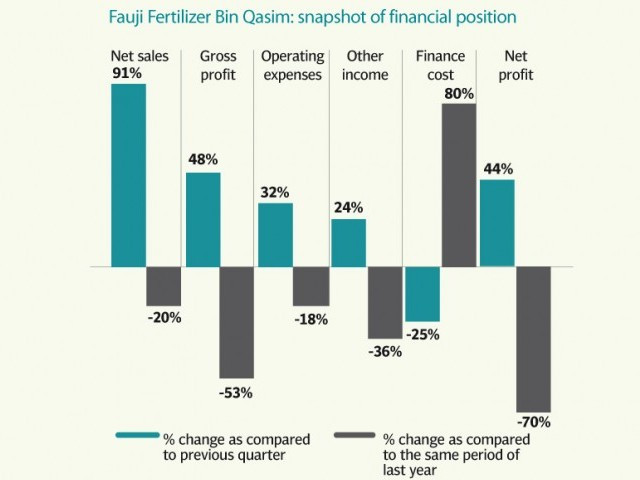

Corporate result: FFBL posts Rs621m loss in second quarter of 2016

Loss came due to lower sales and falling prices of DAP

Loss came due to lower sales and falling prices of DAP. PHOTO: FILE

The loss can be attributable to lower di-ammonium phosphate (DAP) sales, which were down 39% year on year, falling international DAP prices which have squeezed primary margins and higher financial charges due to increase in borrowings for acquisitions and working capital requirements, according to a Sherman Securities’ report on Tuesday.

Loss per share (LPS) was Rs0.67 compared to earnings per share (EPS) of Rs1.26 in the previous year.

Interestingly, the newly formed Fauji Foods Limited contributed a loss per share of Rs0.10 to the books of FFBL.

FFBL posted a 30% growth in its top-line during 2QCY16 compared to last year, but the bottom-line remained in the red due to higher distribution and marketing expenses and finance cost.

Owing to higher inventory levels amid sluggish demand of urea and DAP, the company’s stock-in-trade rose significantly. Thus, liquidity remained a key concern as the company was sitting on net consolidated borrowings (adjusted with cash) of Rs51 billion compared with net borrowings of Rs22 billion as of December 31, 2015.

The KSE 100-share Index rose 130 points to close at 39,147 on Tuesday whereas FFBL share price jumped 2.8% to close at Rs55.13.

Finance cost of the company climbed 51% year on year to Rs633 million in the second quarter of 2016 due to increase in long-term borrowings for financing contemporary projects and increased working capital requirements.

Persistent production leading to higher inventories and stagnant price level of phosphoric acid (the primary raw material) are the key risks for FFBL, according to a Topline Securities report.

Published in The Express Tribune, July 27th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ