In recent years, Pakistan has witnessed a surge in online investment applications and loan apps that promise financial prosperity and easy access to funds. These platforms, initially appearing as beacons of hope, ensnared both the poor and the wealthy, ultimately leaving thousands of victims devastated and billions of rupees lost.

Operating under the guise of legitimate investment opportunities, these fraudulent applications attracted individuals by offering quick and substantial returns for investing small amounts. Bolstered by an initial taste of easy money, unsuspecting victims were enticed to invest more, lured by the promise of even greater rewards. To establish an illusion of credibility, the scammers implemented two-way verification systems and flaunted international phone numbers from the UK and US, exploiting people's trust and confidence in their operations.

As the scam unfolded, victims found themselves trapped in a web of deceit. Once the fraudsters reached their predetermined targets, these nefarious applications abruptly shut down, leaving investors shocked and betrayed. The aftermath revealed a heartbreaking reality: countless individuals from all walks of life had fallen prey to the manipulative tactics of these online scams.

Adding to the complexity of the situation, a disturbing pattern emerged - despite the devastating losses suffered, some victims were enticed by the same scammers to reinvest in a desperate attempt to recoup their previous losses. In a cruel twist of fate, these individuals, driven by the hope of reclaiming what was taken from them, fell into the scammers' trap once again, only to end up losing even more.

Compounding the issue, the online loan app sector in Pakistan experienced a similar pattern of exploitation. Numerous loan apps emerged, initially offering loans at seemingly attractive interest rates. However, as borrowers became ensnared in the clutches of these deceptive platforms, the interest rates began to skyrocket. Multiple apps worked in tandem, exploiting borrowers and generating exorbitant profits through unconscionable interest charges.

Recognising the severity of the situation, the Securities and Exchange Commission of Pakistan (SECP) took action, banning several fake investment applications. In an effort to protect consumers, the SECP recently released a whitelist of secure loan apps, aiming to separate legitimate platforms from the sea of fake ones.

The impact of these scams and fake loan apps reverberates throughout the nation, shattering dreams and plunging families into financial ruin. The need for greater regulation, increased awareness, and stringent measures to combat such scams has become paramount, urging individuals to exercise caution and seek guidance from trusted financial experts before venturing into the online investment or loan app landscape.

It is a somber reminder that in the era of technological advancement, the vulnerabilities of human trust and the urgency to safeguard the interests of all individuals must remain at the forefront of our collective efforts.

We investigated and talked to some of the affected people who got scammed to know the process of this scam.

Design: Ibrahim Yahya

The illusion of financial promise

In a world where financial security and prosperity are sought after by many, online investment apps and loan platforms emerged as seemingly golden opportunities for individuals in Pakistan. Promising a path to wealth and success, these platforms presented themselves as the answer to the dreams and aspirations of hopeful investors.

Fazal Elahi* a driver in Sindh drives for foreigners who visit often here in Pakistan. He made a friend on Facebook who seemed to be a girl from the UK, she shared a link with Fazal to an app by the name of Movii/Movee and explained to him the process of investing and getting the return by watching trailers. As Fazal was a driver and didn’t have enough savings to invest and risk any money, the girl offered to invest on his behalf first. Fazal agreed and registered himself on the app.

“She explained to me the process of signing up and the return that I would get on the investment was attractive. I could see that I could generate enough amount in next three months and straighten my financial issues,” he told The Express Tribune.

Unbeknownst to Fazal, he had unwittingly stepped into a carefully crafted web of deceit. The allure of quick financial gain clouded his judgment, leading him to place his trust in someone he had only met online. Little did he know that this newfound friendship was merely a ploy to lure him into the clutches of a fraudulent scheme.

From small investments to big paybacks

The journey into the world of online investment apps begins with a simple referral from someone you know, luring you in with the promise of lucrative returns. By using their reference code, you open the door to a realm where small investments have the potential to yield substantial profits. Such was the case with Fazal, who found himself enticed by the prospect of financial gain.

After registering on the app using the referral code, Fazal discovered a tempting offer awaiting him. "She initially offered me a starter package, claiming it was exclusively for me, but later I discovered that it was available to everyone. By watching just one trailer, I was earning 0.04 USD per trailer, and with a daily limit of 10 trailers, I was able to make 4 USD in a day and 8 USD in just two days without any initial investment," he explained.

However, once the initial free package was consumed, Fazal encountered a roadblock. He had accumulated $8 in his wallet, but the minimum withdrawal amount was set at $10 which lands into Binance account in 72 hours of time. To reach the threshold, Fazal needed to invest by purchasing a package worth a minimum of $50. Interestingly, the $8 in his wallet could be used to buy a package. The investment process involved transferring funds from his Binance account to the app's wallet, which was a swift process taking only a few seconds. With the funds in his Movii app wallet, Fazal proceeded to purchase a package, which had a validity period of 75 days.

The returns on investment were structured in a way that enticed investors further. For a $50 package, Fazal would earn $0.2 for watching a single trailer, with a daily limit of 10 trailers that refreshed at 9 AM PST. This meant that Fazal would recover his initial investment in just 25 days, with the remaining 50 days dedicated to profit generation. In essence, a $50 investment had the potential to yield a $150 return in 75 days, translating to a $100 profit.

The allure of greater profits intensified as larger investment packages were offered. Investing $200 could yield $600, $500 could generate $1500, and $1000 could result in a $3000 return, all within the same timeframe. The process seemed simple and time-efficient, with the trailers requiring minimal attention, making it all the more attractive to potential investors.

Hopeful investors, seeking to improve their financial standing or make their dreams a reality, were drawn into the web of these platforms. Initially, the apps appeared legitimate, providing a sense of credibility with their professional branding and promises of secure transactions. The prospects of a brighter future and the potential to realise long-held ambitions drove individuals to invest their hard-earned money.

In Fazal's case, he was so impressed by the paybacks that he invested $50 of his own money, which equalled around Rs11,500 in October 2022. He not only invested but also invited his family, extended family and friends to join the platform. "I invited my friends and successfully persuaded them to sign up and invest more. After a few days, when I had earned $200 through watching trailers and referral rewards, I decided to reinvest that amount by purchasing another package. My intention was to maximise my daily earnings and make even more money. Additionally, I also received some direct payments from them for bringing new people onto the app," shared Fazal.

Once users made their initial investments, they were presented with a facade of success as the promised returns began to materialise. These early glimpses of financial growth instilled further confidence and enticed investors to put in more substantial sums, driven by the belief that their dreams were finally within reach.

Similarly, a fraudulent website emerged, mimicking the name, appearance, layout, company profile, and team of a legitimate firm in Bahrain called Ramsis Engineering. This deceptive website, bearing a striking resemblance to the original firm's site, lured unsuspecting individuals with the promise of a small but steady return on their investment. With an investment as low as $10, the case study we are examining pertains to a $55 investment, offering a return of $1.93 over the course of 120 days.

Operating under the guise of legitimacy, the fraudulent website enticed users to visit and click on the "claim reward" button, with refresh timings set at 9 AM. Seduced by the allure of easy profits, many individuals invested significant amounts of money, only to face devastating losses when the website suddenly became inaccessible.

Design: Ibrahim Yaha

Trust shattered

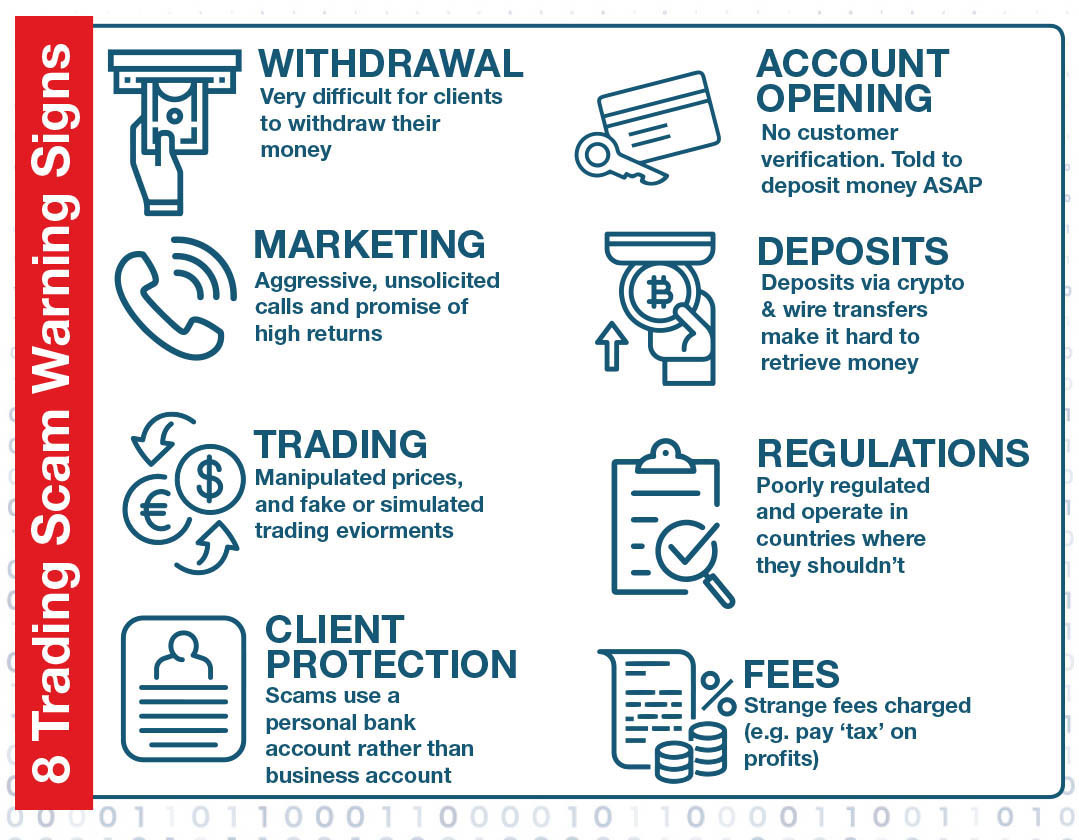

In a cruel display of deceit, scammers operating through online investment apps and loan platforms in Pakistan have exploited two-way verification systems and international phone numbers to gain credibility and prey on unsuspecting victims.

The use of these seemingly secure measures created a false sense of trust among users. Victims, believing in the legitimacy of these platforms, willingly shared personal and financial information, unaware of the impending betrayal.

By flaunting international phone numbers, often from the UK and US, scammers added an air of international credibility to their operations. This manipulation further convinced individuals to invest their hard-earned money, assuming they were engaging with legitimate and reputable organisations.

Iftikhar Khan*, employed at a private company, was introduced to the platform by Fazal. Initially skeptical about both Fazal and the app, Iftikhar's doubts subsided when he witnessed the seamless withdrawals into his Binance account and observed the presence of verifications and international numbers within the Telegram and WhatsApp groups. Convinced by these factors, he decided to give it a try.

"I began with a modest investment of $50 in November 2022, and over the course of five months, I gradually increased my investments to a total of $5250 across three different accounts. I diligently purchased all the available packages, repeatedly withdrawing and reinvesting my funds. My goal was to accumulate a substantial amount before focusing on generating profits. By April 2023, I was earning $250 per day, albeit for a mere seven days," disclosed Iftikhar Khan.

Easy money turns sour

This pursuit of easy money led to heartbreaking stories of loss and betrayal. Victims, drawn in by the promise of quick returns and financial security, now recount their devastating experiences. As the investment amounts grew, so did the risks. Unbeknownst to the investors, the platforms were engineered to ensure an inevitable downfall. At a premeditated point, the illusion of prosperity shattered as the apps abruptly vanished into thin air, leaving investors reeling in shock and disbelief.

Initially, victims were convinced by friends or acquaintances to join these platforms, enticed by success stories and positive outcomes. They invested their hard-earned money, hoping for a better future. However, their hopes were shattered as they discovered the deceptive nature of these schemes.

At first, the investments seemed promising, with returns flowing in. But as victims became more involved, the scammers revealed their true intentions. Promised returns vanished, and demands for additional investments grew, claiming they were necessary for greater profits.

The fraudulent app, Movee, employed manipulative tactics to entice investors into increasing their investments. Capitalising on the occasion of World Labour Day, they offered a deceptive 50% discount on all investment packages, while keeping the earning potential unchanged. This clever ploy compelled investors to pour more funds into the app, as they were lured by the limited-time offer set to expire in just two days.

This strategic move resulted in a significant cash influx for the scammers, who saw an opportunity to maximise their ill-gotten gains. Once they had amassed a substantial amount, the scammers swiftly disappeared, leaving investors in a state of shock and financial loss.

The discount scheme served as a manipulative catalyst, pushing individuals who were eagerly awaiting their withdrawals to reinvest in order to take advantage of the enticing offer. However, little did they know that it was a trap orchestrated to siphon more money from unsuspecting victims.

As per reports that we received from various cities people have lost as much as $55000 from the scam. The apps were working and the returns were making but the withdrawals were not processing anymore.

Trapped in a cycle of false promises and escalating demands, victims found themselves facing financial ruin. Life savings were lost, and burdensome debt accumulated through predatory loans. The emotional toll was immense, as trust was shattered and regret consumed them.

Design: Ibrahim Yahya

The illusion of redemption

Driven by desperation to recoup their losses, victims of online investment scams find themselves lured into the trap once again, enticed by the illusion of redemption. Despite their previous bitter experience, they succumb to the scammers' persuasive tactics, hoping to regain their hard-earned money. Vulnerable and emotionally drained, these individuals are desperate for a glimmer of hope, willing to take another leap of faith.

These scams displayed a relentless persistence. Despite leaving behind a trail of lost millions, the scammers resurfaced with yet another app, replicating the same investment mechanics and returns, albeit under a new name. To regain credibility, the same managers of the previous fraudulent apps claimed that they had been victims of deception themselves, attributing their losses to unscrupulous partners. They assured investors that their new app would rectify previous issues and process withdrawals smoothly.

Trusting these claims and driven by the desire to recoup their losses, people once again fell into the trap. They invested significant amounts, hoping to recover what they had previously lost. Believing they had outsmarted the scammers by recognising the six-month pattern of their previous scams, little did they know that the scammers were one step ahead.

Aware of investors' desperation and their willingness to invest heavily, the scammers vanished in a remarkably short time, only 25 days, leaving their victims devastated once again. This calculated move exploited the trust and vulnerability of those seeking redemption, compounding their financial losses and deepening the sense of betrayal.

“I invested with the aim to recover my previous losses and then discontinue using the app, but the scammers were cunning and disappeared earlier than expected, resulting in even greater losses. Now, after six months, I find myself in a situation where I have lost $1000 instead of making a profit. Unfortunately, I am not alone in this predicament. I personally knew around 4000 individuals who were also involved in this scheme, and there were likely many more in different cities,” lamented Iftikhar with a sorrowful tone.

This disheartening cycle underscores the importance of vigilance and due diligence when engaging in investments. It serves as a stark reminder that scammers can adapt their tactics, making it crucial to thoroughly investigate any investment opportunity and exercise caution even when faced with seemingly familiar faces or promises of redemption.

Predatory lending

In addition to fake investment apps, predatory lending practices have become alarmingly prevalent in the realm of online loan apps, as borrowers find themselves trapped in a web of escalating interest rates and insurmountable debt. These apps lure individuals with promises of quick and easy access to funds, often requiring minimal documentation and swift approval processes. However, once borrowers are entangled in their grasp, the true nature of these schemes reveals itself.

Initially, borrowers may secure a small loan at a seemingly reasonable interest rate. However, as the loan term progresses, the interest rates steadily increase, plunging borrowers into a cycle of perpetual debt. Hidden fees, exorbitant penalties, and aggressive collection tactics or even extortion further exacerbate the financial burden. Desperate for relief, borrowers often find themselves borrowing from multiple apps or taking out additional loans to repay existing ones, spiraling deeper into a state of financial vulnerability.

According to a report by Reuters, Ali, an unemployed software engineer from Pakistan, believed he had found a solution to pay his overdue electricity bill when he decided to take a small loan from a digital lending app.

The appeal of these apps lies in their quick and hassle-free process. Within minutes of submitting his application, Ali received the requested amount of 15,000 Pakistani rupees ($53) in his account, minus a processing fee. However, his relief was short-lived.

Just a week later, Ali started receiving relentless phone calls demanding immediate repayment of the loan or threatening him with penalties for a mere one-week extension. Overwhelmed by the stress, he turned to another lending app to pay off the debt, unaware of the unscrupulous practices he would encounter.

The new lender charged an exorbitant interest rate, turning his initial 15,000-rupee loan into a staggering cost of 230,000 rupees. Unfortunately, Ali's experience is not an isolated case. As more people in Pakistan rely on mobile-based lenders, the proliferation of scams and fraudulent activities has become a growing concern for digital rights and consumer defense groups.

Similarly, in another case, a 26-year-old woman residing in Lahore, who preferred to remain anonymous, deeply regretted the moment she registered herself on a loan app she came across while browsing social media. Despite not applying for a loan, she unexpectedly received a deposit of 10,000 rupees in her bank account several days later, which she promptly returned.

However, instead of acknowledging the repayment, the loan app persistently contacted her and went on to harass her friends and family, taking advantage of the access granted to her contact lists. They resorted to hurling threats and abuse in their relentless pursuit. Feeling helpless, she eventually succumbed to paying around 40,000 rupees as extortion money to put an end to the threats.

Unfortunately, the ordeal did not stop there. She continued to receive calls from the app, prompting her to report the matter to the authorities, seeking recourse for the harassment she endured. This distressing incident highlights the manipulative and predatory practices employed by certain loan apps, causing immense harm and distress to unsuspecting individuals.

Design: Ibrahim Yahya

Regulatory Response

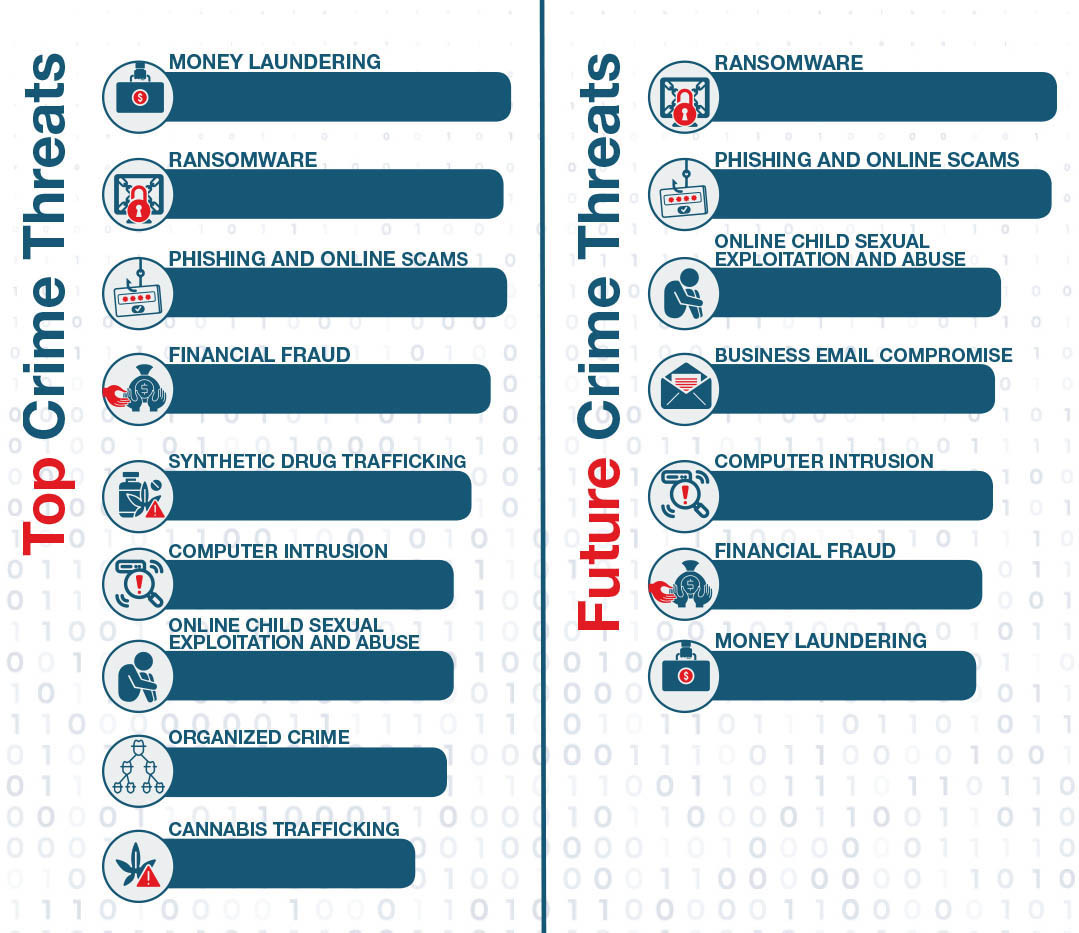

In response to the rising number of fraudulent investment apps and predatory lending practices, the Securities and Exchange Commission of Pakistan (SECP) has taken decisive action to protect consumers. The regulatory body has implemented a ban on 72 fraudulent loan apps, aiming to curb the proliferation of scams and protect investors from financial exploitation.

Additionally, the SECP has released a comprehensive whitelist on May 31, 2023 of secure loan apps that are approved by SECP, providing a reliable resource for borrowers seeking legitimate and trustworthy lending options. This whitelist serves as a valuable tool for consumers, enabling them to make informed decisions and avoid falling prey to unscrupulous loan providers.

The regulatory response from the SECP signifies a commitment to safeguarding the interests of Pakistani citisens and maintaining the integrity of the financial market. By cracking down on fraudulent investment apps and endorsing secure loan apps through the whitelist, the SECP aims to restore confidence in the digital lending landscape and protect vulnerable individuals from financial harm.

Be aware

The proliferation of fraudulent investment apps and predatory lending practices in Pakistan has caused significant financial harm to unsuspecting individuals. These scams prey on the vulnerable, offering quick and easy solutions to their financial woes while ultimately leaving them in deeper debt and despair.

The stories shared by victims highlight the devastating consequences of falling into the trap of these fraudulent schemes. From deceptive promises of high returns to aggressive debt collection tactics, innocent borrowers find themselves trapped in a cycle of financial exploitation.

However, there is hope on the horizon. Regulatory bodies like the SECP have taken swift action to ban fraudulent investment apps and establish a whitelist of secure loan apps. These measures aim to protect consumers, restore trust in the digital lending landscape, and hold scammers accountable for their fraudulent activities.

Moving forward, it is crucial for individuals to exercise caution, conduct thorough research, and rely on trusted sources before engaging with any investment or loan app. By remaining vigilant and informed, individuals can safeguard their financial well-being and contribute to the ongoing efforts to combat financial fraud and exploitation.

*Names have been changed to protect sources' identities