Market watch: Index continues upward trend for second straight session

Benchmark KSE 100-share Index gains 230.74 points

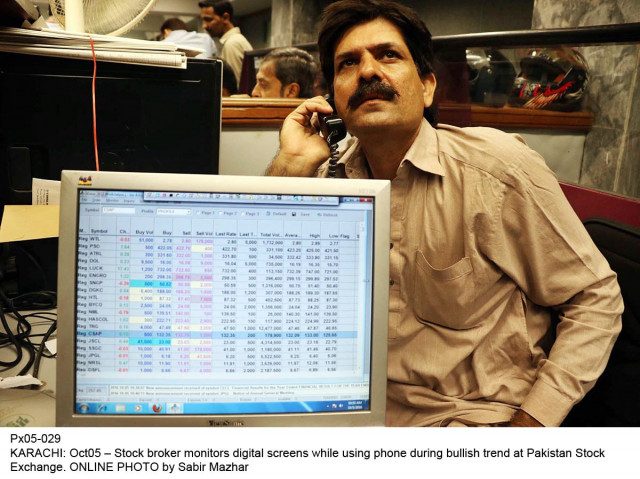

PHOTO: EXPRESS

At close, the Pakistan Stock Exchange’s (PSX) benchmark KSE 100-share Index finished with a rise of 0.49% or 230.74 points to end at 46,920.47.

Elixir Securities, in its report, stated that trading activity as expected remained on the lower side with stocks seeing little participation ahead of year end primarily from institutional investors.

Market watch: Led by oil, stocks recover after two days of losses

“Market after a sideways open gained steadily during the day with select blue-chips across financials, oils, cements and industrial sideboards driving gains on selective value buying,” said analyst Ali Raza.

“Index heavy Habib Bank (HBL PA +2%) emerged as a top performer and contributed over 65 points to the benchmark KSE-100 Index, while Pakistan State Oil (PSO PA +1.3%) and Attock Refinery (ATRL PA +3%) also ended up driven by earnings excitement primarily from inventory gains amid recovering global crude,” Raza commented.

“On the flip side, Hub Power (HUBC PA -1.4%) witnessed correction on low volumes and dented KSE-100 index by most points.

“Expect selective interest to continue in the remaining days of this year with benchmark index hovering and consolidating near 47,000,” he added.

Trading volumes rose to 198 million shares compared with Monday’s tally of 179 million.

Shares of 405 companies were traded. At the end of the day, 204 stocks closed higher, 180 declined while 21 remained unchanged. The value of shares traded during the day was Rs11 billion.

Dewan Cement was the volume leader with 15.2 million shares, gaining Rs1.09 to finish at Rs37.23. It was followed by Bank of Punjab with 13.7 million shares, gaining Rs0.37 to close at Rs17.58 and Dost Steels Limited with 13 million shares, gaining Rs0.20 to close at Rs10.68.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ