While a lot of people argue that the on-going decade would spell the end for widespread utilisation of oil as a fuel in the world, recent global events, such as supply disruption, OPEC production cuts and the Ukraine-Russia war are painting an adverse picture. The past few days have been witness to wild swings in oil prices that have motivated countries to either resort to alternate means of fuel or place a cap on prices through subsidies.

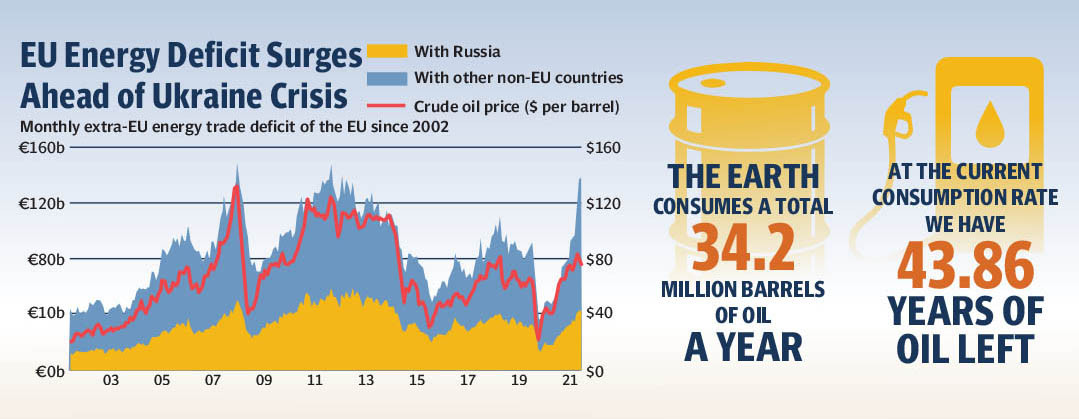

Crude oil price have surged close to $130 per barrel, materialising the fears of the market of surging past $100. This has wreaked havoc among the global economies and countries now expect the already mounting inflation to spike by a manifold. To gain an insight to the scenario, The Express Tribune reached out to stakeholders in the field to prominent stakeholders.

Move to electric

Kabir Qureshi, owner of an electric vehicle dealership in the US stated that orders for such cars soared following the oil price shock. “The ongoing season is considered slow for electric cars because people prefer to buy large oil operated vehicles to go on vacations in the summer season,” he said. “However, last month proved positive for our figures because the jump in bookings offset the seasonal slowdown.”

With the onset of the war, customers are rapidly safeguarding their positions for fuel needs. Given fears that the conflict can spiral into a full-fledged world war, the public knows that a fuel crisis would not end any time soon if that happens. Therefore, the customers are investing in non-oil solutions and this does not just pertain to cars but also for other commodities such as ships, electricity generation and air travelling.

Oil is a peculiar commodity that has a major impact on prices of all other products. Owing to the jump in crude prices, the global rates of steel, freight, nickel, gold and cement jumped rose as well. These commodities are not directly related to oil but still an uptrend was witnessed in their prices, he said.

He noted that consumers’ shift towards electric cars would spell doom for the electric vehicle segment at this moment because companies had not forecasted that.

“The initial impact of the pandemic was borne by the semiconductor industry as chips became harder to find,” he said. “In 2020 and 2021, electronic car manufacturers utilised stockpiles of chips however due to the trade restrictions due to the pandemic. The inventory has ended now and many industries are struggling to gather chips for production for next few months.”

According to him, chip was a vital component of electric cars because it powered the entire structure. A whole car without the chip is basically useless, he said.

Last year, Renesas, which commands nearly a third of the global market share for microcontroller chips used in cars, said that 23 of its machines were damaged in a fire and it took nearly six months to recoup the losses.

Electric car companies are struggling to arrange the semiconductors since April 2021, he said. “Due to chip shortage, the production number of electric cars have already dropped drastically and whatever cars are available in the market are priced at exorbitant levels,” he said. “At such a time, rise in their demand would not only hike their cost by a manifold but also increase the delivery times because production is constrained.”

Another problem is their production, which is still far from pre-pandemic levels, he said adding that owing to hike in prices of global raw material and shortage of semiconductors, the output at production facilities had endured a massive dent.

“Even at our dealership, the supply numbers are slim now and with the war like situation building up, there seems to be no end in sight for the problem,” he said. “At the beginning of 2022, we wishfully projected car production to restore to pre-pandemic levels by June 2022 however owing to the outbreak of Covid-19 Omicron variant coupled with Russian invasion of Ukraine, this seems impossible now.”

According to his forecast, electric automobile output would take many years to restore to original levels in case of global scale war because all the resources would be implemented to produce defence weaponry. This means that all industries, that are not related to defence, will have to face rationing of raw material and cut production as a result.

Finally, there are some minor problems as well such a lack of electric charging stations. He admitted that electric vehicle charging stations were a rare sight in third world nations however, there was a shortage or complete absence of them in few small cities of US as well.

Moreover, with oil phasing out rapidly, the demand of electricity for charging of automobiles is rising rapidly and power producers are unable to maintain pace with their supply. “Enhancing the production capacity of electricity for charging stations is an arduous process and can take eight months to one year even when all resources are employed,” he pointed out. “Hence it will take nearly a year to meet the increase in demand for electricity to charge electric cars.”

Now comes the cost part. Due to oil crunch, the price of gasoline is skyrocketing in European and US economies. European Union giants such as Germany fulfil 40% of their oil needs from Russia. With the sanctions imposed by the western economies, an oil crisis in inevitable and now the same economies that pledged to end production of energy through nuclear means, are delaying their plans of denuclearisation.

Kicking the fuel addiction

An energy expert based in the European Union told The Express Tribune that the European nations were phasing out oil use due to sanctions and Russia’s invasion of Ukraine. “They have decided that they do not want to continue doing business with Russia but this comes at a cost,” he said. “The nations that had pledged to stop using nuclear power to generate electricity are now back to using it.”

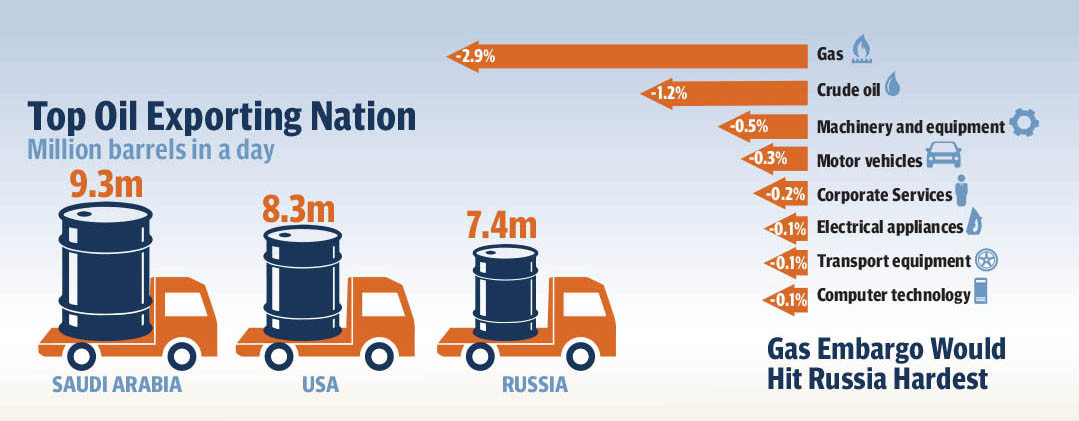

While this is expected to dent Russia’s revenue, it is also expected to send the nations running to find alternate fuel. This has led the countries to shift to alternate fuel in the short run i.e. liquefied natural gas. However, on the flip side, it has lifted LNG prices by a manifold.

Europe’s fuel demand comprised oil, most of which came from Russia and Asia’s fuel demand comprised mainly of LNG. Now, global LNG demand growth was shifting from Asia to Europe due to Russia sanctions, he said. High spot prices in LNG market since late last year have already slowed trade and they are likely to crimp demand growth of the fuel in Asia - the largest consuming region - even as some countries see widening gas supply deficits as domestic production falls.

This comes just as new LNG buyers in Asia, the Philippines and Vietnam, are set to enter the market later this year.

"The LNG market has been evolving in an unfavourable manner for buyers as the supplies are forecast to be tight during the 2021-2025 period while demand is picking up after the pandemic," said Vietnamese state firm PV Gas, which is set to trial the country's first liquefied natural gas (LNG) terminal in the fourth quarter.

"This will lead to a strong price rising trend over the next years with no signs of easing in the short term."

In contrast, European LNG demand is expected to spike up by at least 20% in 2022, reflecting reduced Russian pipeline flows and the need to replenish depleted European gas storage levels, the analyst said. Natural gas and power prices hit all-time highs in Europe as the European Union rolled out plans to cut EU dependency on Russian gas by two-thirds this year, and end its reliance on Russian supplies of the fuel "well before 2030". Europe, which relies on Russia for 45% of gas supplies, could demand more US LNG. “Now, it is a war between Asian and European buyers because both want to score LNG cargoes at attractive rates. This is giving rise to speculation and both sides will need to pay premiums,” he said.

Dent to employment

The halting of Russian oil trade to European Union has also dented a lot of jobs. Ahmer Hussain, who works in a trading firm in Austria, stated that sanctions and suspension of energy trade with Russia had dampened the business of his firm and it was not considering the option of layoffs.

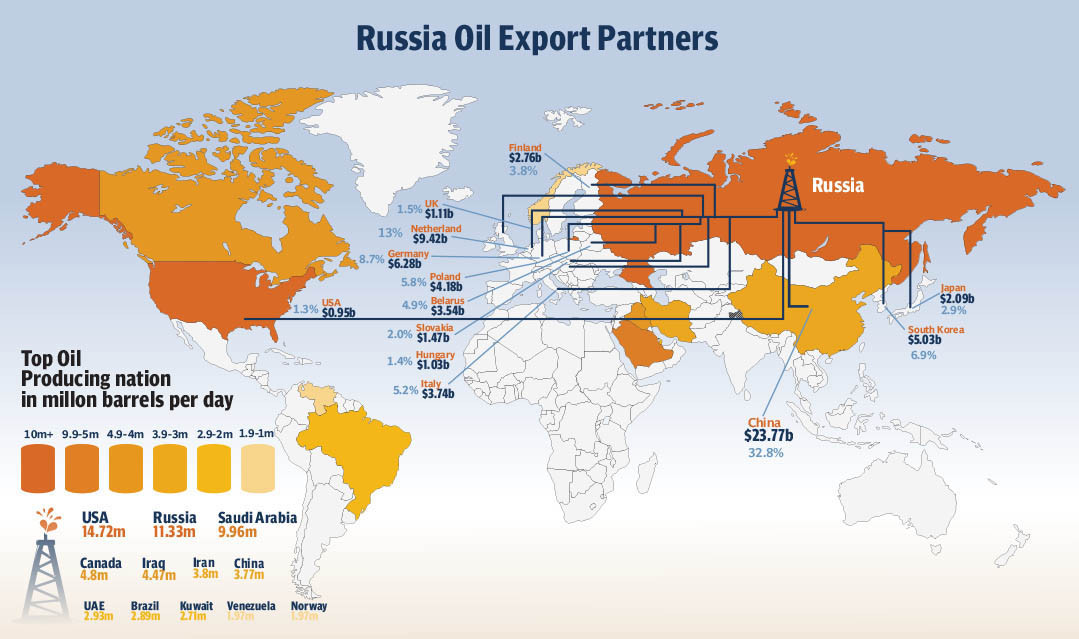

“Oil trading fuelled our business and now we are not able to make any money,” he said arguing that oil margins were far higher than any other commodity. “From the rumours that we are hearing, Russian oil firms are also going out of business. This is precisely why Russia is looking to ink oil supply deals with India.”

India, which imports 80% of its oil needs, usually buys only about 2-3% from Russia. But with oil prices up 40% so far this year, the government is looking at increasing this if it can help reduce its rising energy bill.

Impact on importing nations

Earlier this month, World Bank Vice President for Equitable Growth Indermit Gill stated that persistently high oil prices prompted by Russia's invasion of Ukraine could cut a full percentage point off the growth off large oil-importing developing economies like China, Indonesia, South Africa and Turkey. He added the war will deal further setbacks to growth for emerging markets already lagging in recovery from the Covid-19 pandemic and struggling with a range of uncertainties from debt to inflation.

"The war has aggravated those uncertainties in ways that will reverberate across the world, harming the most vulnerable people in the most fragile places," Gill said. "It is too soon to tell the degree to which the conflict will alter the global economic outlook."

Some countries in the Middle East, Central Asia, Africa and Europe are heavily reliant on Russia and Ukraine for food, as the countries together make up more than 20% of global wheat exports.

Ripples in Pakistan

Pakistan was already reeling from soaring inflation owing to spike in global commodity prices and shortage of output of local agriculture products such as cotton and wheat. Given the spike in international oil prices at such a time, the market had expected petroleum price to soar past Rs200 per litre.

However, the government of Pakistan made a surprise announcement at the beginning of the ongoing month and slashed oil and electricity prices at froze them at those levels till the budget announcement of fiscal year 2022-23. Although this provided the much-needed relief to the common man, analysts have termed it a political move.

Speaking to The Express Tribune, Alpha Beta Core CEO Khurram Schehzad stated that $15 per barrel increase in oil prices can lift Pakistan’s import bill by Rs1 billion. The subsidy given by the government will have two fold impact. First, it will widen the price different which the government has to pay from his own revenue and second, oil marketing companies would be unable to make money hence their import volume will drop drastically.

This will impact power generation of Pakistan as well which is dependent on oil.

Arif Habib Commodities CEO and Managing Director Ahsan Mehanti said that Pakistan’s oil import bill is expected to surge to $20 billion given the recent hike in oil prices and the prevailing rates. Owing to Russia-Ukraine war, oil is expected to reach $150 per barrel while few segments expect it to hit $200 as well. Russia itself has projected oil price to soar past $300 per barrel. “These fluctuations will lift the import bill and as a result, rupee will depreciate,” he said. “Owing to the prevailing uncertainty, current account deficit is expected to rise to unsustainable levels.”

He added that on the flip side, exports will fall because of cost of production of exportable merchandise is rising day after day. Take the example of cement, clinker prices rose along with oil and cement prices registered a surge. Resultantly, cement exports of Pakistan nosedived.