Weekly review: Bullish momentum slows down but index still rises

KSE 100-share Index gains 154 points amid profit-taking

KSE 100-share Index gains 154 points amid profit-taking

“This (the slowed-down pace) was mainly due to selling by local mutual funds during the week after the apex regulator’s restriction to maintain at least 5% of their net assets in cash,” said Topline Securities in a research note.

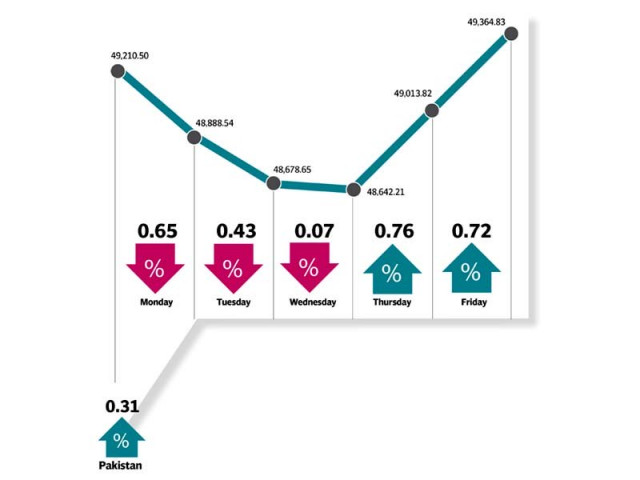

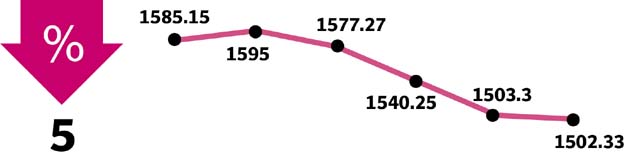

The benchmark KSE 100-share Index closed the week at 49,364.83 points compared to 49,210.50 points at the end of the previous week on January 13.

In the first three days, investors resorted to profit-booking, dragging the benchmark index down. In the remaining two days, however, the market rebounded to close the week in the positive territory.

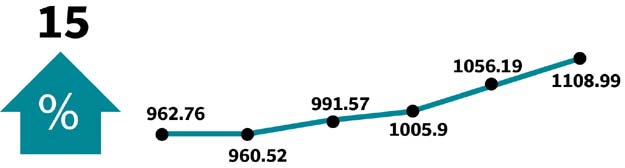

According to Topline, refinery was the best-performing sector, primarily led by National Refinery Limited. Its stock rallied 16% in anticipation of better earnings after the upgrading of its plant.

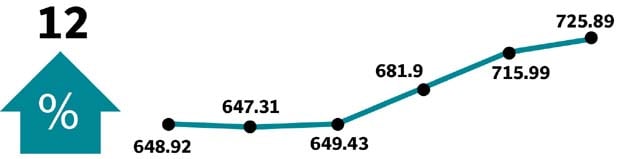

Abnormal activity was witnessed in steel stocks after the National Tariff Commission imposed anti-dumping duties on steel imports from China and Ukraine.

International Steels, International Industries and Aisha Steel Mills surged and outperformed the broader market.

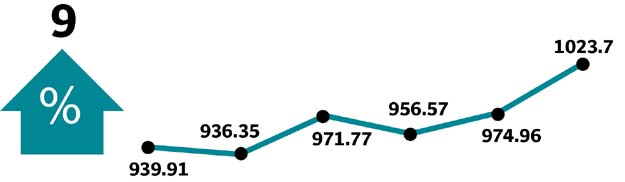

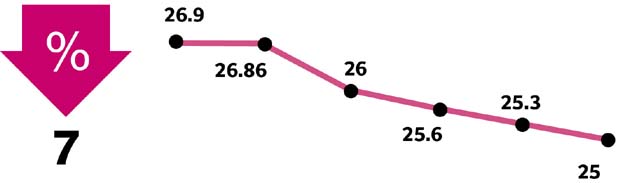

Continuing the trend of past many weeks, foreigners remained net sellers of $46.6 million worth of shares during the week. Selling was mainly noted in banks, followed by textile and electricity sectors. Apart from the refinery sector that rose 7.7% week-on-week, other key sectors that remained in the limelight were automobile, up 7.2% and oil marketing companies, up 1.3%, said JS Research in its report.

On the other hand, index heavyweights recorded profit-booking including exploration and production (E&P) stocks, which fell 4.1% week-on-week, banks, down 2.6% and cement, down 0.1%, JS said.

Most of the selling in the E&P sector came in Oil and Gas Development Company (OGDC) as news emerged of a proposal to sell 5% government stake in the company. It led to an 8% fall in the OGDC stock price.

Foreign investors, who were net sellers during the week under review, have sold a massive $434 million worth of stocks since the start of 2016. However, the benchmark KSE 100-share Index has continued to provide phenomenal returns mainly on the back of strong domestic liquidity.

In 2016, the index soared 60%, making the PSX the fifth best-performing market in the world.

During the week under review, average daily volumes at the PSX were 388.5 million shares whereas average daily value stood at Rs22.2 billion.

In a major positive for the bourse, a Chinese-led consortium acquired a 40% strategic stake in the PSX for $85 million at Rs28 per share. An agreement to that effect was signed on Friday.

During the week, Roshan Packages raised Rs2.1 billion in its book-building process, resulting in a strike price of Rs86.25 per share at which the company would sell its shares to the general public at month-end. The Arif Habib Group announced that it would pour Rs25 billion into a new cement plant that would be completed in the next two years. Its capacity will rise to 3.37 million tons from the current 0.9 million tons.

Pakistan Petroleum Limited also announced during the week that it made a net profit of Rs16.06 billion in the year ended June 30, 2016, 60% lower than Rs38.20 billion in the preceding year.

Among other major news were the widening of current account deficit by 92% in Jul-Dec 2016, approval of steel mill restructuring by the Privatisation Commission board and 328% rise in foreign direct investment in December 2016.

Winners of the week

Millat Tractors

Millat Tractors Limited assembles and manufactures tractors, implements and equipment.

National Refinery

National Refinery Limited manufactures and distributes lube base oils and petroleum fuels. The company markets its products to customers throughout Pakistan.

Abbott Laboratories

Abbott Laboratories (Pakistan) Limited manufactures, imports and markets research based pharmaceutical, nutritional, diagnostic, hospital and consumer products. The company’s key products include antibiotics for respiratory tract infections, peptic ulcer disease and dental infections.

Losers of the week

Oil and Gas Development Company

Oil and Gas Development Company Limited explores and develops oil and natural gas properties in Pakistan.

Standard Chartered

Standard Chartered Bank Pakistan Limited is an international bank that provides consumer and wholesale banking.

Service (Shoes) Industries

Service Industries Limited specialises in manufacturing tires and tubes for motorcycles, bicycles, rickshaws and trollies. The company also produces footwear.

Published in The Express Tribune, January 22nd, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ