This was a difficult budget to prepare, probably one of the toughest in our history. On the one hand, the economic crisis demands restoration of the IMF programme, which calls for sacrifice. On the other, general elections loom large. The political cost of restoring order to the disarray in which the economy has been left is high. The government did not cause the crisis, but it must now repair it.

Budget making is always a challenge. But this budget could not be a mere statement of receipt and expenditure for the coming year. It had to set a clear direction for the economy with the goal of macro stability in the coming year. We will see if the budget measures indeed work to that end.

It is in this perspective that this article reviews the budget. The following metrics are important to give an opinion on the budget, i.e., whether it would:

- Satisfy the IMF sufficiently to restore the programme in the coming days. It probably should

- Are the expenditure and revenue numbers achievable, or should we expect to see supplementary or mini budgets during the year? Expenditure may need revision

- The additional burden on the people through raising indirect and direct taxes, price inflation and removing subsidies and exemptions. Would the pain be felt by all or just the common person? The budget doesn’t deal with some major areas of exemptions and concessions that are not the best use of taxpayers’ resources. But mostly it is defensible on this count

- What is the likely reaction of businesses? They should be relieved.

The budget’s presentation to parliament and the close review by media is a good sign. It is moot though if the budget session reflected well on the state of our democracy. Parliament was virtually without an opposition as an unelected Finance Minister Miftah Ismail delivered the budget speech.

Involvement of elected officials in economic decision making is important. Just see what is the result of the country’s fetish for ‘technocrats’ leading economic decision making. Participatory government is about voicing the aspirations of the people. There is no more important way to do so than in matters of public money that are paid for by the people. Today’s session was another burlesque affront to that idea.

Compared to his last budget speech of 2018, the Finance Minister was today in a more comfortable position. He is not responsible for the economic crisis. And, if his conversations with the IMF niggled within, he did well to not show it. That perhaps explains the combination of caution and hope that the budget speech conveyed.

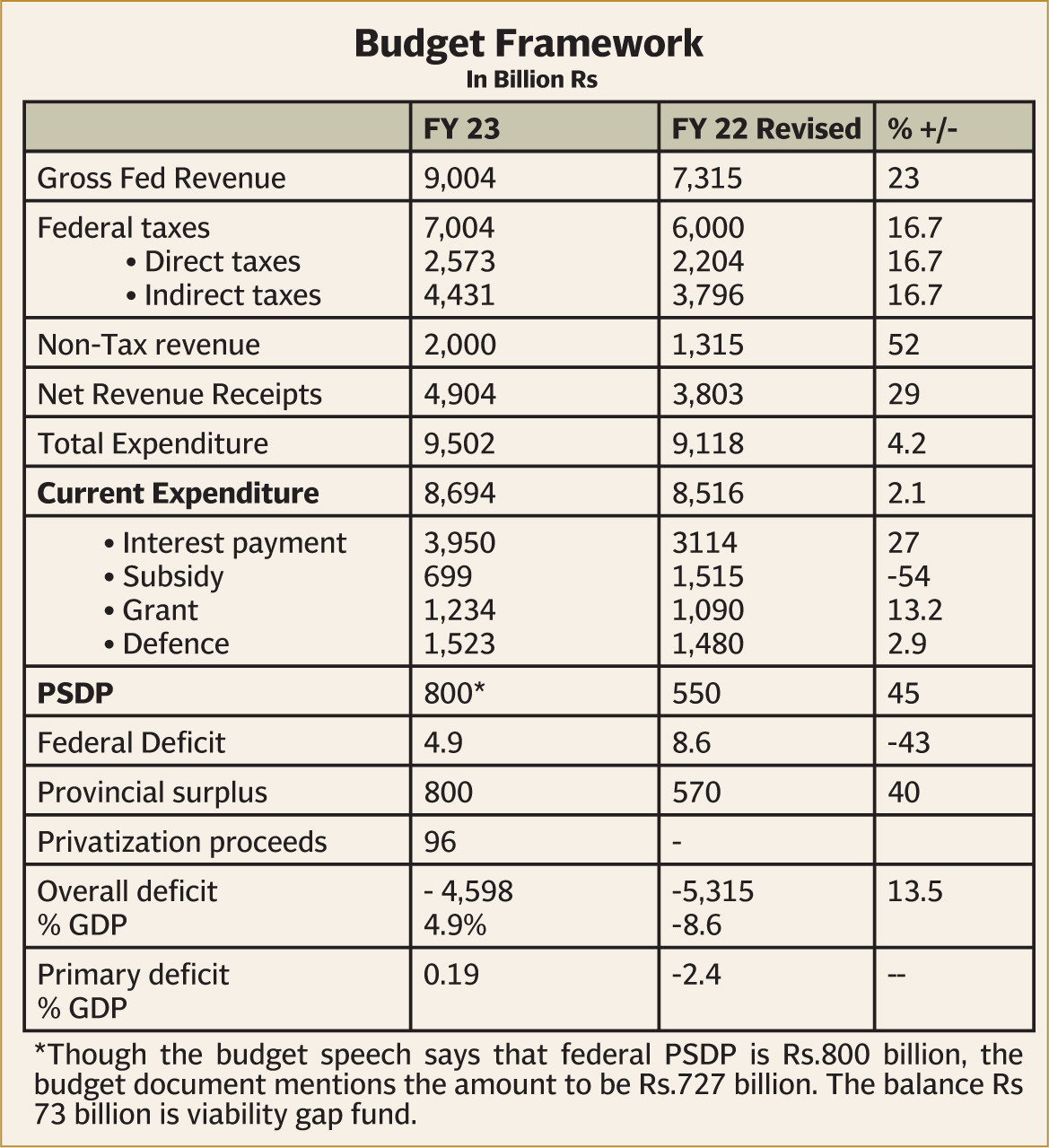

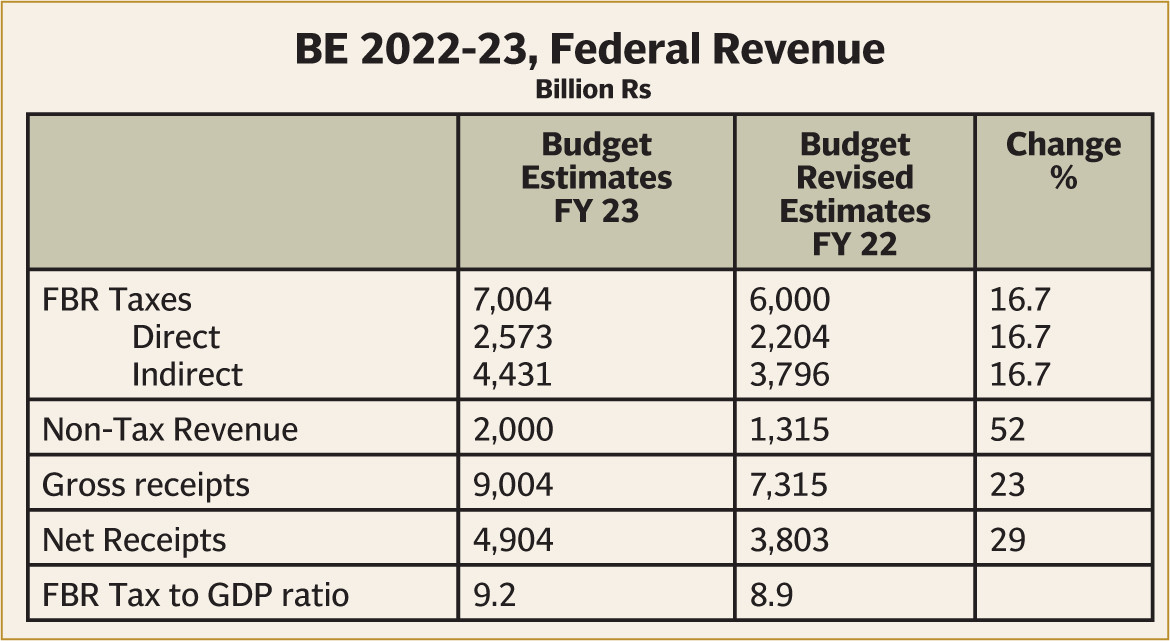

Yet the budget speech and the main documents hide as much as they say. Federal revenue and FBR taxes are estimated to grow 23% and 17% respectively. Current expenditure will go up by just 2% and total federal expenditure by 4%. With inflation rate targeted at 11.5%, this means expenditure would fall in real terms.

We look at the broad numbers to see what is in store for the people in the coming fiscal. Total federal budget outlay for FY 23 is Rs 9,502 billion - about Rs 400 billion more than last year’s estimated outlay. Of this, current expenditure is budgeted at Rs 8,694 billion or 91.5% of total.

For FY 23, budget estimate for interest payments have increased to Rs 3,950 billion or by 27 percent from FY 22 revised estimate. This amount is 41.5% of total federal outlay and a shocking 6% of GDP. Expenditure on interest is 81% of net federal revenue of Rs 4,904 billion.

These numbers need to be imprinted on the nation’s consciousness. This is what years of borrowing has done to federal public finances. Every time the government demands more tax from the people, tax payers must know that 81% of the extra burden will go to pay interest to creditors, including foreign creditors. I too, hope that the Finance Minister too would be conscious of this fact. And indebtedness would increase.

In FY 23, FBR revenue is targeted to increase by 17% over the revised budget estimate for FY 22. Petroleum levy is estimated to be Rs 750 billion, up by about 500% from the revised estimate of FY 22. Yet, the target growth of 17% is high, especially as the economy slows down and as the increase comes on the back of a 28% growth in tax in fiscal 22. Some tax measures may slow the economy or take time to realise, so it is to be seen if growth in revenue would stay in line with budget estimates.

The budget speech may not have been fully forthcoming about where the increase might come from. While looking at the small print to assess, the following facts should be noted.

It is to be seen if the tax measures announced today, such as tax on deemed return on additional immovable assets above Rs 25 million in value, on vehicles of over 1600 cc, fixed tax on traders and credit card cross border remittance would be sufficient to yield the targeted growth in revenue.

An estimated Rs 800 billion as provincial surplus is an unrealistic amount. There is no evidence to suggest that this would indeed happen.

Government has also given tax relief by raising the taxable threshold for salaried and business income. The threshold has been raised by 100% and 50% respectively. Government will also ease advanced tax at import stage and would pay back DLTL.

The expenditure estimates seem to be substantially off mark. Increase in total expenditure is a conservative 4% from the revised budget, current expenditure by 2%. This is especially a challenge as government employees have been granted 15% increase in pay. A fall of 54% in subsidy and a mere 3% increase in defence allocation are unrealistic estimates. The government has shared no plans about reducing subsidy for loss making PSEs.

With the main focus now on primary balance, this means steep cuts in development expenditure. There was no mention of privatising or restructuring loss making PSEs. Perhaps it is in the government’s plans, as the sudden decline in allocation suggests.

Moreover, sectors that have enjoyed surplus rent remain untouched, despite Finance Minister’s stated goal to make the rich pay. Due to generous incentives given to them, these sectors divert investment from the more productive manufacturing sector. Concessions made available to such industries do not yield returns to the economy consistent with their cost to the tax payers.

But the key point is that the numbers do not add up. The budget deficit may be more than projected.

The Finance Minister said that restoration of the IMF programme is an important goal. It is not known where the IMF would like to see the budget deficit. But if the agreed target deficit is 4.9%, the estimates in the budget will not hold. Resultantly, the deficit would be higher. Either there are tax measures that have not been announced, or we must prepare ourselves for a supplementary budget. It is likely that we may see a series of incremental measures to raise indirect taxes or levies.

That is sad, if it were to happen. One would have thought that the government would capitalize on the national mood which understands that we are in an emergency and must all contribute to meet the challenge and avoid future crises.

Some reported action that the IMF insists on to restore the programme did not find mention in the budget speech, though we find allusions to it in the inside pages. The government has to do away with Rs 17/litre subsidy on motor spirit. The budget shows a 90% reduction in subsidy on fuel. Clearly, we would see rise in gas price soon. Together with increase in Petroleum levy, it suggests a belief that prices may decline soon or that increase in pump prices would see repeated hikes. The former is uncertain.

Similarly, subsidy for IPPs is down by 60%, which suggests increase in power tariff soon. As energy prices have continued to increase, we may see more than one round of power tariff increase. No known step has been taken on IMF’s demand to withdraw tax subsidy from some privileged high-ranking officials.

The budget speech gave some strategic direction for growth of the economy. Increase in production of agriculture goods is a clear goal. A number of tax measures would stimulate production. Yet, some fundamental steps to increase yield such as water supply and its efficient use were not touched upon. Nor has government focused on agriculture research or rationalisation of input prices.

Government has also encouraged industrial investment, but did not consider a major private sector demand for credit creation or changes in tax structure that would incentivise investment in manufacturing. Specific tax correction for pharmaceuticals would boost the industry and perhaps lead to some growth in exports.

Information technology is also a stated area of focus. Here again we see no major initiative in support of the laudable stated objective.

In reality, the budget gave no long-term strategy. Government seems reconciled that the coming fiscal would be one to regain economic stability with tempered GDP growth. That is a realistic goal, though whether it is one with which a political party would want to go to general elections is moot.

Despite the attention given to it, the budget is an annual document that estimates that year’s income and expenditure. It is effective as part of a long-term growth and development strategy. Successive governments have not prepared such a strategy. Perhaps that is why bravado becomes a substitute for serious policy-making. The five-year plans of the Planning Commission cannot be considered a growth and development strategy. They have become a routine exercise. The budget speech did not even make a token reference to the five-year plan.

In any case, the general public hardly takes notice of the budget announcement as past hope have been tempered by cynicism. For them, reality lies in the marketplace. Just a short while before the budget was presented, government employees clamoured successfully for a pay increase.

With respect to the budgetary framework, one red flag seems hard to ignore: The fiscal deficit target may not hold. Expenditures are bound to be higher than estimated, and a 17% growth in taxes, despite a number of measures announced, may fall short.

Our last year’s fact sheet said the same about the projected 6.3% of budget deficit. We have ended up with a deficit of almost 9%.

Development budget: PSDP

Last year’s Rs 838.5 billion PSDP was corrected by 38% to Rs 550 billion, 0.8% of GDP. This year too, a correction is likely. There is already talk of bringing it down to Rs 600 billion from Rs 800 billion, a 25% decrease. If government is serious about its claim to stimulate agriculture and industrial growth, reducing the size of PSDP is not consistent.

Also, the limited funding is spread over 1,173 projects with a combined throw forward of several trillion rupees, which means that the projects in the PSDP would take 12 to 14 years to complete. It is better to reduce the number of projects and fund those projects that support the economy’s core goal of economic and export growth.

In an atmosphere of a reduced pie, allocations are never enough. It is good to see that allocation for the water sector is up 10% to about Rs100 billion. Yet that amount has 79 projects to fund. The throw-forward in the water sector is Rs 1.3 trillion. So, at this rate the average completion period of the project is 13 years. The water sector must focus on the key objectives of efficient use of water, increase in supply volumes, and to meet the threat of climate change. Funding a few key projects that would yield results quickly is preferable to spreading too thin.

Allocation for the Railways has increased to Rs 32 billion. That is an encouraging sign, though that means that the $10 billion ML 1 is not yet a priority.

Macro Framework guiding the budget and the balance of payment:

The economy’s targeted growth rate is 5% and the current account deficit is estimated to be 2.5% of GDP or $9 billion. The economy may fall short of the growth rate, though the current account deficit is realistic. Yet, we see the following pressures on the current account.

• A global economic slowdown and high costs may affect world demand for our products. Though demand for textiles, our main export, is not the first to fall, there is still some concern as global demand all over has taken a hit. That we compete on price helps us in such times. The continued decline in rupee value would help also.

• There are no new export products in which Pakistan competes as well as it does in textiles. Government’s announcements about the IT potential and other goods may take time to build into something substantial. We could see growth in the pharmaceutical industry where some increase in export is also expected.

• Estimate of workers’ remittance of over USD 33 billion seems realistic, a growth of about 6% from FY 22. Recent increase in workers’ remittance may have been caused by the attractive conversion rate for their currency. The slowdown in the global economy may not affect remittances to Pakistan. At a time of rising commodity prices, the economies of the Gulf countries, from where most remittances originate, are doing well.

• FDI fell by about 30% in FY 22 to about $1.5 billion. With GDP growth slowing in Pakistan and globally, it is not clear if FDI would revive. News about the Pakistan economy is not encouraging though restoration of the IMF agreement may change perceptions and business confidence. For a number of reasons that have to do with the economy’s competitiveness, Pakistan has never attracted FDI in large amounts, especially not in export-oriented industries.

• In dollar terms, external debt is over 35% of GDP. Dependence on external savings means higher debt servicing needs. Government though is resolved to reduce import. So, pressure on the Balance of Payment should ease. IMF estimates external financial needs of $35 to 40 billion in each of the coming five fiscal years.

• The macroeconomic framework estimates a slight decline in investment to GDP ratio to 14.7% from FY 22’s 15.1%. It estimates savings to stay at a low 12.5%.

Humayun Akhtar Khan has previously remained the Commerce Minister and is currently the Chairman and CEO of Institute of Policy Reforms. The analysis presented in this article is from the institute itself.