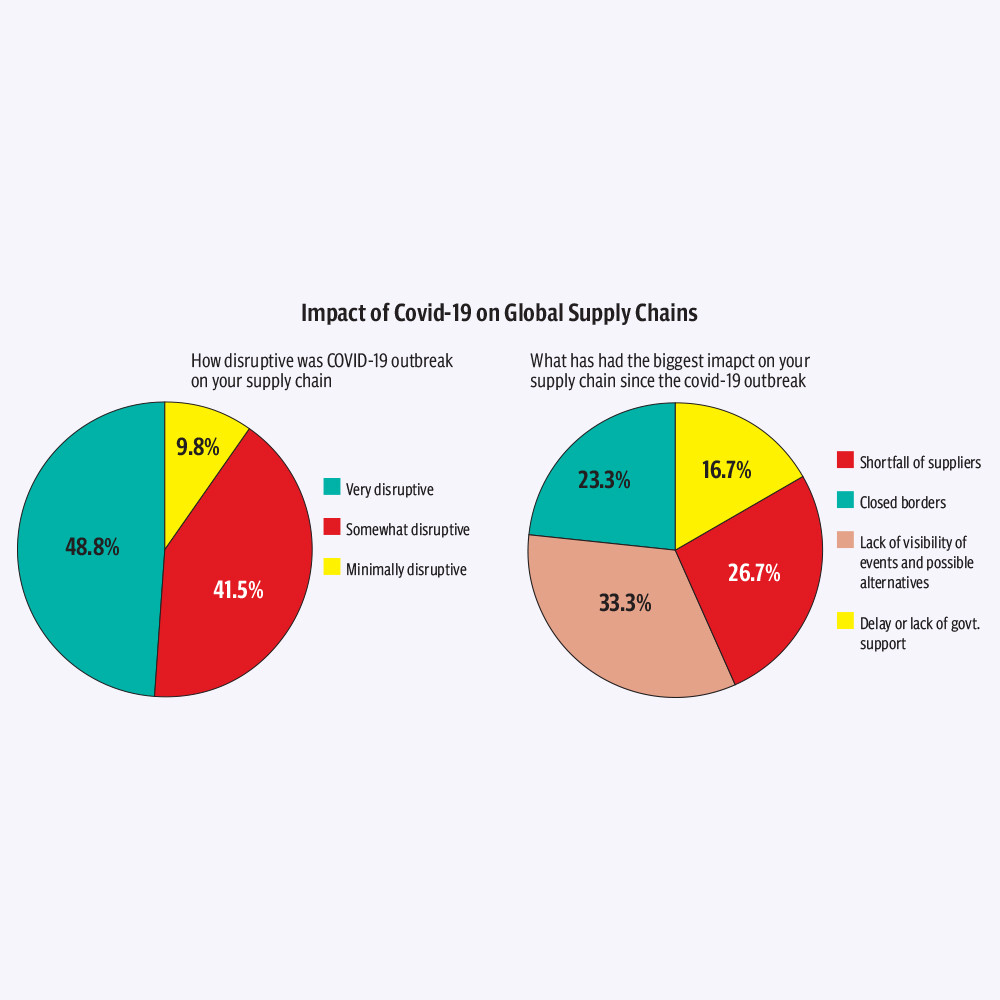

As the world braces up to normalise following a year and a half of severe battering from the Covid-19 pandemic, the after effects of the malady on the global economy continue to emerge in different forms. While the early days of the pandemic saw major world economies impose lockdowns, close borders and reduce business activities, the latest problem concern a disruption in the global supply chain of a majority of commodities. Many of these items are also of daily use.

One year ago, the breakthrough in development of a Covid-19 vaccine renewed hopes putting an end to the pandemic by the mid of the ongoing year. However one year later, the world economy continues to suffer despite widespread vaccination campaigns in many countries including Pakistan. One of the major after effects of the pandemic has been the disturbance in the global supply chain which has slowed down the global recovery from the pandemic.

Speaking to The Express Tribune, cotton trader Saad Ahmed said that the supply chain crisis was being faced due to a cascading impact of Covid-19. “We all know that the pandemic hit China much earlier [end of 2019] than the rest of the world,” he said. “However, due to stringent lockdowns and strict mobility restrictions, Chinese economy began recovering much earlier than the rest of the globe as well.”

Uneven recovery

The cotton importer stated that last year Beijing recorded a nationwide recovery in the beginning of the second quarter (April-June) of 2020 while the earliest rebound witnessed in many other countries, including Pakistan, was in the middle of third quarter (July-September).

Right after the economic revival was evident, China began producing merchandise for the world however demand was low so it was able to supply commodities to the rest of the world.

At the same time, scarcity in demand of a number of non-essential items forced major logistics and transportation companies to scrap their containers and carriers.

“The shipping companies began selling their fleets and containers due to which, congestion at the scrap yard mounted,” he said.“The plunge in demand was seemingly long term therefore the companies had no incentive to pay wear and tear of their assets without utilising them.”

Moreover, majority of these companies were on the brink of bankruptcy due to virtually no business hence they decided to sell few of their containers and carriers to keep the business afloat.

Towards the end of 2020, a breakthrough in vaccine trials partially turned the market sentiment around and signaled an end to the pandemic in early months of 2021.

In addition, in order to stimulate a turnaround in the economy, a handful of first world countries announced relief for their residents. The US, for instance, paid a cumulative $2,000 (in two installments of $1,200 and $800) to its citizens.

This liquidity injection coupled with the upbeat newsflow of discovery of Covid-19 vaccine significantly boosted the demand of all products across the globe. “At this moment, people began spending,” Ahmed said.“Most of the people were still working from home so they bought a lot of a new stuff including home renovation products, technology gadgets (such as laptops) and other essential products.”

The demand in the global economy began recovering but bear in mind that at the same time, the supply was limited.

Port problems

Due to Covid-19 restrictions, ports were not fully functioning at that time, he said. Ahmed added that many ports were still taking less traffic but a lot more ports had restrictions in place towards the end of 2020 and the start of 2021. In the initial months of 2021, a handful of unprecedented events further aggravated the situation. “Occasional outbreak of the virus in China hindered the production process, the spread of delta variant saw most countries impose stringent lockdowns again and majority of the carriers were shipping Covid-19 vaccines to the nations” he said. “At such a point, the Ever Given obstructed the Suez Canal and paused the flow of logistics from one of the most important shipping routes in the world.”

The giant ship go stuck in the Suez Canal on March 23 and blocked the movement of any traffic from the route till March 29, 2021. During this time, an estimated $9.6 billion worth of trade was lost.

Moreover, US began experiencing conflicts at its ports, he said. “The ports of Los Angeles and Long Beach are highly desired routes from Asia to continental US and these two placed began recording a huge influx of ships that they were unable to handle,” he said. “The port companies began implementing wait times for incoming ships which has now growth to 10 days.”

The average wait times, which was non-existent before the pandemic surfaced in the world and stood at 7.5 days in August 2021. There were hundreds of ships lined up to offload their containers however, ports are unable to process them despite the fact that they have implemented round the clock operations.

“Earlier, ports had set timings during which they operated,” stated the importer. He detailed that a port consists of main area where ships are docked and there is a separate area known as outer anchorage where they wait for being berthed.

Outer anchorage in ports in most parts of the world has been filling up because while there was no notable expansion in shipping lines, the scrapping of containers and carriers contracted this segment. Today, the global supply chain is far from normal because suppliers are unable to meet demand due to a host of factors other than the ones already mentioned.

Other factors?

The official stated as soon as lockdowns began easing and the recovery of global demand began, the freight companies jacked up prices partly to erase the losses borne during lockdown and partly because of the huge influx of export and import orders.

Arif Habib Corporation Managing Director and CEO Ahsan Mehanti said that Covid-19 is still raging in many parts of the world and lockdowns are in effect in a few countries. “The manufacturing sector in these countries is working at half or reduced capacity due to the pandemic induced restrictions,” said Mehanti. “Low amount of workforce translates to drop in production while demand is stable. This has created a wide gap between the demand and supply of products in the world.”

Few days back, China shut a terminal for two weeks due to rise in virus infections, he said. This took place in the world’s third busiest port and this was the second time in 2021 when the operations at the port were suspended.

On one hand, some countries are unable to absorb the traffic on the port while on the other hand, frequent closure of port operations is being witnessed. This has also alleviated the supply crunch, he said.

“These are the after effects of the pandemic,” Mehanti said. “Furthermore, the clearance of goods is also consuming a large window of time compared to the pre-Covid era.”

Moreover, many countries are not issuing business visas either which can help resolve this issue to some extent.

During business-to-business meetings with their foreign counterparts, traders ink agreements to switch trade routes to less congested passages that could reduce traffic at busy ports. Moreover, cross border trade is also blocked in many areas. Giving the example of Pakistan, he said trade is largely suspended with Afghanistan and India.

Input scarcity

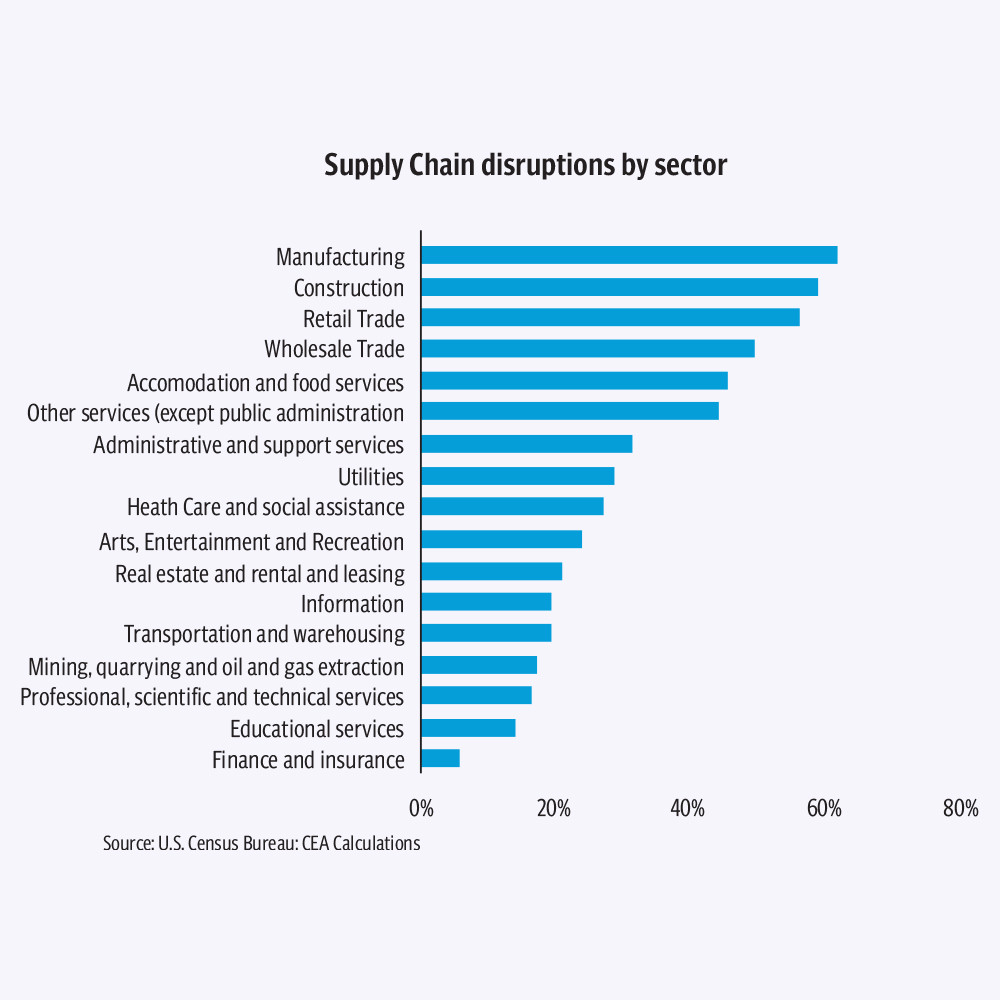

The supply chain crisis has lately evolved into a raw material shortage for the global manufacturing sector. What was termed as a temporary phase is not expected to improve for a long time.

Few months ago, the world witnessed a shortage of semi conductors that threatened entire digital manufacturing base as well as automobile production. Now, this problem has evolved further.

Alpha Beta Core CEO Khurram Schehzad said that the outbreak of Covid-19 forced suppliers to limit production because there was no demand for their products. “Back in March 2020, the malady was expected to continue for a few years and demand was not projected recover over the next one to two years,” he said.

In April 2020, oil fell below $0, which signaled excess supply and virtually no demand. This dampened sentiment of producers because up till that moment, oil was considered a necessity and was supposed to remain unaffected by any crisis, he said. Keep the oil price dip in view, producers had little incentive to continue on with production.

Therefore inventories of factories shrank and now the world faces a deficit of inputs for the production process even for essential commodities.

Sometime, an input has to undergo manufacturing process to act as raw material for manufacturing of another product such as semiconductors. They undergo massive manufacturing processes only to act as inputs for automobiles, laptops, mobiles and other digital gadgets.

Now, raw material for daily use items such as cooking oil and ghee is also in a deficit and this has triggered a crisis for factories all across the world. “World demand is recovering and the supply is not ample to fulfill demand therefore prices of commodities and raw material are soaring,” he said.

Inflationary pressure

While the supply is limited on one hand and prices are rising, the logistics industry also has a deficit of containers therefore their rates are also surging. The global supply chain is experiencing a multifaceted challenge.

The number of containers with logistic firms remained limited hence the companies were unable to absorb the sudden rise in demand.

“As a result, they raised the per container cost,” said Schehzad. “Right now, the demand is high, and a shortfall is being witnessed in raw material, commodities, inputs, transport and logistics.”

One can say that world does not have enough supply to meet the recovering demand even if logistic and transport issues are resolved.

Coal and oil prices are soaring primarily due to reopening of economies and jump in energy demand stemming from planned revival of manufacturing base. Resultantly, the energy prices are skyrocketing as well.

The cost of finished products and intermediary goods is climbing due to hike in input costs.

“Prices of metal, particularly steel is on the rise,” he said. “A massive chunk of world demand came from China as it opened.”

Schehzad said that China is dependent on coal and while, Australia is huge exporter of the fossil fuel, Beijing refrains to buy from it due to geo-political problems.

“Hence, change in geo political situation is also contributing to global supply crunch,” he said. “China has supply of products but most western countries refrain from trading with it.”

Holiday season

Cotton importer Saad Ahmed said that holiday season is kicking in around the world and demand for all products ticks up during October to December every year.

There is not doubt that things have started to improve in many countries but the world has a long way to resolve the supply crunch issue.

“US and Latin and America are facing shipping problems but things are improving in other nations,” he said. “US port congestion is not expected to normalise atleast until March 2022. It can prolong far more than that but March is the earliest estimate.”

Ideally, the port condition of US is expected to normalise at the beginning of 2023.

This has created a huge export backlog for companies all around the world and shipping firms are taking back empty containers with them. He detailed that earlier, the containers would be filled with merchandise destined for other parts of the world.

“Importers and export-oriented industries in Europe and US are operating below capacity.,” he said. “Railway, trucks and air cargo have no capacity either to facilitate exporters in delivering merchandise by the deadline.”

He was of the view that there were low chances of resolution of the problem in the short run

How is Pakistan faring?

Ali, who supplies raw cotton to textile mills in Pakistan, revealed that raw cotton imports to the country are facing delays and the problem is expected to persist until the middle of 2022. “Raw material is a bit harder to secure right now and due to this, the domestic cotton prices are at a historic high,” he said. “Freight rates, applicable on valued added exports, have soared as well.”

The gap between receipt of export orders and final delivery has expanded to six months. He detailed that when the orders were registered, the rise in freight costs was not taken into account and the sudden hike in fares is mounting losses for exporters. According to him, shipment delays were being experienced on the export side as well which has sparked liquidity issues among exporters. The working capital cycle for exporters has risen from one month in pre-Covid times to two to three months now. Furthermore, the global supply chain disruption has triggered a slowdown in Pakistan’s exports.

“At present, the textile sector has the capacity to fetch $1.8-1.9 billion per month in exports however it is only able to bring in $1.5 billion in revenue under this head,” he said. “Overall due the supply crunch, profits of companies have been impacted and costs have risen therefore they have jacked up prices and this is impacting the overall competiveness of the country in the export arena.”

He revealed that Pakistan’s export share is increasing amid US-China trade war while the country also managed to secure a massive amount of export orders in the previous months as the malady battered the regional economies.

An import dependent nation

Schehzad stated that Pakistan was facing grave spillover effects of the global supply crunch because the country is dependent on imports. “Energy commodities in Pakistan are mostly imported and prices of oil, coal and LNG are scaling new peaks,” he said.

On the other hand, machinery worth millions of dollars is being imported by businessmen of Pakistan under the State Bank of Pakistan’s Temporary Economic Refinance Facility (TERF). The facility aimed to boost expansion of companies and plants to accelerate economic activity.

With freight costs surging around the world, the imports under TERF will become more expensive, said Schehzad. He lamented that for every $1 earned through export by Pakistan, $3 were spent on imports.

Mehanti noted that Pakistan depended on export earnings for foreign exchange however 60% of the inputs in local exportable merchandise were imported. “The increase in freight prices amid Covid-19 has significantly surged the input cost as well,” he said. “Our import volume has declined but not import bill because of uptick in raw material prices.”

Due to low imports, the exports of Pakistan are declining. On the other hand, they have turned expensive as well and the country is not getting as many export orders as it did in previous months, he regretted.

The supply crunch is also impacting rupee and triggered volatility in local currency against the US dollar.

Import substitution

When asked whether it was a good opportunity to steer import substitution in the economy, Mehanti was of the view that foreign Investment was needed for it and investors were not moving around due to travel curbs.

“The supply crunch has impacted our FDI as well,” he said. “However, our relations with Middle Eastern nations are improving and we can ink oil facilities on deferred payment basis to reduce fuel price inflation. Qatar, Saudi Arabia and UAE can help Pakistan in this regard.”

This however, is a short term solution, he stated.

In the long term, the investment environment has to improve and tax incentives have to be offered to foreigners to steer local production

Schehzad stated that Pakistan had a golden opportunity to steer import substitution however there were a lot of structural issued that were difficult to resolve.

“The governance is weak, and provincial and federal governments are not cooperating,” he lamented. “Hardcore reforms are needed.”

The state-owned entities are denting public finances of the country while Pakistan’s inclusion in the Financial Action Task Force (FATF) grey list is discouraging foreign investors to build plants in the country. He criticised the economic managers for not importing energy when it was being offered on cheap rates in 2020.

Views of global agencies

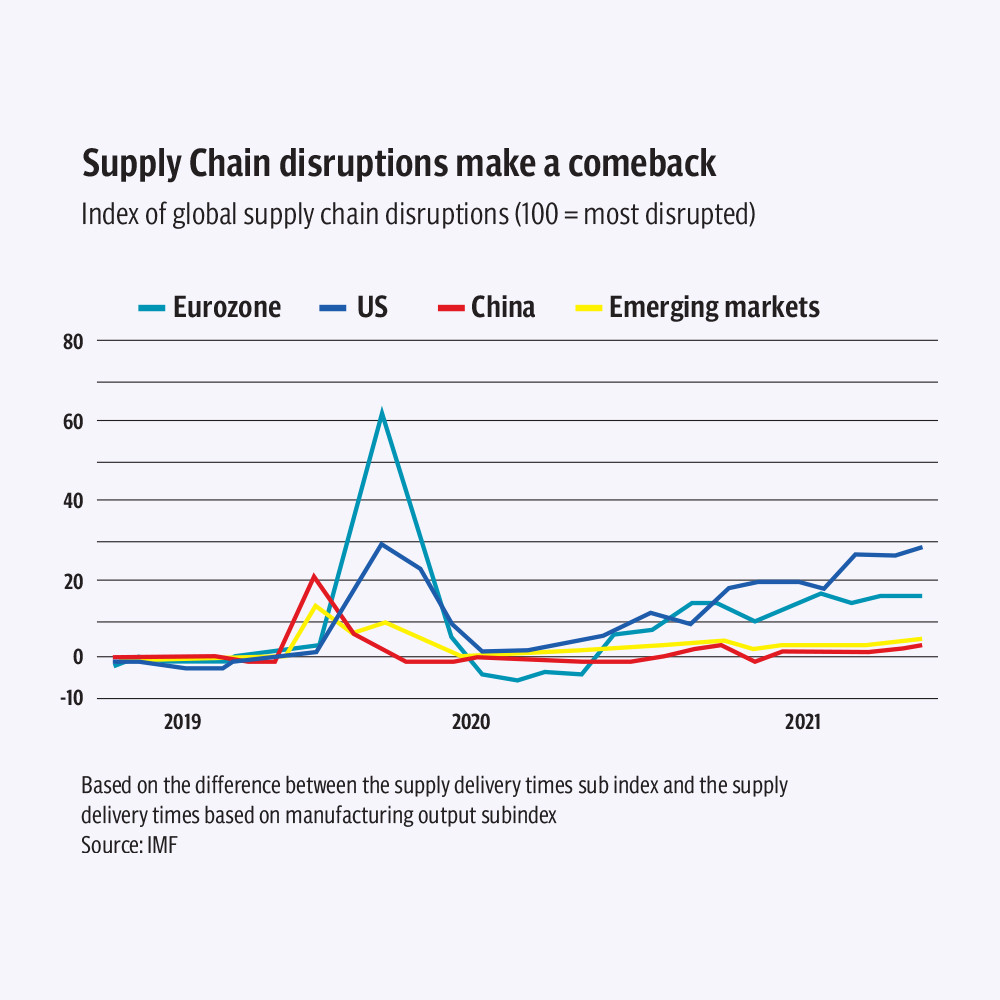

The International Monetary Fund has stated that supply chain disruptions have become a major challenge for the global economy since the start of the pandemic. Shutdowns of factories in China in early 2020, lockdowns in several countries across the world, labour shortages, robust demand for tradable goods, disruptions to logistics networks, and capacity constraints have resulted in big increases in freight costs and delivery times.

Suppliers’ delivery times in the United States and the European Union have hit record highs since late 2020. The recent sharp drop in the delivery times reflects surging demand, widespread supply constraints, or a combination of both. During such times, suppliers usually have greater pricing power, causing a rise in prices. Moreover, these supply chain delays can reduce the availability of intermediate goods which, combined with labor shortages, can slow down production and output growth.

Once the number of new Covid-19 cases starts to decline, capacity constraints and labour shortages should ease, taking some of the pressure off supply chains and delivery times. However, some experts believe that there is unlikely to be swift relief from supply chain disruptions. Elevated demand during the holiday season in some of the world’s largest economies, another wave of new Covid-19 cases, and extreme weather events, if they materialise, could cause further supply chain disruptions.

The World Economic Forum said that as the coronavirus crisis is wearing off in many parts of the world, supply chain troubles are increasing once more for many companies, mainly concerning the US and the Eurozone. Supply chain disruptions have developed during the pandemic, spiking in early 2020 and picking back up over the course of 2021 as the new normal causes all types of goods to become more sought amid a more permanent reopening. The supply chains in China and emerging markets, on the other hand, are less affected.

Still reeling from lockdowns and restrictions as well as the loss of manpower due to illness or travel restrictions, many suppliers had to restrict their production and were no longer able to meet their delivery obligations in full. And as even a single missing supply part can quickly affect production processes in a massive way, the complex structure of global supply chains can quickly fold.

According to the IMF, supply chain disruptions together with increasing raw material prices are also a reason for the rise of consumer prices. The IMF expected this global inflation to reach its peak at the end of 2021 and return to pre-crisis levels in many countries by the middle of 2022.

On the other hand, a recent report from the European Central Bank stated that shipping disruptions and input shortages are leading to considerable bottlenecks in global supply chains.

“During the recovery phase of the Covid-19 pandemic, households increased their purchases of certain products, such as electronics and home improvement equipment, which caused a stronger-than-expected surge in demand, especially in some sectors,” it said. “This rise in demand coupled with events beyond the reasonable control of suppliers (owing to force majeure), such as coronavirus outbreaks in ports, accidents at plants and adverse weather conditions, led to bottlenecks in the transport sector and caused shortages in specific inputs such as plastics, metals, lumber and semiconductors.”

As inventories fell at the onset of the pandemic owing to the running-down of stocks and shortages of inputs resulting from closures and conservative inventory policies, companies struggled to keep up with the swift rise in demand and the replenishing of depleted stocks. This demand and supply imbalance is evidenced by the unprecedented lengthening of suppliers’ delivery times, especially in sectors relying on transportation and inputs from sectors experiencing shortages, namely computer and electronic equipment, machinery and equipment, wood products, motor vehicles and chemicals.

Shipping volumes have recovered since the trough in mid-2020. In the first half of 2021, temporary disruptions, such as the Suez Canal incident in March, led to severe strains in global shipping but did not halt the positive growth dynamics, as reflected in the global (total) and European North Range ports’ throughput indicators. European air cargo traffic was more severely affected by the pandemic as a result of the unprecedented reduction in passenger flights, which decreased cargo capacity.

However, by the start of 2021 air cargo traffic had once again reached its pre-crisis level thanks to firms partly switching from sea freight to air transport.

The shipping routes experiencing the most severe strains are those from Asia to North America and from Asia to Europe, leading to extraordinary increases in shipping costs.

Shipping capacities on the Asia to North America route rebounded more strongly from the pandemic than on the Asia to Europe route, partly on account of increased capacity driven by the robust recovery pattern observed in the United States. Given the relatively inelastic supply of shipping capacity and disruptions in the transport sector, spot (short-term) container freight rates for Asian outbound routes have soared to record levels, particularly for routes to North America. This has also led to a redirection of capacity towards this more lucrative route at the expense of other routes.

The shipping business relies mainly on fixed long-term contracts. In the current environment, the negotiation of new long-term contracts has probably been affected, resulting in a remarkable, albeit less strong, increase in freight rates for long-term contracts than for contracts based on spot rates.

EU countries are among those countries most affected by the shipping and input-related bottlenecks. Suppliers’ delivery times remained lengthy in almost all countries in August, with EU countries, the United States, the United Kingdom and Taiwan being particularly affected.

In the euro area, export sectors that experienced the fastest recovery are facing higher supply shortages. In particular, exports of motor vehicles, electronics and fabricated metals, which had expanded considerably up to the first quarter of 2021 compared with the first quarter of 2020, were affected by supply constraints which slowed the continued expansion of these sectors. This underlies the role played by strong demand in the lengthening of suppliers’ delivery times. The delays also extended to the machinery sector, which relies on electronic equipment and fabricated metals as inputs.