Amid Inflation via careless fiat pumping, could an asset backed currency save us? Gone are the times when a family could survive on a single paycheck. It appears as if things are getting out of hand, but only one in a million people understand why. The long-running dispute between fiat and commodities is over, as the system that is ultimately accountable for the majority of today's inequalities hides a legitimised theft that is the basic foundation of financial institutions in the modern world.

Which begs the question, is the modern banking system producing money and trapping the working class in a never-ending cycle of debt? Modern-day currency has replaced gold and silver as the main mode of trade. While the value of paper money depends on supply and demand and trust of governments. This results in dependency on fiat money altogether and ignoring the commodity money. The focus is on the central bank, whether it has been too aggressive in raising the money supply or if interest rates have been fluctuated too low. What impact it will leave on inflation if this scenario reverses? And the truth is far worse than that, as researchers claim that the unregulated money cycle is a danger to the economy.

Over the period 1980 to 2020, data from the SBP on the money supply shows a considerable increase in M2. There is a noticeable increase in broad-based money supply M2 in the monetary data. Shockingly, the rise in money supply in 2020 exceeds statistically interpretable for the past one and a half centuries.

Pakistan has a double-digit inflation rate of 10 percent, compared to the desired 2 to 3 percent, as the data from the SBP depicts a drastic view on the inflation rate over the period of 40 years. The country's economy was still suffering from the 2009 financial crisis. GDP took a leap during that period, but it has since tripled and appears to be on the rise. Although export services currently generate most of Pakistan's GDP, the country's trade imbalance and national debt continue to grow.

Looking back over the past 20 years, the KIBOR rate has been steadily decreasing, the economy was booming but inflation was increasing. As a result, the general public has more money at their disposal. The purchasing power is determined by the amount of money in circulation and not in hand. SBP shows an increase in fiat money over the period of 1980 and 2020. Total reserves including gold and current US dollars of Pakistan in 1980 were $1.56 billion, which reached $18.52 billion in 2020. While total reserves minus gold (current US$) were $4 billion which rose to $14.59 billion. This indicates that the rise of fiat money is booming day by day resulting in the depreciation of money/commodity.

The GDP rate was sputtering during this period from 2000 to 2020, which pointed to these factors. Severe inflation has frequently been the fourth warhorse of an economic catastrophe, with stagnation and financial instability throughout history.

The ongoing race between debt and inflation, highlight that the country’s money supply can be raised in several ways besides simply printing more. Bank reserve ratios plus interest rates could be changed to suit the scenario. Reduced interest rates are likely to stimulate demand for borrowing, and banks will have more money to lend as a result. This would increase government spending and demand for products in Pakistan, causing inflation.

A run like this would lead to financial turmoil and a new recession. Some economists hope for an inflation-fueled boomlet, which would result in economic stagnation. And the Federal Reserve would be powerless to intervene.

A run like this would lead to financial turmoil and a new recession. Some economists hope for an inflation-fueled boomlet, which would result in economic stagnation. And the Federal Reserve would be powerless to intervene.

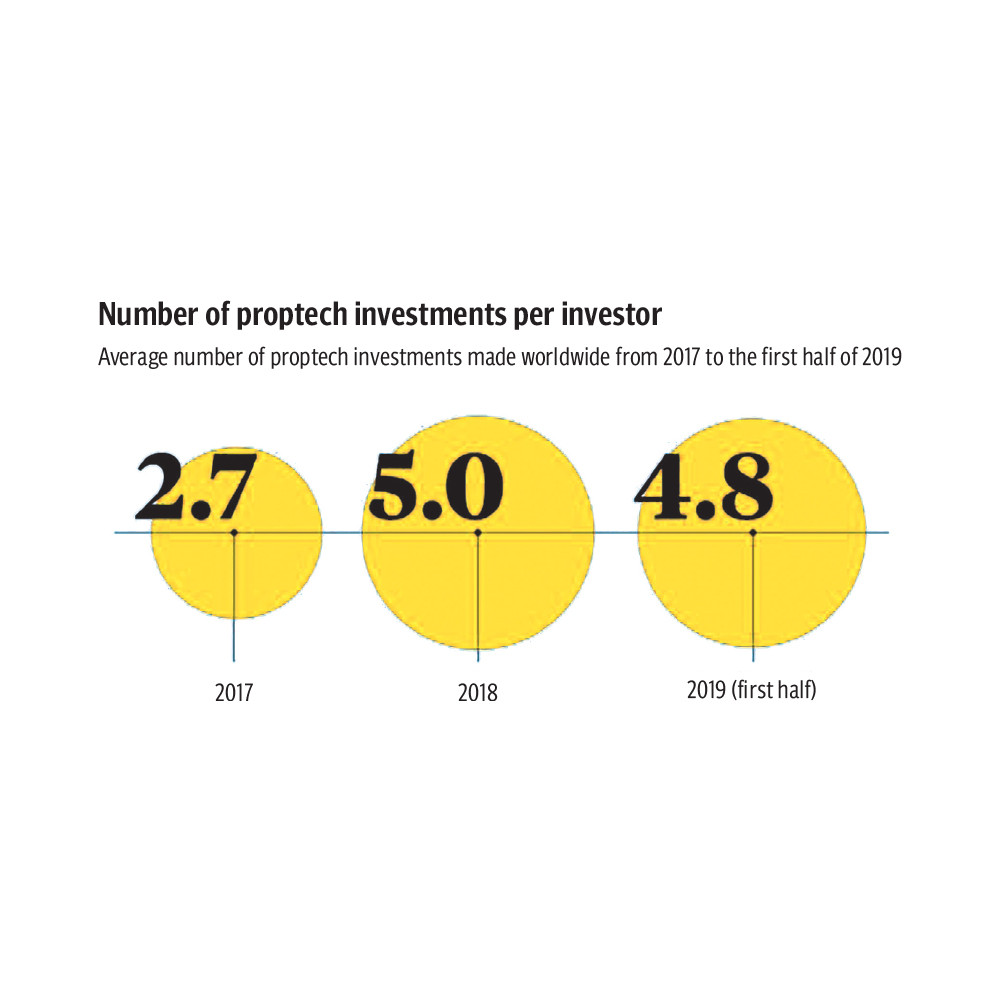

Real estate isn't known as an industry which promptly embraces change. The idea of the asset class, which contains enormous heterogeneous resources exchanged a generally private market, is maybe a valid justification for this. By and by, in present circumstances we are seeing a fight for portion of the overall industry between conventional advisors and a detectable second rush of innovation based innovation. The principal wave (PropTech 1.0) occurred in the US, UK and somewhere else during the 1980s. This was all to do with information and figuring power. The creation of registering during the 1930s and 1940s and the resulting 40 years of advancement made nearly nothing or no effect on property markets.

The development of private asset with various styles, obligation and asset supported securitisation, the appearance of REITs, the development of a subsidiaries market improved benefits and requested a considerably more quantitative and research centered way to deal with execution estimation and venture technique. The quick globalisation of the real estate as far as financial backers, wellsprings of capital significantly decreased the insularity of the business and brought expanded requests for a more examination drove item. PropTech 1.0 was king from 1980s to 2000s.

PropTech 1.0 to PropTech 2.0 wave

The stretch from PropTech 1.0 to PropTech 2.0 seems, by all accounts, to be the on-line real estate sector. For model, in the UK, Rightmove begun in 2000 by the main four UK bequest real estate agencies at that point, naming Countrywide, Connells, Halifax and Royal and Sun Alliance. Zoopla was launched in the market in 2007, trailed by OnTheMarket in 2015. In the US, Trulia was established in 2005 and Zillow was launched in 2006; later Trulia was gained for $2.5bn by Zillow in 2015.

PropTech 2.0 has proceeded the early PropTech 1.0 spotlight on private real estate sector since it is a homogeneous genuine domain resource type with more open data i-e costs and leases, and in light of the fact that it is a tremendous resource type that everybody collaborates with, giving business visionaries clear open doors to disintermediate existing data suppliers and commercial centres.

Real estate digital asset is characterised as the product apparatuses and stages utilised by various members in the real estate business, including intermediaries, financial backers, land centred money lenders, land owners and supervisors. The class incorporates online land rental and purchasing guides.

It very well may be securely recognise that more interest is shown in the private real estate than the commercial real estate. In light of the Savills, 2017 data, the worldwide residential market is assessed to associate with five or multiple times the size of the worldwide commercial market. The possible result for a fruitful private tech firm is to the point of defending genuine financing, while the commercial property arrangements are less convincing.

Any additional value creation in the gold standard is dependent on physical mining, whereas value creation in fiat is based on IOUs & minting. However, value creation in real estate is the developmental segment, where the multiplier effect of developmental investments is between 3 times and 10 times, coupled with a boom in employment and growth in associated industries.

The mindset here shifts from store or value to value creation.

Meta entering the market

Bits of gossip are fracture that Facebook's parent organisation Meta Platforms (FB) is attracting up plans to make a non-fungible token (NFT) commercial centre. News arose on the Financial Times', website which referred to ‘a few group acquainted with the matter’, recommending Meta's commercial centre plans are acquiring momentum and more power.

There's a great deal of interest and publicity around NFTs. In 2021 the market for NFTs swelled to $41 billion (£36 billion) and is getting up to speed to the complete size of the worldwide artistic work market. Many accept Meta’s contribution will guarantee that NFTs become more standard. Minutes after this news broke, Twitter took the front foot and added NFT integration for profile pictures for blue subscribers; who can now connect their wallets to their profiles.

PropTech verticals, horizontals and Pakistan’s standings

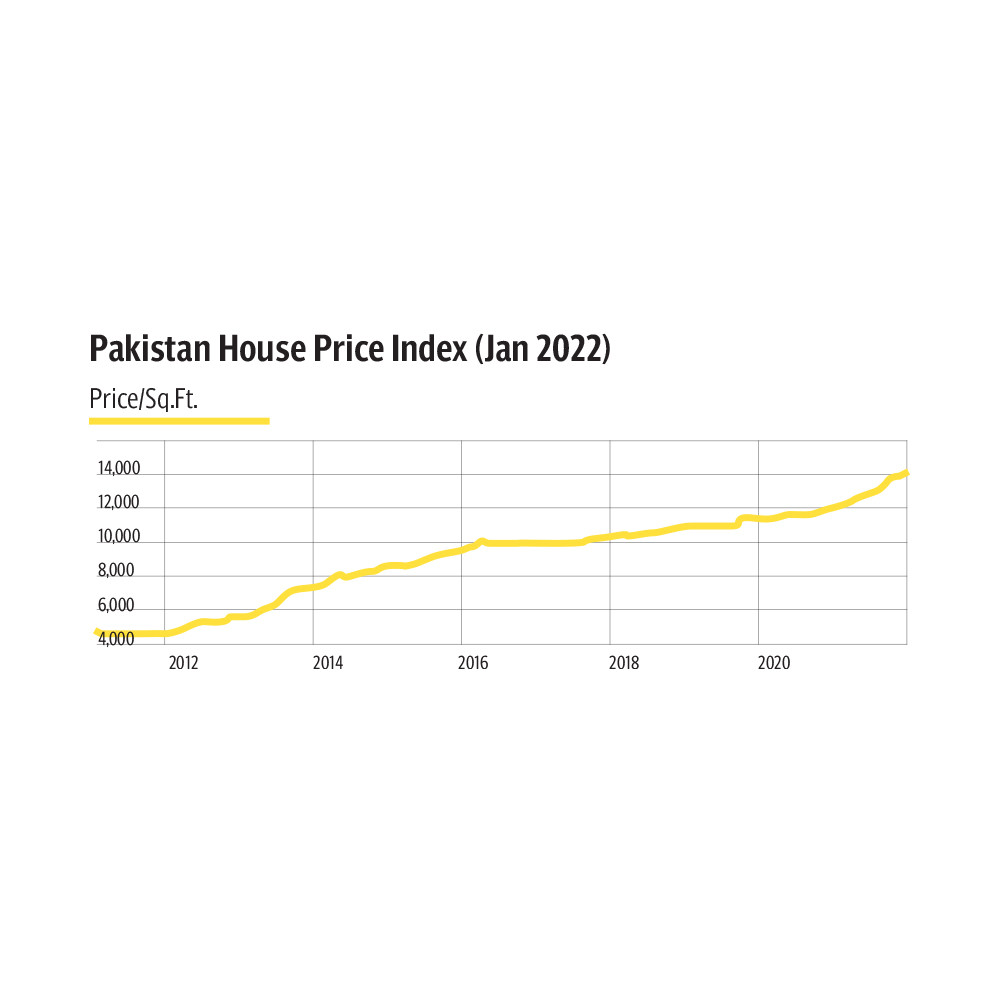

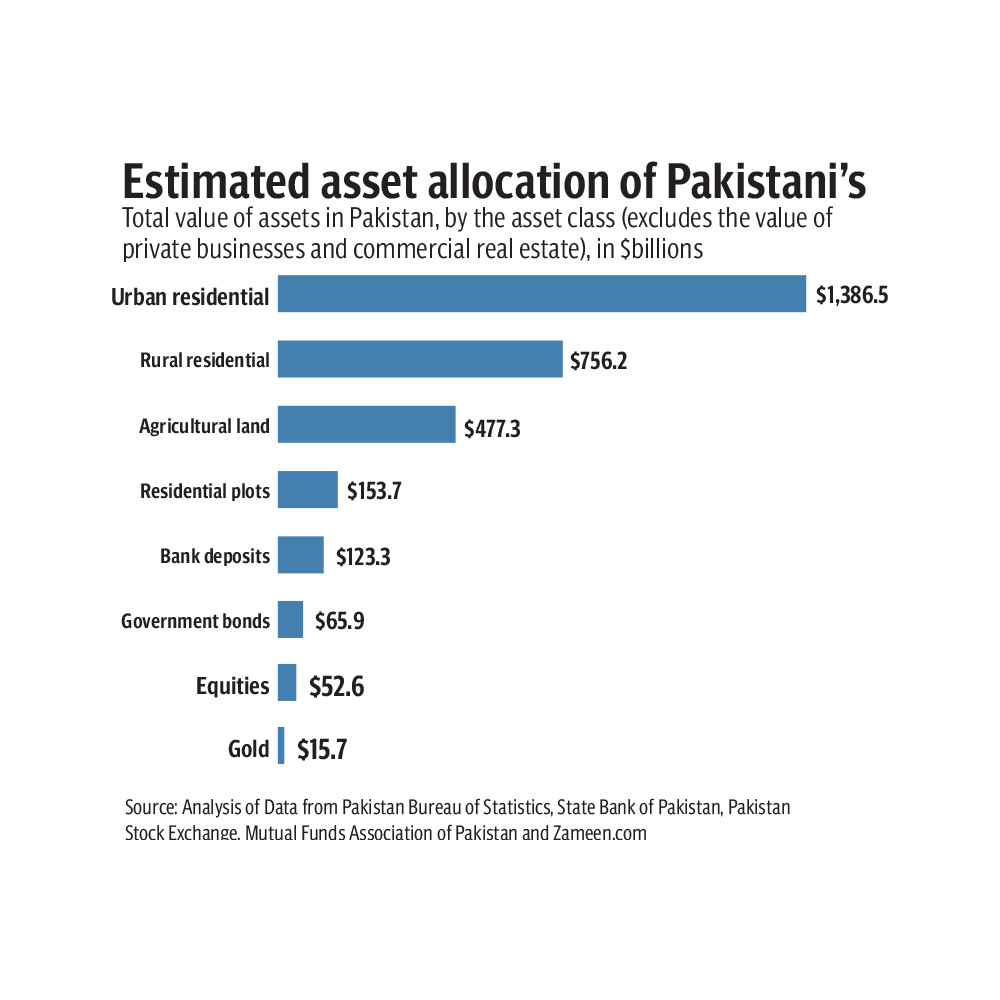

Based on a combination of Zameen.com and Pakistan Bureau of Statistics data, analysis by profit estimated that the total value of all real residential estate in Pakistan – urban and rural houses and apartments, and residential plots in urban areas – is approximately equal to $1.211 trillion.

The total annual market size of residential and commercial real estate till 2040 is $40 billion, which commercial and residential valuations rising by 12 per cent and 8 per cent per annum, respectively.

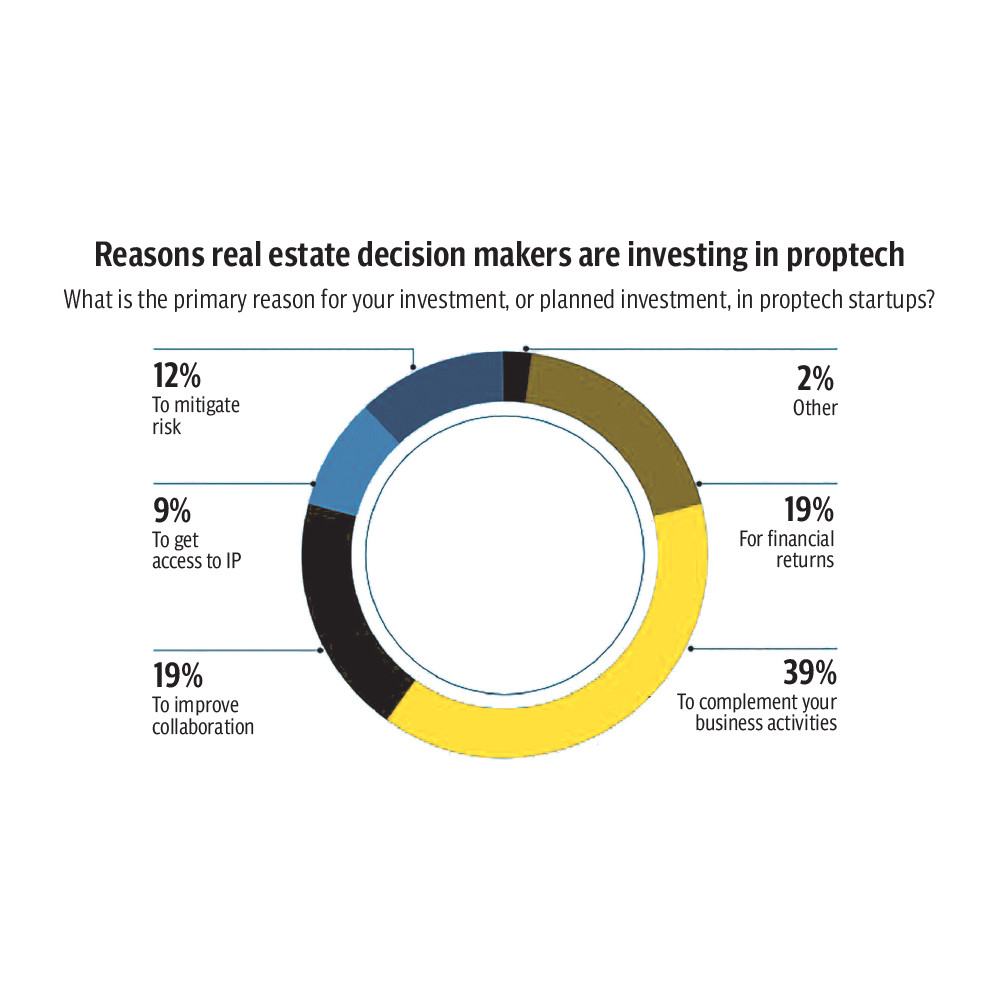

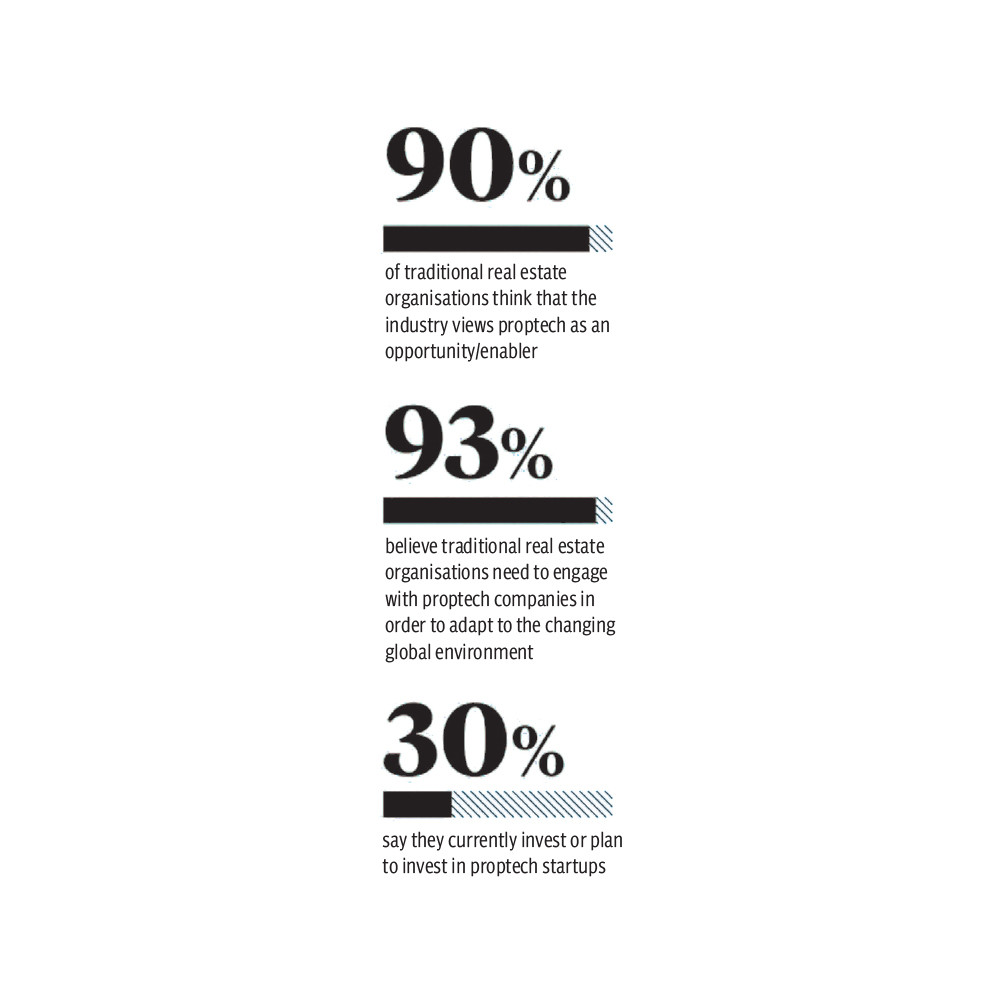

Unlike fiat currency and cryptocurrency, real estate is asset-backed and appreciates relatively consistently. Couple this with the Securities and Exchange Commission of Pakistan (SECP) publishing a position paper in 2020 titled, ‘Regulation of Digital Asset Trading Platforms’, it stands to reason that very soon we could come to rely on a digital asset-backed property tech solution.

“If money is backed by any asset, then growth of that money and eventually economic growth would be restricted to the supply of that asset,” said Ammar Habib Khan, Group Chief Risk Officer at Karandaaz Pakistan. “Sukuks follow a similar structure, where Islamic financing is backed by tangible assets. So GoP may issue a Sukuk, and let it be backed by an airport, motorway, etc. But they run out of real estate to pledge. A digital asset organsation in this case would be blocking off real estate or land permanently as money supply increases till the time it has no land left to pledge, unless it revalues the land and keeps at it perpetually.”

The concept of fractional ownership and real estate tokenization is under the 2nd Cohort of Regulatory Sandbox, with the aforementioned report introducing the concept of digital assets and gauging the opportunities and risks of introducing the same in Pakistan, under a bespoke regulatory framework. The only issue is that the real estate market is hard to: enter, track, leave, and value.

Any digital asset organisation (DAO) that seeks to launch a DAO asset that is backed by real estate would need to create affordability and inclusivity through fractional non-demarcated ownership, a transparent and accessible to all distributed ledger with milestone-based funding rounds, a secondary marketplace to ensure increased liquidity, and cost-based valuations for addressing information asymmetry.

The need to provide real asset value to the end-user, is the claim on which PropTechs are marketing and thriving, but the question lies is will they be assisted by regulators? Will developers be willing to integrate? Thoughts which lead to the reason why we need to further develop this new technological solution.

Earlier SECP also issued a press release about firms engaged in illicit schemes involving the fractionalisation of real estate assets and selling those fractions to the general public via their online platforms/websites naming Xstate Technologies (Private) Ltd Company, Beacon Marketing (Private) Ltd, International Hospitality Investment Group (Private) Ltd, Dao Proptech (Private) Ltd and Neo Cassa (Private) Ltd.

“DAO PropTech's model is not only progressive but prudent,” said Nayyar. “All DAO powered projects are on the development schedule. With DAO PropTech’s solution, real estate investments will become yet more secure and inclusive in the future.”

Smart real estate, smart urban areas and savvy structures are terms in like manner use which depict innovation based stages which work with the activity of real estate assets. The resources can be single property units or whole urban areas. The stages may essentially give data about building or metropolitan focus execution, or they may straightforwardly work with or control building administrations. This area upholds land resource, and the property.

The initial real estate offerings (IREO), a concept popularised by Citado, would be the primary source of revenue for the DAO property technology company, with milestone-based funds disbursement to developers, time-locked smart contracts, and blockchain-powered record keeping. With this approach, the SECP may be working towards the democratisation of resource allocation and distribution, inclusive decision making through liquid democracy among all stakeholders, and decentralised and inclusive ownership. Hence, this could be a moonshot opportunity for the alienated.