Pak-India relations take centre stage, but index climbs

Finishes at 40,542 points with turnover registering notable increase.

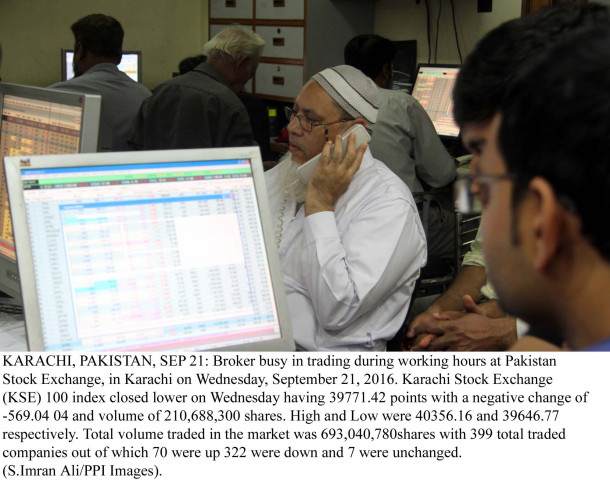

PHOTO: PPI

The bulls remained active and helped the index close at an all-time high of 40,542 points, with turnover registering a notable increase.

Market watch: Index powers past 40,500 after see-saw ride

Thursday in particular was an erratic day as stock markets on either side reacted strongly after Indian claims of a surgical strike along the Line of Control (LoC).

The news took its toll on stock market participants who were earlier rejuvenated after the Organization of the Petroleum Exporting Countries (OPEC) committed to cut production, giving the index-heavy oil and gas sector a much-needed boost after months of a bearish run that has seen share prices plummet.

An over-500-point increase quickly vanished around mid-day as participants consolidated and trimmed positions with uncertainty over the future of Pakistan-India relations took centrestage.

Heavy volumes that touched a record high of 712 million were also observed the same day.

With tensions subsiding to some extent, investors turned bullish on Friday broad-based activity into both third-tier and bluechips.

The outgoing month of September saw the index register a 1.8% increase after its 0.7% gain in August. Foreign selling continued for a second consecutive month and stood at net $41.3 million compared to $20.4 million in August.

Cherry picking remained the key theme as investors stayed cautious over rising tensions. The agreement in OPEC meeting to cap oil production was the only major trigger in the market.

Automobile assembler was the top gainer over the week, up 7.7%, followed by oil and gas exploration and commercial banks, which increased 1.9% and 1.3%, respectively. Power Generation & Distribution sector emerged as the top loser as it fell 0.5%.

Pakistan-India tension: Stocks fall, but absorption power remains strong

Notably, Dewan Cement attracted huge volumes after the announcement that a Chinese investor has been allowed to conduct due diligence to acquire DCL.

Additionally the International Monetary Fund completed its 12th and final review under Pakistan’s Extended Fund Facility ($6.2bn loan), approving the immediate release of the last tranche of $102 million.

Average daily volumes for the outgoing week decreased 27% week-on-week to 528 million shares while average daily value fell 9% week-on-week to Rs15 billion/$144 million during the week.

Winners of the week

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to other companies. TRG Pakistan manages call centers and offices located in Pakistan and elsewhere throughout the world.

The Bank Of Punjab

The Bank of Punjab operates under the status of scheduled bank in Pakistan. The bank provides commercial banking services.

Indus Motor

Indus Motor Company Limited was created through a joint venture agreement between the House of Habib, the Toyota Motor Corporation and the Toyota Tsusho Corporation, in order to assemble, manufacture and market Toyota vehicles. The company is also the sole distributor of Toyota vehicles in Pakistan.

Losers of the week

Associated Services

Earlier called Latif Jute Mills Limited, the company is one of the industrial machinery and services firms in Karachi.

Arif Habib Corporation

Arif Habib Corporation Limited is a holding company. The company holds interests in the securities brokerage, investment and financial advisory, investment management, commercial banking, commodities, private equity, cement and fertiliser industries.

PakGen Power Limited

Pakgen Power Ltd generates and distributes electricity. The company operates an oil-fired electricity generating plant in Mehmood Kot, Muzaffargarh Punjab.

Published in The Express Tribune, October 2nd, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ