In the maze of Pakistan's bustling marketplaces and quiet alleyways, a transformative story is unfolding—one written by the resilient hands of women entrepreneurs. In a nation where economic progress intertwines with societal norms, the rise of women-led businesses emerges as a beacon of change, especially poignant as we celebrate Women Entrepreneurship Day. The need for women to step into the entrepreneurial arena is not merely a matter of choice; it's a strategic imperative for a country like Pakistan. As we navigate through the economic fabric of this South Asian nation, the undeniable truth surfaces: empowering women in business is not just a moral obligation but a pragmatic necessity. The untapped potential of women entrepreneurs holds the key to unlocking new avenues of growth, fostering innovation, and nurturing a more inclusive economic landscape that resonates from the urban centers to the provincial capitals.

Amidst this dynamic landscape, a recent report by Karandaaz Pakistan, a development finance company, casts a spotlight on the intricate tapestry of women-led businesses in Pakistan. Drawing insights from the journeys of these enterprising women, the report goes beyond numbers to reveal the narratives of audacity and resilience. It becomes apparent that behind the statistics lies a compelling story—a story of women navigating the challenges of entrepreneurship, defying societal expectations, and carving spaces for themselves in a traditionally male-dominated realm. As we delve into the pages of this report, the vibrant mosaic of women-led businesses in Pakistan comes to life, portraying not just economic ventures but stories of empowerment that ripple through communities, leaving an indelible mark on the nation's economic fabric.

Women-led businesses in Pakistan

The survey conducted by Karandaaz Pakistan unfolds a rich narrative of women-led businesses. Representing a diverse cohort of 435 entrepreneurs across provincial capitals, including Islamabad and Rawalpindi, the geographical distribution encapsulates the breadth of experiences and challenges faced by women in business. Among these dynamic women, the majority, particularly those in the 21–40 age group, are crafting a new narrative, challenging norms, and reshaping the entrepreneurial paradigm.

One of the survey's poignant revelations is the spectrum of motivations propelling women into entrepreneurship. For 36% of respondents, the journey begins from a place of financial necessity, underlining the socioeconomic complexities these entrepreneurs navigate. Strikingly, 34% embark on their business ventures driven by a passion or hobby, exemplifying the diverse and multifaceted motivations that fuel their enterprises.

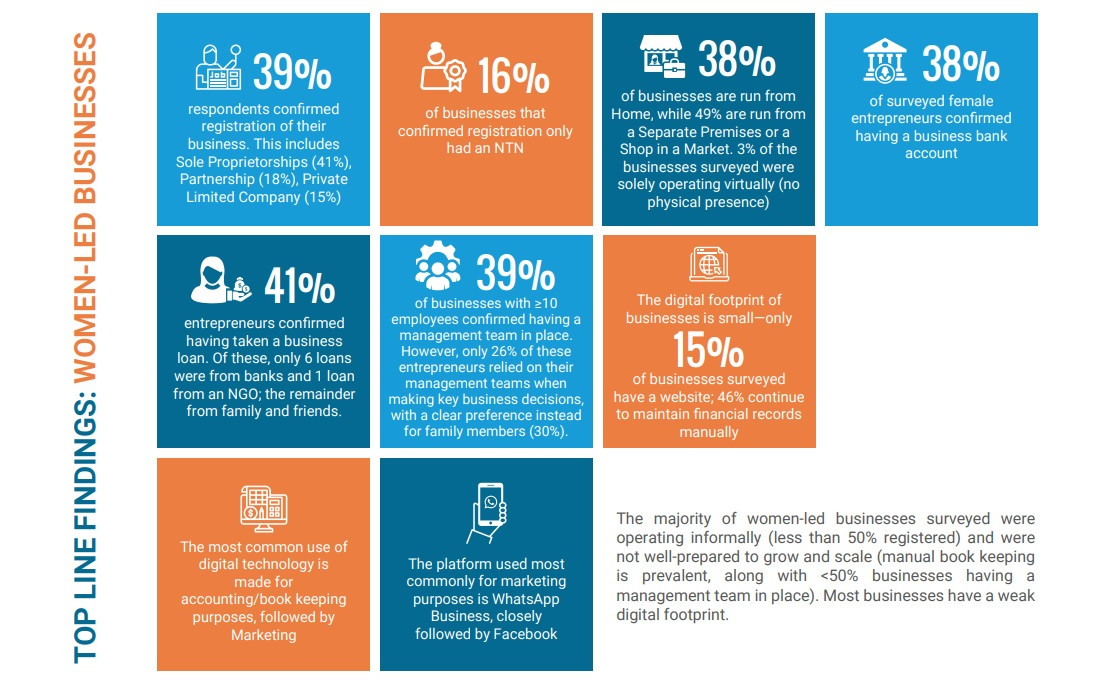

As the survey delves into the financial landscape, a tale of contrasting realities emerges. While a remarkable 81% of female respondents boast personal bank accounts—an impressive surge compared to the overall financial inclusion of women estimated at 13%—only 38% possess a business bank account. This nuanced dynamic reflects both progress and persistent challenges on the path to financial inclusion for women entrepreneurs.

Technological prowess and adaptability stand out as defining features of these women-led businesses. A staggering 98% own smartphones, a stark contrast to the 38% of adult women owning a mobile phone as reported in broader surveys. In this digital landscape, WhatsApp Business emerges as the go-to platform for marketing, showcasing the entrepreneurial acumen that leverages technology for business growth.

Technological prowess and adaptability stand out as defining features of these women-led businesses. A staggering 98% own smartphones, a stark contrast to the 38% of adult women owning a mobile phone as reported in broader surveys. In this digital landscape, WhatsApp Business emerges as the go-to platform for marketing, showcasing the entrepreneurial acumen that leverages technology for business growth.

Business formalization and registration are pivotal aspects highlighted by the survey. While 38% of female entrepreneurs confirmed having a business bank account, a majority of 39% have formalized their businesses by getting them registered. Sole proprietorships (41%) and virtual businesses (3%) stand shoulder to shoulder with businesses operating from separate premises or shops (49%).

A significant 74% of respondents assert their independence from loans, yet for those who seek financial support, 83% turn to the familiar network of friends and family. The banking relationships of these entrepreneurs paint a varied picture, with Habib Bank Limited leading the way, followed closely by Allied Bank Limited and others. Interestingly, Orix Leasing Pakistan (OLP) emerges as a notable player, named more frequently than other commercial banks.

The findings further shed light on the initiatives aimed at bolstering financial inclusion, with over 50% of women entrepreneurs reporting mobile money account ownership. This aligns with the State Bank of Pakistan's proactive measures, exemplified by the Banking on Equality policy and the

The report unravels the entrepreneurial landscape's digital facet, where WhatsApp Business takes center stage for marketing, closely followed by Facebook. In an era where digital presence is paramount, these platforms serve as the digital storefronts for women-led businesses.

As the survey navigates through the realms of investment practices, land ownership, and government initiatives, it becomes evident that the story of women-led businesses in Pakistan is one of resilience, adaptability, and untapped potential. The complex interplay of economic empowerment, financial inclusion, and the evolving entrepreneurial landscape sets the stage for a future where women entrepreneurs play an increasingly pivotal role in shaping Pakistan's economic narrative.

Shumaila Rifaqat, the Head of Innovation Challenge Fund (ICF) & Monitoring, Evaluation and Learning at Karandaaz Pakistan, talking about importance of conducting this report on women-led businesses in Pakistan said, “Karandaaz recognized a significant knowledge gap on information concerning women-led businesses (WLBs) in Pakistan. Motivated by the need to address this gap, Karandaaz conducted a systematic review and assessment through the Women-led Business Survey. This survey represents a deliberate effort to document and profile the WLB segment, aiming to provide insights into the size, formality, and maturity of women-led businesses, as well as utilization of financial services and digital technology platforms by them.”

“With a focus on small and medium-sized enterprises, the survey also seeks to identify barriers to growth and produce actionable, forward-looking insights. The survey is not only useful for Karandaaz in the implementation of its women economic empowerment programmes but also has utility for other stakeholders at large,” she added.

Women's health & environmental sustainability

In Pakistan's entrepreneurial landscape, Mehreen Raza's journey with SHE-GUARD unfolds as a compelling narrative of resilience and determination. Born into a humble and self-made family, Mehreen's upbringing was steeped in values of consistency, diligence, and commitment to making a difference despite limited financial resources. It was a childhood marked by the powerful mantra instilled by her mother – "at least TRY."

This ethos became the driving force behind Mehreen's vision for SHE-GUARD, a startup with a mission deeply rooted in women's empowerment and environmental sustainability. Mehreen's desire to contribute to women's empowerment, tackle climate change, and make a lasting impact led to the creation of a startup that goes beyond conventional boundaries.

Reflecting on the challenges faced, Mehreen notes, "I lucked out, and Almighty chose me for this extremely dignified and noble cause. The journey was not without its share of obstacles, with societal taboos surrounding menstrual hygiene posing a significant challenge.” Despite facing mockery on the bold topic, Mehreen and her team remained steadfast, growing more confident that they were on the right track.

SHE-GUARD, is not just a startup; it's a movement. The innovation lies in providing eco-friendly sanitary pads that address not only women's reproductive and menstrual hygiene issues but also contribute to reducing solid waste and fighting against climate change. The product itself, described as "biodegradable, plastic, and chemical-free, herbal-treated sanitary," stands as a green and sustainable solution to replace harmful materials.

The startup's commitment extends beyond product development. The "Shaoor: The Enlightenment" campaign becomes a vehicle for raising awareness on menstrual hygiene and environmental consciousness. Mehreen emphasizes, "Our journey mirrors the strength of countless women striving for this very basic yet most important dignity. It's a journey that navigates complexities, fostering a path toward empowerment and societal change.”

In the landscape of entrepreneurship in Pakistan, especially for women, the challenges are palpable. Seeking guidance revealed a mixed response, with some embracing the bold idea while others offered misguided advice. The lack of business backgrounds, limited platforms, and societal expectations add to the complexity. Yet, SHE-GUARD remains undeterred in its commitment to reshape the discourse around menstrual hygiene and sustainability.

The startup's journey involves reaching out to incubators and accelerators, a path demanding persistence. Despite gender biases, SHE-GUARD gains recognition through competitions like those sponsored by The Asia Foundation at NIC Karachi. The tide is turning as more recognition is given to the transformative impact of women-led initiatives. The journey, though arduous, fortifies the mission, making it about overcoming challenges and pioneering meaningful change.

Mehreen, reflected on the unique position of women in decision-making roles, noting, "I believe that a significant number of women only need credible and safe spaces, encouragement, appreciation, and vibrant opportunities to make the most of their potential." It's a testament to the universal attributes that women possess—multitasking, negotiation skills, and management capabilities.

Mentorship from esteemed incubation centers becomes a catalyst for SHE-GUARD's journey, with Mehreen at the helm. Competing and refining work through boot camps and acceleration programs refines the strategy for eco-friendly sanitary pads. “The support empowers the startup to amplify awareness on menstrual hygiene and climate change, ultimately contributing to sustainable impact,” says Mehreen who recently won an award at the 10th Shell Tameer Award for her start-up in Women Empowerment category.

The journey is marked by turning points and milestones, from pitching ideas for the first time to gaining recognition from illustrious platforms nationally and globally. Awards from The Asia Foundation, the International Union for the Conservation of Nature (IUCN), The French Embassy, and others validate the startup's impactful trajectory.

SHE-GUARD, led by Mehreen Raza, is not just a business; it's a transformative force challenging societal norms and contributing to a healthier world. Through Mehreen's unwavering commitment and the belief that every woman deserves access to eco-friendly options, SHE-GUARD pioneers change, leaving an indelible mark on the entrepreneurial landscape of Pakistan.

Accelerating talent

In the ever-evolving landscape of business, incubators, accelerators, ventures and supportive programs have emerged as pivotal players, particularly in fostering the growth and empowerment of women-led businesses. These entities, coupled with tailored programs, have become instrumental in addressing the unique challenges faced by women entrepreneurs in Pakistan.

These platforms play a crucial role in providing the necessary support structures for startups, guiding them through the early stages of development, and accelerating their growth. The landscape is adorned with programs designed to empower women-led businesses, such as the Karandaaz Venture, Standard Chartered Women in Tech initiative, and Shell Tameer Awards, each contributing to closing the gender gap and advancing women's economic empowerment.

Standard Chartered Bank (Pakistan) Ltd. and INNOVentures Global (Private) Limited have partnered to create the Standard Chartered Women In Tech programme. This supports female-led businesses enabled by technologies, providing them with training, mentorship, and seed grant.

Whereas, Shell Tameer Award is a nationwide competition, to recognize, celebrate and reward young talent making significant contribution in the national entrepreneurship space. This year they held their 10th edition.

Shumaila Rifaqat, the Head of Innovation Challenge Fund (ICF) & Monitoring, Evaluation, and Learning at Karandaaz Pakistan, provides insights into the challenges encountered by women-led businesses in Pakistan, underscoring the vital role these entities play in addressing these issues.

According to Shumaila, women-led businesses encounter numerous challenges hindering their growth. "A critical obstacle is the limited access to finance," she notes, underscoring how this hampers their ability to secure loans and venture capital. The societal and cultural norms add another layer, subjecting women entrepreneurs to biases affecting decision-making and market access. Limited professional networking opportunities further constrain access to mentors and collaborators.

Shumaila highlights the need for tailored training and business development support programs to alleviate these challenges. "The underrepresentation of women in leadership roles and the difficulty in accessing markets contribute to the overall challenges encountered by women-led businesses," she adds. To bridge this significant gender economic opportunity gap in Pakistan, Shumaila advocates for special incentive schemes.

Karandaaz Pakistan has been addressing the unique needs of women entrepreneurs since 2017. Women Ventures (WV) is our flagship gender finance initiative which provides access to finance to women led businesses along with business development support services. It provides the full Info – WED Story spectrum of support required by a WLB to meet its growth ambition. This program fills the gap for women entrepreneurs in the missing middle category, not served by micro-lending institutions or commercial banks.

“The program stands out by offering both pre and post-investment support, emphasizing the holistic development of women entrepreneurs and their enterprises. Women Ventures programme has also partnered with National Bank of Pakistan to reach women entrepreneurs in smaller cities. We are also entering into new partnerships with other local and international entities to cover additional dimensions of women economic empowerment in the near future,” explains Shumaila.

Karandaaz Pakistan, committed to championing women's financial inclusion, has introduced tailored programs to support women-led businesses. Shumaila explains, "The Women Ventures program provides growth capital and comprehensive business development support across various sectors." She emphasizes the program's uniqueness in offering both pre and post-investment support, addressing the holistic development of women entrepreneurs and their enterprises. Shumaila highlights the collaboration with the National Bank of Pakistan to reach women entrepreneurs in smaller cities, further expanding their impact.

Karandaaz's Women’s Financial Inclusion program, led by the Digital Financial Services unit, adopts a strategic three-pronged approach: enhancing financial awareness, deploying women-centric products, and digitizing payments in women-dominated value chains. The Financial Inclusion of Women Challenge (FIWC) actively seeks proposals for gender-smart financial products, aiming to prioritize the financial inclusion of female customers.

Shumaila also shares success stories resulting from Karandaaz's incubation and acceleration programs. "The Karandaaz WV portfolio includes businesses led by remarkable women who have fought against a challenging operating environment," she notes proudly. The businesses have not only obtained growth capital but have also expanded their market share, even in the challenging post-COVID economic environment.

In essence, the role of incubators, accelerators, and ventures in supporting women-led businesses in Pakistan is pivotal. With programs like Women Ventures, Karandaaz, under Shumaila's guidance, actively contributes to bridging the gender gap, providing financial inclusion, and fostering an environment where women entrepreneurs can thrive, innovate, and contribute significantly to Pakistan's business landscape.

Future outlook

The future outlook is both promising and transformative. As the entrepreneurial landscape continues to evolve, incubators, accelerators, and ventures, including impactful programs such as Women Ventures, Karandaaz Venture, Standard Chartered Women in Tech, and Shell Tameer Awards, play a pivotal role in shaping a more inclusive economic terrain. The commitment to closing the gender gap and advancing women's economic empowerment sets the stage for a future where women entrepreneurs are poised to thrive, innovate, and contribute significantly to Pakistan's dynamic business ecosystem.

The resilient spirit and untapped potential of women entrepreneurs, as unveiled by the report, amplify the narrative of empowerment. The diverse motivations driving women into entrepreneurship, the complex dynamics of financial inclusion, and the technological prowess showcased in digital marketing underscore the multifaceted nature of women-led businesses. With a focus on addressing barriers to growth, the report becomes a compass guiding the way forward, providing actionable insights that can shape a future where women-led businesses are at the forefront of economic development and societal change.