Let me take you back a decade. You have been anxiously looking forward to a movie and have already grabbed tickets for you, your family and friends. The more anticipated a movie was and the more cinemagoers were expected to see it, the more cinema owners would look to book it. This was the way the business kept moving.

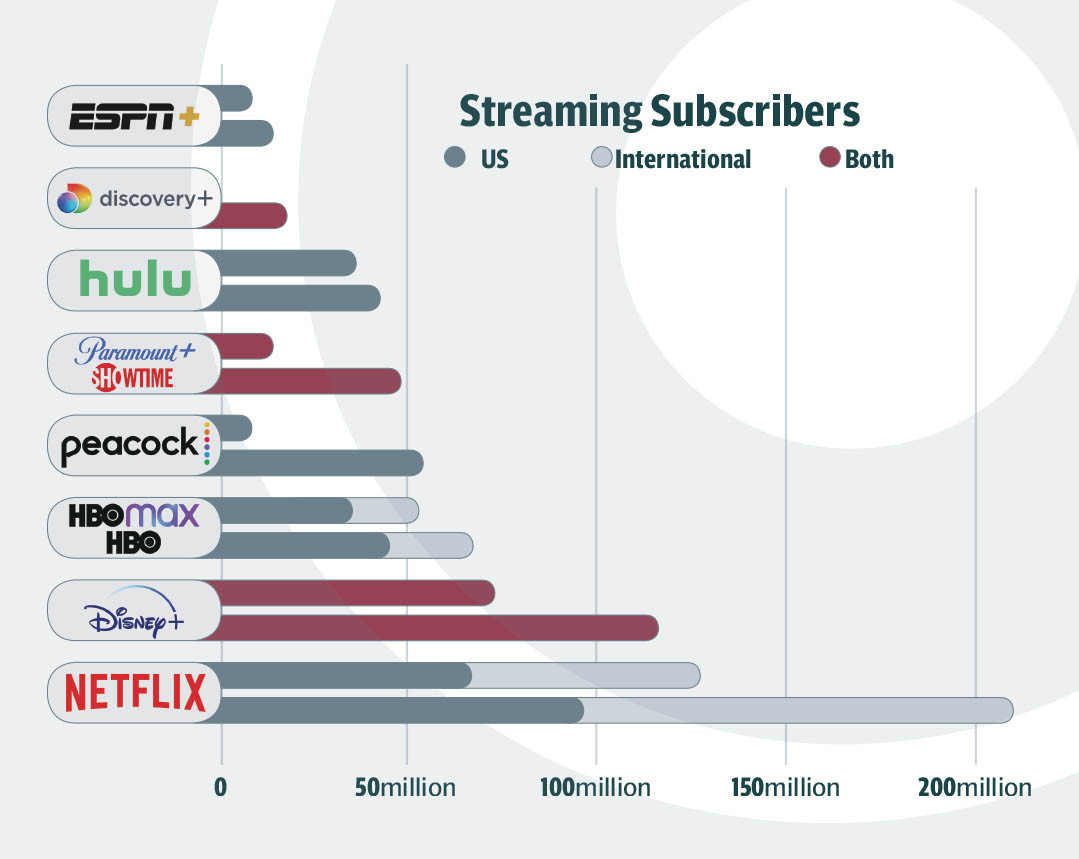

Let’s return to our present times now. While some huge blockbusters still pull viewers to the cinema, for most other offerings, people would rather wait. Instead of costly DVDs or VHS cassettes before them, you have amazing streaming services at your disposal like Netflix, HBO Max, Disney+ Hotstar, Hulu and more. In this model, you pay a monthly fee to get the rights to watch a library of shows and movies at your convenience. Pretty simple, only now, a lot of the most anticipated content is walled of between various platforms. Monthly fees for all platforms may stack up to a substantial sum, so you’re forced to choose.

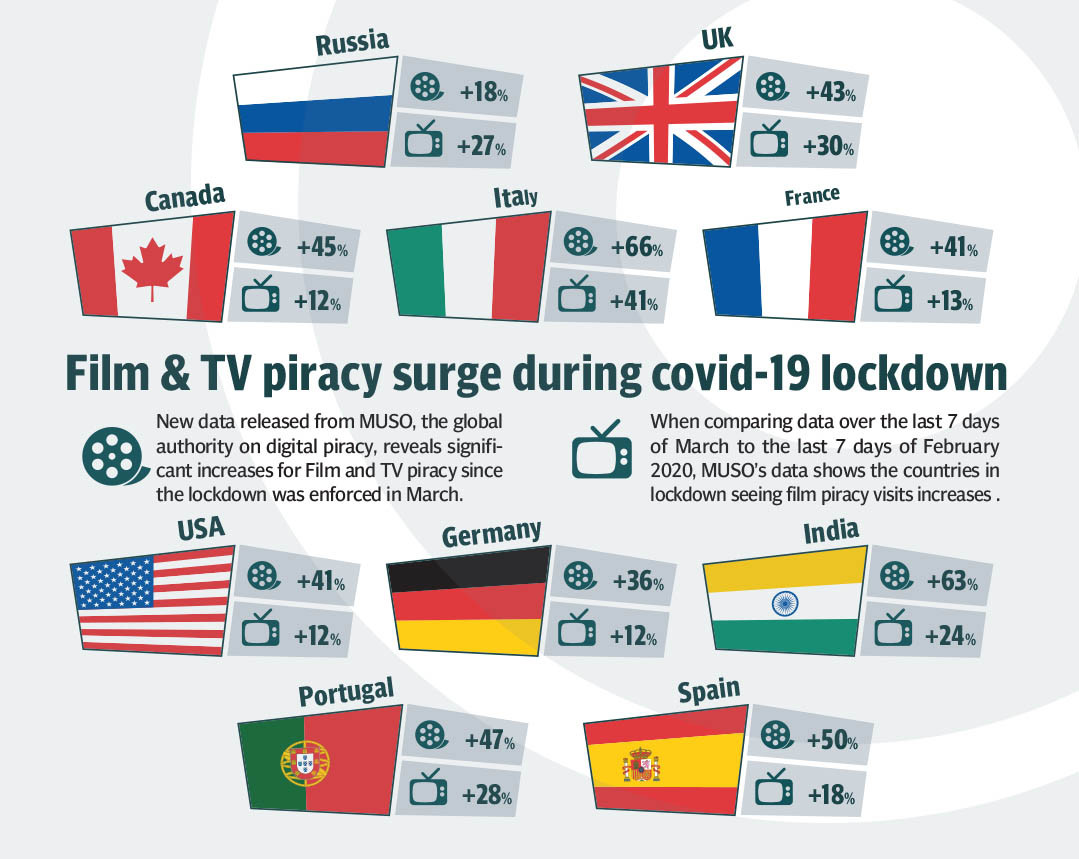

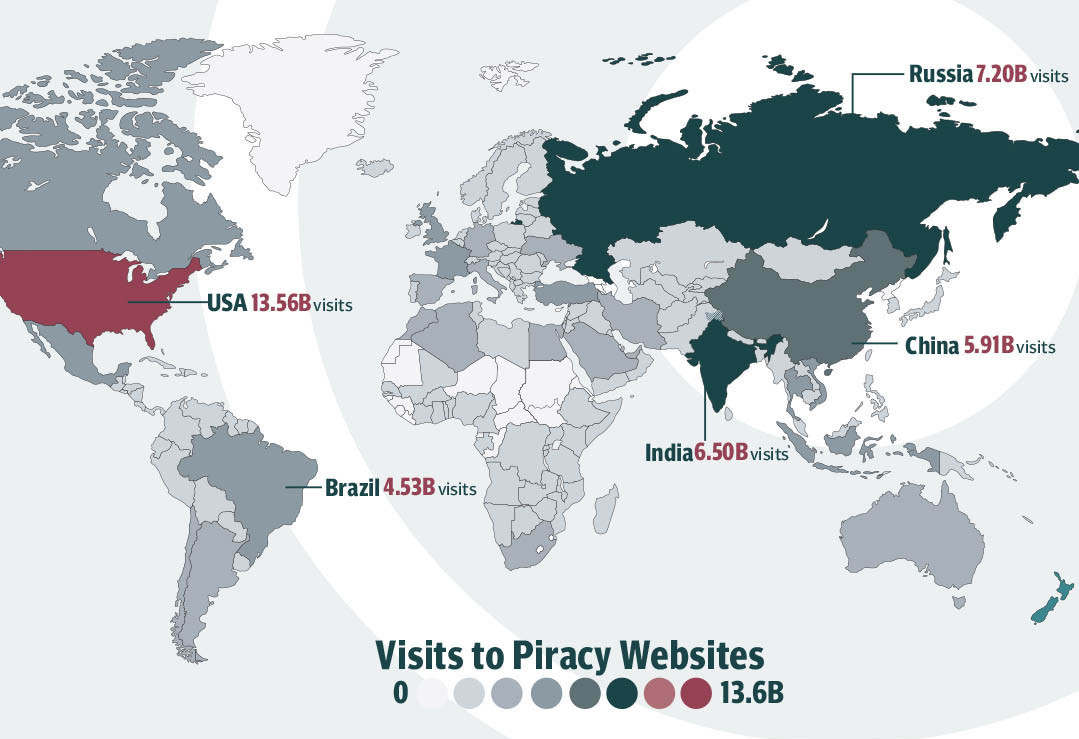

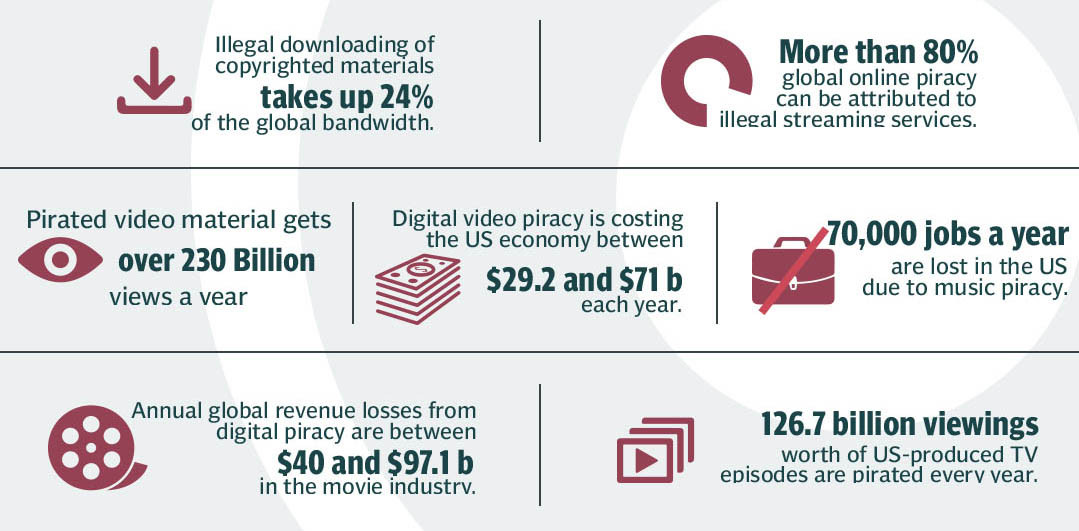

A more convenient albeit technically illegal path used to be torrenting, especially during its heyday in the 2000s. No subscriptions, and no service locator issues, all available under one umbrella. Given strict economic flux, and a lot of different streaming platforms, are people going back to torrents?

Bit Torrent’s comeback

After more than a declining use of Bit Torrent signaled by the traffic on the streaming platform, the platform is again gaining the pace by facing an inflow of large number of traffic. The primary reason behind it can be the fact about multiple inclusive subscription model based streaming platforms. You pay to each streaming service provider to see the content at different platforms. For example, if you want to watch a show at Hulu or HBO Max in Pakistan, you have to buy VPN too. While if you choose Bit Torrent, you cutout the VPN and streaming service provider straight away.

This is shockingly surprising in a way. The wall against unlicensed downloading has been the low priced good picture quality available to watch content. Netflix had a stable subscription plan but by increasing the prices it has started pushing subscribers back to BitTorrent, which as things stand provides universal content. It is true that online streaming platforms provide quality content but again, an average person, especially in a country like Pakistan, is not willing to spend somewhere around Rs4,500 simply on subscriptions for streaming platforms. Pakistanis have a long way to go before they are willing to pay for local content. This is simply because of varying tastes in market segments.

“SEC (socio-economic classes) A and B are more interested in English language content and is already subscribed to services like Netflix and Amazon prime,” said Nofil Naqvi, Head of Content, Z2C limited. “The rest of the market doesn’t have the buying power to afford paying for content. Distributors need to come up with a better solution to make it viable for them.”

It is also a base line fact that schooling as well as work in SEC A and B hones proficiency in English, which in turn fosters a special affinity to foreign content among them. SEC A and B pay for content by subscribing to foreign services like Netflix and Amazon Prime. Perhaps if local services did a better job at marketing and SEO, they may experience more successes even with these market segments.

The music industry has seemingly ducked this threat effectively, thanks to platforms like Apple Music and Spotify. While these platforms don’t have their own inclusive content, the subscription to one of them provides access to a vast range of content.

Their video counterparts, in trying to develop a competitive edge over their competitors, have increasingly focused on developing an exclusive library. As this catalogue grows, however, viewers who may find shows across various platforms appealing are left confused among which service to choose by budget constraints.

Netflix cut the path of unlicensed downloading in a way by providing a low budget model of subscriptions. But by re-modelling subscription fees multiple times over, the platform has started to hemorrhage subscribers and traffic. Whereas, some of the other platforms already have an ad-sponsored model, they lack the competitive advantage due to exploitation of the data of its huge subscription base.

A very small number of viewers in Pakistan are interested in shows streaming at Disney+, Hulu or HBO Max due to various reasons ranging from genre and brand appeal. But when the content you want to watch is location-blocked in your home country, piracy goes beyond an appealing solution to virtually the only one. If you can’t figure out a way to legally to watch certain content, it is inevitable that you go around some other way to watch it. BitTorrent is the most famous way to do just that.

As torrent use and piracy gain traction, and a segment of viewers gets increasingly used to free content, the bigger challenge for streaming platforms would be to revert them back to paying a subscription fee. By having multiple choices on their disposal and some of them where you don’t pay anything, if people start accessing P2P sites again to access their favorite season, shows, and movies, then online streaming services providers are the only one to blame themselves in the decline.

To curb the threat of piracy, recently two anti-piracy changes came from the Google and Netflix. Google was successful recently to force the closure of the famous piracy tool YouTube Vanced. YouTube Vanced used to provide multiple features which one could get through YouTube Premium subscription. On the other hand, Netflix is testing a monthly fee model for its users who share their accounts with others. Sharing accounts with others also falls under piracy. Netflix is hopeful that this step will help subscribers to revoke back on sharing their passwords and accounts with others, which eventually can push users eventually to start their own paid subscription plans.

Only problem is that these steps don’t benefit the end user at all. The deterrence measures against piracy don’t work as effectively as giving users easy access to reasonable lower priced quality content. This is a straight carrot instead of stick approach.

Where are Netflix subscribers going?

Netflix is the most popular streaming platform in the Sub-continent and Pakistan especially. Netflix saw a significant boom on the screens of the Pakistani elite screens after the launch of the Nawazuddin Siddiqui starrer “Sacred Games” based on the Vikram Chandra book. Netflix runs on a pay-watch method but most of the screens in Pakistan are shared.

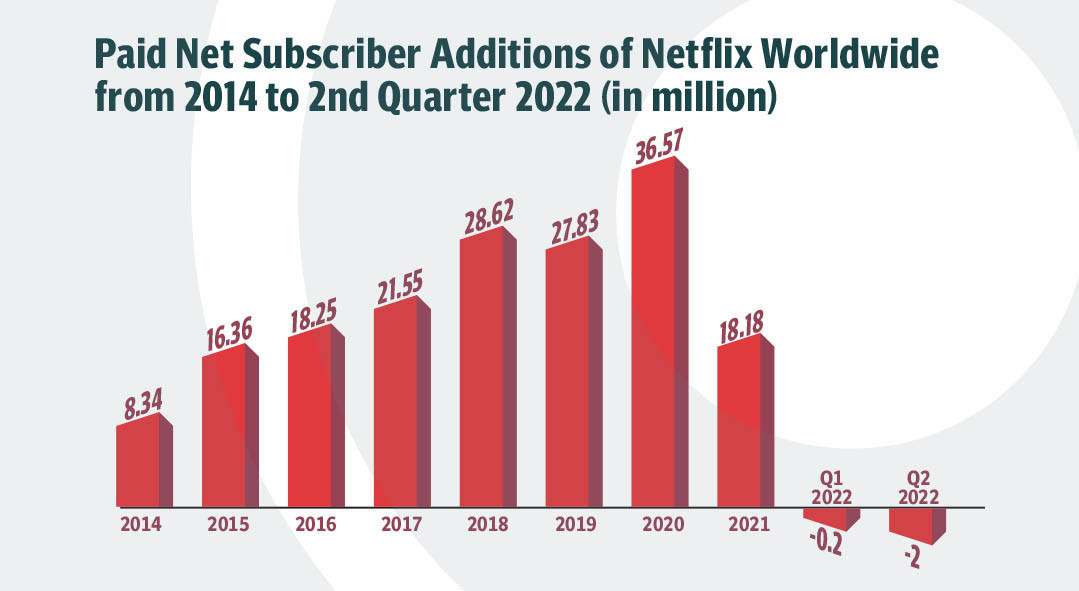

But after ten years of uninterrupted rapid expansion, Netflix's empire is shrinking, indicating that competitive rivalry in the streaming space is heating up. Netflix has dropped its long-standing resistance to a moderate ad-supported subscription layer after getting pummeled from shareholders following the disclosure that it ended up losing 200,000 subscribers in the first quarter, the first downward revision in a decade. Bringing the total number of people to 221.6 million. It is expected that another 2 million will be lost in the following year. The news caused a 20% drop in the price of the company's stock.

Netflix is the most famous streaming platform in Pakistan followed by Amazon Prime. There are other platforms which are serious threats to Netflix but not in the case of Pakistan. If you want to watch a show on HBO Max or on Hulu in Pakistan, you can’t. These streaming services do not provide services in Pakistan, forcing you to buy a VPN and then watch, effectively doubling your monthly fee. Left alone paying remotely for Netflix, most of the viewers do not take that route.

Inflation is forcing households to reevaluate their disposable incomes. The Trade Desk’s latest research results demonstrate that in UK, £20 is the most households will recognize spending on subscription services. Compounding the problem is a steady increase in production costs, which threatens to render Netflix's current business model unsustainable. By converting £20 into PKR, and taking into account Pakistan’s economic fragile condition, a very minute chunk of society will be willing to pay around roughly Rs4,500 to subscribe. Amazon raised the price of a Prime membership recently. The price of Hulu with Live TV went up in 2021, even though it does come with Disney+and ESPN+ incorporated now. Spotify also increased subscription costs in 2021 as well.

The ad sponsored model of Hulu and Disney+

These platforms have a very successful ad sponsored model. The subscriber is given options to choose a payment model of his/her compatibility. If the subscriber does not choose the premium model, the platform shows ads in between the show after a certain portion of watch time. The enforced part is that the viewer cannot skip the ads and as the show or episode of a season comes to its end, the length of the ads shown increases. Disney has long provided an ad-supported component on almost all of its amenities, including the Asia-focused Hotstar. The company announced earlier this month that it plans to initiate an ad-supported Disney+ platform in the United States subsequently this year.

According to extensive Kantar survey earlier this month, in UK alone, in order to save money, 215,000 fewer households paid for at least one subscription model in the first quarter of this year compared to the previous quarter. Fifty-eight percent of households (16.9 million homes) had access to at least one paid subscription model in the first quarter, a sharp decline from the previous three months. Cost-conscious consumers canceled 1.51 million streaming video-on-demand (SVOD) services during the quarter, a significant increase from the previous quarter's cancellations of 1.04 million.

In Pakistan, Amazon Prime opened the gate by attracting more subscribers purely based on the fact that they are cheap and they connect with local micro-finance sector, i.e Easy Paisa to subscribe by laying claim to a share of around 27%. Following Amazon Prime in the line is surprisingly Disney+, which still cannot be accessed in the country without a VPN. Thanks to local package providers, Disney+ has a market share of around 14%. This claim is yet to be confirmed based on the fact that Disney+ traffic comes diverted via a changed IP location. The streaming king of screens; Netflix falls on the third spot with a share falling back into single digit at 9.4%. The simple reason behind subscribers bidding farewell to Netflix is their continuous increase in the subscription plans.

But the question is why Netflix is too reluctant about sticking to its existing model? It is not able to cover its expenses, and resultantly choosing to increase subscription fees. Its subscribers, in turn, are leaving the platform to other options available online. Netflix rejected straight away a lower fee ad-funded model for the platform. This synthesis can be seen as a success in the shape of Spotify ‘Freemium’ model.

Netflix competition in Pakistan

Netflix does have a cutting edge against other online streaming platforms like Hulu, HBO Max or Disney + Hotstar due to content blockage and area-wise blockage. But the platform, while seeing a splurge in its subscribers, has prominent competitors, at least in Pakistan, such as Iflix, Starz Play and main television channels. According to disclosed data, Netflix, the largest streaming service operating in Pakistan is on route to garner Rs1.2 billion ($7.1 million) in cash flow from the country this year, its sixth year in operation. That may seem small in comparison to Netflix’s global market, but just one local television network can generate as much as Rs4 billion by showing local TV dramas which a wider audience relates to.

Iflix, one of the other contenders of Netflix, is headquartered in Kuala Lampur. Iflix made a name for itself when it first launched due to the lower subscription cost and the content library, which included prevalent Pakistani TV television shows and films as well as global offerings. The platform was also well-known for its wide range of children's content, and it quickly established itself as a family service.

Starz Play, which is more popular in the Middle East and North Africa (MENA) region, is another streaming on demand service closer to home and competitor of Netflix in Pakistan. It was developed in the Middle East but brought to Pakistan through a partnership with Cinepax. It allows subscribers to stream Hollywood movies, TV shows, documentaries, and children's content, as well as watch series as they are released in the United States. Arabic, Bollywood, and Pakistani substance are also available on the platform.

On one hand, Netflix is losing its subscribers but on the contrary, other local minor players are seeing a boost in the subscriptions. Meaning, most of the people are actually not routing towards piracy.

“We at STARZPLAY currently have a 1 Million+ active subscriber base on our platform and have seen a massive 400% increase in playtime consumption after covid-19,” said Hassan Javed, Marketing Head STARZPLAY by Cinepax. “The demand for local original productions skyrocket, and we have also launched our own original productions namely ‘Karachi Division’ starring Shamoon Abbassi, ‘Mumkin’ starring Faysal Quraishi and more.”

The primary reason behind Netflix losing subscribers are payment gateways. Credit Card penetration in Pakistan remains remarkably low with less than 1% of customers using credit/debit cards. Pakistanis are still reluctant with their credit/debit card information sharing. Mobile payment options remain the number one option in the country. Even if someone is willing to pay, there are no local payment gateways to pay and of course PayPal doesn’t work in Pakistan. The reason behind growing subscriptions of Amazon Prime and STARZPLAY is the fact that they have partnered with telecom providers operating in the country. Netflix lost this trick.

“We have daily, weekly, and monthly Mobile price plans for as low as Rs.8/day enabling millions to potentially subscribe and stream our service,” said Javed.

According to the PTA, Pakistan has 167 million cellular subscribers and 83 million broadband subscriber base in 2019-2020. This can be a right penetration for Netflix to add another payment method to its gateway to attract potential and left subscribers back.

A potential ad-advertising strategy

Netflix has a reputation for taking bold creative risks, however, when it comes to advertising, it may need to exercise caution. For years, the company has blazed its own tracks in the domain of broadcasting. However, if it chooses to sell advertisements, it will compete with competitors with decades-long links to large ad spendthrifts such as Unilever, Procter & Gamble, J&J, Sanofi and more. To be more transparent about their campaigns and ads, Netflix will have to come up with an open idea like Hulu.

Just because Netflix hasn’t forced its viewers to watch ads while streaming on its platform, it doesn’t mean that the provider hasn’t worked or ventured with brands before. Stranger Things, another big original hit for Netflix was liked and talked by many. There was a long list of brands that partnered and created ads and products based on the hit show released in 2019. There may not have been open advertisements during the stream but there were plenty of ads goofing around it. Burger King, Levi’s, BR are prominent marketers to hop on the Stranger Things bus which is about to return with another season on the platform. Similarly, Netflix partnered with Ben and Jerry back in 2020 when B&J launched a limited ice cream flavor called Punchline to promote the Netflix comedy “Netflix is a Joke”.

Netflix will not be the first in the list to embrace the fact of having a low cost ad supported model of subscription worldwide, but it certainly will also not be the last. In Pakistan, Netflix has been successful in catching eyeballs but what was the competition? Almost none. Now that local players are in the business and seeing a major increase in their revenue and number of subscribers, it’s time that Netflix thinks seriously about how to catch and attract back the Pakistani market that has 167 million cellular subscribers and 83 million broadband subscribers. These numbers are realistic and always going to increase.

Netflix needs to come up with a locally produced content. Another trick Netflix can use is to partner with local cellular/SIM service providers or micro-financing sources like Jazz Cash and Easy Paisa to make subscribing easier. In terms of media advertising, people who watch Hulu or other service providers have no to minor interest in the ads based on the fact that those ads are mostly aimed at US clientele.

To break into the Pakistani market as the leveraged and biggest player, Netflix needs to do four things. Bring in a local payment gateway model, decrease subscription plans to match or compete with local players and other competitors, add locally produced content on its platform and partner with a local media advertising agency for its ad subscription model.

The real question is not whether Netflix is planning to launch an ad-backed low cost subscription model in a year or two, but whether it can utilize this very time to think and strategize accordingly about how to innovate and target what viewers should experience in advertising based on each country. Give brands an area to push and extend to go an extra mile and at the same time, make money. In context of Pakistan, it is easily doable. And if Netflix is able to pull it off, it can be the King of Pakistan’s online streaming industry.