The global feminist movement has brought tons of issues to the limelight and many of them pertain to the financial sector such as the gender wage gap and unequal hiring ratios of males and females at workplaces. One similar phenomenon that is slowly attracting the spotlight is the pink tax.

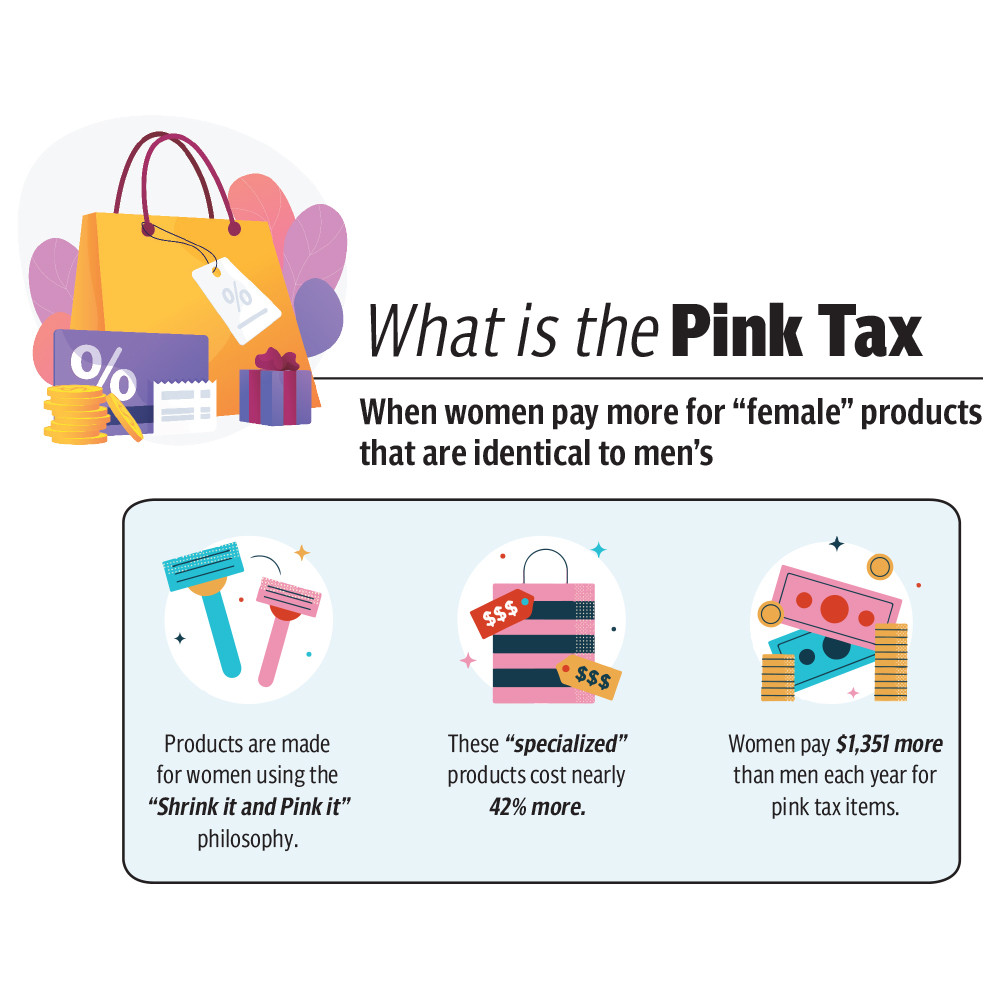

The term pink tax is misleading because it is not a tax and revenue generated from it does not enter the exchequer. It is, in fact, a form of price discrimination based on gender.

Speaking to The Express Tribune, Pune based IDC market analyst Akshaya detailed that the pink tax is a kind of gender-based price discrimination due to which women are usually charged higher than males while purchasing identical goods.

“It is not a tax on women's goods rather it is a surcharge that forces individuals who use feminine items to pay more,” she said. “Keep in mind that these are the same items that are promoted differently to make women pay more.”

Talking about pink tax in India, she said that a razor advertised for males costs Rs80 rupees while an identical razor, which is intended for female usage, costs a staggering Rs250.

The disparity in this case cannot be overlooked, and turning a blind eye to it might jeopardise all attempts to live in a fairer society, she added.

Unseen expense

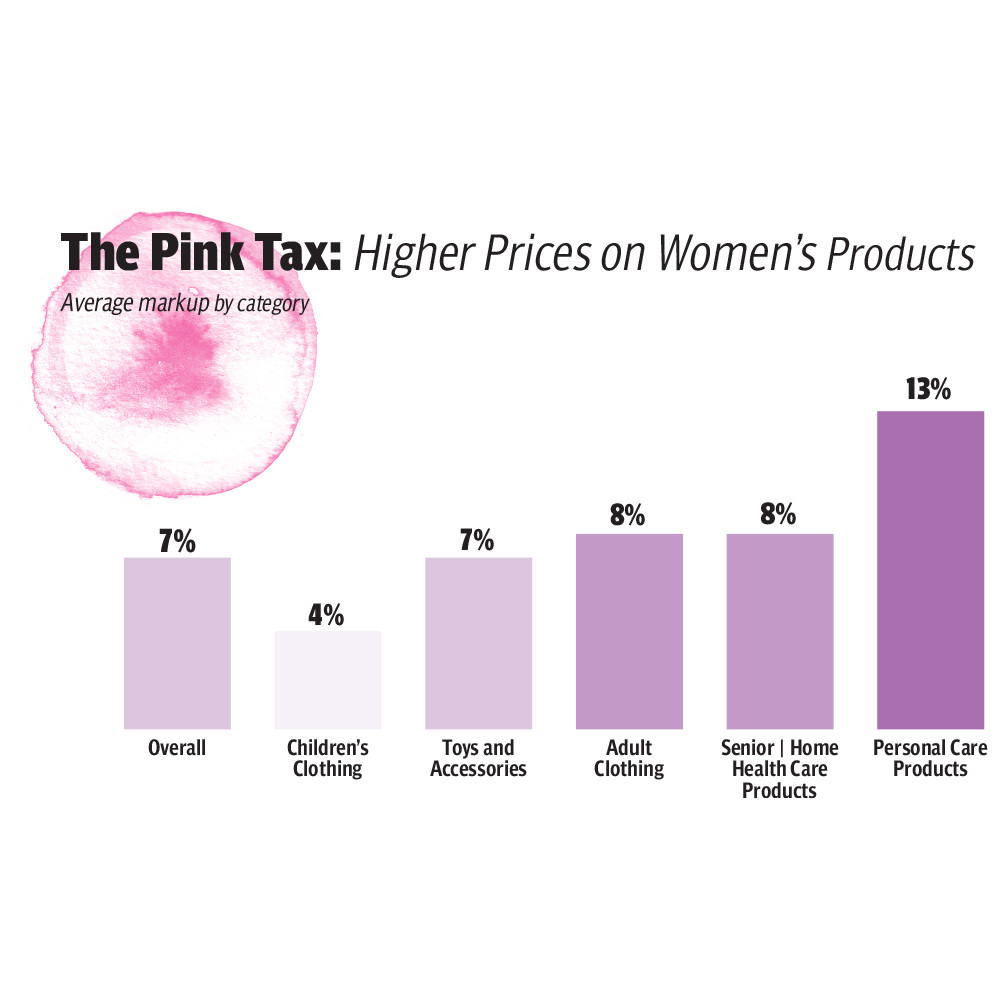

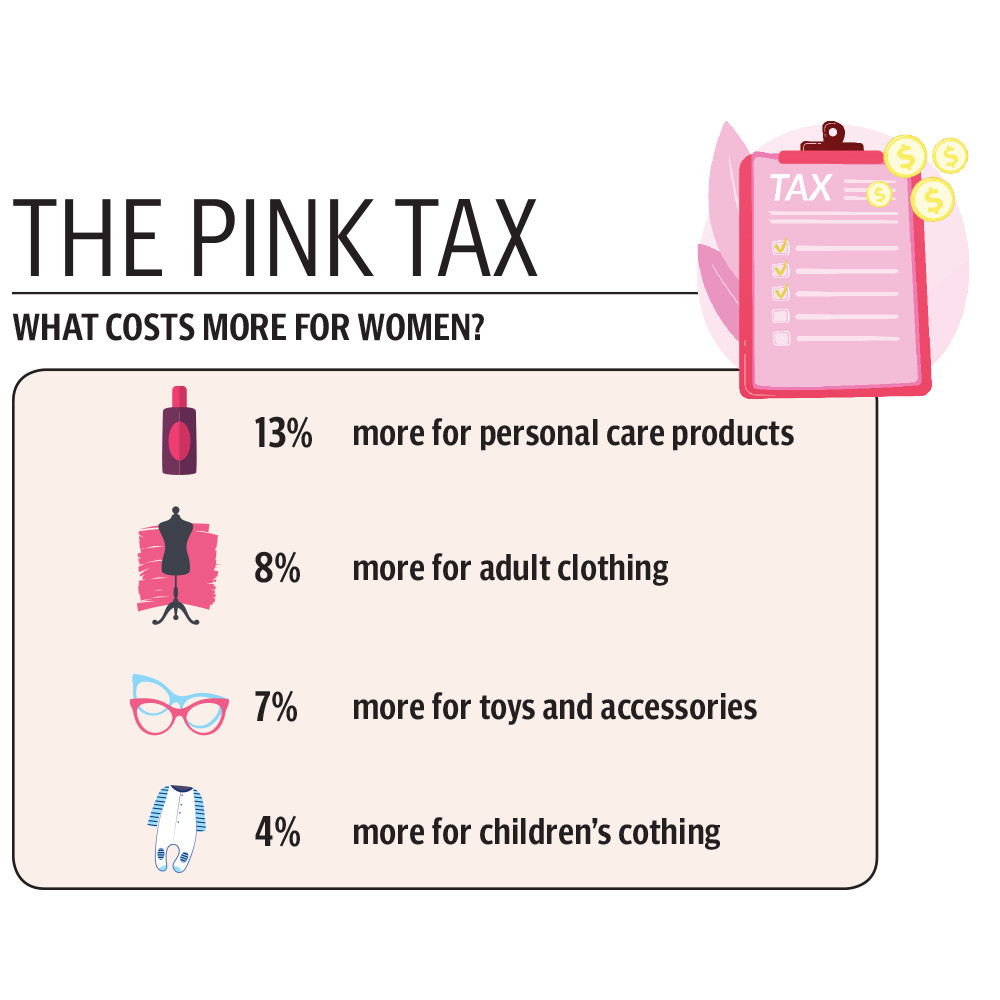

According to a study by the New York City Department of Consumer Affairs, goods marketed and packaged for women and children are stereotypically promoted and packaged in pink and purple with glitter and flower scents, and cost 7% more than items marketed and packaged for men. The unseen expense that women must pay for goods that are produced and sold exclusively for them is referred to as the pink levy.

“This suggests that women will be expected to pay more for such things simply because we are females or in other words, men would be paying less for the same goods as we are being charged for,” she said.

What’s worse is that in a society where gender wage gap persists, women are forced to pay more for equivalent goods due to this tax, she voiced concern.

Citing a study called The Cost of Becoming a Female Consumer, that compared the costs of over 800 items, she said that it concluded that women's products are priced 7% higher than men's products. In the case of personal care items, the percentage increases to 13%.

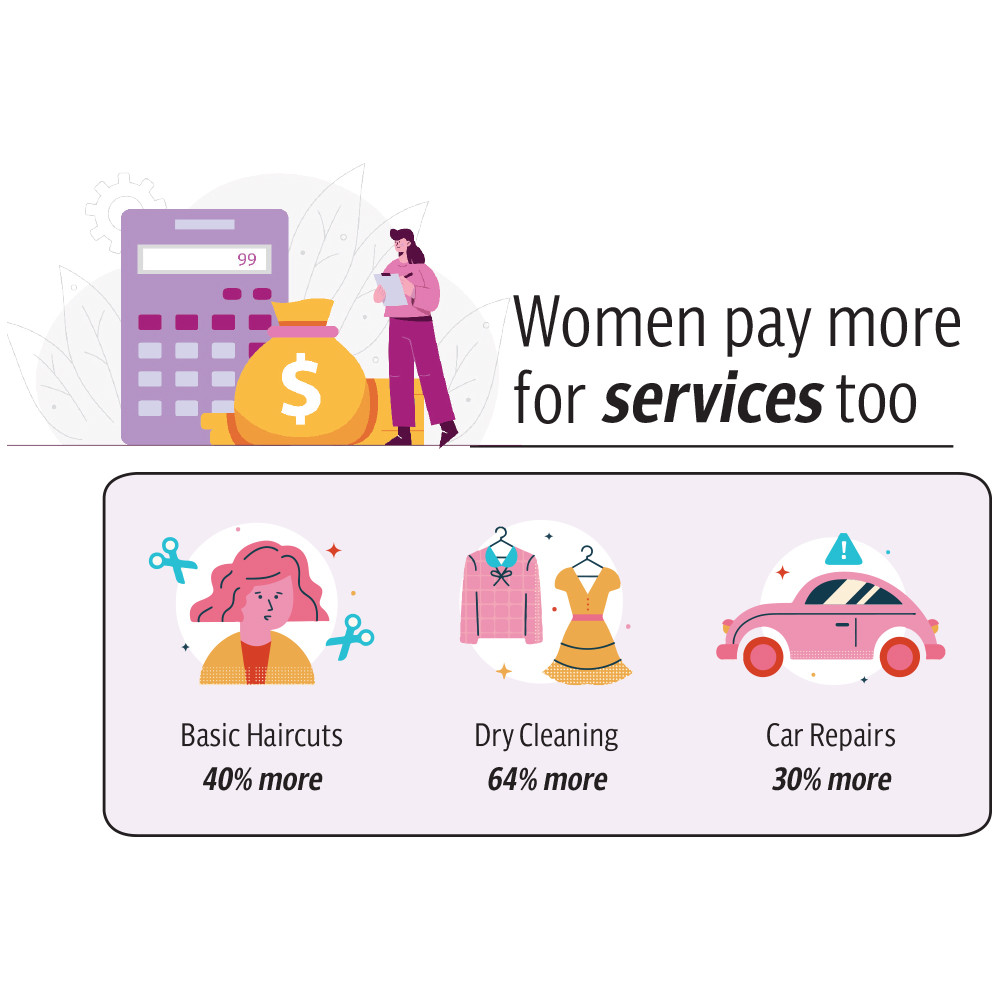

“Let us untangle stuff if it is a bit tangled. Women's haircuts are usually more expensive than men's haircuts at certain salons,” she said. “Women's personal care devices, such as razors and deodorants, are more expensive than men's as well.”

Aside from the exterior casing, the "female" version of a product is always quite similar to the regular version, Akshaya said.

Delhi based Chartered Accountant Siddharth Kathuria said that due to this gender based price discrimination, women end up spending more for the same range of products and services as compared to men. He added that pink color is usually associated with women hence this surcharge is known as the pink tax.

Capitalism in action

Delhi based financial blogger Vanshaj Bindlish said that the very nature of the pink tax shows that it not a tax because the government does not earn from it rather it is just additional amount that women pay unknowingly to firms that are minting money from this phenomenon.

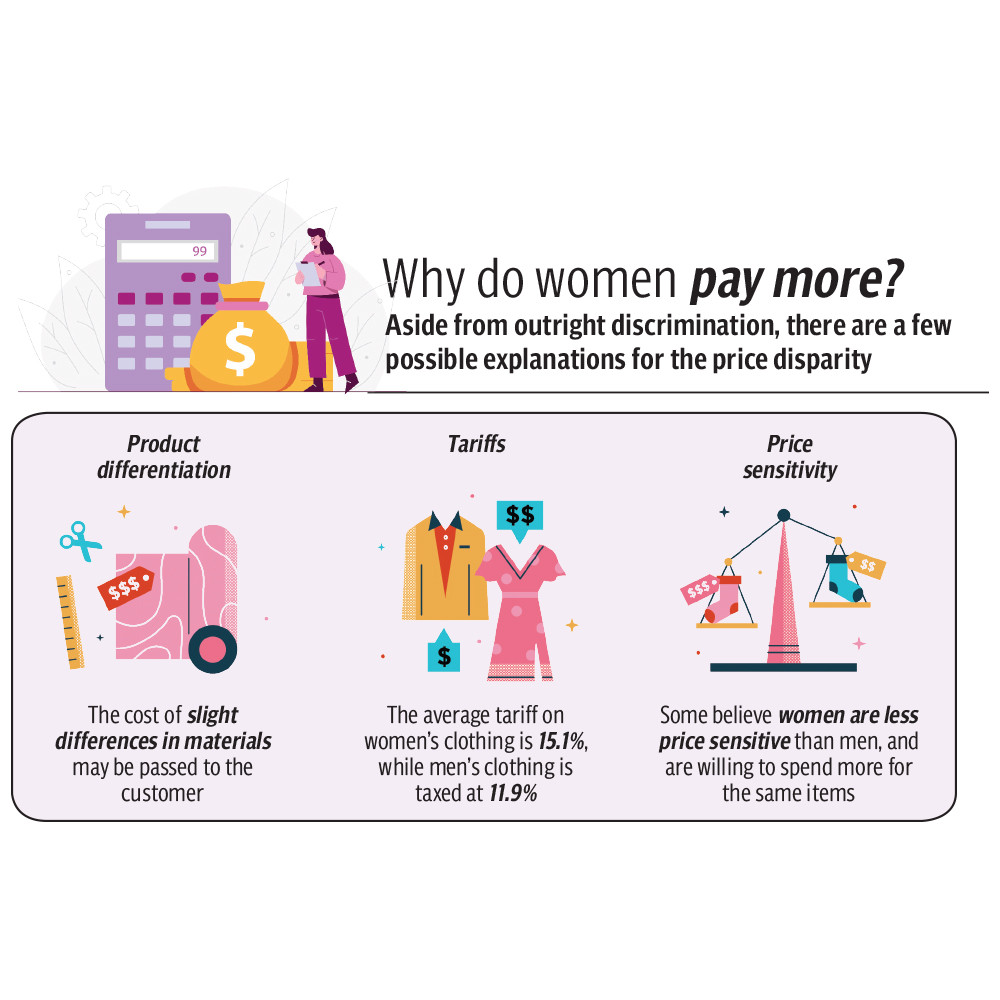

The prime motive of companies is to maximise profits and this way, they are able to enhance earnings by offering the same products to women but packaging it differently.

“Pink tax is a less known phenomenon and a vast majority of people are unaware about it,” he said. “I too come across this quite recently and was surprised by it.”

Lack of knowledge is one of the major reason why women fall prey to this lucrative scheme of the companies.

“Companies can do anything for profits and they will continue to consider pink tax ethical until government authorities interferes in the matter,” he said. “Why would they stop if half of the society is unknowingly paying a higher amount for a product?”

Gateway drug to discrimination

Talking about consequences of gender discriminatory pricing, Akshaya said that surely there is a significant economical impact of pink tax as it acts as an umbrella to issues pertaining to wage gap in different industries however this is not the only effect of the surcharge.

There is a social impact as well that has to be highlighted equally, she said.

For instance, women's anxieties as a result of cultural judgments of their appearance and lifestyle encourage gendered pricing and allow corporations to rob enormous sums of money from those who buy their products to meet unachievable societal norms.

“Society frequently says that women are less sensitive to increased pricing and since they are ready to spend more for a product or service, marketers discriminate against them on the factor of price,” she said.

She pointed out that some companies argue that pink tax is no different from hike in rates of air tickets as purchase dates draw closer. Terming the comparison absurd, she said that price difference in airline tickets is neither directed at a specific group of people nor does it contribute to a larger system of oppression.

Regardless of the explanations, the fundamental implication of this gendered pricing is that it costs a woman much more to live in a society than males.

Asked if male marketed products are sold more due to pink tax, she said that the scenario could materialise in near future with rising awareness of pink levy among women.

Siddharth Kathuria said that when women pay pink tax on products and services over a long period of time, the marginal amount on every purchase eventually adds up to a substantially large number, widening the pre-existing income gap between men and women.

He was of the view that if this factor was highlighted on a vast scale, it could impact women’s purchasing decisions in future.

He also believed that products marketed for males are not sold more despite pink tax because of psychological mindset that male products are meant to be used by men only.

“Even if the male products are marketed more, women are hesitant to buy them for themselves however this perception is wrong and we need to steer a change,” he said.

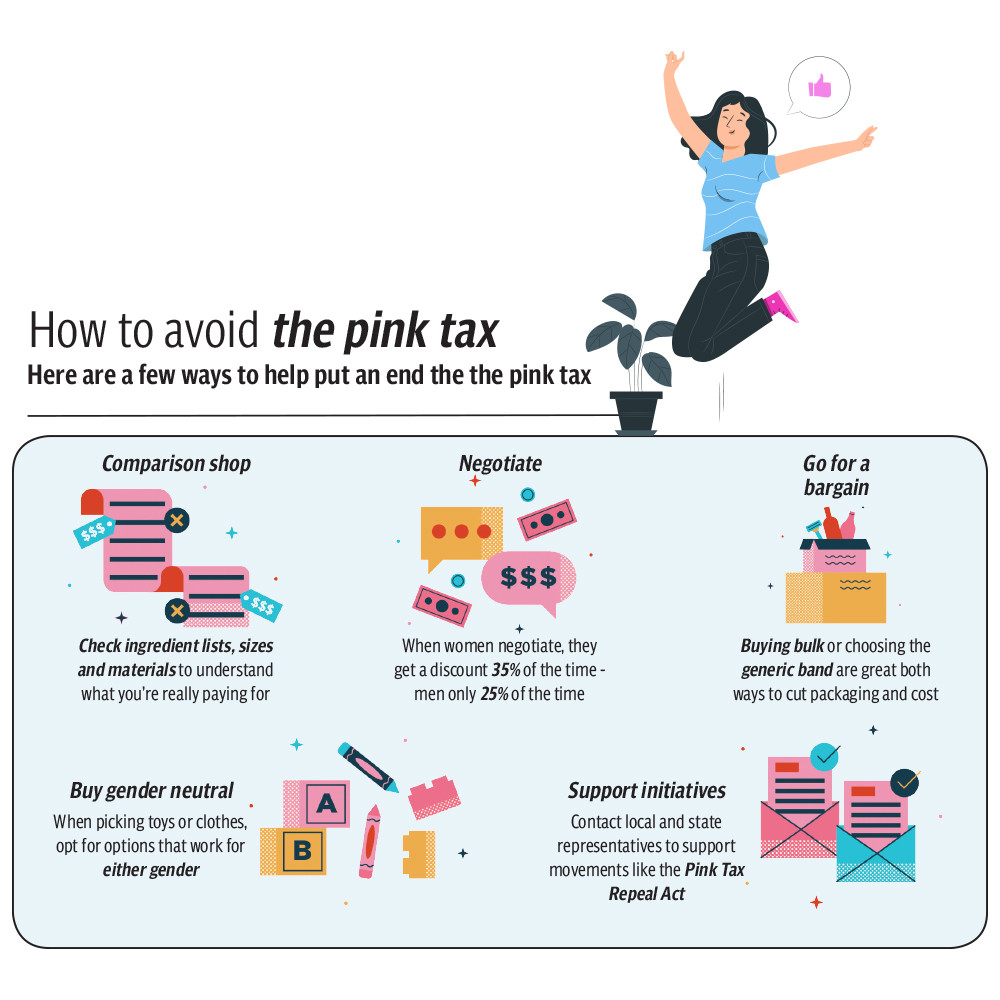

Evading the pink tax

Akshaya said that pink tax exists on a lot of items ranging from cosmetics and accessories to clothing and shoes.

“Products created and marketed particularly for women are more expensive than gender-neutral products,” she said.

Giving suggestions for getting around the pink tax, she recommended females to opt for generic versions of an item especially if the variance or advantage is not significant.

She also urged buyers not to be misled into buying a commodity just because it comes in a nice pink package.

“Another option is to shop around as much as possible to avoid the pink charge and look for razors, perfume, and other personal care goods that are labelled "men's."”

Kathuria said that the first and foremost step towards ending the pink tax would be to educate consumers on this issue.

“The higher the amount of consumers who are aware of the pink tax, the less likely they will be to buy unfairly priced goods—and the more likely we will be to see change,” he said. “Recently, European Wax Center launched an online calculator to show how much the pink tax an average consumer has paid over the lifetime. More such tools would be useful in making the effects of the pink tax more urgent.”

Moreover, he said, the civil society can work with legislators and partner up with the government officials to end this menace. He gave example of California where a political leader launched the Pink Tax Repeal Act on Equal Pay Day in 2018.

He added that people can also seek out other advocates and work with them to introduce legislation and steer change to end this kind of price discrimination.

Echoing his views, Bindlish said that awareness about pink tax was vital to combat he issue.

“Women need to deliberately choose products that are manufactured for men so they can avoid it to some extent,” he said.

He stressed that pink tax cannot be avoided completely until laws are introduced against such practices and this can happen only if both men and women voice the issue on an international level.

“This tax clearly brings the issue of inequality upfront and it should not prevail in any society,” he stressed.

He voiced hope for a more equal future following implementation of effective laws which force large scale corporate enterprises to do business ethically.

CSR with a feminist twist

Speaking about how brands can deal with the incidence of pink tax, Kathuria said that as an initial step, they should adjust their prices.

“If a brand charges a higher price for products solely because they are marketed towards females, it should know that consumers are calling for higher equality and the most popular course of action for them would be to stop buying from brands that charge pink tax,” he said. “So while it might seem obvious, price adjustments will be the first step to equality.”

He further recommended firms to embrace gender neutrality in their output.

“Today, brands like CoverGirl (by naming its first male supermodel) and Zara (by launching a genderless clothing line) have taken steps in this direction,” he said. “On the other hand, new unisex personal care options from companies like Brandless, Panacea and Non Gender Specific are being introduced all the time.”

Similarly, he directed companies to create something that would appeal to everyone instead of an outdated pink and blue version.

Moreover, he emphasised that firms can also innovate around the consumer just like American company Billie which is actively campaigning against the pink tax and marketing its products with tagline that the company was against pink tax.

In conclusion, majority brands are not actively standing up to the pink tax rather they are enabling it therefore it is time for marketers to step up and make a change, he said.

Pink tax in Pakistan

A source from the FMCG sector of Pakistan, on the condition of anonymity, confirmed that pink tax was prevalent in the country and local businesses resorted to gender discriminatory prices to inflate profits.

The difference in prices does not seem too much. Most Pakistani FMCG companies impose pink tax of Rs10-25 per product on items that cost below Rs100 but in the longer run, this can cumulatively cost a woman millions of rupees, she said.

“What is ironic is that there is no age at which the pink tax kicks in. It starts right after birth because baby suits for boys are priced lower compared to girls,” she remarked.

She said that even in sports, the gear for females in mostly priced higher and it is harder to find in Pakistan as well.

Pink tax is paid by girls for school bags, water bottles, notebooks, pens, stationary, watches, toothbrushes, cycles are other items during the adolescent stage, she stated.

“However, it is good to see that many wholesale and retail businesses and supermarkets have started combating the pink tax by equalising the price of men and women variants of the same products,” she cherished.

According to her, pink tax was a strategy of the companies to enhance revenues by introducing separate items aimed at women.

The source detailed that this practice is being employed for past many years but now consumers have turned smart enough to realise it and buy cheaper variants of products that are marketed for men.

Companies have been capitalising on gender for quite some time but it is only recently that people have begun to realise, she noted.

“On the international level, mask companies introduced a pink surgical mask which was priced higher than usual blue or green surgical mask,” she lamented. “Similarly, some pharmaceutical companies have introduced different tablets for women in international markets including Panadol and they are priced higher therefore pink tax is prevalent in pharmaceutical sector also which is absurd.”

She elaborated that in the previous years, this practice was widespread in the mobile phone industry but lately it has turned almost non-existent in this particular segment.

In 2012, mobile phones of feminine colours such as red, pink and purple were Rs1000-1500 more costlier than their usual black and white counterparts.

“Few firms justify pink tax by claiming that marketing of women products is costly since it is just targeted at half of the population compared to general products which cover whole population in the same marketing campaign,” she said.

She voiced firm hope that with right amount of campaigning, this practice could end in next 10-20 years and without pink tax, world would be a more fairer and equal place.