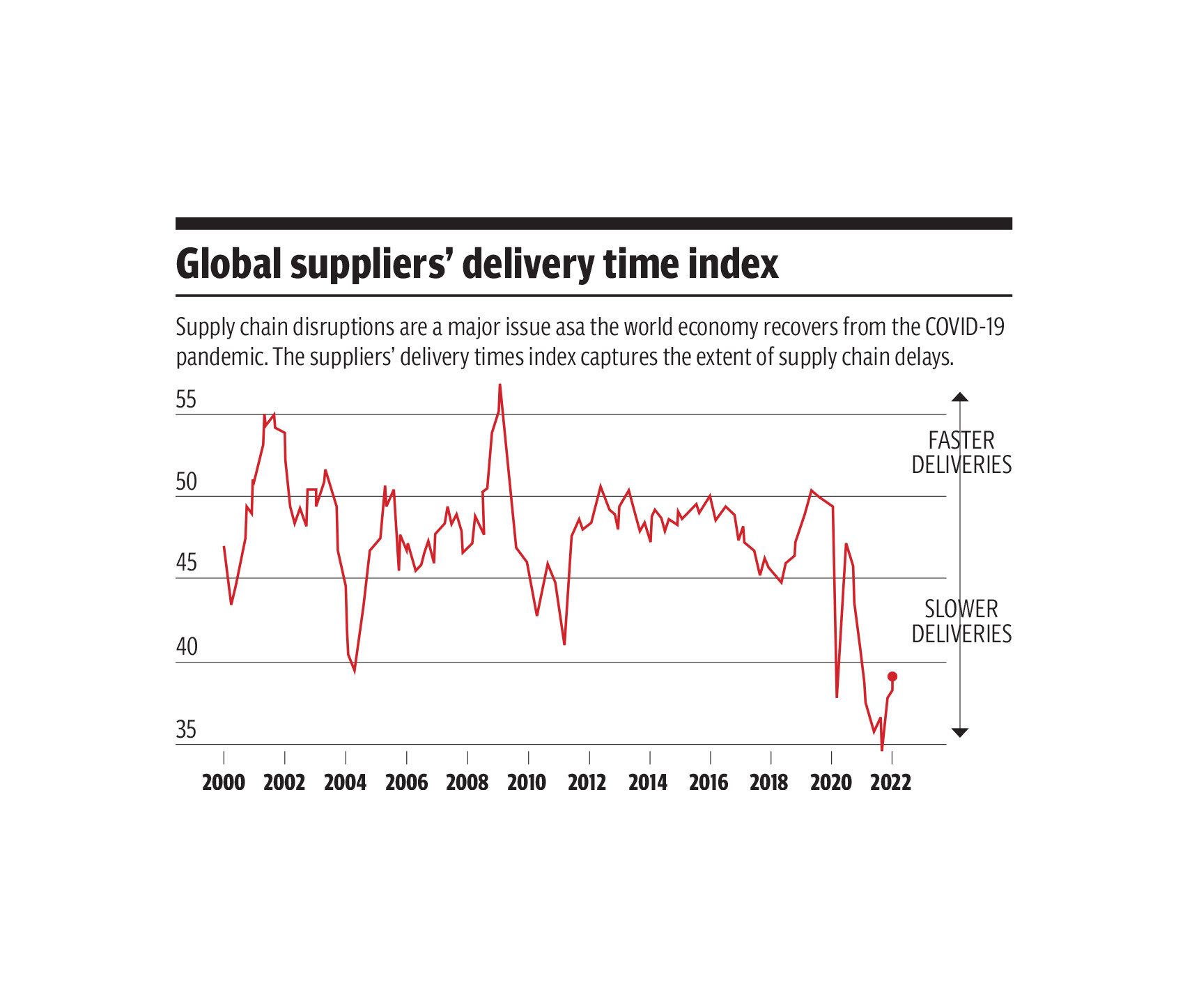

At the midpoint of last year, the world was rocked by an extraordinary economic catastrophe. Supply chain constraints emerged, initially due to the cascading impact of the novel coronavirus pandemic as closure of economies impacted the foreign trade and freight industry, driving up prices of commodities.

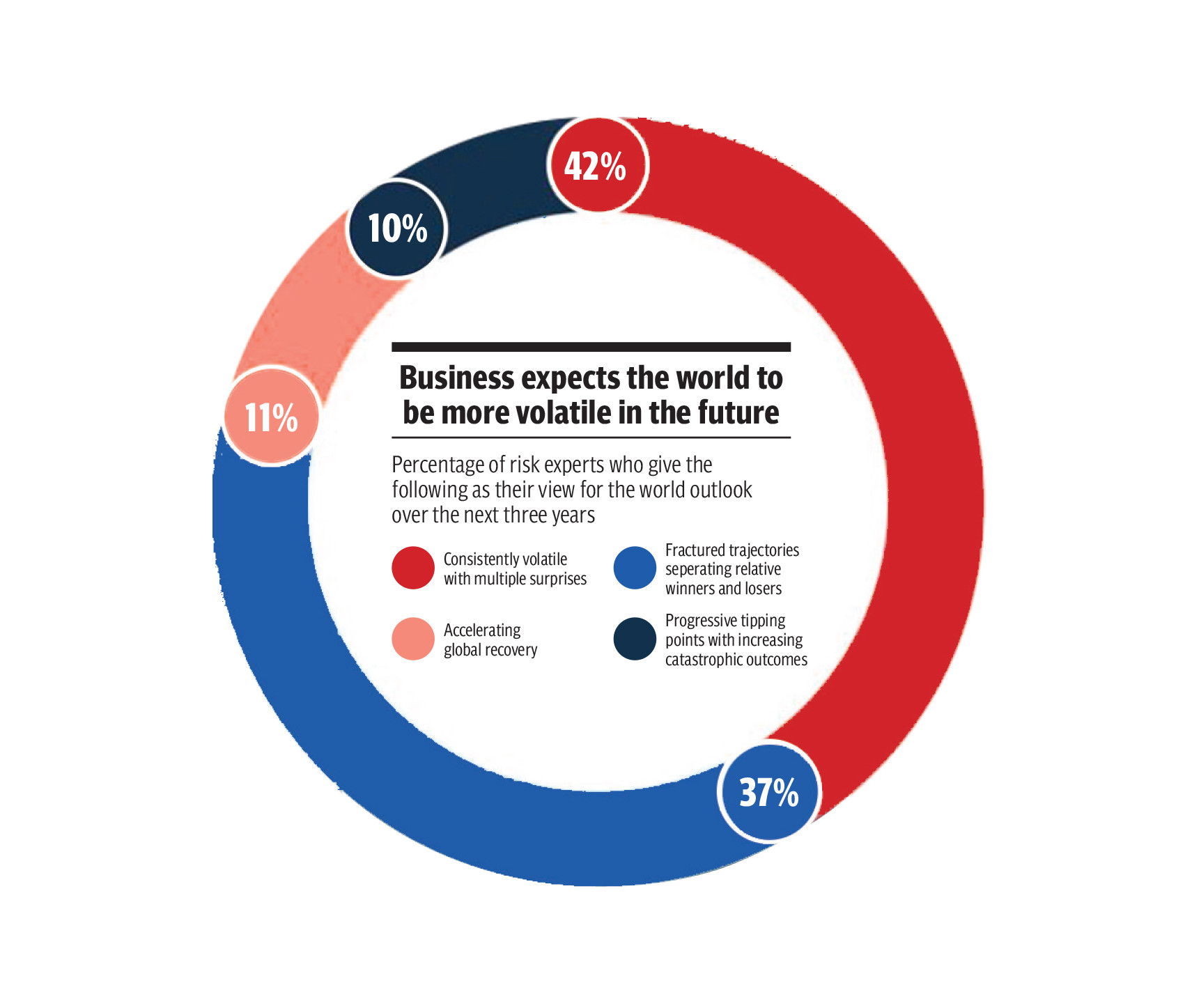

Still, experts had hoped the supply chain woes would by and large subside in the first few months of the current year. But enter the on-going Russia-Ukraine war and those hopes appear all but dashed.

Moscow’s move to invade neighbouring Ukraine had ripple effect on global trade and the recovering global economy. Concurrently, resurgence in Covid-19 cases in China has once again renewed lockdowns in the country and further exacerbated the challenge of the supply crunch.

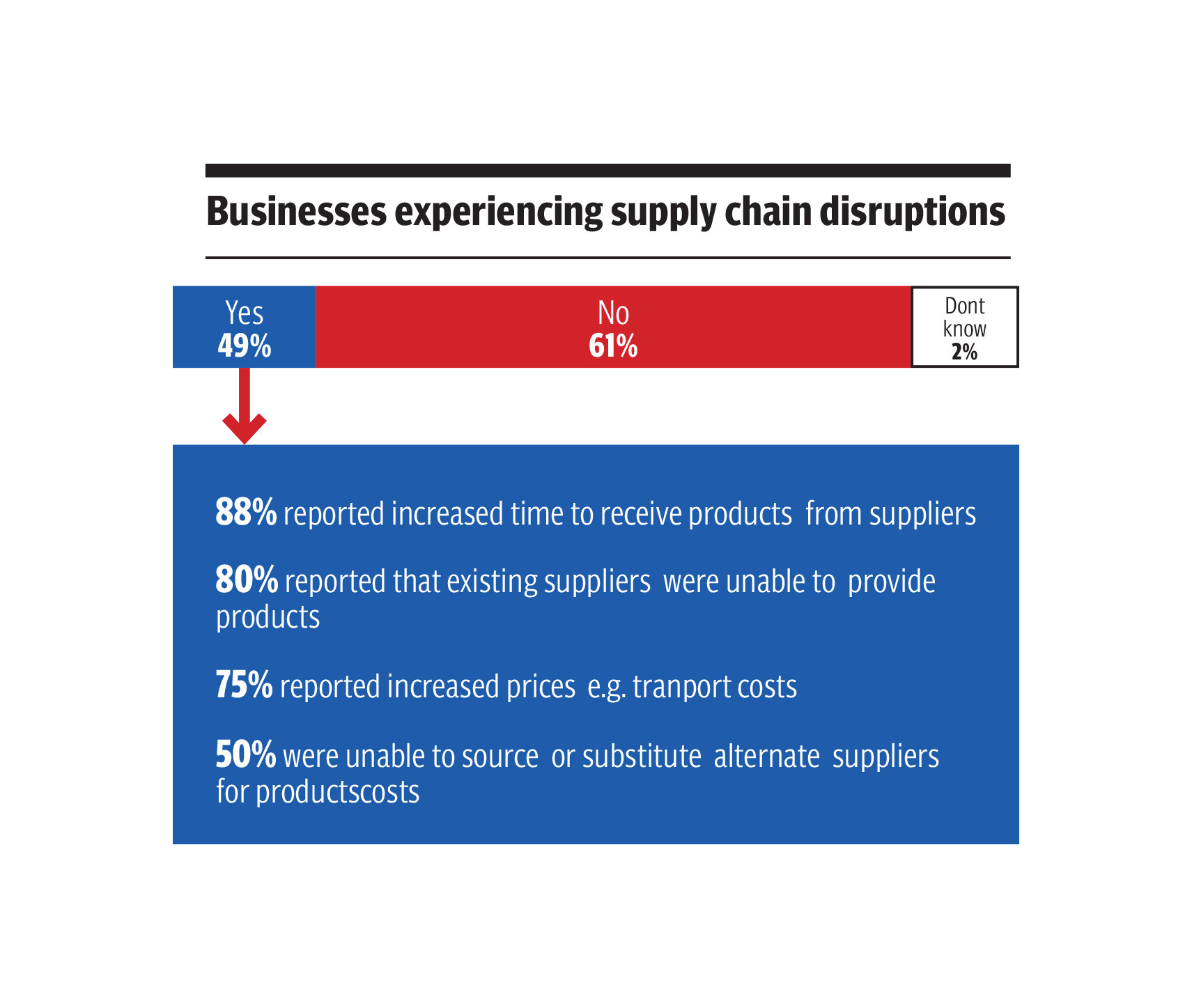

Speaking to The Express Tribune, retail market expert Habib Zaman stated that the supply chain crises emerged from a simple and straightforward issue to a multifaceted problem. “Nearly six months ago, the problem was easier to explain because it was emerging from rise in freight costs and supply backlog,” he said. “At the same time, the world was looking forward to resolution of the issue as soon as majority countries around the world lifted Covid-19 restrictions, a move that was expected in early January 2022.” Now, the problem has turned complicated because a lot more factors are at play.

Crisis in Ukraine, crisis round the world

Zaman highlighted that outbreak of war in Ukraine was the primary reason behind the escalation in supply chain disruption. Earlier, the issue stemmed from delays at the ports but this time around, the world is giving aid to Ukraine therefore the containers meant for trade, are being used to provide assistance to Ukraine.

“This is adversely affecting the global trade activities because it is clear that there is a shortage of available containers for goods exchange,” he added. “To recall, the world was already reeling from a container shortage and now, the supply chain is on brink of a complete disaster.”

The official added that during war times, countries run out of essential commodities hence Ukraine was facing shortage of medicines, food, fuel, oil and energy commodities. At present, global economies are support Kiev therefore they are sending these essential commodities and other items to it in huge volumes. “While Ukraine is benefiting in a sense from aid, the global trade is suffering so there is a trade-off to the help extended by foreign nations,” he said. “These containers are going to Kiev loaded with supplies and returning back empty which is raising the cost for shipping companies and the governments.”

He detailed that shipping companies were bound to facilitate movement of supplies to Ukraine however owing to the losses, they have hiked prices of their freight for trade to all other parts of the world. This is primarily why the supply chain crisis has escalated, he said adding that the cost of performing trade activities soared.

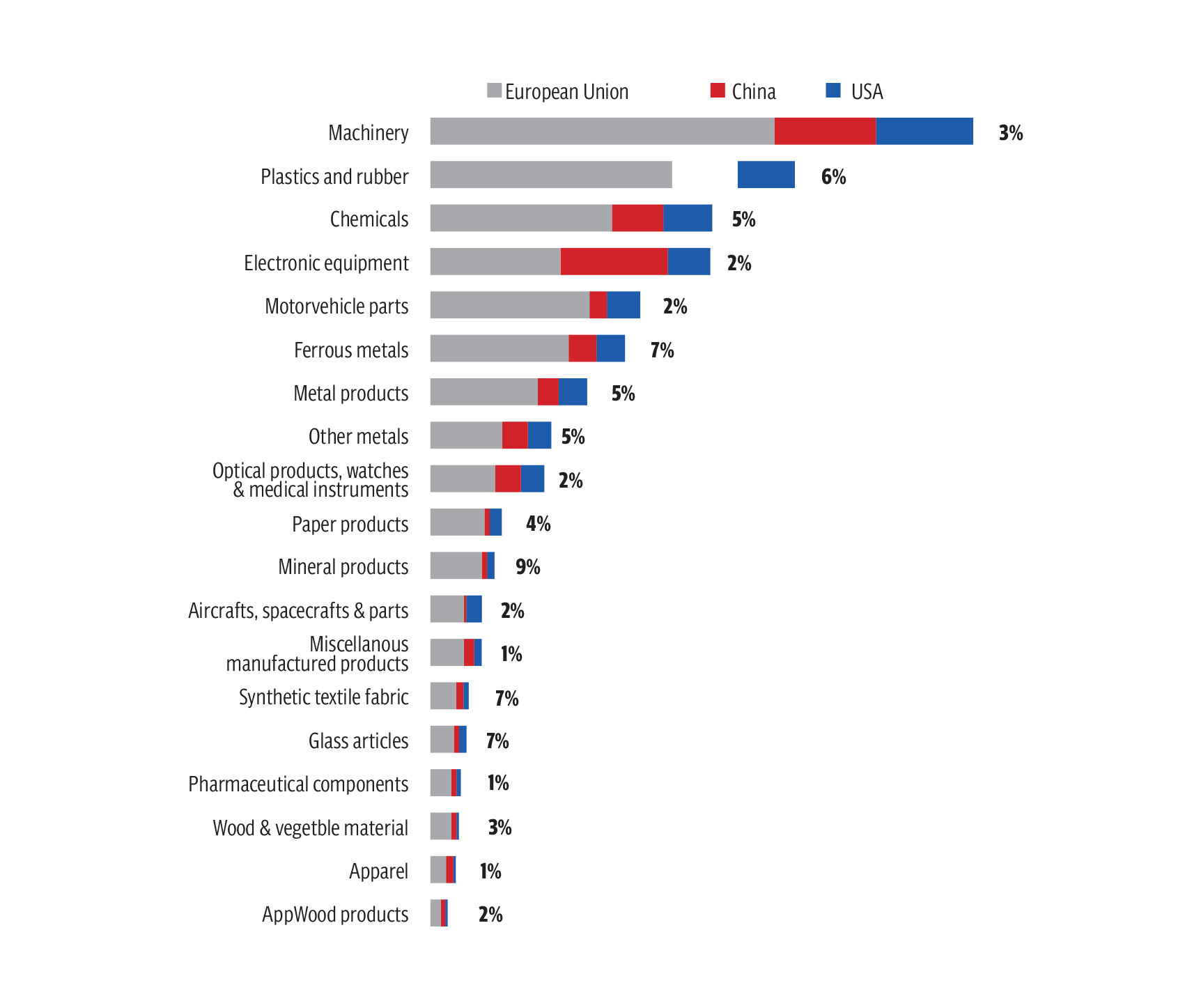

He explained that freight charges were hiked by 300-700% by some companies. Ukraine is a major exporter of steel, coal, fuel and petroleum products, chemicals, machinery and transport equipment and grains like barley, corn and wheat and the outbreak of war made the authorities suspend trade of these commodities.

Food items make up a massive chunk of Ukrainian exports and following complete suspension of trade of those commodities, food prices are sure to skyrocket in all wheat, corn and barley importing countries and a scarcity is on the cards as well.

Similarly, coal price spiked to historic levels a few days ago and part of the reason behind the increase was disruption in energy trade to and from Ukraine.

The out of European companies was already suffering due to the coronavirus pandemic as the conflict in Ukraine led to growing shortages of key components.

The new snags pose a further threat to economic recovery in Europe, potentially prolonging existing bottlenecks that in some sectors were not expected to clear until next year. Asia-Europe routes have been worst hit by issues including acute port congestion and cargo disruption due to the closure of Russian airspace, a JPMorgan analysis showed.

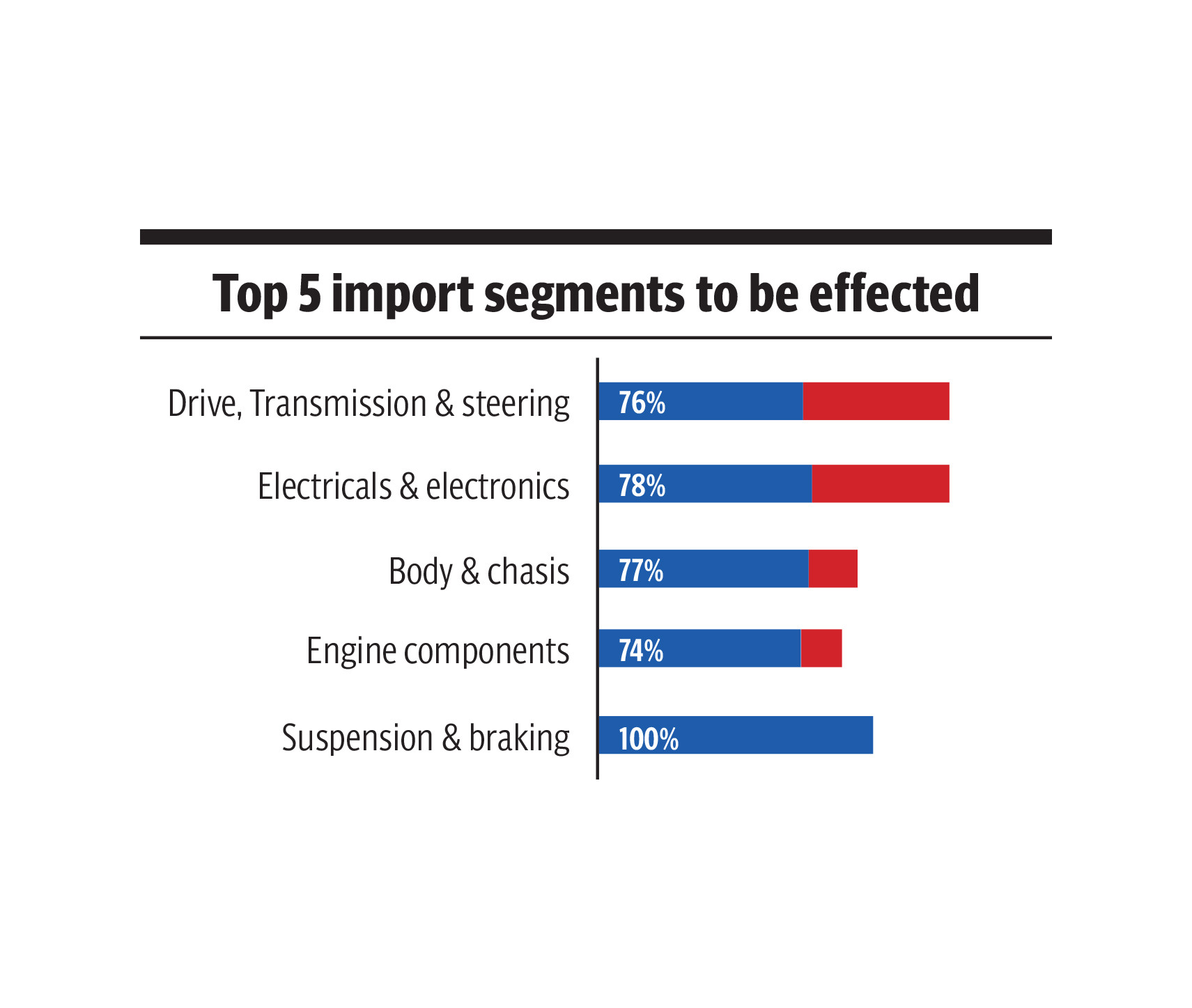

The conflict's impact on shipping, rail and air freight has been compounding problems in the European auto supply chain at a time when inventory levels were already low and carmakers were still reeling from a chip shortage and soaring energy prices. As well as high-grade nickel, the price of metals used in car production, from aluminium in bodywork to palladium in catalytic converters, has also soared since the invasion.

Taking Russia off the trade grid

On the flip side, the West acted to isolate Russia as soon as it began its military intervention in neighbouring Ukraine and resultantly, a huge proporation of Russian trade endured a massive dent. Last month, US President Joe Biden hit Russia with a wave of sanctions that impeded its ability to do business in major currencies along with sanctions against banks and state-owned enterprises.

Prime Minister Boris Johnson also unveiled Britain's largest-ever package of sanctions against Russia, targeting banks, members of President Vladimir Putin's closest circle and wealthy Russians.

European Union leaders also agreed to impose economic sanctions on Russia.

However, the bloc held back from taking the harshest measures sought by Ukraine and split over just how far to take the sanctions, leaving details to be worked out in the coming days.

The EU threatened freeze Russian assets in the bloc and halt its banks' access to European financial markets. The sanctions also target Russia's energy and transport sectors among others, and seek to stifle its trade and manufacturing with export controls. It is pertinent to mention that Russia is leading player in global energy trade and a prominent member of the OPEC+.

“The isolation of Moscow by the world is gravely impacting the global economy,” Zaman said. “Let us break down its effect on the supply chain step by step.”

First of all, it gave dent to Russia in terms of revenue. Russia had planned to fuel the war through petrodollars and they have stopped. This has led Moscow to implement the currency swap strategy and demand payment of its energy commodities in roubles. If the deal does not go forward, Russia would soon approach the brink of bankruptcy.

Secondly, European nations were major consumers of Russian oil and energy commodities and they resorted to suspend trade with Russia. This sent the fuel price in the respective economies soaring and they rushed to secure alternate fuel. Therefore, the initial brunt of the supply chain crisis was borne by European economies, the analyst said. “Now that the world has moved to halt trade with Russia and given the economic sanctions on it, a major volume of global trade has vanished and this is exacerbating the problem,” he said.

If a huge volume of global trade of essential commodities disappears, the remaining volume faces price hikes and that is what was being witnessed.

Prices of general items have risen all over the world and food inflation is skyrocketing. Both Ukraine and Russia occupy immense space in global trading arena and with war underway, the world is bearing grave consequences.

Since the invasion began, western allies have frozen Russia's central bank's foreign currency assets, banned key Russian banks and wealthy elites from hard currency transactions and put restrictions on exports of advanced semiconductors and other technology.

Covid spikes in China

Just when the global economy braced itself for the impact of war, rise in Covid-19 cases in China forced the government to impose fresh lockdown measures. Some of the toughest measures have been applied in the key manufacturing hubs of Shenzhen, Dongguan and Changchun, as well as the Chinese financial centre of Shanghai, which is home to the world's busiest container port.

“Shipping activity is nearly suspended and merchandise just keeps on piling on the port and warehouses which is expanding the supply chain crisis,” Zaman said. “Now, factories have stopped production due to lockdowns and once the backlog of material at the ports ends, the supply chain problem will take a grave turn.” To gauge the fallout of the problem, it is important to realise that trade of two economic giants (China and Russia) has nosedived and one prominent player (Ukraine) is not exchanging major items anymore.

Impact on Pakistan

The rebound witnessed in the supply chain problem is having spill over impacts on Pakistan as well primarily in the shape of imported inflation, input shortages and slowdown in economic activity. Khalilur Rehman, a researcher from Pakistan, said that the uptick being witnessed in the country’s inflation was the direct effect of supply chain disruption.

“There is a global container shortage underway and whatever containers are available, are priced at exorbitant levels so traders are left with two options i.e. either book containers at those prices and hike costs of final product or stop doing business. The second option is obviously not viable so traders are forced to hike prices,” he said.

Presenting sector-by-sector breakdown, he added that the initial impact was borne by the automobile sector. For a long time, the car manufactures absorbed the impact but last week, several car companies hiked prices by lofty proportions citing the sharp increase in freight cost. Moreover, steel rates in Pakistan also spiked because the raw material has turned expensive for companies. Now, the food price inflation as well as food shortage seems imminent.

Alpha Beta Core CEO Khurram Schehzad stated that the direct impact of global supply chain disruption on the country was rampant inflation. “Food and energy prices are bearing the direct brunt of this problem in Pakistan and we have seen them spike over the past few days,” he said.

However, the lockdown in China has dragged the oil prices lower and it will bode well for Pakistan in the coming days. Talking about the political uncertainty, he added that whoever holds office, should keep this problem in mind and work towards a strategy to resolve this.

Arif Habib Commodities Managing Director and CEO Ahsan Mehanti stated that Pakistan was impacted by supply chain disruption over China lockdowns mainly through surge in freight cost that impacted viability of exports. Impact of Ukraine-Russia war is surge in global crude oil prices led rupee to depreciate and has also caused unprecedented surge in circular debt in the power sector. All this happened due to disruption in supply chain.

Researching the problem

A report from European Central Bank stated that strains in global supply chains of goods have been weighing on the global business cycle since late 2020. Supply chain bottlenecks stem from the interplay of several factors. First, the strong rebound in global demand for manufacturing goods, in part induced by the rotation of consumption away from services in the context of the pandemic-related containment measures, was not matched by an equal increase in the supply of goods.

Second, some sectors have been hit by severe supply shortages, particularly of semiconductors, with supply struggling to accommodate the surge in demand for electronic products and equipment, and in the automotive sector, which is gradually recovering after a sharp drop in output in 2020.

Finally, disruptions in the logistics industry – resulting primarily from container vessel activity, port congestion and strict lockdown measures in some key Asian countries that produce intermediate inputs – further exacerbated supply bottlenecks. “Given the multifaceted nature of supply bottlenecks, monitoring a relatively large set of indicators is useful for tracking their causes,” it said. “This can make it easier to identify any signs of improvement or deterioration in specific economic sectors at an earlier stage.”

In the case of ocean freight, a distinction needs to be made between the costs associated with containers and with dry bulk shipping. While dry bulk shipping is used for transporting commodities, container ships are commonly employed to transport intermediate and finished goods. Therefore, the cost of container shipping is more relevant for assessing the severity of current supply bottlenecks, since the constraints appear to have been mostly affecting intermediate and finished goods.

Recent data suggest that supply bottlenecks in the euro area and the United States remain at historically high levels. “In general, the situation remains difficult, particularly in the euro area. This was recently corroborated by our regular survey of contacts in the corporate sector, who indicated that supply issues have generally not eased over recent months and are expected to continue throughout 2022,” it said. In particular, supply constraints caused by disruptions to transportation and logistics are more pervasive and are likely to be more persistent in the absence of any softening of global demand.

A report from IMF said energy and commodity prices—including wheat and other grains—have surged, adding to inflationary pressures from supply chain disruptions and the rebound from the Covid 19 pandemic. Price shocks will have an impact worldwide, especially on poor households for whom food and fuel are a higher proportion of expenses. Countries that have very close economic links with Ukraine and Russia are at particular risk of scarcity and supply disruptions, it said.