Debt swaps for emission reduction are a crucial tool for addressing three pressing issues: they can help maintain fiscal sustainability, promote biodiversity and green recovery, and foster long-term sustainable economic growth. Around 30 economies worldwide have undertaken debt-for-climate swaps as of right now (primarily in Latin America and the Caribbean). Around $2.6 billion in debt swap accords were reworked globally from 1987 and 2015, of which $1.2 billion was spent in traditional projects. Additionally, 29 international countries benefited from debt swaps throughout the pandemic.

Debt swaps can modify procedures, strategies, and structures in the direction of a green rebound, going past merely acting as finance sources for particular industries. Such programs allow national debt to be channeled toward meeting environmental pledges and significantly advancing the Paris Agreement Goals. Debt swapping is a contemporary strategy that entails buying the debt of developing nations and demanding that they commit to safeguarding biodiversity and irreplaceable ecosystems in exchange.

Identifying process of a green and blue bond

But what makes a bond green bond is interesting. How to label a bond, loan, or sakuk as green have an identification process. The first track is for proposal, resource, and expense eligibility. This entails the issuer exhibiting that the green bond's initiatives, holdings, and spendings are consistent with an array of green interpretations, or a categorization. Recognizing Environmental Projects, Assets, and Expenditures describes how to choose which categorization to use and when not to use one.

The second track is for the authenticity of the lender's institutional governance framework when it comes to bond labelling mechanisms. This involves processes and management for identifying green projects, assets, and expenditures; managing bond proceeds; and reporting and disclosure on a routine basis in accordance with the issuer's Green Bond Structure.

Social, sustainable, and sustainability-related bonds (green bonds) have also gained traction in the last three years. When used correctly, the growing volume and liquidity of the feasible bond fund economy presents a valuable guidance and support for borrowers to raise capital for long-term sustainability goals.

Blue bonds are one of many funding sources intended to guide ocean wellness and blue economies, and while they are valuable tools, they are best suited for countries with strong ocean governance, sustainable economic activities, and a borrowing infrastructure.

Pitch of the blue bonds

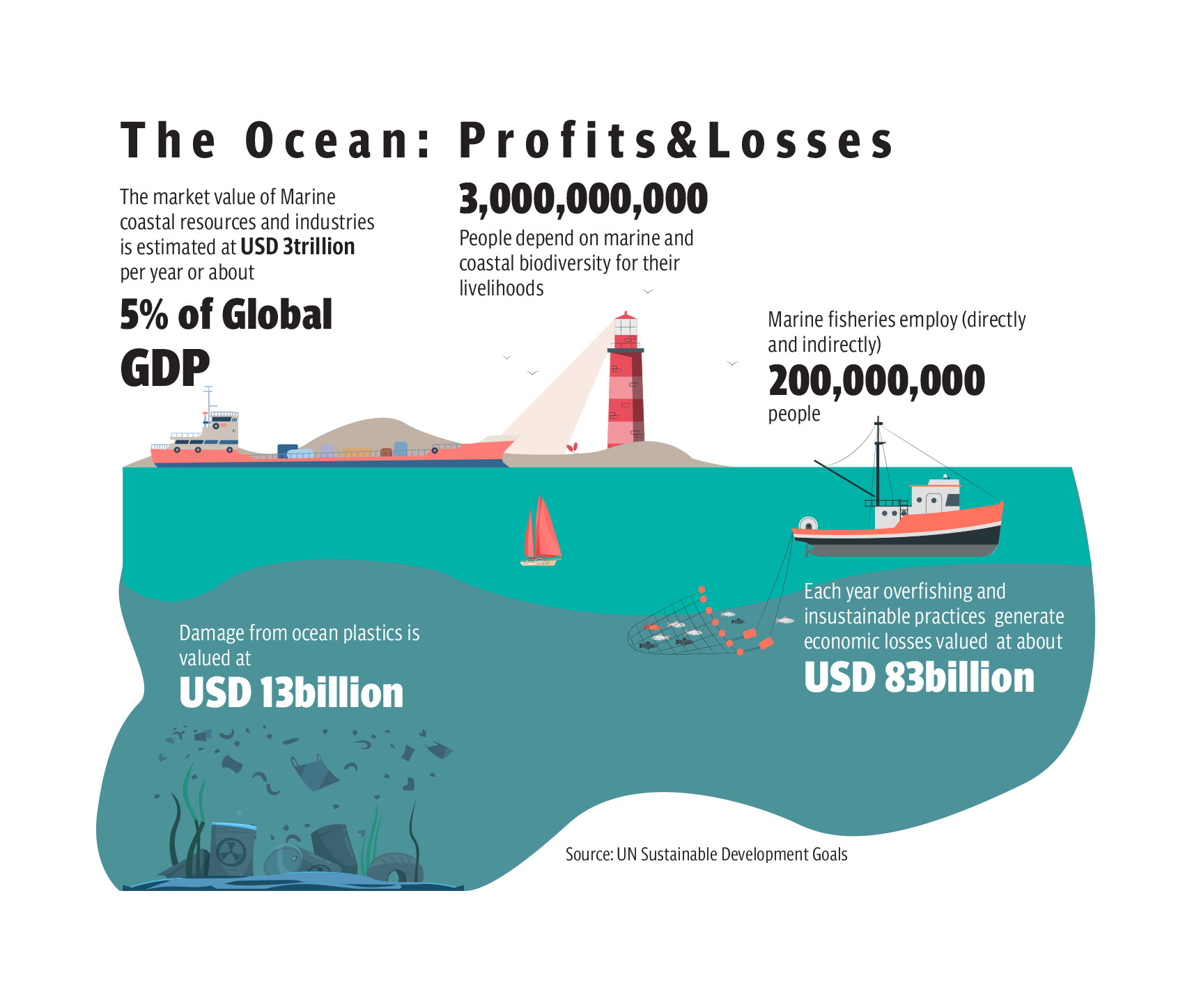

Blue economy and blue finance notions are mirrored in the 2030 Agenda for Sustainable Development, a sequence of international development aims adopted by the United Nations Sustainable Development Summit in 2015. The 2030 Agenda emphasised the Sustainable Development Goals (SDGs), a set of 17 goals aimed at eradicating poverty and creating a more sustainable planet.

The SDGs are global aims that apply to all nations. Goal 14 focus on “Life Below Water”. It calls for a healthy and environmentally friendly use of marine resources that preserves the ecosphere while allowing for economic growth.

The World Bank defines blue bonds “as a debt instrument issued by governments, development banks or others to raise capital from impact investors to finance marine and ocean-based projects that have positive environmental, economic and climate benefits."

According to ADB - A blue bond is a relatively new form of a sustainability bond, which is a debt instrument that is issued to support investments in healthy oceans and blue economies.

To issue a blue bond, a blue bond guideline is created or an existing green bond framework must be expanded to overtly incorporate blue projects. The structure includes a categorization of blue projects (a classification of the various project types that are permitted) as well as eligibility criteria for each segment. The framework also specifies how the projects' blue impact will be tracked and reported.

How blue economy helped debt swap: Evidence from Seychelles

Following 2008 economic reforms, Seychelles effectively reduced its public debt from 175% of GDP to 60% of GDP by 2015, including a 45% buzz cut conferred by the Paris Club of creditors in 2010. However, because of the limited fiscal support and Seychelles' reasonably high GDP per capita, access to concessional finance was restricted.

Seychelles pursued an aggressive strategy to fund long-term development of the Blue Economy, converting US$21.6 million of national debt through the world's first Blue Economy debt for nature swap and issuing the world's first sovereign blue bond. The Seychelles Conservation and Climate Adaptation Trust (SeyCCAT) was founded to disburse funds from these measures in a productive manner to assist the governance and augmentation of Seychelles Marine Protected Areas (MPAs), viable fisheries, as well as other activities that contribute to the sustainability, preservation, and safeguarding biodiversity, as well as climate change adaptation.

With 38% of GDP, tourism is the primary driver of the economy. It has a formal employment rate of 25%. Conversely, fisheries account for 20% of GDP and 20% of formal employment. Seychelles is heavily reliant on blue tourism. And there is a lot of emphasis on eco-tourism, which was high quality, minimal impact, and high return.

The Seychelles Blue Economy Framework intends to reach a framework of environmental sustainability that encompasses Seychelles' oceanic environment's opportunity to generate employment, ensure income equality, foster innovation, identify adaptive capacity, and increase resilience to shocks.

These improving adherence have proven to be extremely effective. With the help of The Nature Conservancy, the debt conversion enabled the Seychelles government to make a policy commitment to protect 30% of its Exclusive Economic Zone through MPAs. The Seychelles Blue Bond was announced in 2018. Overseas investors contributed $15 million to the Blue Bond, illustrating the prospects for countries to use capital markets to fund the sustainable use of marine resources.

The Seychelles Blue Economy Strategic Policy Framework and Roadmap was critical to the Blue Bonds Plan's achievement, as it outlined how the finances would be immersed prior to the debt securities being issued. The SeyCCAT Blue Grants Fund has already gone through four rounds, with the final one on July 6, 2020.

From debt for equity swap to debt for nature swap

The debt for equity swap was pioneered by advisors to third world country governments. The framework was tested on Chile first. In order to prevent any growth of the bond market, Chile developed a more credible framework that allowed for the conversion of debt into equity. Local banks compete for the privilege to conduct transactions to exchange a specified, fixed amount of foreign debt into local currency at the Central Bank's monthly auction. The banks serve as agents by helping the holders of international debt change it into cash or a resaleable commodity denominated in pesos with the approval of the local debtor. It was considered as a way to rescue banks and third world countries from the global debt crisis.

Certain foreign debt claims are eligible for conversion into equity by nonresidents under the provisions, and they can be bought on the secondary market without using the auction system. Restitution of capital or dividends is governed by a variety of requirements, and the domestic currency acquired must be used for authorized investments. Each application was evaluated on a case-by-case basis by the Central Bank, which started to insist in 1988 that each conversion be accompanied by at least a tiny quantity of new money.

The Central Bank of Chile stated in 1987 that the country's debt-for-equity program would be extended to permit the creation of overseas investment organizations, whose assets, acquired through the acquisition of subsidized debt, may be reinvested in a variety of Chilean equities and investment funds.

But how do someone account for debt-to-equity swap is important to understand. The method of accounting of a debt-equity flip entails over drafting the entire debt portion of the business designated for swap purposes and giving credit it into an equity shares issue account. Debt-for-equity swaps entailed western banks willing to sell a fraction of the lines of credit owed to them by developing countries to a foreign investor at a rebate. This resulted in the creation of a secondary market for debt, with some countries' debt being sold for as little as 5% of its face value.

The debt sale necessitated the approval of the creditor country, which would compensate the foreign investor by giving them shareholding in a domestic industry or cash equivalent to be used within the state in the amount equal to the face value of the debt.

Debt swapping formulation: Evidence from Pakistan

Earlier this year, United Nations secretary general during his visit to Pakistan appealed for a substantial debt relief. Let alone recent floods in Pakistan caused an estimated damage of 10% of the country’s gross domestic product (GDP), a country which is already in debt trap with total external debt and liabilities surging to around 40% of the GDP. While the debt servicing jumped to over $15 billion during last year. Debt swap is a viable option but under what conditions is important to understand.

Either it is debt payback, debt swapping for equity or debt swapping for nature? But the difficulty is in identifying suitable investment opportunities for which debt can be swapped—either because there are none available or because authorities withhold the permission.

At best, the debt equity conversion may have a useful life of two to three more years. But the debt swap cause controversy because they speed up the privatization process in third world countries. Because they provide cheap business opportunities and avenues to the international investors at a low rate. This led to an increase in FDI because there is also no evidence of knocked down pieces.

Debt swaps are now to be sponsored by impact investors, who are private individuals or organizations who contribute funds in the hope of profiting from them. Debt swaps are pertinent to the topic of sustainability finance because of this. So how this evolution of sponsor work is important to understand.

Another framework which can be used is to low down the local currency valuation; which Pakistan seems to be using. This help in debt conversion. Role of SBP and private commercial banks in it is significant. It involves exchanging debt paper for equity, which is then sold to a consortium of bidders, with the returns on capital calculated by the profits realized by the capital appreciation. In this frame of reference, investments in the hospitality and tourism enterprises have been particularly convincing. The accomplishment of either of these mutual fund schemes is predicated, above all, on the readiness of creditor banks to offer considerable quantities of debt paper at a discounted rate, which most major banks appear unwilling to do.

But the ideal time limit of this debt-equity swap is not defined. For example, one of the debt markets perform best within a period of two to three years. That too, depends on the nature of volatility in the country. And that too is a risk. If major investment opportunities do not attract towards it, then venture enterprises grab them.

On the other hand, what government can do to swap its debt is to privatize its properties. Many are already privatized, but government can benefit from the under-valued dump properties who are not attractive enough for a breather. But that is too un-realistic to happen. Government cannot afford to take up the risk of swapping its properties with debt because it’s in loop and government will end up in having no under-over-market valued properties left to swap for.

The role differentiation of government and its central bank is important to understand, either it is of a financial service provider or a buying debt institution. Governments in developing nations pay off foreign loans in exchange for repurchasing the debt rather than merely exchanging foreign debt for local currency payments. This simply scale up the funding. But what about debt buybacks? Debt buybacks are always negotiated at a higher degree confidentiality because it can leave both positive and negative effect on other investors and creditors.

Similarly, when the debt exchange for the Seychelles was completed, it was revealed that TNC had originally asked the contributors of the Paris Club for a deal worth $80 million with a rebate of 25% but had instead been successful in obtaining a debt swap for $21 million with a discount of only 6.5%.

Pakistan recently was proactive on the climate fund. From an angle of enthusiasm, this fund can be seen as debt for nature swapping. But a country like Pakistan, who is debt crunch and borrowing more money to pay off previous loans have a long road. Blue economy or green economy are the way forward but a country with total debt and liabilities peaking by an unsustainable 24%, to Rs62.5 trillion at the end of September 2022 will be holding the rope with soggy hands end at the time of negotiations, either at debt swapping time or debt buyback time.

Ali Asad Sabir is a freelance writer. All information and facts are the sole responsibility of the writer.