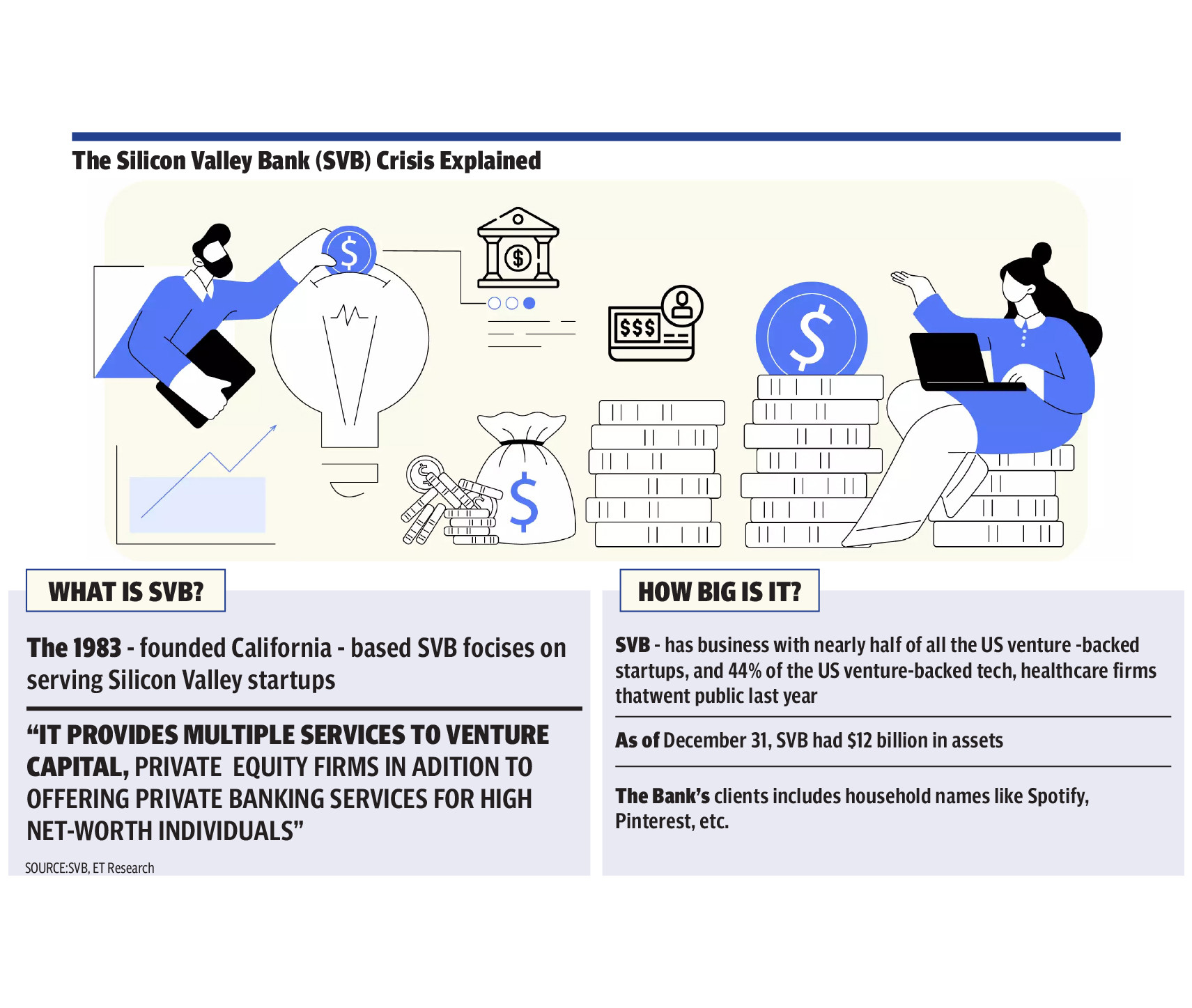

Silicon Valley Bank, or SVB, is a financial institution that provides banking services to technology and life science companies, venture capitalists, and private equity firms. SVB was previously one of the largest banks serving the tech startup industry — and the 16th largest bank in the US overall. After the bank was forced to sell bonds at a loss, its stock price plummeted and depositors panicked, leading to a classic bank run. Since the Financial Crisis of 2007-2008, the collapse of Silicon Valley Bank, or SVB, marks the second largest bank failure in the United States.

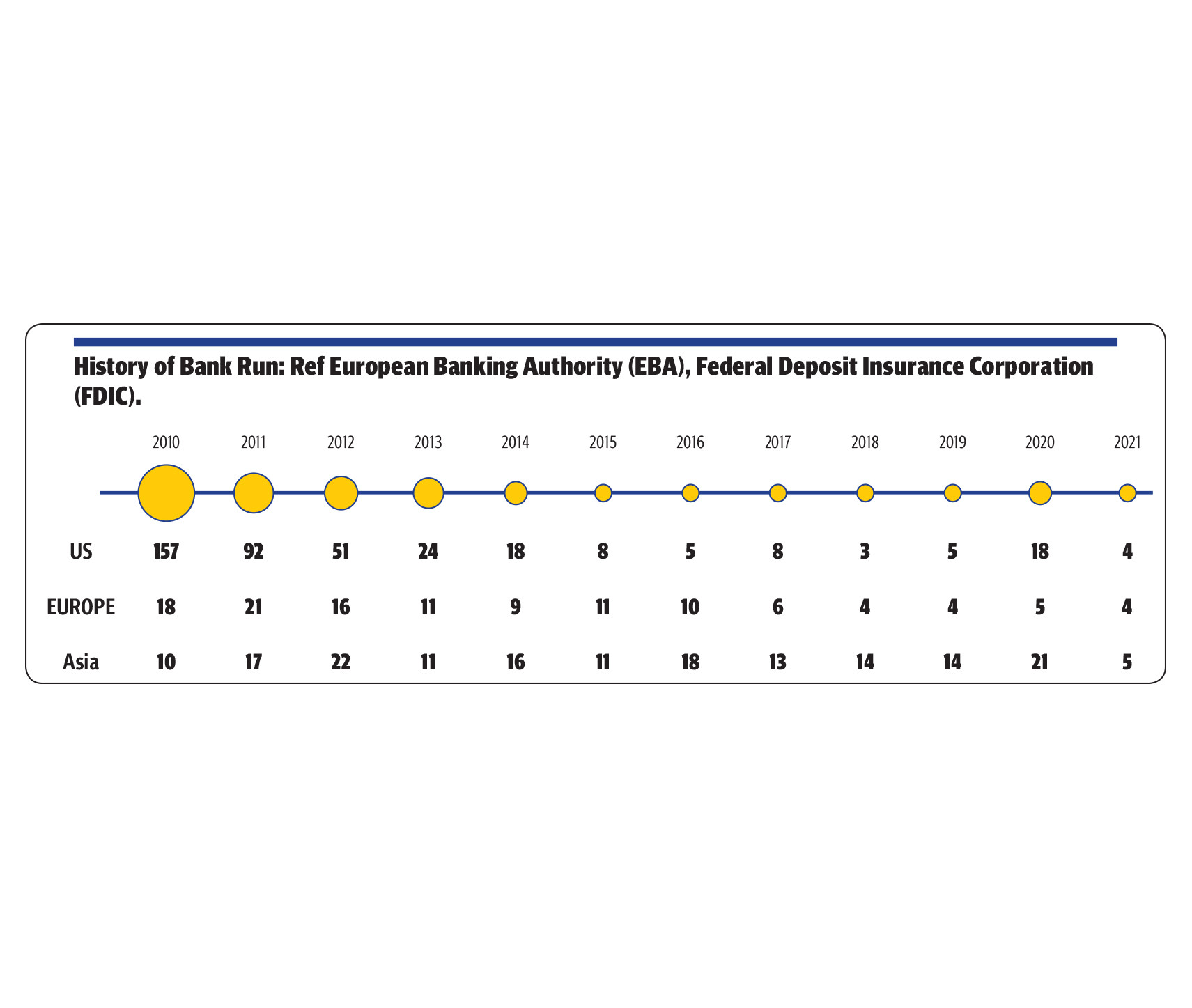

According to data from the Federal Deposit Insurance Corporation (FDIC) and the European Banking Authority (EBA), there were 233 bank failures in the US, Europe, and Asia from 2010 to the first half of 2021. The US had the highest number of bank failures during this period, with 371 banks failing between 2010 and 2021, while Europe had 132 bank failures and Asia had 161 bank failures.

Reasonable panic

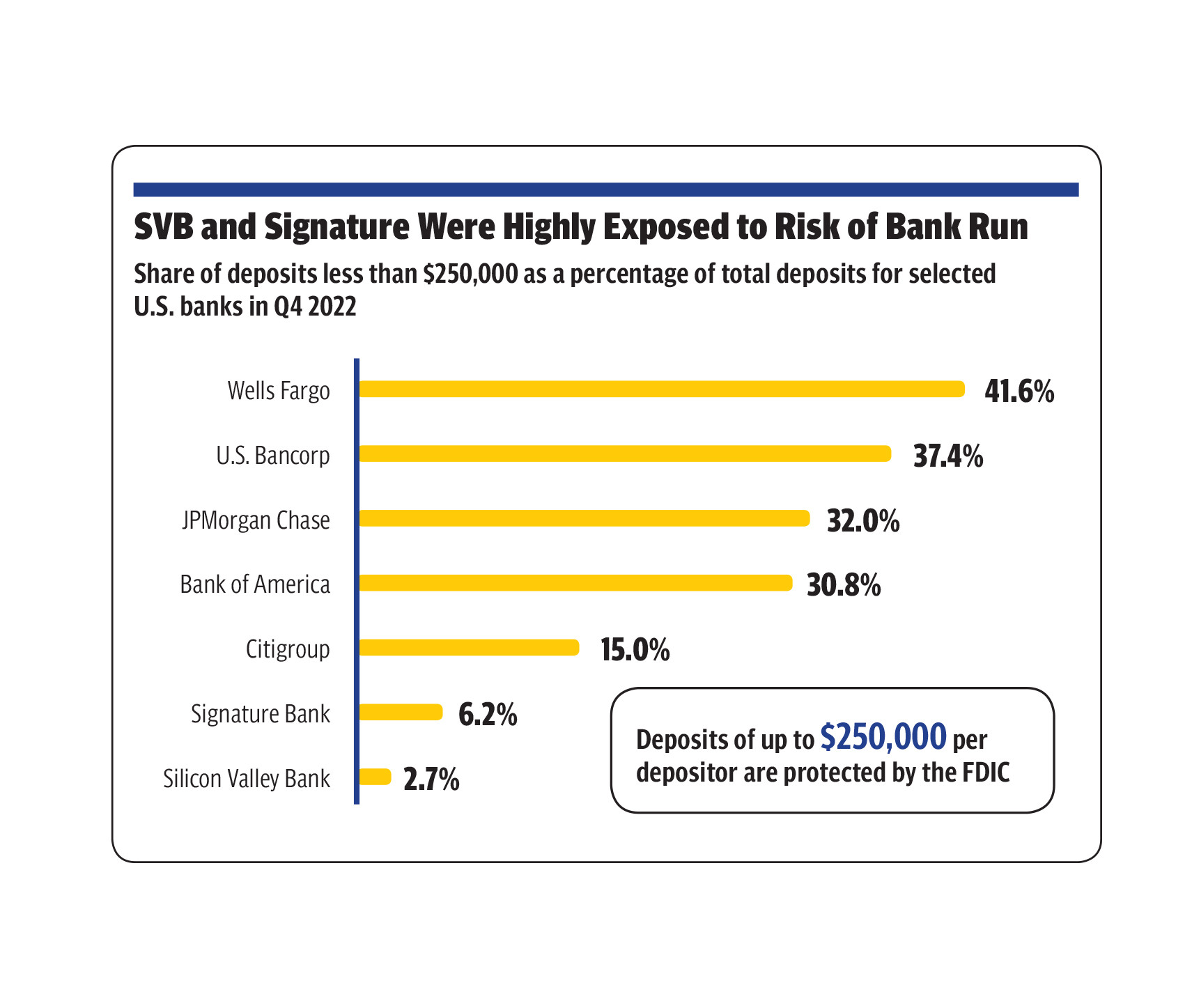

SVB's depositors were mostly technology startups from the Bay Area, and their accounts held more than the federally insured amount of $250,000. The depositors' panicked reactions were reasonable, as SVB had taken a significant unhedged risk by investing heavily in long-term bonds with the assumption that interest rates would remain low.

However, this assumption proved to be incorrect, leading to SVB becoming insolvent or near-insolvent. It is important to note that the failure of SVB is not indicative of a larger problem in the financial system. Rather, it can be attributed to the poor business decisions made by the bank. As a result, shareholders have lost their investment, and bondholders are expected to experience significant losses.

The events that followed demonstrated the weaknesses in the banking system of the United States. While SVB likely had sufficient assets to reimburse depositors, it would have taken a considerable amount of time, leaving numerous tech companies in financial limbo. The possibility of widespread layoffs and bankruptcies loomed across the technology sector, and the US Government was concerned about the potential loss of faith by depositors in other banks too. Consequently, on March 12th, 2023, they deemed SVB too significant to allow to fail and guaranteed all the bank's deposits. However, if the sale of SVB's assets does not cover the costs of the depositors' bailout, a fund financed by all banks will be required to contribute, punishing the entire industry for the recklessness of the one bank.

What is a bank run?

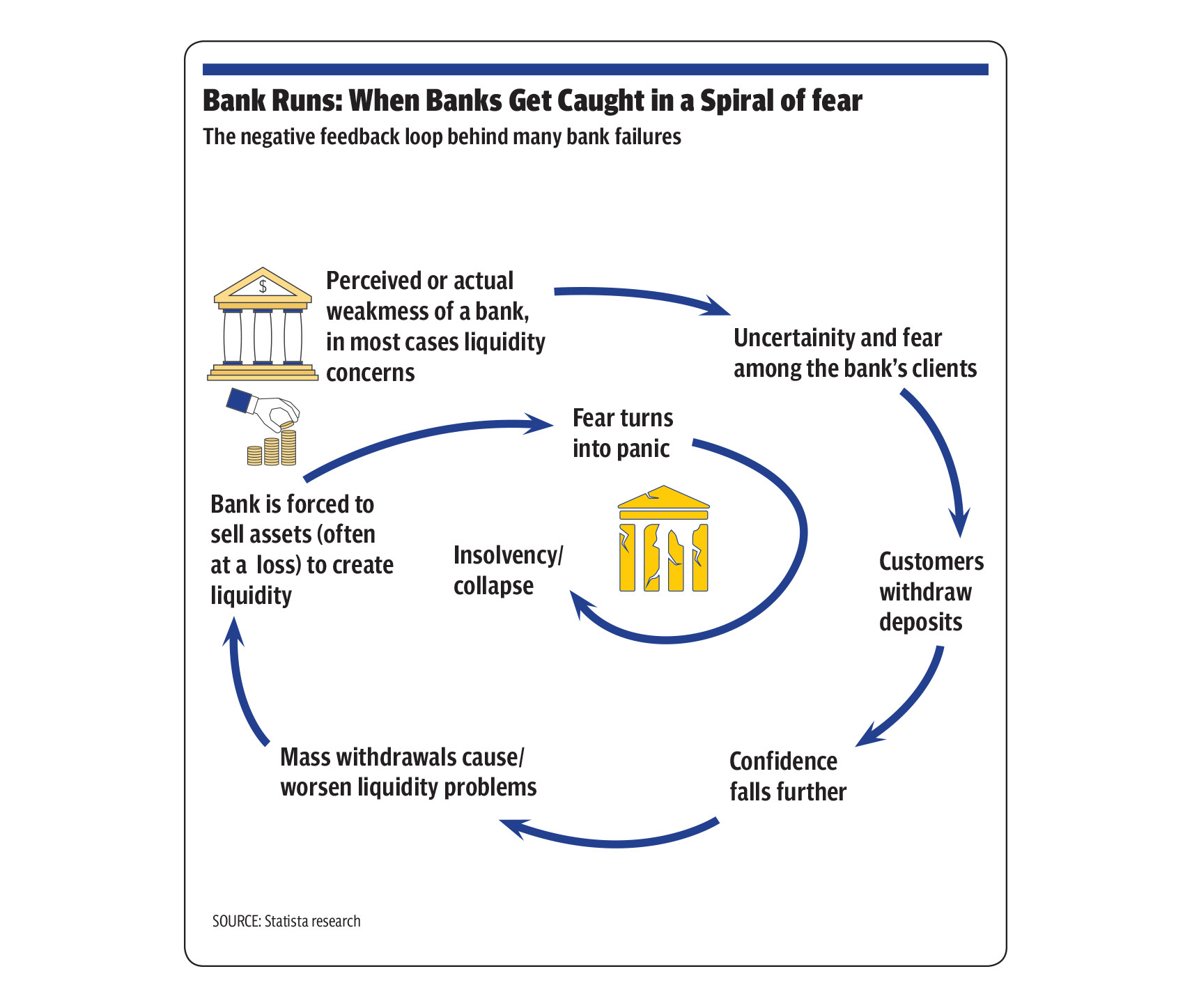

The concept of a Bank Run is derived from a situation in which many of the depositors simultaneously withdraw their funds from a bank, usually due to concerns about the bank's solvency or ability to repay its debts. In a bank run, depositors fear that their money may be lost, leading to a rush to withdraw their funds. If enough depositors attempt to withdraw their funds, the bank may be unable to meet their demands and become insolvent, leading to a further loss of confidence in the bank and a worsening of the bank run. Bank runs can have severe consequences for the financial system, as the loss of confidence in one bank can spread to other banks and trigger a broader financial crisis. To prevent bank runs, governments and central banks may use various measures, including deposit insurance, lender of last resort facilities, and capital requirements, to maintain the stability of the banking system.

A history of default

One example of a bank that provided services to technology companies and defaulted is Silicon Valley Bank's predecessor, Imperial Bank. Imperial Bank was a major lender to technology startups during the dot-com boom in the late 1990s and early 2000s. However, Imperial Bank's aggressive lending practices and concentration in the technology sector left it vulnerable to the downturn that followed the dot-com bubble. In 2002, Imperial Bank was seized by federal regulators and its assets were sold to Comerica Bank.

Another example is the failure of IndyMac Bank, which was a major lender to the mortgage industry and real estate investors, including private equity firms. IndyMac Bank's lending practices were highly aggressive and it specialized in making subprime and Alt-A mortgage loans, which proved to be highly risky during the 2008 financial crisis. In 2008, IndyMac Bank was seized by the Federal Deposit Insurance Corporation (FDIC) and its assets were sold to OneWest Bank.

Northern Rock (UK, 2007): In 2007, customers of the British bank Northern Rock rushed to withdraw their savings in what became known as the "credit crunch" crisis. The bank had become heavily reliant on short-term borrowing to fund its lending, and when the global financial crisis hit, it was unable to secure the funding it needed to continue operating. This led to a run on the bank, with customers queuing up to withdraw their savings.

Northern Rock was a British bank that specialized in mortgage lending. In the early 2000s, the bank grew rapidly by offering attractive mortgage deals to customers. It also relied heavily on the wholesale funding market to finance its lending. However, when the global financial crisis hit in 2007, the wholesale funding market dried up, leaving Northern Rock unable to raise the money it needed to continue operating. This caused panic among its customers, causing a depositor run. The bank's financial position rapidly deteriorated, and it was eventually nationalized by the UK government.

While social media did not have much of an impact in the case of the Northern Rock Bank run, it did play a major role in the bank run experienced by Yes Bank, India. The crisis was triggered by concerns over the bank's financial health, including the large amount of bad loans on its books and allegations of financial irregularities. These concerns were exacerbated by rumours and speculation circulating on social media platforms such as Twitter and WhatsApp.

As the rumours spread, customers of the bank became increasingly concerned about the safety of their deposits, leading to a run on the bank. Many customers rushed to withdraw their savings, causing long lines and chaotic scenes outside Yes Bank branches across the country.

The impact of social media was particularly significant in this case, as rumours and speculation spread rapidly through online networks, as WhatsApp has such a huge network of users. The Indian government and the Reserve Bank of India were forced to step in to prevent a total collapse of the bank, and eventually, the bank was placed under a moratorium, with withdrawals limited to a certain amount.

The impact of social media on the Yes Bank crisis underscores the importance of effective communication and transparency by banks and regulators. In a digital age, where information can spread quickly and easily, it is essential for banks to be open and transparent about their financial health and to communicate clearly with their customers. This can help to prevent false claims and speculation from spreading and can help to maintain confidence in the banking system.

Furthermore, it is crucial for regulators to monitor social media and other online platforms to identify potential risks and to take appropriate action to mitigate these risks. This can include measures such as issuing clarifications and statements to correct the spread of misinformation and reassure customers about the safety of their deposits.

Social media contagion

Coming back to the case of the Silicon Valley Bank run, when major investors and businesses began pulling out their deposits from SVB, word spread like wildfire on Twitter.

“SVB Has Gone Under Completely” citizen journalist The Vigilant Fox posted in a March 11 tweet that was viewed by 2.9 million people and retweeted more than 6,000 times. The ease of online banking and the amplification of offline conversations, through social media, contributed to a modern and destructive bank run. In the present era, panic can spread rapidly through just a few clicks on a screen. SVB’s clientele composed of a tight-knit tech community, which meant that social media highly intensified the already serious caution spreading within the community. Along with social media chatter, the bank was quickly unraveled.

Lessons for Pakistan

The bank runs that happened in the past had a plethora of reasons that led to their customers losing confidence in the bank's ability to protect their savings. These included:

The bank's heavy reliance on one specific domain to raise funding, wholesale funding in the case of Northern Rock which left it vulnerable to changes in the financial markets. When the wholesale funding market dried up, Northern Rock was unable to raise the money it needed to continue operating.

The bank's management was slow to respond to the crisis and failed to communicate effectively with customers. This led to a loss of confidence in the bank's ability to weather the storm. The lack of communication and Transparency between organizations, and the people in power, and the general public is already so prevalent in Pakistan, that any misinformation spread over social media, especially on TikTok which is in high gears, would lead to an even faster downfall of the banking system in Pakistan that that of Silicon Valley.

Moving forward, there are several lessons that can be learned from these bank runs:

Effective communication is crucial in times of crisis. Banks need to be transparent with their customers and provide reassurance that their savings are safe. Methods of this could be regular issuance of Statements of the bank’s Financial Position for greater transparency between the bank and its customers, which will create a trust that will be difficult to break through the spread of misinformation.

Governments and central banks have a key role to play in stabilizing the banking system in times of crisis. They can provide liquidity to banks to help them weather the storm and protect depositors' savings. It is also essential for regulators to keep track of social media and other digital platforms to detect possible risks and take necessary measures to minimize them. Such measures may involve issuing statements and clarifications to counter the spread of false information and reassure depositors about the security of their funds.

Ali Asad Sabir is a political economist and senior research assistant at the Institute of Development and Economics Alternatives (IDEAS). Waleed Mahmood is a research assistant at IDEAS. All facts and information are the sole responsibility of the writers.