The recently passed tax ordinances, coupled with the continuous rise in fertiliser prices, are unlikely to cause a significant effect on farmers, according to analysts.

According to BMA Capital, the agriculture sector contributes around 23 per cent to the country’s GDP, but accounts for less than one per cent of government revenues. Tax collection from the sector remains minimal despite the fact that it continues to enjoy subsidised inputs, such as fertiliser, and freedom to charge prices over and above international prices.

Analysts believe in order to increase Pakistan’s dismal tax-to-GDP ratio, which stands at 10 per cent, the policy framework should start targeting the agriculture sector.

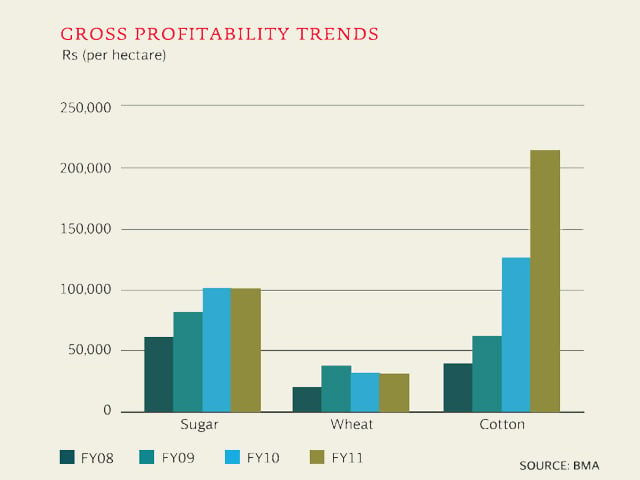

Overall, three major increases in fertiliser prices have taken place over the last two years, due to gas curtailment and implementation of sales tax. Cumulatively, the urea price increase was a significant 48 per cent since December 2009. However, increasing crop prices has allowed for easy absorption of the increase. During the period, crop prices have rallied significantly, resulting in improved farm revenues, while gross profitability for certain products such as sugar has increased by up to 63 per cent.

Improved farming margins have aided growth of rural incomes. As a result, rural incomes have catapulted much faster than witnessed before. Additionally, farming feasibilities have improved due to the widening input-output gap which has provided farms an incentive to expand and improve current practices. Thus, while rising crop prices are beneficial for inducing modern farming techniques, taxation of some inputs is unlikely to cause a significant dent in crop feasibilities.

Edging closer to the fiscal 2012 budget, it remains to be seen if any concrete steps are announced in this direction.

Published in The Express Tribune, March 23rd, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ