2018: The year Pakistan’s auto sector hit a bump in the road

Rupee depreciation, curbs on non-filers hit existing players hard, new entrants continue to enjoy benefits

A car manufacturing plant. PHOTO: AFP

The rupee witnessed massive depreciation against the US dollar, which then led to the existing carmakers raising their prices on multiple occasions to pass the impact of increased cost on to the consumers.

Adding to this, the Pakistan Muslim League-Nawaz (PML-N) government, in its last budget unveiled a surprising decision, which severely impacted the sector.

In the budget for fiscal year 2018-19, the government placed a ban on purchase of automobiles by non-filers, in an attempt to encourage people to file their income tax returns. Whether this measure succeeded in achieving its target is a different matter, the move, however, elicited an adverse reaction from the industry. Over the course of the past year, the government also hiked the interest rate by a cumulative 4.25 percentage points, which added to the woes of the sector.

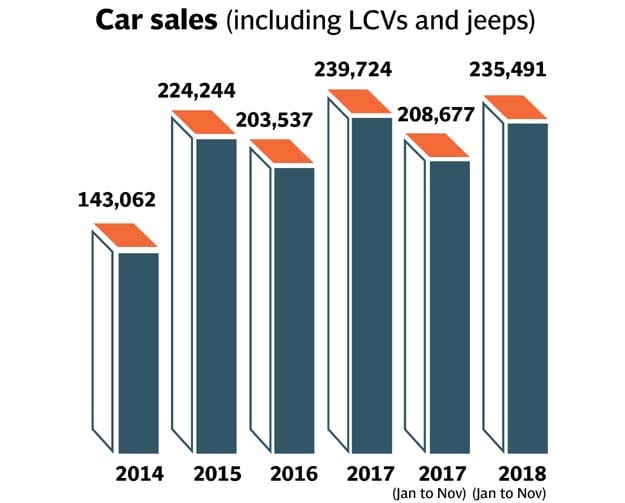

If numbers are to be believed, the auto sector, which was in its growth phase hit a roadblock as sales dropped significantly. Overall, automobile sales dipped 17% year-on-year to 17,442 units in November 2018, whereas sales dropped 30% to 17,442 units on a month-on-month basis against 24,850 units in October.

The existing three

It was a trying year for Indus Motors, Pak Suzuki and Honda Atlas, as company profits suffered owing to various developments in the economy. The previous government's decision to restrict non-filers from purchase of automobiles and the massive depreciation in the rupee significantly dented demand.

"In terms of calendar year, it has been the worst for the auto sector, although there was some growth seen in the previous fiscal year," said AHL analyst Arsalan Hanif.

Citing reasons for the dismal performance, he said the restrictions on non-filers and the massive rupee depreciation played a key role in the sector's decline.

The devaluation in rupee impacted demand as purchasing power of consumers also decreased, he added.

The earnings of all three companies dropped as they struggled to deal with the changing macroeconomic indicators. Indus Motor Company, which assembles and manufactures Toyota cars in Pakistan, had to stop taking orders because of the sharp depreciation, which made import of auto parts expensive and increased the cost of production.

In terms of earnings, profit recorded by the company witnessed a decline of 3% in the quarter ended September 2018 compared to the previous year. However, the company had witnessed a surge of 19% for the same period in 2017.

With the competition increasing in the sector, Indus Motor also announced to import completely built units of Toyota Rush in a bid to capture the price segment between its Corolla and Fortuner vehicles. Apart from this, the company also looked to boost its performance as the board approved an investment of Rs3.3 billion to increase its annual production capacity.

Meanwhile, Pak Suzuki also faced some serious competition as United Motors ventured into the passenger car market, tapping the low-priced segment of the society, which has largely been catered to by Suzuki Mehran. Additionally, profits reported by Pak Suzuki plunged by a massive 55% in the January to September period, while the share price of the company fell 62% during the year.

However, on the occasion of achieving milestone of manufacturing two million vehicles, the company also announced an investment of $460 million in a brand new plant.

During the past year, Honda Atlas raised its car prices four times, while Indus Motor and Pak Suzuki raised their prices four and five times, respectively. The three automakers are also expected to increase prices in January.

New entrants

Following the announcement of the long-delayed auto policy in 2016, many car makers were enticed to take advantage of the incentives offered under the policy. After a hiatus of seven years, the Shehzore truck was launched in February 2018, marking the first project to resume production under the Brownfield status. Following the launch, officials of SsangYong Motor Company - a South Korean SUV manufacturer - also met with the management of Daehan Dewan Motor Company to discuss plans to introduce SUVs in the upcoming year.

On the other hand, Ghandhara Nissan also geared up to make strides in the sector, as it announced to start production of Datsun vehicles in Pakistan. According to officials the company would invest Rs4.5 billion over the first four years. The company also launched its locally-assembled JAC Motors X200 one-ton pickup and signed an importer's agreement with France's Renault Trucks SAS. In a notification, it announced that it has imported a few units to conduct a trial of the vehicle in Pakistan, a move meant to test the market and the product's demand.

Renault, which expressed its intent to venture into Pakistani market last year, acquired an industrial plot for setting up an automotive plant. The project, which has been started in partnership with Al-Futtaim Group, has acquired 54 acres of land in the Faisalabad Industrial Estate Development and Management Company (FIEDMC), the largest industrial zone in the country, and will invest $140 million. The French carmaker will start vehicle production in 2020.

Hyundai, which is also setting up a plant in Faisalabad, is also set to roll out locally-assembled Hyundai cars in March 2020.

On the other hand, South Korean car maker Kia has already launched two new vehicles - Grand Carnival 11-seater family passenger car and a one-tonne pickup - in the form of completely built units.

Future plans

2018 marked a positive for the sector in terms of interest expressed by various automakers in the Pakistani market. Considering the incentives offered under the auto policy, many Chinese automakers were keen to capture a share in Pakistan's auto market. A Chinese subsidiary, Joylong Pakistan, announced intent to provide light commercial vehicles to Pakistan's dilapidated transportation sector by importing completely built units (CBUs) from China. On the other hand, Master Motor Corporation plans to collaborate with China-based Changan to manufacture crossover SUVs as well as light commercial vehicles.

In a big win for the sector, Volkswagen - the world's largest automobile manufacturer - entered into an agreement with a local luxury brands dealer for the assembly of vehicles in Pakistan, becoming the second European carmaker that will make inroads to capture the Japanese-dominated market.

The National Logistics Cell (NLC) also signed an agreement with Daimler AG - the German automotive corporation that owns Mercedes-Benz - for the local assembly and production of Mercedes‐Benz trucks in Pakistan. Sazgar Engineering Works, which manufactures auto rickshaws, was also given approval to set up a new car manufacturing plant in Pakistan in partnership with a Chinese company.

On the outlook for 2019, Hanif predicted the year to remain dull for the existing players and a probable decline in sales further. However, he was of the view that the new players have a better chance as they have an added advantage in the form of various incentives.

Government initiative

Keeping the global trend in view, which is rapidly moving towards environment-friendly cars, the government in its budget for fiscal year 2018-19 also announced some measures to cut costs and encourage the use of such clean vehicles in the country.

"To promote environment-friendly electric vehicles, an enabling fiscal environment for related infrastructure is necessitated. It is, therefore, proposed that 16% customs duty on charging stations for electric vehicles may be withdrawn," announced Finance Minister Miftah Ismail during the budget speech.

Published in The Express Tribune, January 1st, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ