In Pakistan’s initial foray into solar energy, the idea of installing solar panels in residential houses was far-fetched and most of the consumption was in industrial areas. Over the recent years, much has changed, and currently, with the electricity price hike even the middle class households are forced to consider shifting to solar energy so that they may save a few thousand rupees every month to manage their budget amid rising inflation in the country.

However, the recent change of government policies have left consumers in limbo where they are unsure about the increased taxes or new taxes or any other additional expenses they can face in coming years.

“I have been thinking to shift on solar energy for three, four years now. As the cost is quite high, I have been budgeting for it,” shared Muhammad Azeem who lives in a 120-sq yards house with a family of six people. “We have six rooms in the house and an 8KVA system is what we have been planning. Until two years ago, a solar panel installation was costing 600,000 to 700,000 rupees. Last year it was costing somewhere around 1.2 million but now with fluctuating prices, an on-grid system is being quoted for one million rupees,” he said.

The news of taxes, net metering and tariffs is making him re-think his decision. If such taxes are implemented then it would mean that he would be paying the amount in taxes that he was planning to save in bills.

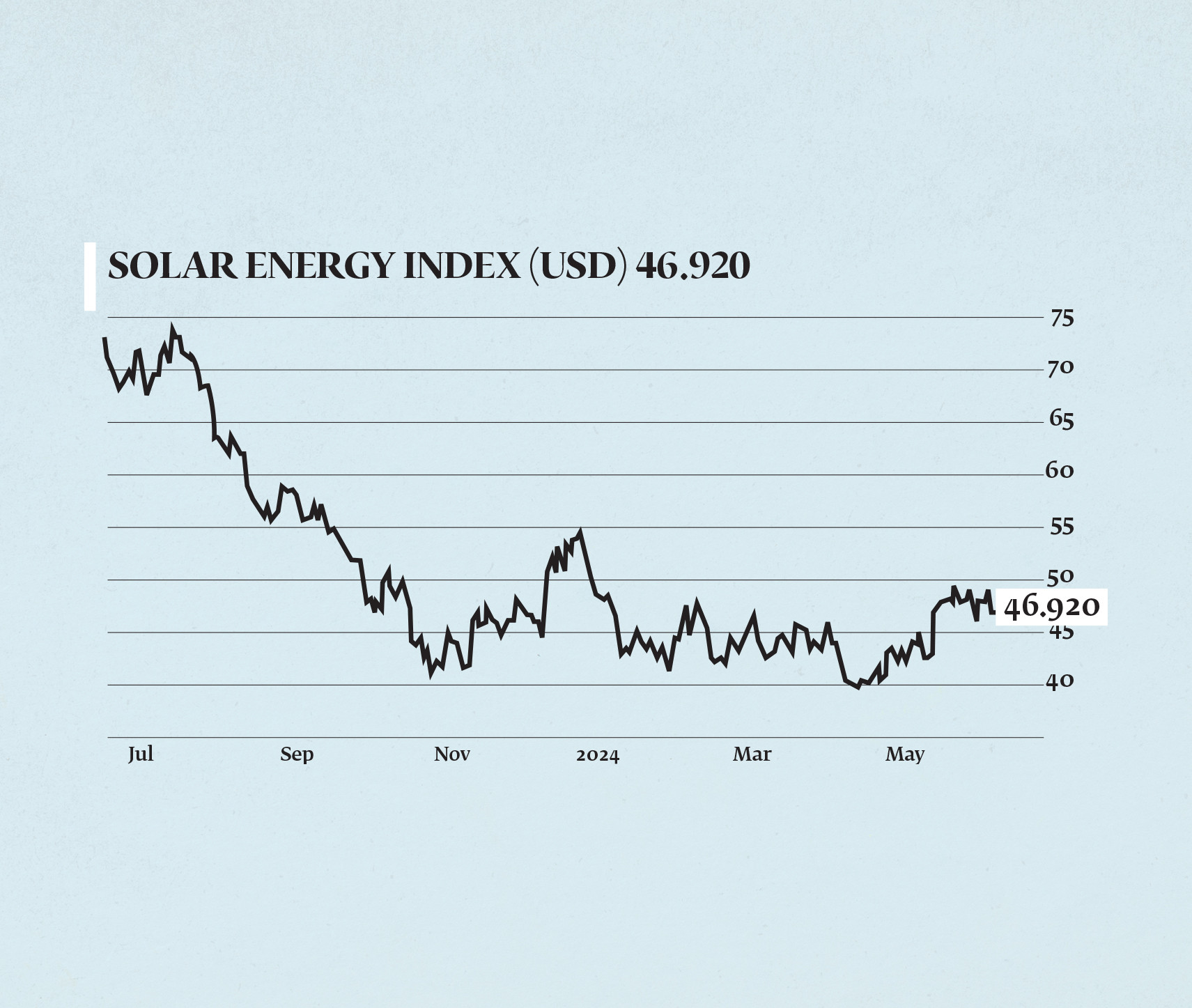

Due to a number of factors, the cost of solar panels has fluctuated significantly in Pakistan over the last few years. The recent change in tariffs and import levies on solar-related equipment has driven up prices overall. This covers sales taxes, regulatory fees, and customs charges on solar panels and associated parts. The depreciation of the Pakistani rupee is also another major factor because imported solar panels are now more expensive due to the Pakistani rupee decline against foreign currencies, particularly the US dollar.

Currency changes have a direct impact on prices of solar equipment, as a significant amount of it is imported. “Price fluctuation does impact the business because the market that we work in is mostly catering the middle class. The middle class households were not able to afford solar panels when the prices rose but this year when the prices went down and the heatwaves made lives miserable, many have opted for solar energy so that they can get uninterrupted electricity,” told Ali Majid, general manager of Longi Pakistan.

The availability and price of raw materials and completed goods have been impacted by supply chain disruptions worldwide, especially those made worse by the Covid-19 pandemic. Prices have increased substantially due of increased shipping charges, but majorly the world is facing climate catastrophes, heatwaves and changing temperatures are causing more demand of renewable energies in third-world countries.

Pakistan's need for solar panels is rising as a result of the country's expanding energy requirements and regular power disruptions. Prices may keep rising as more people and companies turn to solar energy for dependable electricity due to the spike in demand.

The results of government initiatives supporting renewable energy have been conflicting. Subsidies and incentives can reduce costs, but abrupt changes in policy or the elimination of incentives may result in price increases. “Government policies will bring an impact as net metering will take away the lucrative advantage from the consumer and they have to get back-ups for storing the energy and that will cost them other than the installation. Right now, there is this leverage to use energy in a similar manner with peak hours and off hours but with net-metering this factor will change,” explained Majid.

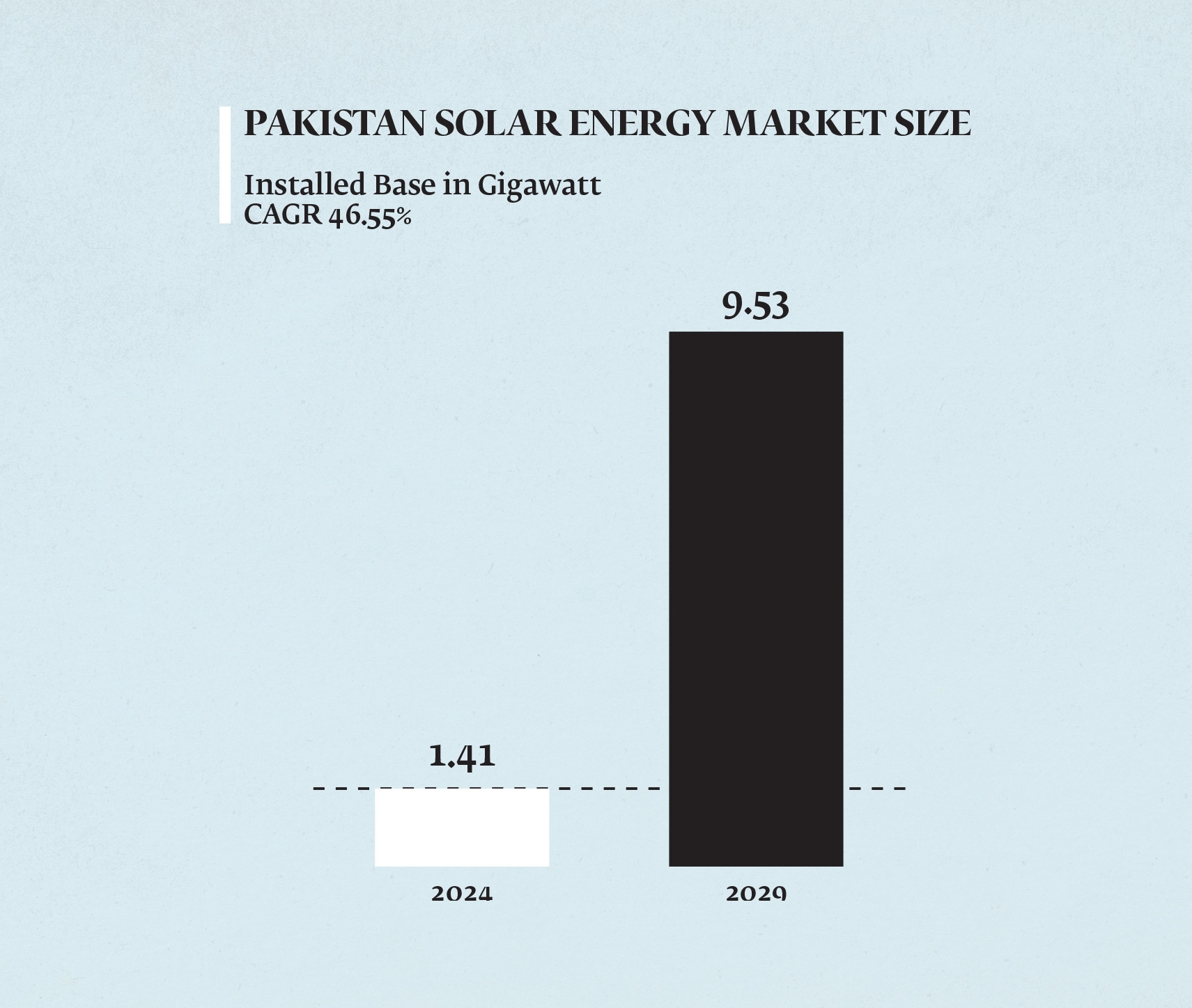

In Pakistan, solar energy adoption is growing despite price increases. Government initiatives, growing public knowledge of the advantages of renewable energy sources, and the long-term financial savings linked to solar power are the main drivers for this. Through a number of programmes, such as tax breaks, net metering laws, and financial aid for solar energy installations, the Pakistani government has been encouraging solar energy. Enhancing energy security and lowering dependency on fossil fuels are the goals of these initiatives. “These regulations will slow down the shift but people will move towards solar energy because of the price hikes in the electricity they are buying from the government,” Majid said. He added that in an effort to decrease reliance on imports, there is a growing trend towards the production of solar panels and their components locally. This may take some time to fully materialise, but it can help stabilise prices and generate jobs locally. “Right now the return on investment for solar panels installation is 12-16 months and you can enjoy free energy for 45 years,” he said.

As solar technology advances, solar panels become more cost-effective and efficient. Better energy storage systems and bifacial panels, which gather sunlight from both sides, are examples of innovations that are becoming increasingly widespread. Businesses and households wishing to engage in solar energy now have more financing choices at their disposal. This makes it simpler to finance the first investment and includes solar leasing, power purchase agreements (PPAs), and green financing. “Energy storage is getting cheaper worldwide. People can use energy generated directly by sunlight when the sun’s out and use excess power stored in sophisticated batteries when it’s not, helping them recoup their investments faster by cutting their power costs,” the general manager at Longi explained.

As sustainable practices gain traction and environmental consciousness rises, more people and companies are starting to think about solar energy. It is anticipated that this change will fuel the solar market's long-term expansion. Due to outside economic factors and changes in policy, there may be some obstacles in Pakistan's short-term outlook for solar panel pricing, but overall, the trend seems to be favourable. Future growth and price stabilisation are probably going to be driven by rising adoption, technology breakthroughs, and pro-business government policies.

Through a technique known as "net metering," owners of solar panels can sell any extra electricity they produce back to the grid, essentially running their meter backwards. Businesses that use solar electricity and companies in the solar industry in particular may be significantly impacted by this system in a number of ways.

“Words such as net-metering or tariffs or different types of plates are very fancy words for layman, and my concern is to provide uninterrupted electricity to the house which requires less hassle. So, the government, its policies, solar energy companies and their jargon are just for them. A normal Pakistani only requires ease at reasonable rates,” told Atif Khan who shifted to solar energy 10 months ago. He also added that he was not aware of the many factors such as cleaning the panels for better efficiency, being on-grid or off-grid when there is a power breakdown for longer hours, etc.

By allowing for the monetisation of excess generation, net metering increases the financial appeal of solar electricity. The demand for solar installations may rise as a result, which would be advantageous for producers, installers, and service providers of solar panels. Net metering has the potential to greatly increase the return on investment for companies who use solar power. Businesses can reduce their electricity costs by selling extra power back to the grid, which increases the appeal of solar installations.

A wider range of enterprises may take into consideration implementing solar power as the financial benefits of net metering become more widely acknowledged. As a result, the market for solar goods and services may develop, supporting the expansion of the sector. In the solar sector, innovation may be spurred by the possibility of higher profitability. In order to produce more affordable and efficient solar technology, businesses might increase their R&D spending, which would promote healthy competition and technical advancement. “For the longest of time, Longi alone had the market share for R&D, especially in monocrystalline plates which are more effective and better panels than polycrystalline plates that were being used. Monocrystalline plates were introduced in 2015 and they have proved to be a game-changer in the market,” Majid said.

Net metering regulations are susceptible to change and might differ greatly by region. Uncertainty can be introduced by abrupt policy changes or drops in net metering rates, which may have an impact on investment and company planning decisions.

Issues with voltage regulation and supply and demand balancing may arise in areas with high solar penetration. Utility providers may have to incur more expenses and infrastructure investments as a result, which they may then pass along to solar companies and customers. Financial gains could be lessened if net metering rates are set too low. This might reduce adoption rates and have an effect on how profitable solar installation companies are.

By broadening their product offers, solar companies can reduce risks. This could entail branching out into different renewable energy sources, delivering maintenance services, or offering energy storage options. “I have included a storage system as well which helps when there is power breakdown but then if net-metering is implemented the cost and peak hour usage will be affected,” said Khan.

Businesses can support the creation of a stable regulatory framework and promote favourable net metering rules by interacting with legislators and joining trade associations. Demand can be increased by informing prospective consumers about the financial advantages of solar power generally and the benefits of net metering. It's critical to communicate clearly about long-term savings and environmental advantages.

By making investments in cutting-edge technologies like energy management programmes and smart inverters, it is possible to maximise the integration of solar electricity into the grid and increase the effectiveness and advantages of net metering for all parties. Because net metering increases the financial attraction of solar electricity, stimulates demand, and encourages innovation, it can have a profoundly positive effect on the solar sector. Businesses must, however, handle potential grid management issues as well as regulatory concerns. Solar companies can profit from net metering and help increase the use of renewable energy by implementing calculated strategies and supporting solid legislation.

What’s on the panels

The process of manufacturing monocrystalline solar panels involves using silicon that is single-crystal. In order to do this, a single silicon crystal must develop before being cut into wafers. The Czochralski method is the name of this procedure. “Monocrystalline panels have greater efficiency rates (15–25% or more). This is as a result of improved electron flow made possible by the single-crystal structure, these panels have a consistent appearance and are usually dark or black in colour. The slicing operation gave the cells their rounded corners,” told Sarim Ali who is a supplier of plates in Pakistan.

Because of the intricate manufacturing process and superior material quality, Monocrystalline solar panels are more expensive to make and typically have a 25-year warranty and a longer lifespan. When compared to polycrystalline panels, they perform better in high temperatures and low light which is ideal in Pakistan. “Due to their increased efficiency, these panels are perfect for homes with small roof spaces and because of superior performance and high efficiency, businesses frequently choose them,” he shared.

While on the other hand polycrystalline panels have many crystal structures that obstruct electron flow, their efficiency rates are typically lower (13–16%). In the market there are many silicon crystals present, these panels typically have a speckled, less uniform appearance and are typically blue in colour.

“Because the manufacturing process is less complicated and wasteful, they are less expensive to create, although they often don't last as long as monocrystalline panels, they are nonetheless strong and frequently have guarantees of 20 to 25 years,” he explained, adding that mostly polycrystalline panels are used in residential installation.