Energy security is a referenced term that came into discussion in 2004 when Russia invaded Georgia, the energy security thread rolled on the communication again when in 2014 Russia again invaded and then annexed the Ukrainian territory of Crimea. The concept and idea of banning Russian cheap energy was tabled but at the time, the price was too cheap to act on it. However, since this time Russia entered in Europe’s backyard, energy security was unavoidable.

Banning Russian energy is directly proportional to increasing LNG demand in the EU and US. Meaning no cheaper LNG for Pakistan; an idea which Pakistan worked on to get cheap energy. It is pertinent to mention here that Pakistan spends roughly $100 million for a single LNG cargo from the spot market, a record for the cash-strapped country. But, what’s a spot market? Let’s discuss about spot market later in the piece.

Keeping these constraints in consideration, it indicates that the scale of prospective LNG demand will continue to rise in the near to medium term (assuming natural gas production volumes and price policies stay stable). According to projections from the Ministry of Energy and OGRA, Pakistan's indigenous supply will barely meet 22.3 percent of the market demands by 2030.

If the long-delayed I-P and TAPI gas pipeline initiatives do not join the network, the estimated yearly gross energy deficit between 2021 and 2030 is anticipated to be 2,593 mmcfd. To bring this shortfall into perspective, it is 2.7 times the size of LNG purchased by the country in 2020. Problem is supply-demand. LNG have new more attractive buyers in the market and poor countries like Pakistan will now face the heat of increasing demand of LNG in the EU, UK and the US.

EU and US new love with LNG

Russia is the world's top oil supplier to international markets, according to the International Energy Agency, and its natural gas powers the European economy. And this time, the Russia's aggressive assault of Ukraine has stirred up power sector and geopolitics, pushing oil and gas prices to their highest levels in in a decade and pushing several countries to rethink their energy supply.

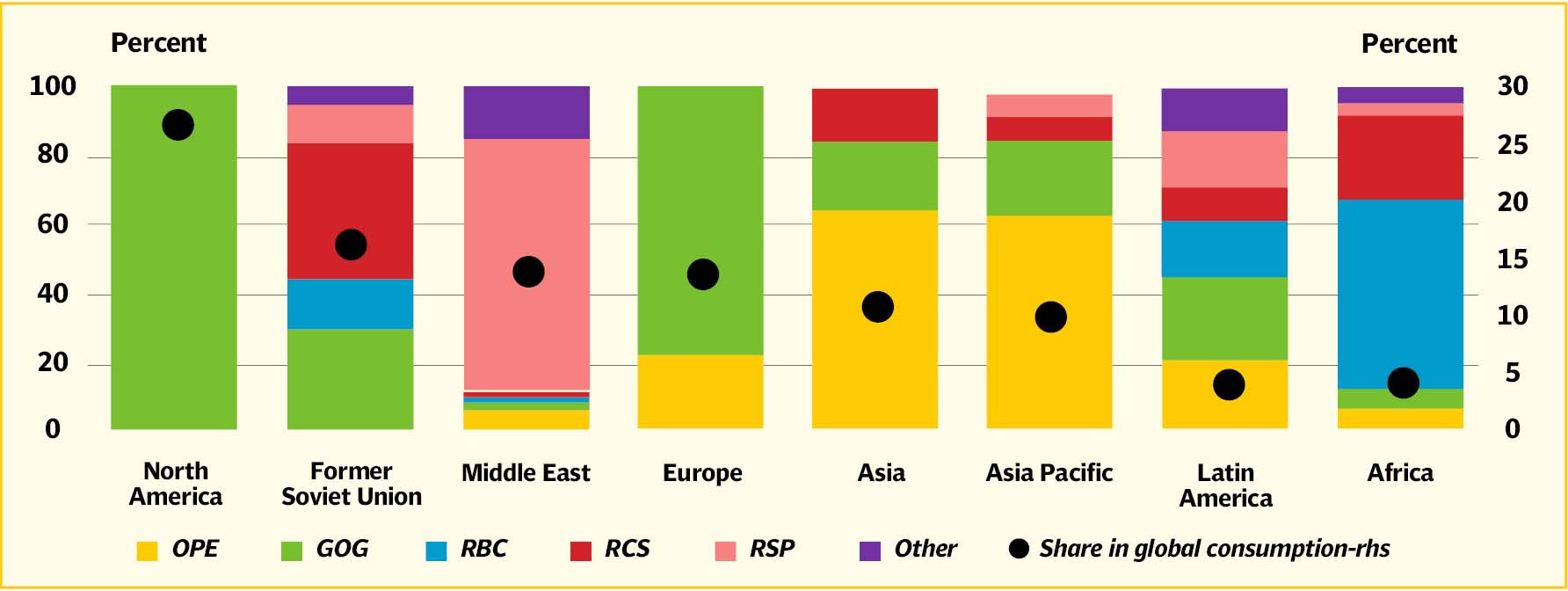

The United States, the European Union, and others have slapped punitive penalties on Russia and declared intentions to phase out the country's use of coal and oil. Despite Russia's bombing of Ukraine, its oil and gas continue to flow to Western countries who have criticized the incursion. Russia supplies about 40% of natural gas to European Union overall, but many individual European countries receive a much higher proportion. By banning Russian oil import to EU and US, these countries are adjusting themselves to alternative energy sources to fulfill their energy needs.

The European Commission has announced intentions to reduce Russian gas imports by roughly two-thirds by the conclusion of the year. This plan is heavily reliant on increased foreign liquefied natural gas. The aim of the commission is to replenish 101.5 million cubic feet of Russian gas by the course of the year. Increasing imports to Europe from other nations might account for approximately 60% of the reduction, with another 33% coming from increased renewable-energy sources and conservation measures.

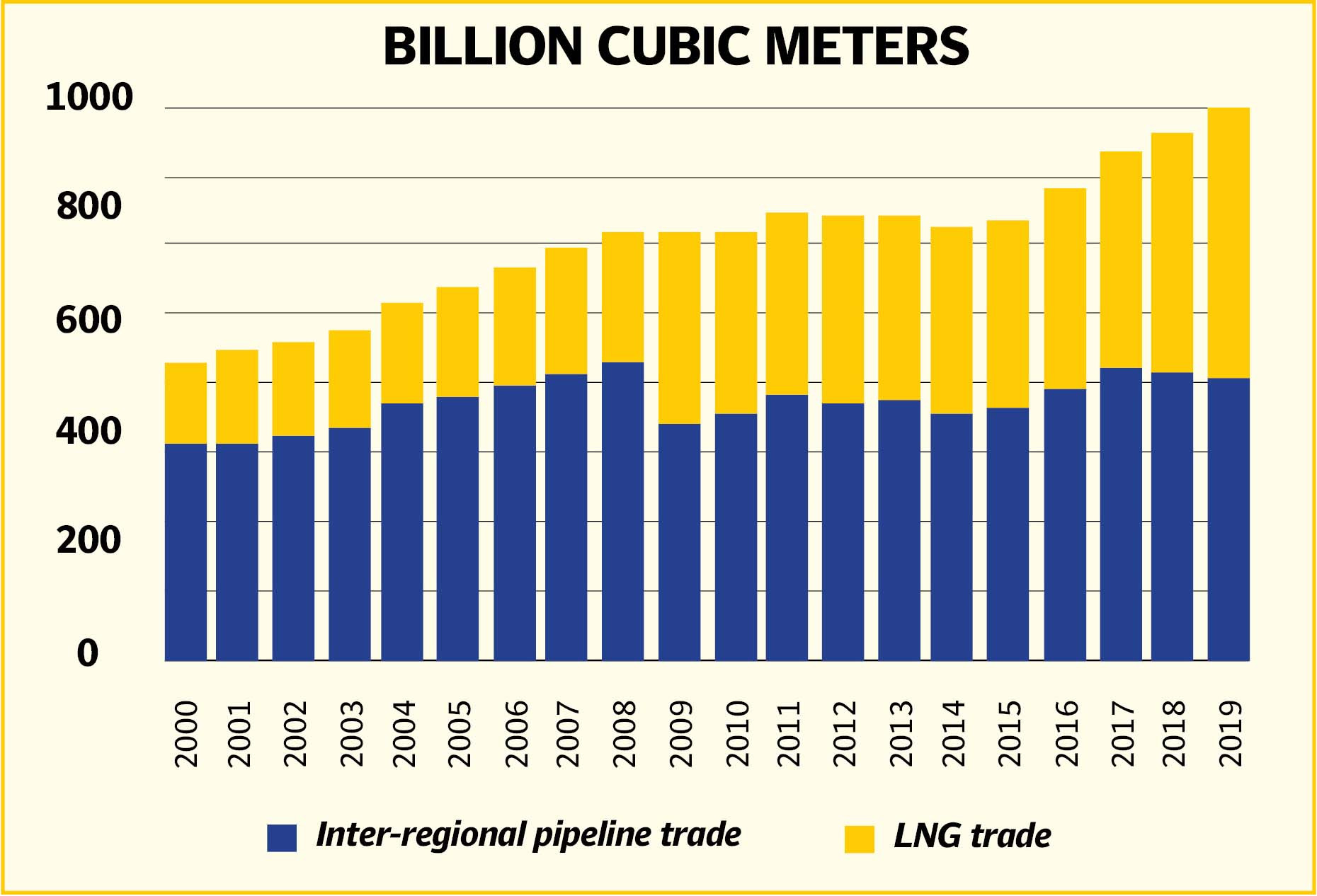

Meanwhile, Europe has increased its need for LNG. So far this year, Europe's LNG imports have increased by 50% compared to the corresponding time last year and exhibit no declining trend. Countries such as Germany and the Netherlands are accelerating the development of hovering import docks, with the first ones set to open sometime in the next six months.

In response to rising demand, Qatar recently announced plans to raise its LNG generation capacity by 64% by 2024 in order to capitalize on newly found gas supplies. Other natural gas producing countries, notably Canada, Mozambique, and other West African countries, also have declared similar development ambitions.

Pakistan facing the heat: No more cheaper LNG

The interruption in energy supply from the world's largest supplier, Russia, is causing global energy prices to rise. This is a big setback for an oil-importing country like Pakistan, especially given that oil makes for a large portion of its importation. This has the tendency to further drain our national reserves, reducing the nation's buying power.

Pakistan; an oil importing country to fulfill its energy needs is again caught between the Russian-Ukraine war. A decade ago, the world's fifth-most populated country took particular precautions to protect itself from the types of severe price increases that are currently shaking the market. It invested a lot of money in liquid natural gas and inked long-term contracts with suppliers in Italy and Qatar. Some of those suppliers have already defaulted, albeit they keep selling into the more affluent European market, placing Pakistan in the very predicament it hoped to prevent.