheduled 3:30 pm despite extremely low volumes.

Wednesday, September 14

The stock market’s upward momentum continued amid better volumes as local institutions were active during the trading session. Pakistan State Oil and Fauji Fertiliser Bin Qasim triggered the improvement in the sentiment at the Karachi Stock Exchange.

Thursday, September 15

For a second day running, equities struggled along the neutral line as investors opted to play it safe. The broader market traded in a narrow range as investors avoided fresh positions after statement by US Defence Secretary about using US Army against Haqqani Network if Pakistan’s government fails to address its concerns, said Elixir Securities equity dealer Sibtain Mustafa.

Friday, September 16

The stock market rose, in line with global markets, in a dull session as investors preferred to stay on the sidelines ahead of the weekend. Activity remained low on the back of rising macro economic concerns, drying foreign inflows and growing tension in US-Pak ties, said Elixir Securities equity dealer Sibtain Mustafa

Published in The Express Tribune, September 18th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ