Starting a startup is a daunting task, and for many entrepreneurs, securing seed funding is a crucial step in turning their vision into a reality. It's the fuel that ignites the engine of innovation, allowing founders to transform their ideas into tangible products and services. But what if funding dries up, not because your idea lacks merit, but due to circumstances beyond your control? This is the dilemma facing young entrepreneurs in Pakistan, where political instability, economic uncertainty, and a lack of investor confidence have cast a shadow over the startup ecosystem.

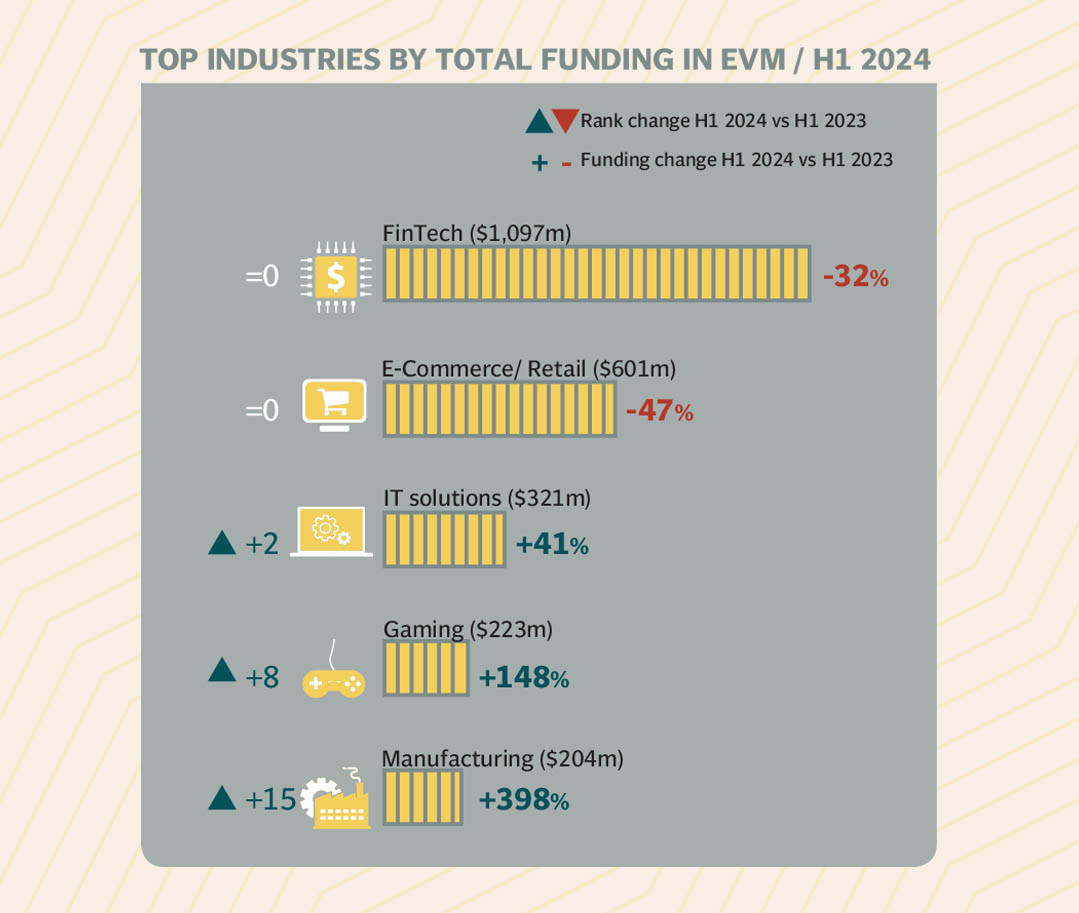

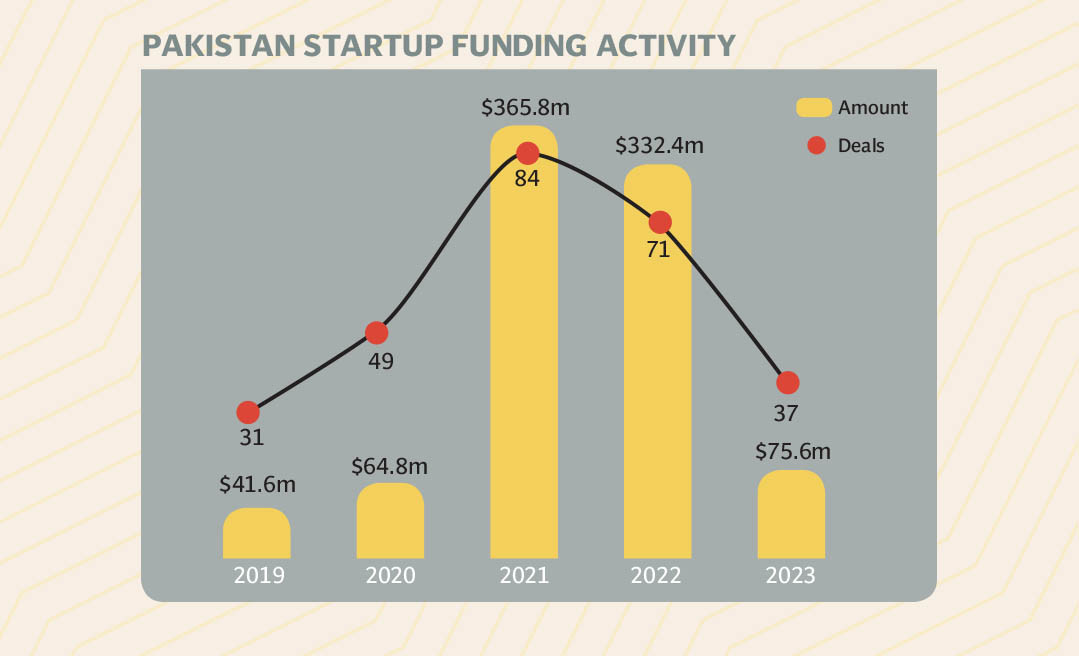

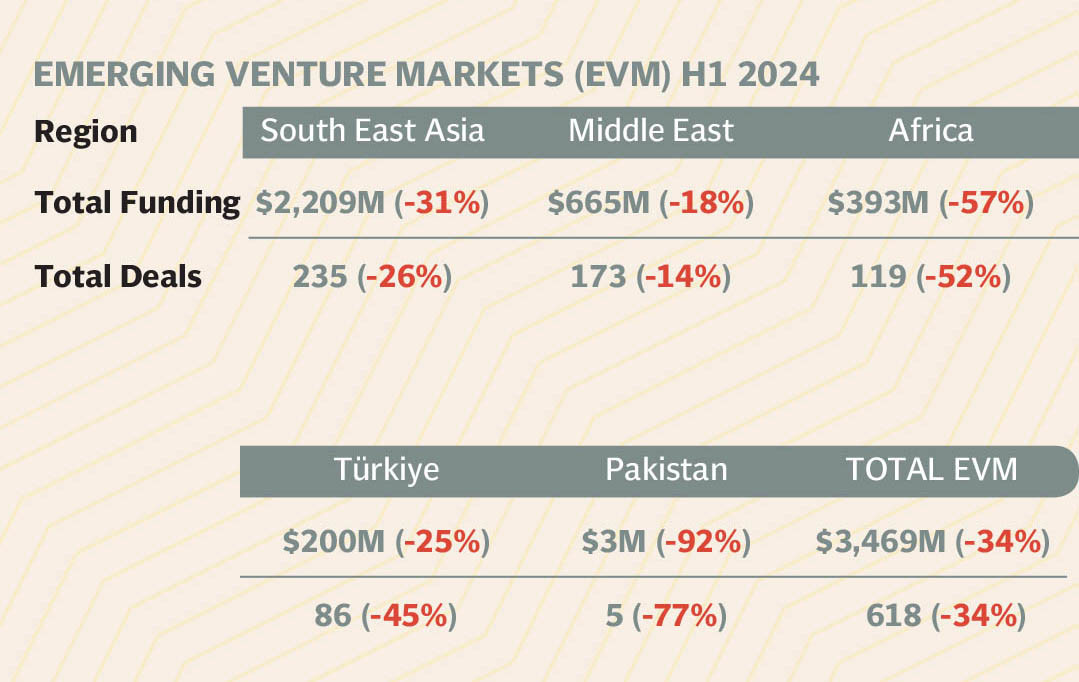

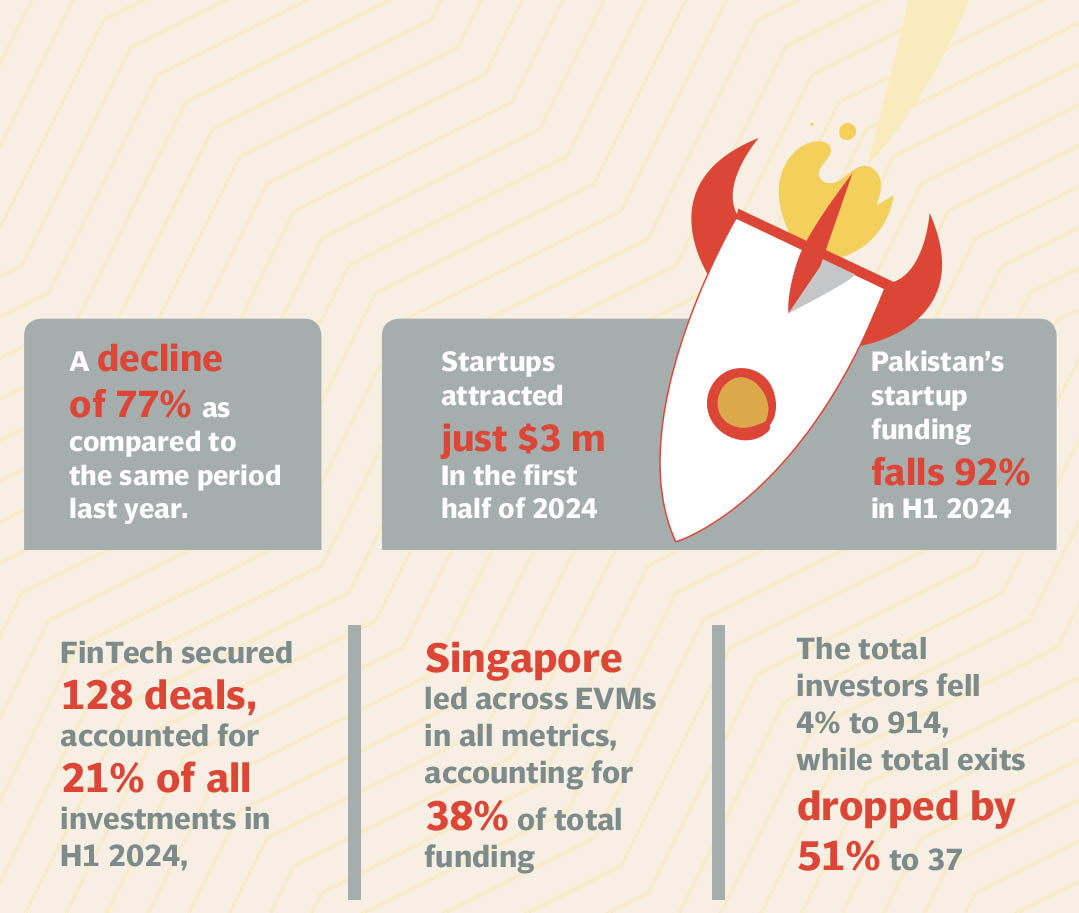

The numbers paint a stark picture. According to data analytics firm Magnitt, Pakistan's startups attracted a mere $3 million in seed funding in the first half of 2024, a staggering 92% drop compared to the same period last year. This decline is part of a larger trend, with seed funding in Pakistan's startup ecosystem experiencing a steady downturn since 2022. The country's startups secured $43 million in funding in the first half of 2023, which itself was a significant drop from the $104 million raised in the same period in 2022.

This drastic decline in seed funding has left many entrepreneurs wondering if their startup ideas are worth pursuing. Will they be able to secure the funding needed to take their projects to the next level, or will they be forced to abandon their dreams? The uncertainty is palpable, and the consequences are far-reaching. Without seed funding, startups struggle to innovate, create jobs, and contribute to the country's economic growth.

As we explore the reasons behind this decline and its impact on Pakistan's startup ecosystem, we speak with experts and entrepreneurs who are navigating this challenging landscape. We'll examine the factors contributing to this downturn, from political instability to a lack of investor confidence. We'll also hear from those who are finding ways to thrive despite the odds, and explore potential solutions to revitalise seed funding in Pakistan.

Current state of seed funding in Pakistan

As the startup ecosystem in Pakistan navigates uncharted waters, a pressing question looms large: what's behind the alarming 92% drop in seed funding in the first half of 2024? Is it a symptom of a broader global trend, or a localised phenomenon? The answer, much like the future of Pakistan's startup scene, remains uncertain.

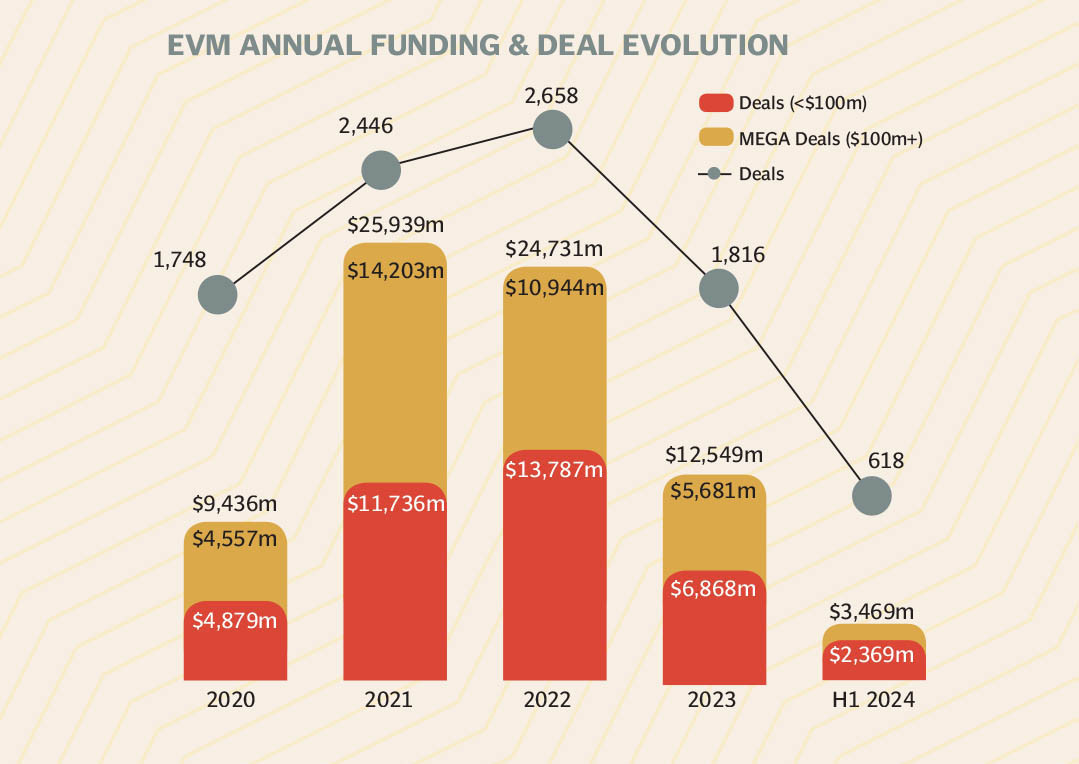

Omer Zabit, Principal at Shorooq Partners, a leading venture capital firm with a focus on emerging markets, attributes the decline to global and local factors. "We've seen the funding slow down globally, with frontier markets like Pakistan seeing the most impact. Besides global macros, there are considerations around political and policy stability, forex risk, and Pakistan-specific macro-economic challenges."

Syed Azfar Hussain, Project Director at the National Incubation Center Karachi, echoes this sentiment, "VC funding has generally declined all over the globe. Economic downturns, inflation, and geopolitical instability have made investors cautious worldwide. Over the past few years, some startups have been valued at exceedingly high levels. A correction in these valuations also led to a decrease in funding as investors reassess the true worth of companies."

Hussain also highlights Pakistan's unique challenges, "Pakistan's market is at a very nascent stage, and adding to the global factors, the nascent ecosystem also lacks a local base of investors that have preferred technology sector and scalable startups as their preferred vehicles for investments."

The primary challenges facing startups in Pakistan, according to Hussain, are; Pakistan's ecosystem lacks local venture capitals (VCs), there are very few organised angel investment networks platforms and syndicates, the founder quality needs improvement as well, many startups lack the product market fit, which gives little hope for scalability and funding, and the overall investment enablement is low because of red tapism.

Hussain also highlighted the general feedback in Pakistan, which is that the deals were decreasing from the start compared to the rest of the world. “If you look at the ecosystem from 2018, there are no deals at all. Generally, there is less investment in startups, resulting in lower deal flow,” said Hussain. “When deal flow is low, overall investment is also low. This is an old problem that wasn't present globally.”

The second issue he highlighted was that the political and economic instability in the country is even worse than the rest of the world. The third problem he highlighted that a significant portion of the population in Pakistan does not believe in technology and startups. “Local angel investors are scarce,” he adds.

Despite these challenges, some startups are finding ways to thrive. Hassan Khan, co-founder and CEO of Zyp Technologies, which recently raised $1.5M in Series Pre-A funding led by Shorooq Partners, sees the decline in funding as a blessing in disguise.

"It's a blessing in disguise. Seeing the slow down worldwide in startup funding, we decided to focus on the B2B delivery rider segment and not build a production version of the prototype designed for the younger generation. This is so we can have a longer runway using our existing funds. It helped us optimise our solution for delivery riders faster, as seen by the success with Chughtai Lab and their subsequent purchase order."

Talking about the challenges they face in securing funding, Khan said, “Several conversations with VCs went well but many decided to 'wait and see' how Pakistan's situation emerges but we continued to make good progress with Chughtai Lab and TCS which enabled larger VCs like Shorooq to see the potential which led to them funding us.”

Shorooq Partners' investment strategy remains bullish on Pakistan, despite the funding climate. Zabit notes, "We continue to be long on Pakistan owing to both the immense talent available within the country and also the opportunity in specific sectors touching the common person, like daily essentials, financial services, mobility, and housing."

Educating entrepreneurs

While addressing the decline in seed funding, it's essential to acknowledge that entrepreneurs themselves face challenges that hinder their growth. Educating entrepreneurs from the outset is crucial to equip them with the necessary skills and knowledge to navigate the startup ecosystem effectively.

Traditional education systems and incubation centers play a vital role in imparting essential skills and knowledge to entrepreneurs. However, innovative approaches are also emerging to reach a broader audience. Mentors and educators are leveraging social media platforms like TikTok to share their expertise with new and current entrepreneurs.

These platforms offer an unprecedented opportunity to reach a massive audience, leveraging algorithms to deliver valuable content to those who need it most. By harnessing the power of social media, educators can provide entrepreneurs with; practical advice on navigating funding challenges, insights into market trends and consumer behavior, guidance on refining business models and pitches, and access to valuable networks and connections.

As Azad Chaiwala, CEO of Azad Chaiwala Institute, explains, "The youth is there [on TikTok]. So I just make content of their interest and put their work there." By leveraging his massive following on TikTok, Chaiwala aims to promote entrepreneurship and business education among young Pakistanis. He believes that by creating content that resonates with their interests, he can inspire a new generation of entrepreneurs.

Chaiwala's strategy is simple yet effective. He focuses on addressing the issues and concerns of his audience, answering their questions, and providing valuable insights. "Obviously, I look at their issues. And I just keep on talking about them. And the second is, I answer their questions." By doing so, he creates a snowball effect, where more and more people engage with his content, asking questions and seeking similar advice.

The impact of platforms like TikTok in educating the masses cannot be overstated. Chaiwala believes that TikTok holds far more value than traditional education systems or government initiatives. "Everybody looks for their news on social media. And TikTok, I guess, leads the media as far as vertical videos and short-form content." By harnessing the power of TikTok, educators like Chaiwala can reach a vast audience, inspiring and educating entrepreneurs in the process.

As Chaiwala puts it, "Myself and other people's efforts will then combine and become a niche, which we can call a business niche. The algorithm will drag them into that. And then they will see my content. Their mentality will start changing when they will see my videos again and again." By creating engaging content and leveraging TikTok's algorithm, Chaiwala is able to inspire and educate entrepreneurs, empowering them to succeed in the business world.

Talking about the current economic climate, Chaiwala notes, “The climate has nothing to do with it. They simply have to create a product which is viable, which is sold, and prove profitability and demand." He emphasises that a good product that solves people's problems will attract customers and generate revenue, making funding less of an issue.

In fact, Chaiwala believes that a successful business can thrive without relying on seed funding. "And then, what do they say, I don't think they even need to secure seed funding or any kind of funding. That is their rinse and repeat process." He advises entrepreneurs to focus on creating a product that sells, and then invest the profits to grow the business.

Sharing his advice about how to make business attractive to seed investors, Chaiwala explained in simple words, "Profit. Make profitable businesses with systems." He stresses that a business with a robust system in place, not reliant on a single person, is more likely to appeal to investors.

When it comes to mentoring, Chaiwala looks for individuals who are driven to succeed. "I look for people who want to run," he says. He then provides guidance, shares his network, and offers financial support to help them grow. "I teach them. I'll share my contact books. I'll back them financially. I'll mentor them and make them run faster and win bigger races."

Throughout his journey, Chaiwala has learned valuable lessons about what works and what doesn't. He warns against relying too heavily on funding, saying, "I wasted a lot of money trying to prop up people who are not interested in running, who are not interested in business." Instead, he advises entrepreneurs to focus on building a solid business foundation. "Just create good products which are sold and solve people's problems. And the rest will take care of itself."

He believes that traditional education systems lack practical, relevant knowledge that can solve real-world problems. He aims to address this gap through his content and training, focusing on straightforward business principles. "Business is straightforward. Take one thing for one rupee and sell it for one and a half rupees. The money in between is your effort, your profit, whatever you want to call it."

He also criticises the over-complication of business education, emphasising the importance of hands-on experience and simplicity. "I don't believe in written stuff and putting it in too much formality. I just believe in getting your hands dirty and getting down. Start small. And if it fails, then do one more. Do one more."

He also stresses the importance of practical investment advice, such as dollar-cost averaging, and encourages entrepreneurs to take calculated risks. "Invest your 1% in 10 tranches. If it is less, then it is less. You will get an average price," he says.

By addressing the gaps in traditional education, Chaiwala aims to empower entrepreneurs with the practical knowledge and skills needed to succeed in business.

The floating ship

Despite the challenges facing Pakistan's startup ecosystem, including the decline in seed funding, the entrepreneurial spirit remains unbroken. In fact, the number of incubators and accelerators in Pakistan is on the rise, providing a lifeline for innovative ideas and determined founders.

Like a ship that continues to float despite turbulent waters, Pakistan's startup scene persists, driven by the resilience of its entrepreneurs and investors. Amidst the downturn, success stories like ZYP Technologies' recent funding securement offer a beacon of hope.

Zyp Technologies has raised $1.5M in Series Pre-A funding led by Shorooq Partners to enable a citywide launch of Zyp's electric smart mobility technologies in Lahore, Pakistan. This investment will fuel the establishment of over 60 battery swap stations and the deployment of 1000 Zyp Utility Motorcycles (ZUM 2000) in the next 12 months.

Khan, the co-founder and CEO of Zyp Technologies, highlighted the transformative effect of Shorooq Partners' investment; "This pivotal investment accelerates us towards achieving Pakistan's electric vehicle ambitions by 2030. Zyp is removing affordability barriers for high-quality electric vehicles designed specifically for Pakistan's tough environment."

Khan further explained how Zyp's electric smart mobility solution addresses Pakistan's environmental goals, he said, "Around 43% of pollution in our cities comes from vehicular emission, and 75% of the vehicles are motorcycles. As people adopt electric vehicles, our air quality levels will start to improve."

Omer Zabit, Principal at Shorooq Partners, commented, "Our investment in Zyp Technologies will drive significant environmental and economic benefits for Pakistan in the long term by addressing some of the challenges that delivery companies and the mobility industry typically face."

Zabit explains that they invested in Zyp Technologies due to the vast potential of Pakistan's mobility market, particularly in bike transportation, which has the strongest household penetration. He believes Zyp offers the perfect solution for this segment to transition to electric and sustainable transport, within the average Pakistani's reach, and is confident that Zyp will dominate this market, revolutionising travel in Pakistan and underscoring the resilience and innovative spirit of the nation's startup ecosystem.

In the next 6-12 months, Zyp plans to expand its presence in Lahore, with more Zyp Energy branded swap stations and ZUM 2000 motorcycles on the road. The company is also in trials with several businesses to convert their fleets to electric, reducing operational costs.

As investors and entrepreneurs navigate the choppy waters of funding, they remain undeterred, seeking opportunities to collaborate and innovate. The proliferation of incubators and accelerators demonstrates a commitment to nurturing talent and ideas, ensuring that the startup ecosystem remains afloat.

This phenomenon is a testament to the power of entrepreneurial spirit and the unwavering belief in the potential of Pakistani startups to make a mark on the global stage. As the ship sails on, it carries with it the dreams and aspirations of a nation, buoyed by the determination of its people to succeed against all odds.

Coming years

Despite the turbulent waters facing Pakistan's startup ecosystem, a few beacons of hope remain. The proliferation of incubators and accelerators is providing a lifeline for innovative ideas and determined founders. Government initiatives aimed at fostering a conducive business environment are also showing promise.

Hussain notes that the decline in seed funding may be exaggerated, as "If there are five deals versus one deal, then the difference is obvious." He also hints at potential mergers and acquisitions on the horizon, which could further boost the ecosystem.

Looking ahead, the future of seed funding in Pakistan appears bright, thanks to the convergence of several key factors. The establishment of the Pakistan Startup Fund is expected to provide crucial early-stage capital to innovative startups, addressing financial constraints that often impede growth. Angel investor-led networks and funds will also play a significant role in bridging the funding gap, bringing not only capital but also mentorship and strategic guidance.

Hussain shares, “There is a noticeable shift in investor appetite towards diversification beyond traditional sectors like real estate, with technology-driven sectors offering potential for high returns and transformative impact. With these combined efforts, Pakistan is poised to become a hotspot for entrepreneurial activity, driving economic growth and innovation.”

Talking about the government policies and initiatives he said, “They also have a crucial role to play in supporting seed funding. The Ministry of IT and Telecom's National Incubation Center program has already facilitated the startup ecosystem, while the recently launched Pakistan Startup Fund aims to catalyze venture investments. The fund provides equity-free capital to help startups raise their first external investment, with the government allocating up to two billion rupees annually.”

Other initiatives, such as Singapore's Startup SG and the UK's Enterprise Investment Scheme, offer valuable lessons for Pakistan. These programs provide comprehensive frameworks for startups, including simplified business registration and compliance processes, as well as tax reliefs for investors.

Despite the decline in seed funding, the ecosystem will continue to produce innovative products and startups, driven by the country's nascent stage and numerous problems to solve. Digital transformation and the need for digitalisation across all verticals also offer ample opportunities for growth. As Azfar Hussain notes, "investments are vital for highly scalable products and startups, but our ecosystem also needs adoption for its better, so I am optimistic on this front."

The resilience and adaptability of Pakistani entrepreneurs continue to drive progress. While challenges lie ahead, these elements are keeping the hopes of a brighter future alive. The coming years will be pivotal in shaping the trajectory of this ecosystem, and although uncertainty prevails, the potential for growth and innovation remains.

According to Zabit of Shorooq Partners, the funding landscape in Pakistan and the region is expected to evolve significantly in the next year. “While the number of deals closed may be smaller compared to last year, the amount of dollars invested is larger, indicating that startups are growing and the investment landscape is becoming more competitive,” shares Zabit.

However, Pakistan's funding landscape might take time to recover, notes Zabit. “Nevertheless, a major trend is emerging - Pakistani talent is building for the rest of the world, creating a talent arbitrage that offers a great cost advantage and keeps Pakistan a vital player in the region,” he adds.

To startups in Pakistan struggling to secure funding in this challenging environment, Zabit advises focusing on strong business fundamentals and economics. "Companies have to prove out their economic viability far sooner than all the predecessors across the globe," he emphasises. “It's more probable to get funding to grow a viable business model in this environment, rather than trying to grab market share through negative economics and price cuts.”

Zabit observes that founders are building in this new reality, as Pakistan continues to offer sizable market opportunities for startups to disrupt various sectors. “By prioritising economic viability and strong business fundamentals, startups can increase their chances of securing funding and achieving success in this competitive landscape,” shares Zabit.

As the ship sails on, it carries with it the dreams and aspirations of a nation, buoyed by the determination of its people to succeed against all odds. By educating entrepreneurs through a combination of traditional and innovative methods, they can be empowered to overcome the challenges they face, including securing seed funding. With the ongoing evolution of the startup ecosystem, Pakistan's entrepreneurs are navigating the choppy waters of funding and innovation with renewed hope and optimism. As the ecosystem continues to grow, it's essential to prioritise entrepreneur education, ensuring that the next generation of founders is equipped to succeed and drive the nation's startup scene forward.