Pakistan's economy is not an exception to the disruptive global financial trend known as open banking. Due to technical improvements and legislative actions, Pakistan's financial environment has gradually shifted towards open banking in recent years.

Through the use of Application Programming Interfaces (APIs), open banking enables financial data from banks to be accessed and utilised by outside financial service providers. The aim is to promote creativity, rivalry, and cooperation in the financial industry. With the State Bank of Pakistan (SBP) launching measures to update the financial ecosystem, the idea gained traction in Pakistan.

In Pakistan, SBP has taken the lead in advancing open banking. The Open Banking Framework was unveiled by the SBP in 2019 and provides standards for banks to safely communicate customer-permitted data. The framework sought to stimulate competition, improve financial transparency, and foster innovation in the financial industry.

State Bank’s initiatives

SBP has introduced several initiatives to promote open banking in the country. To offer principles and rules for the adoption of open banking practices throughout the nation, the State Bank of Pakistan established the Open Banking Framework. When sharing customer-permitted data with third-party service providers, banks and other financial institutions were obliged to adhere to the criteria and guidelines outlined in this framework.

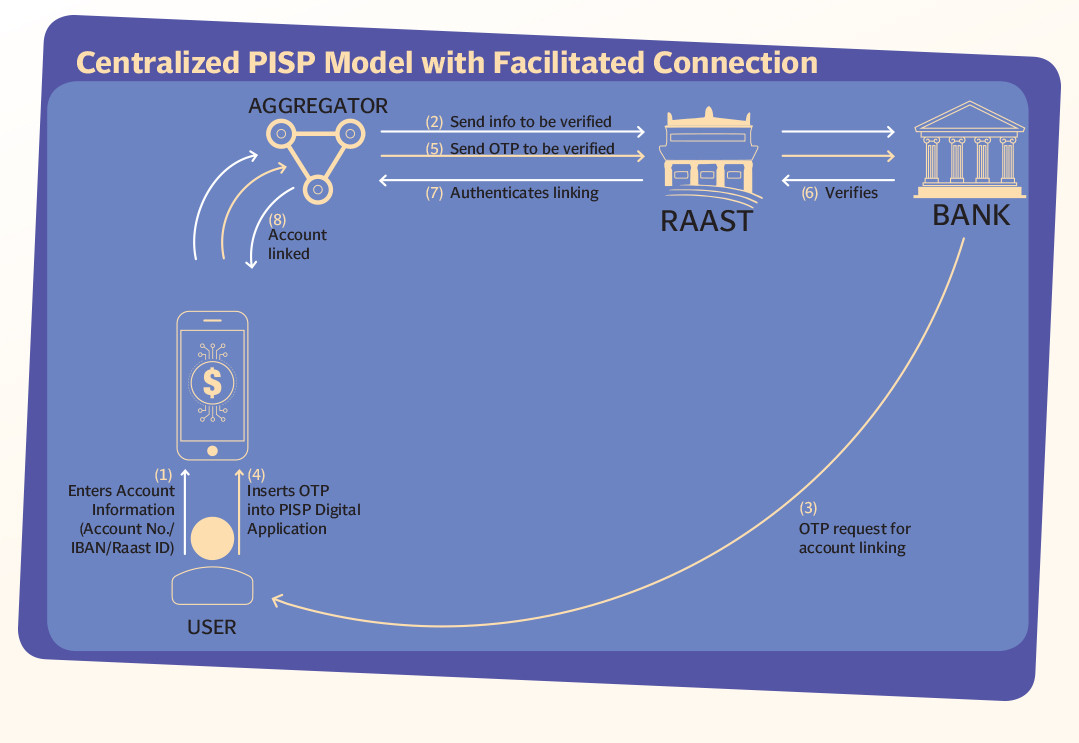

To enable safe and uniform data transmission between banks and approved third parties, the SBP placed a strong emphasis on the creation and uptake of standardised APIs. The smooth operation of open banking systems depends on these APIs. To promote innovation in the financial industry, particularly open banking, the SBP built a regulatory sandbox. “Fintech firms and financial institutions can test new goods, services, and business models in a regulated setting under regulatory watch,” explained a federal ombudsman banking officer. The SBP concentrated on making sure that clear and strong customer consent procedures were in place. This includes options for clients to expressly authorise to the exchange of their financial information with outside service providers. In open banking projects, customer privacy and data protection are essential factors to take into account.

The SBP released guidelines to make sure that banks and other financial institutions have strong cybersecurity safeguards in place because it understood how important data security is to open banking. This includes safeguards for consumer data while it's being exchanged across various participants in the open banking ecosystem. To help with input and insights, the SBP has been trying to bring all stakeholders on the table, which include banks, fintech firms, and other pertinent entities. By working together, we hope to overcome obstacles and improve the regulatory framework as the open banking landscape develops.

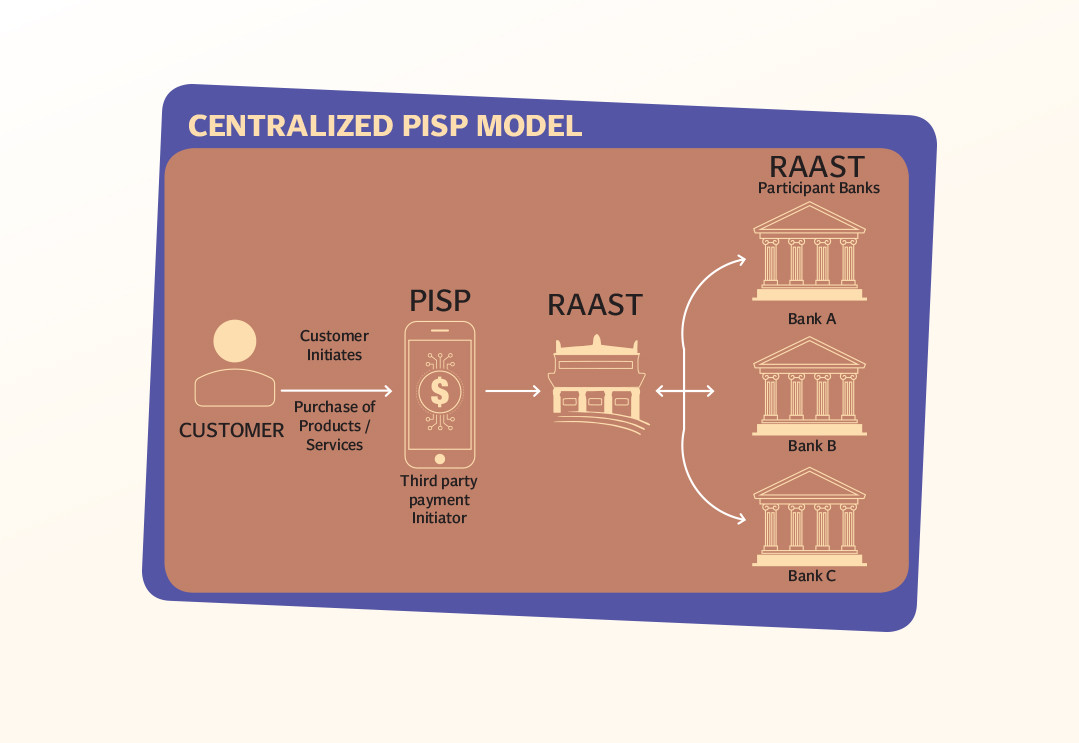

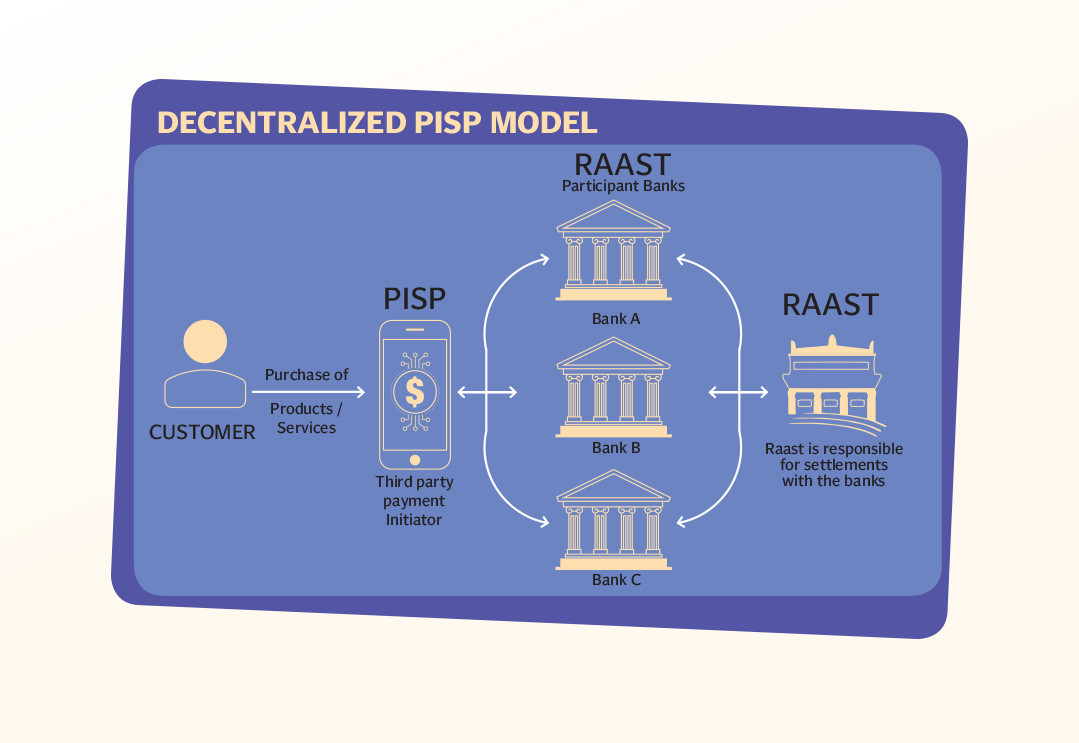

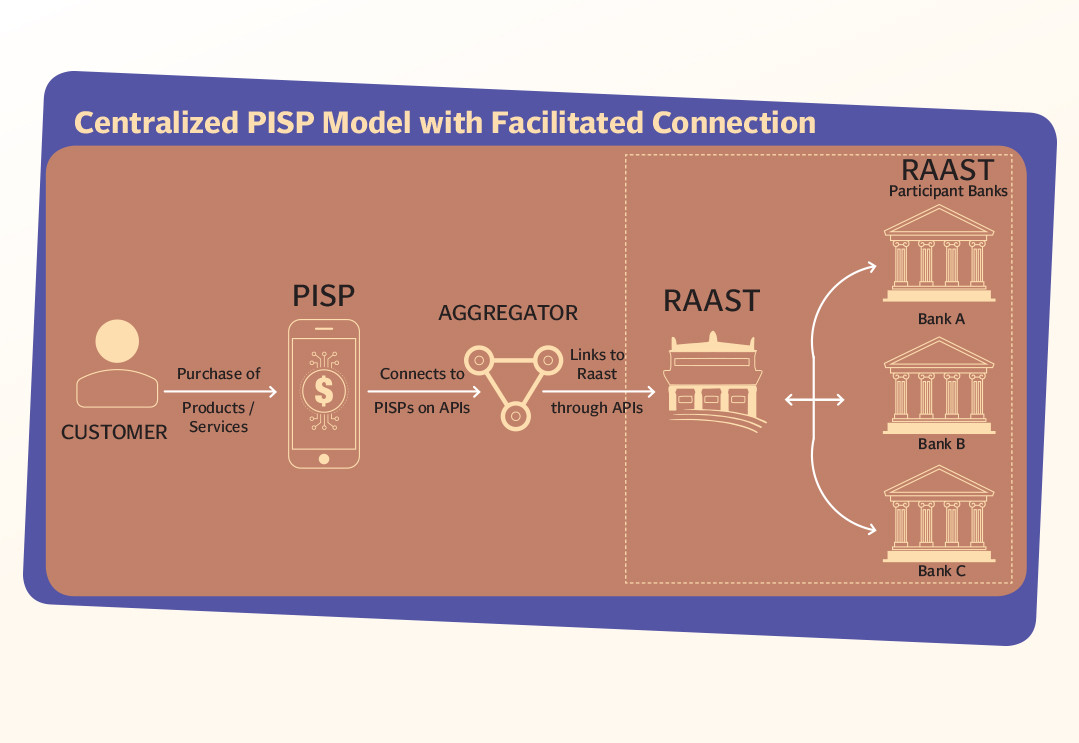

To start within Pakistan two years ago RAAST was launched as a pilot project to channelise the transactions and Karandaaz is the third party that manages it on behalf of the regulatory authority.

Open Banking has revealed the potential of traditional financial services, it facilitates the dissemination of data to financial institutions and third parties. It will help create a better ecosystem for market users in Pakistan.

Karandaaz has issued a white paper on open banking, presenting its benefits and outlining the future path of open banking. Karandaaz has also host a roundtable conference on Open Banking recently with stakeholders to deliberate on the future of Open Banking in Pakistan, offering a platform for dialogue and exploration of its prospects, told CEO Waqas ul Hasan.

Challenges

The worry about security lapses is one of the main obstacles. Strong cybersecurity measures are essential as open banking entails the exchange of sensitive financial data. It is crucial to have a secure infrastructure that guards client data from unwanted access.

“Open banking adoption is strongly dependent on sophisticated technology infrastructure. The digital gap is a major obstacle in Pakistan, as some areas still do not have access to fundamental financial services. Developing technology and making sure that everyone is digitally literate are necessary before open banking can be successfully implemented,” told the deputy CEO of an IT firm, Waqas Alam. He was also of the view that in open banking there are two types of possibilities with data consumption and data exposure so every bank will be exposing their data but who is there to consume?

Getting around the regulatory environment might be challenging. Strict rules must be followed by banks and other financial organisations to guarantee the safe exchange of data. Maintaining regulatory compliance while promoting innovation is a complex issue that calls for ongoing cooperation among parties. “Gaining the confidence of clients is difficult as many people could be reluctant to adopt open banking because they are worried about the security of their personal financial information. For open banking to be widely accepted, public awareness and education about its advantages and security precautions are essential, Pakistan is still way behind the rest of the world,” told Alam who manages the gulf region for his company.

The success of open banking depends on ensuring smooth interoperability between various financial institutions and outside service providers. Innovation may face barriers due to unstandardised methods and systems that impede data interchange.

How can it help the Pakistani market?

Investments in cybersecurity infrastructure must be substantial if open banking is to become more trustworthy. Putting in place cutting-edge security procedures, encryption tools, and routine audits can all help reduce the dangers related to data breaches.

It is imperative to improve the technology infrastructure, particularly in underprivileged places. Together, the public and private sectors can increase digital connectivity and make financial services more widely accessible at reasonable prices.

“The establishment of a regulatory environment that fosters innovation and guarantees data security and compliance requires regulators to take a cooperative stance, closely collaborating with banks, fintech firms, and other relevant players. Public awareness initiatives that are extensive in scope can be used to help the general public understand open banking,” told the banking ombudsman while adding that, initiatives for education should emphasise the advantages, safety precautions, and possibilities for financial inclusion that come with open banking.

It is crucial to standardise protocols for interoperability and data transmission. Working together across the industry to create uniform standards may simplify procedures, lessen conflict, and promote the creation of creative solutions.

Open banking has the potential to transform Pakistan's financial system, promote innovation, and increase financial inclusion. “A prosperous open banking environment can be achieved even with ongoing obstacles if regulators, financial institutions, and technology providers work together, it is like making one window and making it easy, obviously anything that will come will do with a cost, and here the cost is data,” told Noman Mukhtar, SVP/Competency Lead, BFS Business at Systems Ltd.

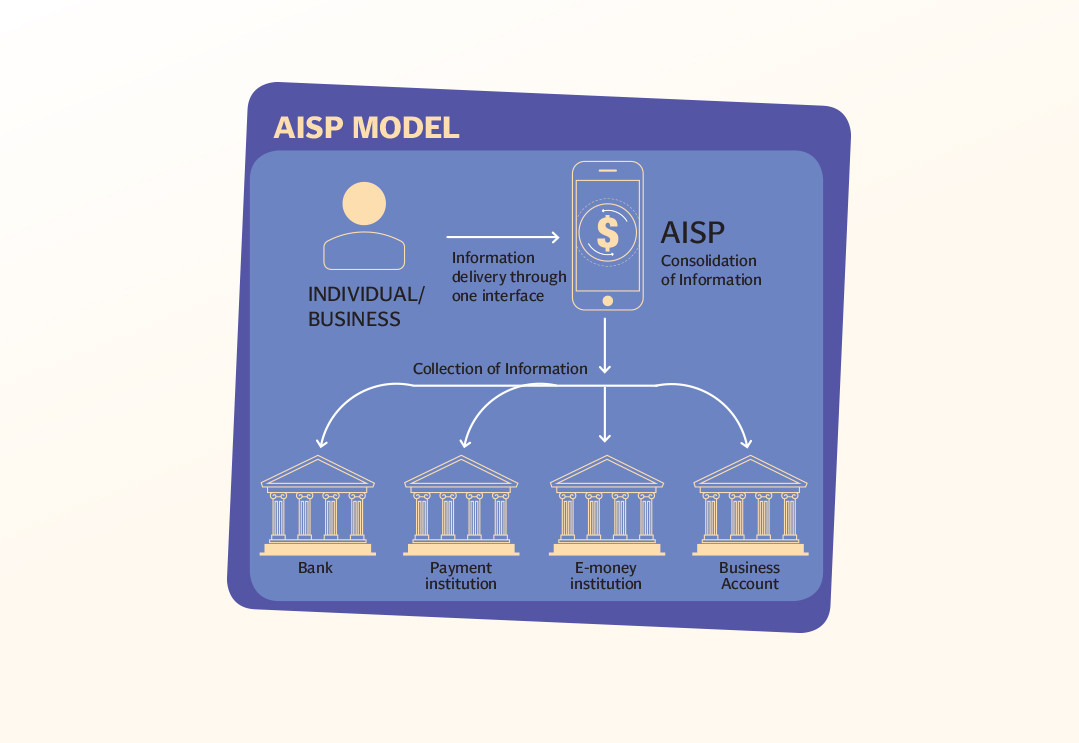

Through the resolution of security issues, infrastructure development, regulatory cooperation, and public education, Pakistan can fully realise the benefits of open banking and usher in a new era of financial services for its people. “With open banking when the banks will expose my transactional data in the market then banks can play around with it in terms of marketing, giving me targeted discounts and gaining my trust to adapt their banking platforms,” explained Alam sharing how the simple understanding is making one window banking such as one mobile application that can have data from all bank accounts.

For example, I have three bank accounts of different banks but one bank came up with a digital app to synchronise all banking accounts in one app from where all banking can be done, this will also provide the spending habits so that discounts, loans, and other services can be done given the data provided but all this data has to be exposed through a proper channel and with the consent of the customer, he explained. UBL and ABL have already exposed their transactional data but in the current scenario, no one is ready to use that data because no one has the tendency to build that one platform and also customers need to be given benefits for switching to it rather than making it difficult.

Why Pakistan needs it?

For Pakistan, open banking has a lot of potential advantages. Its adoption can help with several issues and promote financial inclusion and innovation.

Through the provision of a wider range of financial services to those who were previously underserved or excluded from the formal banking sector, open banking can play a crucial role in fostering financial inclusion. The development of creative solutions meeting a range of financial needs is made possible by the capacity to share data with other providers.

“Open Banking is a key pillar of the financial market, it is necessary to understand the dynamics of the economic ecosystem where financial institutions are performing. With numerous entities involved in Open Banking, it is necessary to define their roles. Karandaaz being a key part of the current system is working in safeguarding various business models and working to facilitate robust connections between financial institutions while playing a pivotal role in advancing financial accessibility and security,” told Taimoor Ali, Group Head, Digital Financial Services.

Innovation and competitiveness in the financial industry are fostered by open banking. It is possible to construct cutting-edge financial goods and services by granting third-party developers access to financial data via standardised APIs. This may result in a financial ecosystem that is more responsive and dynamic.

By granting users more control over their financial information, open banking empowers users. Individuals can decide whether to share their data with reliable third parties through explicit consent methods, which paves the way for individualised and customised financial services. This increases consumer choice and makes it easier for people to make better financial decisions. “With such steps, SBP is the only channel through which it can be a win-win situation, every stakeholder has something to take from it either bank or customer but in the longer run it will be a game changer in the banking sector as in the next decade banking will be branchless just like across the globe,” told Alam predicting that already newer generation avoids going to the branch but the problem arises when the elders who have actual money in this country do not believe in banking and deals in cash whether its traders or businessmen.

Open banking adoption can lower operating costs and simplify financial procedures for consumers and banks alike. Automation of a range of financial tasks, including payments and account aggregation, can save costs and boost productivity.

Fintech companies can flourish in an atmosphere that is supportive of open banking. “These organisations can use open APIs to create cutting-edge products, such as budgeting tools and payment apps, fostering a thriving financial technology ecosystem that helps both consumers and companies, and not just that but also they need a regulator to control the flow of data too,” told Mukhtar.

Transnational transactions go more smoothly when open banking is used. Standardised APIs facilitate cross-border financial management for people and companies, fostering global commerce and economic activity.

People can transfer between financial service providers more easily when open banking is available. Consumers can move their financial information between institutions with ease thanks to standardised data sharing, which encourages healthy competition among banks. Sharing an example such a platform like WhatsApp, if we make it that easy by just providing information transactions are done within no time and cost less why would a customer not use it? Questioned Mukhtar adding that it is not something that will happen after two decades but with the ease and not going to branches in concern youth want everything in their mobile phones and that is why many consumers will apt for open banking but the serious concern is data which eventually the fintech will use to make money either by regulating charges or with data.

What will banks gain?

Banks can integrate offerings from other sources to broaden their service offerings through open banking. Because of this, banks are able to offer their clients a wider range of financial services and products without having to create them all from scratch. “The main idea is to understand that with costumers transactional data the bank can offer them deals and discounts such as if they know a customer travels every year during these months they can offer him great deal which can benefit the customer but also by using the specific bank services can help the bank to generate profits too,” said the deputy CEO.

Bank operating costs are decreased through the automation of many financial procedures made possible by open banking. Banks can take advantage of the advantages realised from open banking practises while concentrating on their core strengths by utilising outside expertise and technology.

Through partnerships with other service providers, banks can reach new clientele that might have certain financial requirements. This can assist banks in reaching a wider client base and broadening their market reach.

“Open Banking has brought forth numerous opportunities for stakeholders, providing them with efficient minute-by-minute solutions for financial needs, contributing to the advancement and improvement of the fintech ecosystem.

It has also established an ecosystem conducive to innovation and progress, opening up new avenues of services for banks and businesses,” Analyst research and insights at Karandaaz, Saad Sarfraz.

Account management and consumer onboarding are made easier with open banking. Standardised data sharing facilitates easy bank switching for customers and streamlines and expedites the onboarding process.

Open banking systems frequently have more stringent security and legal requirements. This can help banks handle consumer data securely and comply with regulations for improved risk management and compliance. “The major take for banks is cost-cutting if the cost of dealing with one customer is 100Rs a day then such platforms can cut it to 20Rs, which saves 80Rs for the bank straight away because branch banking is not involved which adds to security, premises, electricity, employees salary etc,” the SVP explained.

Collaboration between established banks and emerging fintech companies is encouraged by open banking. Through this agreement, banks will be able to make use of the fintech companies' agility and creativity, which could result in reciprocal benefits. “The major step is that any Fintech can develop an app and be the provider of the service where banks will be exposing their data and the app can consume it and help both end users,” Alam said adding that open banking efforts have the potential to enhance financial transparency by offering more extensive and instantaneous access to financial data. Consequently, this may boost endeavors to counteract unlawful financial operations. However, how well these programs go with more general regulatory and compliance standards will determine how effective they are in resolving FATF concerns but with these sanctions, Anti-money laundering (AML) and countering the financing of terrorism (CFT) are two aspects of FATF compliance. Pakistan must prioritise the implementation and reinforcement of its AML and CFT regulatory framework, financial transparency, customer due diligence procedures, and the efficient enforcement of these measures to allay FATF concerns.