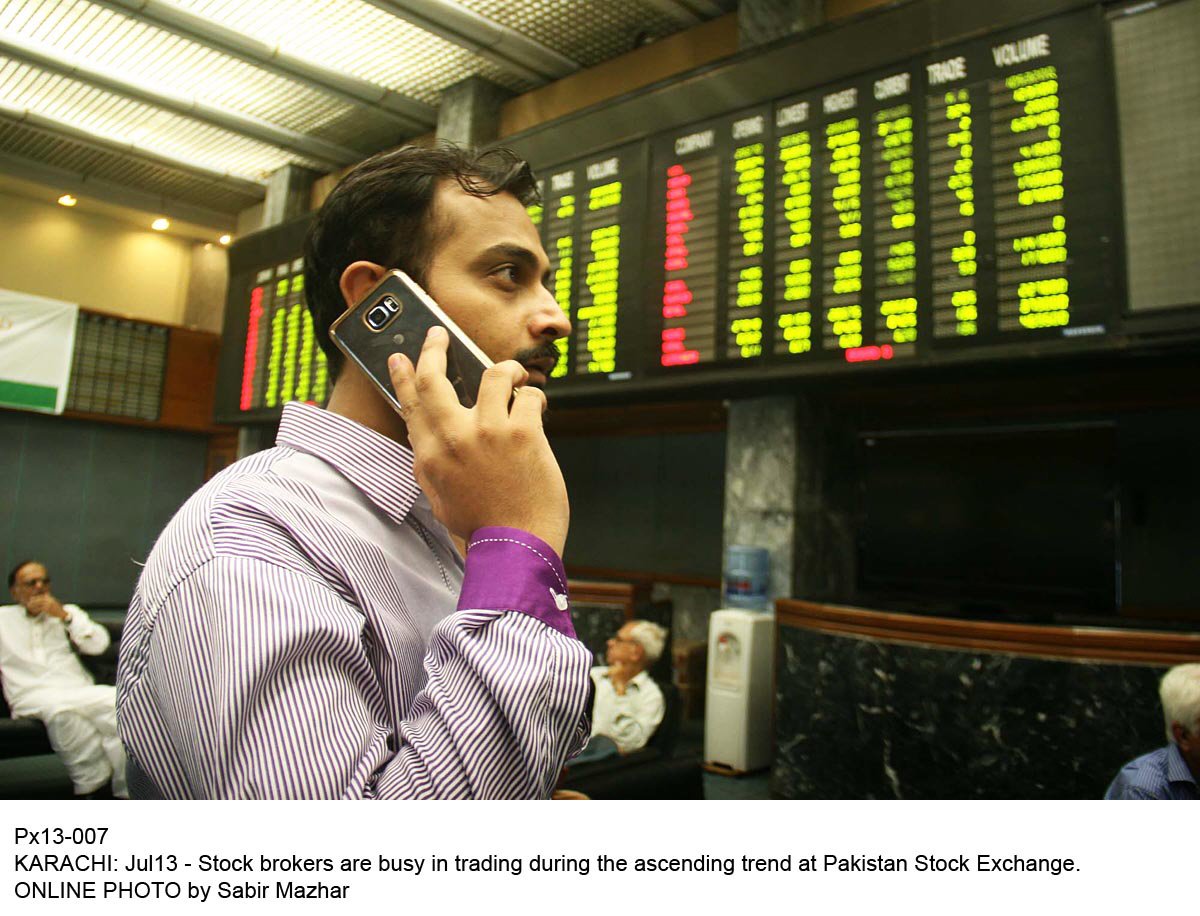

The benchmark KSE 100-share Index moved up 1.1% (428 points) week-on-week and closed just shy of the 40,000 mark at 39,927 points.

Despite above-expectation financial results of Oil and Gas Development Company, pressure on the oil sector kept the market subdued in the first two days of the week. By mid-week, the index bounced back amidst burgeoning volumes in the last two trading days.

Gains in the market were led by financial stocks with Habib Bank Limited (HBL), MCB Bank and National Bank of Pakistan (NBP) cumulatively adding 140 points. MCB Bank and HBL bounced back after a slight correction over bland quarterly results.

NBP, on the other hand, posted outstanding quarterly earnings, beating the street consensus. The other notable index-mover was Murree Brewery, which rallied on the back of a huge 1,500% bonus along with full-year results.

Other heavyweight sectors showed mixed trends. Cement stocks in anticipation of strong August off-take numbers and financial shares turned green towards the end of the week.

News reports suggesting that the Drug Regulatory Authority had agreed on a further increase in medicine prices triggered stock buying in the pharmaceutical sector. The automobile sector welcomed depreciation of Japanese yen, which makes imports cheaper for the industry.

Speculation was rife about the acquisition of K-Electric after it was reported that two Chinese companies had submitted bids to acquire a 66% stake in the power utility. As the rumours spread, the company saw heavy trading and an increase in its share price.

Foreign currency reserves of the country crossed $23 billion during the week on account of inflows from international financial institutions. The current account deficit stood at $591 million, up 152% month-on-month.

Remittances sent by overseas Pakistanis fell 20% while services exports also dropped sharply.

Combined deficit of goods, services and income stood at $2.19 billion in the first month of FY17 compared to $2 billion in the same period of FY16. Even after the GSP Plus status and zero-rated tax regime, exports continued to be on the downtrend, going down by 4% year-on-year.

Volumes remained flat (+1%) week-on-week at the bourse averaging 232 million shares. Foreigners remained net buyers mopping up shares worth $1.9 million during the week under review.

Winners of the week

Murree Brewery

Murree Brewery company limited specialises in the manufacture of beer and Pakistan made foreign liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

International Steel Limited

International Steels Limited manufactures steel. The company produces cold rolled, sheet, and hot dipped galvanised sheet steels. International Steels serves the construction, appliances, automotive, agricultural implements and packaging industries.

Service (Shoes) Industries

Service Industries Limited specialises in manufacturing tires and tubes for motorcycles, bicycles, rickshaws and trollies. The company also produces footwear.

Losers of the week

Habib Metro Bank

Habib Metropolitan Bank Limited is a fully accredited commercial bank. The bank provides banking services to individual and corporate customers including personal loans, education loans, mobile banking, cash management services, short & long term financing, international trade, and savings accounts.

Ibrahim Fibers

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a polyester staple fiber manufacturing plant. The company manufactures a wide range of polyester staple fiber and it also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres Limited also owns an in-house power generation plant.

Shell Pakistan

Shell Pakistan Limited markets petroleum and petrochemical products. The company also blends and markets different types of lubricating oils.

Published in The Express Tribune, August 28th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1714024018-0/ModiLara-(1)1714024018-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ