For 32-year-old Lahore resident, Amna*, the phone call seemed like a godsend. A self-proclaimed representative from her bank informed her that her account had been compromised and that she needed to provide her login credentials to secure it. Trusting the caller, Amna shared the sensitive information, only to realise later that she had fallen prey to a sophisticated phishing scam. The scammer made off with a substantial amount from her account, leaving Amna shaken and financially vulnerable.

Amna's story is not an isolated incident. Online scammers are targeting thousands of Pakistanis every day, with many falling victim to phishing, fake calls, and social engineering tactics. According to a study by Visa, ‘Stay Secure,’ 91 per cent of Pakistan consumers are at risk of responding to scammers. The financial losses are staggering, but the emotional toll is just as devastating.

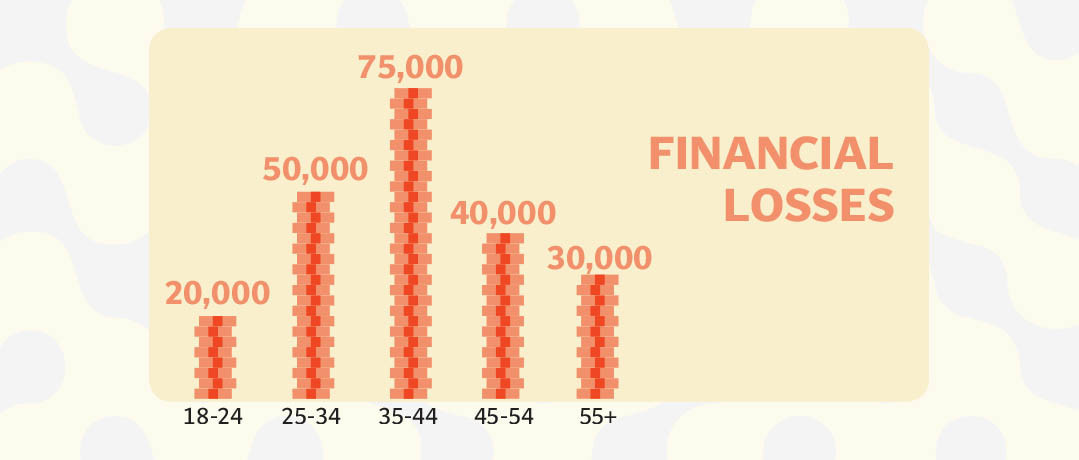

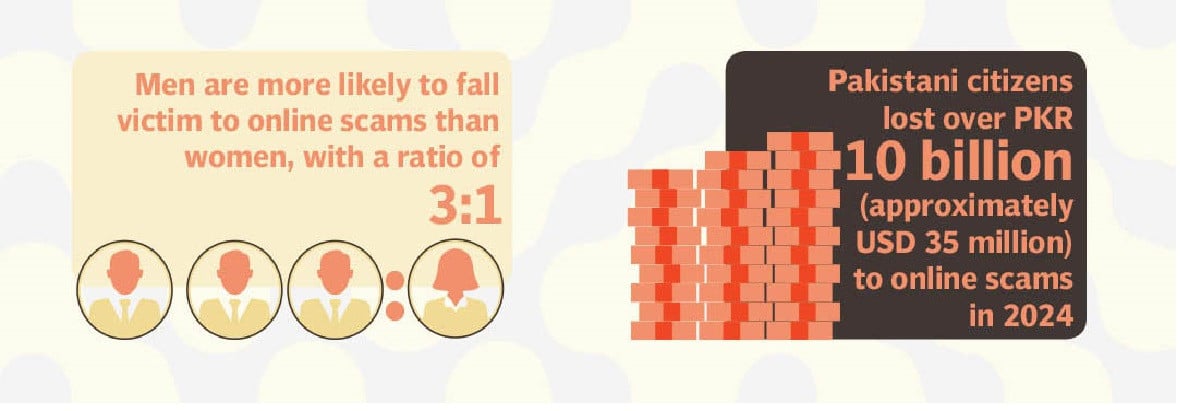

The rise of online scams in Pakistan is a disturbing trend. As more Pakistanis turn to digital payments and online transactions, scammers have adapted, using sophisticated tactics to part people from their hard-earned savings. The numbers are staggering: in 2024 alone, Pakistani citizens lost over PKR 10 billion to online scams.

But there is hope. The State Bank of Pakistan (SBP) has joined forces with a financial inclusion organisation to combat online scams, launching a series of initiatives aimed at educating citizens and strengthening the country's digital payments infrastructure.

Intensifying onslaught

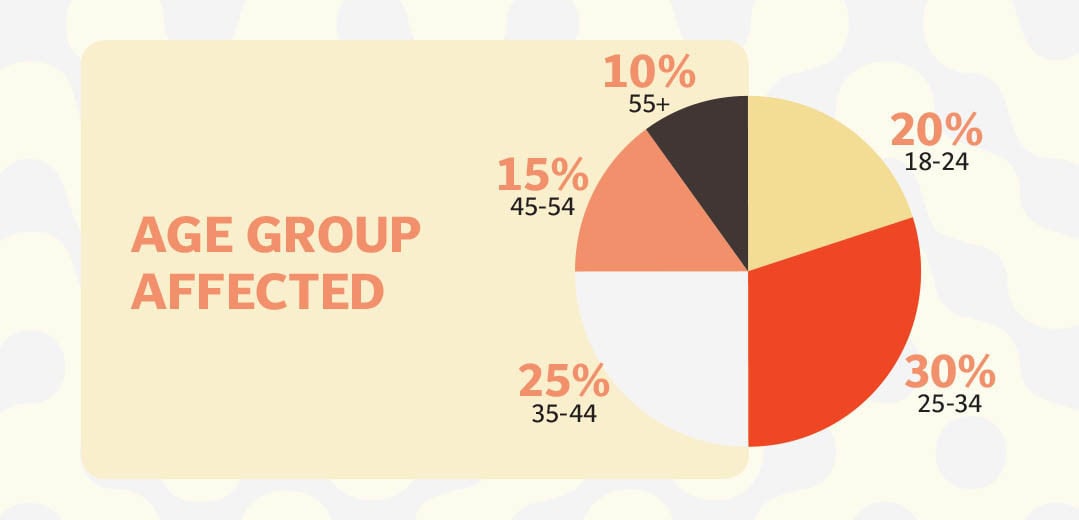

Online scams have become an increasingly prevalent threat in Pakistan, with millions of citizens falling victim to phishing, fake calls, and social engineering tactics every year. A recent study by Visa revealed that 91 per cent of Pakistani consumers are at risk of responding to scammers, with 52 per cent having been victims of scams at least once. Even more alarming is the finding that 21 per cent of the victims have been tricked multiple times, against the global average of 15 per cent. This alarming statistic highlights the urgent need for greater awareness and education about online scams.

The study, which surveyed consumers in Pakistan, found that over-confidence is a major factor in leaving people vulnerable to online scams. Despite 56 per cent of respondents claiming to be scam-savvy, 9 out of 10 are likely to miss common warnings of fraud. This disconnect between awareness and action is concerning, as it suggests that many people are not taking the necessary precautions to protect themselves online.

The study also found that 74 per cent of respondents would act on a message with a positive hook, such as "free gift" or "you've been selected." This susceptibility to positive messaging is a key tactic used by scammers to lure victims into their traps. Moreover, the study revealed that 41 per cent of respondents would fall for messages about a security risk, such as a stolen password or a data breach.

The consequences of online scams can be distressing. Victims often lose substantial amounts of money, and the emotional toll can be just as severe. Moreover, the rise of online scams has led to a decline in trust in digital payments, which can hinder the growth of e-commerce and digital financial services in Pakistan.

So, what makes online scams so prevalent in Pakistan? One reason is the increasing adoption of digital payments and online transactions. As more people go online, the potential for scammers to target victims increases. Additionally, the lack of digital financial literacy and awareness about online scams leaves many people vulnerable to these types of attacks.

Furthermore, the study found that people are more likely to worry about the vulnerability of others rather than themselves. Over half of the respondents (53 per cent) are concerned that their friends or families will fall for a scam email offering a free gift card or product from an online shopping site. This lack of personal vigilance is a major concern, as it suggests that many people are not taking the necessary precautions to protect themselves online.

Another issue is the lack of awareness about the language of fraud. Scammers often use sophisticated tactics to craft messages that appear genuine and compel recipients to take immediate action. The study found that only 57 per cent of respondents reported looking to ensure a communication is sent from a valid email address, while 55 per cent will check if the company name or logo was attached to the message.

To combat online scams, it is essential to understand the tactics used by scammers. The study identified prevalent patterns in the language most associated with scams, including the use of positive hooks, urgent action requests, and fake security risks. By being aware of these tactics, individuals can better protect themselves from online scams.

The SBP along with other institutes has been taking actions against the scams and trying to educate people, still a large amount of people remain unaware.

Anti-fraud efforts

The SBP has taken a proactive approach to combating online scams and fraud. Recognising the need to safeguard the financial wellbeing of the public, SBP launched an anti-fraud initiative aimed at empowering customers with the knowledge to recognise, prevent, and report financial fraud.

"The objective of this anti-fraud initiative is simple but essential: empowering customers with the knowledge to recognise, prevent, and report financial fraud, thereby fostering trust in the banking sector," explains an SBP spokesperson to The Express Tribune through an email interview.

To achieve this objective, SBP's initiative takes a comprehensive approach to customer education and awareness. The campaign uses a mix of traditional channels like print and electronic media, as well as modern platforms like social media, to reach people from all walks of life.

"We use a mix of traditional channels like print and electronic media, as well as modern platforms like social media, to make sure our message reaches people from all walks of life," says the SBP spokesperson. "The goal is to break down complex financial concepts into simple, easy-to-understand messages, highlight common fraud tactics, and provide practical advice that customers can act on. By including relatable, real-life examples, the campaign connects with people on a personal level, reinforcing the importance of staying vigilant about online financial security."

One of the key challenges in combating online scams is the lack of awareness about the tactics used by scammers. To address this, SBP's campaign includes real-life examples of common scams, such as phishing, fake calls, and social engineering tactics.

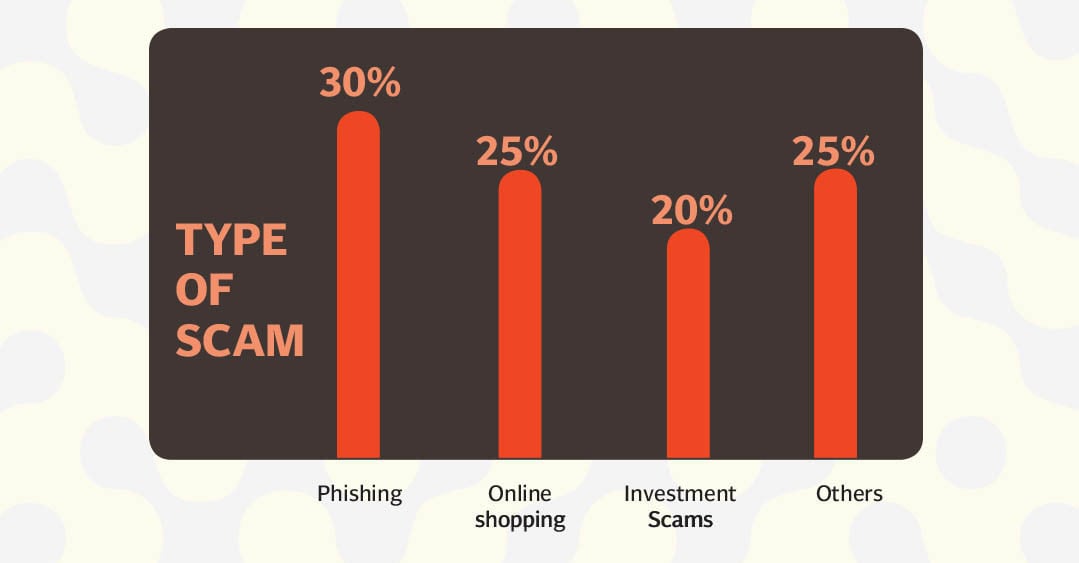

"The nature of scams continues to evolve, with phishing, fake calls impersonating as officials of banks or LEA or SBP, and social engineering tactics being some of the most common," notes the SBP spokesperson. "To address these challenges, SBP has strengthened its regulatory framework, including introducing robust mobile app security guidelines and Enhancing Security of Digital Banking Products and Services."

In addition to customer education and awareness, SBP's initiative also focuses on strengthening the mechanisms for reporting and resolving online fraud cases. SBP has directed all regulated financial institutions to maintain dedicated channels for reporting fraud, ensuring customers have a clear and immediate recourse.

"Customers are urged to promptly report fraudulent activities to their banks through customer contact centers, mobile apps, or through branches," explains the SBP spokesperson.

Financial institutions also play a critical role in implementing SBP's anti-fraud measures. Banks are required to deploy fraud risk management solutions that enable real-time reporting of fraudulent transactions and prompt blocking of affected funds.

"In addition, banks are required to adhere to mobile app security standards and have implemented EMV Chip & PIN technology, significantly reducing card skimming incidents. The adoption of EMV 3DS standards also protects e-commerce transactions from fraud. Multi-factor authentication is now a standard security feature, further strengthening customer protection. Financial institutions are also required to stay in regular communication with customers and other banks, sharing updates on fraudulent activities and emerging threats," notes the SBP spokesperson.

SBP also collaborates with law enforcement agencies to prosecute fraudsters and enhance the capacity of law enforcement to handle digital financial crimes.

Talking about the goals of SBP's initiative, the SBP spokesperson said that the short-term goal is to raise immediate awareness about prevalent fraud tactics, equipping customers with practical knowledge to safeguard their financial information. “The long-term goal is to foster a culture of financial literacy, ensuring that public trust in digital financial services remains strong, and driving broader adoption of secure digital payments. By achieving these objectives, SBP aims to build a resilient and inclusive financial ecosystem," shares the SBP spokesperson.

Partnering up

The financial inclusion organisation Karandaaz has been playing a crucial role in supporting the SBP’s anti-fraud initiative. By facilitating collaboration between stakeholders and providing technical expertise, it has helped to create a more robust and resilient digital payments infrastructure in Pakistan.

According to Sharjeel Murtaza, the organisation’s Chief Digital Officer (CDO), "One of the key barriers for adoption of digital financial services is the perceived high level of risk associated with digital transactions. No matter how sophisticated and advanced digital solutions are deployed in an eco-system, if safety, security, privacy, and the overall sanctity of the transactions is not guaranteed, the adoption will always remain limited."

To address this challenge, the organisation has been working closely with SBP to devise, update, and execute national awareness campaigns for countering digital fraud. The campaigns, which have been tailored to local needs and contexts, aim to educate the public about the risks associated with online scams and provide practical tips on how to stay safe online.

"We firmly believe that while technological solutions and policy measures need to be put in place at the supply side, awareness of the demand side is equally critical to ensure minimal frauds take place," emphasises Murtaza. "We have partnered with renowned social media platforms for running the campaigns, which have been tailormade utilising professional production houses and actors with content that is fully localised and relatable to day to day scenarios faced by the common man."

In addition to awareness campaigns, the organisation has also been providing technical support to SBP to strengthen the country's digital payments infrastructure. This includes scouting for effective systems and technologies by engaging with global centers of excellence for learnings that can be used to detect, prevent, and resolve online fraud with an ambition to create a playbook for the local eco-system based on global best practices.

The organisation’s technical expertise has been instrumental in identifying potential solutions that can be used to combat online scams. According to Murtaza, "There are inbuilt capabilities of systems that are currently being utilised by the financial sector as well as SBP as a regulator. However, there is no central system/mechanism currently in place that is dedicated to countering digital frauds."

“We believe SBP is committed to introducing a central system in the near future and there is no specific technology stack that it is considering. Karandaaz remains committed to supporting SBP’s vision and strategy and is contributing with its technical expertise for scouting the most effective system,” he added. To address this gap, it has been working closely with SBP to explore potential solutions, which includes evaluating different technologies such as artificial intelligence and blockchain that can be used to strengthen the country's digital payments infrastructure.

The support has also been instrumental in facilitating collaboration between stakeholders, including banks, fintechs, and government agencies. According to Murtaza, "Karandaaz commands the stature of a dependable and neutral entity that aims to engage with relevant stakeholders and develop a consensus for every initiative before embarking on it."

Talking about at which stage is the initiative with SBP is currently at, Murtaza shared it’s a programme that is in the making and some parts are already in execution such as awareness campaigning. “Technological interventions will follow along with policy measures to embed a thorough and convenient redressal mechanism for users of digital financial services. A fully potent anti-fraud system would not just involve the SBP and the financial institutes/fintech but in fact it will be beyond those and include PTA, NADRA, and law enforcement,” explained Murtaza.

Looking ahead, the organisation plans to continue supporting SBP's anti-fraud initiative, with a focus on introducing new technologies and innovations that can help to detect and prevent online fraud. According to Murtaza, "We always seek commitments from anchor organisation/s for every initiative. Presence of a change champion and capability of the anchor organisation/s for institutionalising the change/s is a precursor for Karandaaz. Capability does not mean only the financial muscle for long term sustainability of any intervention but also considers the human capital, business processes, policies, rules, and regulations."

To ensure the sustainability and scalability of the initiative, it has established clear metrics and indicators to measure success. This includes tracking the number of people reached through awareness campaigns, as well as the number of online fraud cases reported and resolved.

"There are different impact metrics applicable to different interventions," notes Murtaza.

*Name changed to protect privacy at the request of the individual.