With the novel coronavirus pandemic encouraging cash averse economies, cryptocurrencies have gained significant traction. Long seen with some scepticism on account of their mysterious technological nature, this has been especially true over the past few weeks as a handful of big-ticket firms pledged their support for using digital currencies as a payment mechanism.

The pace of global digitalisation accelerated last week in particular after renowned firms, such as Mastercard and Tesla, voiced their interest in adopting cryptocurrencies as a mode of payment. This move is expected to trigger a cryptocurrency revolution across the world and could lead to a wider acceptance of digital currencies as modes of payment as well as pave way for development of required infrastructure to adopt such currencies.

Even as it has made strides in the digital side of things in recent years, Pakistan, like in other aspects of the sector, seems to lag behind when it comes to cryptocurrencies.

Illegal tender

At present, digital currencies are not considered legal tender in the country by the central bank. In a statement in 2018, the State Bank of Pakistan stated that virtual currencies like Bitcoin, Litecoin, Pakcoin, OneCoin, DasCoin, Pay Diamond or Initial Coin Offerings (ICO) tokens are not legal tender, issued or guaranteed by the government of Pakistan. “SBP has not authorised or licensed any individual or entity for the issuance, sale, purchase, exchange or investment in any such virtual currencies/coins/tokens in Pakistan,” the central bank announced.

“In view of the foregoing, all banks/ development financial institutions/ microfinance banks and payment system operators (PSOs)/payment service providers (PSPs) are advised to refrain from processing, using, trading, holding, transferring value, promoting and investing in virtual currencies/tokens.

Furthermore, banks/ development financial institutions/ microfinance banks and PSOs/PSPs will not facilitate their customers/account holders to transact in virtual currencies/ICO tokens. Any transaction in this regard shall immediately be reported to financial monitoring unit (FMU) as a suspicious transaction,” SBP concluded.

Pakistan is not alone either in its blanket ban on digital currencies. Six other nations, namely Bangladesh, Nepal, Egypt, Algeria, Morocco and Bolivia have a complete prohibition on cryptocurrency at the moment. An even larger number of nations, including Canada and China have placed significant usage restriction on the technology as well. While it is legal to hold cryptocurrency in these nations, banks operating in them are not allowed to open or maintain accounts or have a correspondent banking relationship with companies dealing in virtual currencies unless they fulfil a set of strict legal formalities.

Also read: Bitcoin set for worst week since March as riskier assets sold off

Demystifying crypto

What is a cryptocurrency and how is its price regulated? According to prominent cryptocurrency expert Jan Lansky, it is a kind of payment mechanism that does not require a central authority and its state is maintained through distributed consensus. Moreover, cryptocurrency is an intangible asset and it does not exist in a physical form.

Because there is no institution backing cryptocurrencies, they are prone to price massive volatilities. In fact, one particular digital currency recorded 3,200% growth over a period of three months.

Many cryptocurrencies are decentralised networks based on blockchain technology, which is a distributed ledger enforced by a disparate network of computers. Distributed ledgers are a way to record and share data across multiple data stores that each have the exact same data records and are collectively maintained and controlled by a distributed network of computer servers, which are called nodes.

DESIGN: KIRAN SHAHID

According to a European Union paper on cryptocurrencies, blockchain is a mechanism that employs an encryption method known as cryptography and uses a set of specific mathematical algorithms to create and verify a continuously growing data structure that takes the form of a chain of transaction blocks. Data can only be added to this structure and existing data cannot be removed, providing a complete and secure transactional history.

blockchain is an essential component of cryptocurrencies as it helps collect data pertaining to transactions and store it electronically on computer systems. In practice, the EU paper describes it as “a technology with many faces” that can exhibit different features and cover an array of systems ranging from fully open to permissionless.

On an open, permissionless blockchain, a person can join or leave the network at will, without having to be pre-approved by any central entity. All that is needed to join the network and add transactions to the ledger is a computer on which the relevant software has been installed. There is no central owner of the network and software, and identical copies of the ledger are distributed to all the nodes in the network. The vast majority of cryptocurrencies currently in circulation are based on permissionless blockchains.

On a permissioned blockchain, the nodes that serve as validators of transactions must be pre-selected by a network administrator who sets the rules for the ledger. This allows a way to easily verify the identity of the network participants. However, at the same time it also requires network participants to put trust in a central coordinating entity to select reliable nodes.

Permissioned blockchains can also be further divided into two subcategories. Open or public permissioned blockchains, which can be accessed and viewed by anyone, but where only authorised network participants can generate transactions and/or update the state of the ledger, and closed or‘enterprise’ permissioned blockchains, where access is restricted and where only the network administrator can generate transactions and update the state of the ledger.

Crypto wallets and exchange

A defining feature of cryptocurrencies is that they are generally not issued by any central authority, rendering them theoretically immune to government interference or manipulation. It is a relatively newer form of digital asset based on a network that is distributed across a large number of computers.

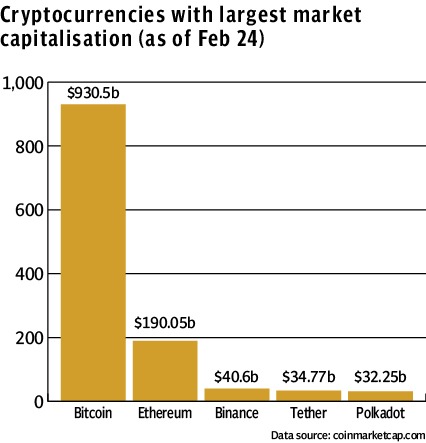

Some of the most prominent and widely circulated cryptocurrencies around the world include Bitcoin, Ethereum, Ripple, Bitcoin Cash and EOS.

Just like different currencies can be bought on at currency exchangers, cryptocurrencies can be purchased from dedicated digital currency exchanges or physical cryptocurrency ATMs. The largest cryptocurrency exchange in the United States by trading volume is Coinbase which offers users the facility to purchase digital currencies through its application. Lately, a few brokerage firms have begun offering cryptocurrency exchange services as well. Robinhood, an application that helps retail investors pour money in stock market, has also started offering cryptocurrency exchange services and users can freely trade select cryptocurrencies on the application.

Since cryptocurrencies do not exist in physical forms, they are stored in digital wallets called coin wallets which are quite similar to digital bank accounts. These wallets offer the facility to store and exchange cryptocurrencies as well as to convert them to cash. Coin wallets are encrypted to protect user’s privacy and investment.

Mining digital ‘gold’

The amount of cryptocurrencies available in the market depends on its mining. Mining, with regard to digital currencies, is a technique of using advanced computers to produce more cryptocurrencies and add it to the ledger or blockchain. Mining helps regulate the prices of cryptocurrencies because it is the supply mechanism of digital currencies while demand is generated from the general public.

The price of the digital currency bitcoin hits an all-time high this year. PHOTO: REUTERS

In order to keep track of past transactions without a trusted intermediary, most cryptocurrencies rely on an automatic process to achieve consensus among a majority of participants, according to a World Bank report on digital currencies and blockchain. To solve the so-called ‘distributed consensus problem’ that arises from this process, participants are allowed to compete for permission to add a new batch of transactions to the decentralised database.

This is achieved by letting participants use their compute power to solve a difficult puzzle, the solution of which is impossible to find analytically and can only be reached through trial and error. The first person that solves the puzzle can add a block of new transactions to the chain of existing transactions and broadcast the new block to the network, so that all participants can update the blockchain in their own copy.

Although the puzzle is difficult to solve, its solution is easy to verify, allowing the nodes in a cryptocurrency network to easily determine if a proposed block is valid and should be added to the chain. Even if a node goes offline for a period of time, the network is not jeopardised. When the node goes back online, it accepts the longest valid chain as the correct one.

According to the WB report, if honest participants own most of the computer power, the expectation is that they will create the longest chain, as the probability that they add new blocks is proportional to their computer power. As a result, the longest chain can be considered the consensus view.

If a dishonest participant adds a block that is not accepted by others in the chain, that block will not become part of the longest chain, because the participant will not have enough computer power to add more blocks to the chain quickly enough.

The difficulty of the puzzle is adjusted regularly – every two weeks for Bitcoin in order to create about one block per 10 minutes. Limiting the addition of a new block to the blockchain to one every 10 minutes prevents the network from being overwhelmed and keeps the size of the blockchain manageable.

Competition for the right to add a block to the blockchain also solved the problem of the creation of new electronic coins, the WB report explains. People who solve the puzzle receive a combination of newly minted coins and transaction fees. “The creation of new digital coins is like unearthing gold, which is why the puzzle solvers are called miners in the world of cryptocurrencies,” the report states.

So what are the risks?

Detailing the issue to The Express Tribune, Arif Habib Commodities Managing Director and CEO Ahsan Mehanti said legalisation of cryptocurrencies and their recognition as legal tenders were not in the national interest of Pakistan.

This is because money can freely move in and out of Pakistan through cryptocurrency trade and it will be difficult to keep a track of each and every transaction.

“Moreover, majority of these digital currencies are priced in dollars hence uncontrolled trade can distort the foreign exchange market of Pakistan,” he said. “If massive amount of investment takes place in a dollar based cryptocurrency, it can weaken Pakistani rupee in a single day.”

The official pointed out that cryptocurrencies were also prone to massive fluctuations hence regulators will face problems in controlling the buying and selling price if their trade is allowed.

One of the petitions claims Bitcoin as the second legal tender in Luxembourg. PHOTO: AFP

Mehanti added that the State Bank of Pakistan has a Foreign Exchange Manual and all trade in the foreign currencies should adhere by rules of the manual. He voiced fear that trade in digital currencies break some of those rules.

“In addition, cryptocurrency trade can also breach anti money laundering laws and in such an incidence, Pakistan as a whole would have to pay the cost,” he said. “Cryptocurrencies are easier to misuse and it had been reported that a certain cryptocurrency was used to fund unrest in Syria a few years ago.”

An inevitable paradigm shift

On the other hand, Alpha Beta Core Managing Director Farhan Bashir Khan assumed a softer stance for cryptocurrencies and supported their regularisation at a smaller level.

“It is a fresh technology and every innovation has its merits and demerits,” he underlined. “However, regulation of cryptocurrencies remains an issue.”

He detailed that blockchain technology enabled cryptocurrencies to have distributed ledgers.

A distributed ledger is a database that is shared and synchronised across multiple institutions and in case of cryptocurrencies, these institutions are countries of the world.

“Anyone can participate in mining of cryptocurrencies and blockchain technology helps with cryptocurrency transactions,” he said.

He added that global institutions such as Mastercard were moving towards decentralisation of cryptocurrencies however in Pakistan, only SBP could grant a licence for trade of digital currencies.

“At present, our central bank is focusing on fintech revolution,” he pointed out.

He said that different countries have assumed different positions on cryptocurrencies and while some governments are actively investing in it, others have imposed a total ban on its trade.

“This new technology should be adopted,” he stressed. “The existing payment solutions might become obsolete in future so it is better to adopt newer technologies to avoid payment hurdles in years to come.”

Talking about the regulatory side, he was of the view that citizens of Pakistan should be allowed to trade cryptocurrencies at a smaller level if global trade posed severe issues for the country.

“If there are problems with adopting international cryptocurrencies as modes of payments, local solutions should be developed and approved by the State Bank to create awareness among masses.”

Besides, approval of digital currencies on the local level will discourage cash economy, which is one of the major aims of the State Bank after Covid-19 surfaced in Pakistan.

The dark side of caution

Farhan voiced fear that if Pakistan failed to approve cryptocurrencies timely, then confusion will persist among masses and they will become vulnerable to scams and frauds.

New technologies are used to exploit people and criminals have begun scamming Pakistanis under shady cryptocurrency investment schemes, he said.

A Bitcoin (virtual currency) coin is seen in an illustration picture taken at La Maison du Bitcoin in Paris, France, June 23, 2017. PHOTO: REUTERS

The official lamented that many such scams were underway in Pakistan.

He emphasised that the central bank or prominent financial sector institutions should work to create awareness regarding it.

Pakistan has low penetration of insurance and mutual funds and this is a highly complicated technology hence awareness is needed at a large scale.

“People tend to give in to the hype and organising awareness sessions will teach them the risks and dangers of the digital currencies,” he said. “Cryptocurrency is a risky asset and people should be taught what kinds of transactions are dangerous.”

Digitally averse consumers

An official from the financial sector of Pakistan, on the condition of anonymity, highlighted that Pakistan had a lofty unbanked population that wants to make only cash transactions.

“A massive chunk of public is averse to digital payments, insurance schemes, mutual funds, investment in stocks hence adoption of cryptocurrency will be very difficult for Pakistan,” he said. “Digital currency is itself a very complicated concept and it will be a labourous task to motivate the public to adopt it.”

“Here, people like to keep cash in hand rather than store it in financial institutions,” he said. “They are likely not to trust investing or storing cash in an online currency.”

He pointed out that most people of the country do not understand the mode of payment through QR codes and stressed that Pakistan would have to make stringent efforts to promote use of cryptocurrencies if they get a go ahead from the State Bank of Pakistan.

He added that there will be problems related to privacy of cryptocurrencies highlighting that Pakistan would need to create a highly secure and updated ecosystem to adopt them.

He recalled a few past incidents where data of bank consumers in Pakistan was leaked and as a result, a handful of people lost money from their accounts.

“If such an incident affects cryptocurrency trade, it will be enough to divert people away from it once and for all,” he said.

Not as easy as you think

Talking about the region, he said even India, which is way ahead of Pakistan in terms of digitalisation, was having a hard time adopting cryptocurrencies.

At present, Indian government is preparing Cryptocurrency bill which will ban all cryptocurrencies in the country except for a state-backed digital currency.

He pointed out that though detrimental, such a move would also help educate the citizens and prepare them for cryptocurrency revolution.

A CEO of an e-commerce company told The Express Tribune that there were a lot of questions and confusions regarding cryptocurrencies from everyone including the regulators of Pakistan.

When asked whether his platform would readily adopt cryptocurrencies as a payment mode, he said it was unlikely due to strong price fluctuations in them.

“Unless cryptocurrencies are fully legalised or allowed by the central bank, we cannot use it as a payment method,” he said.

Global concerns and challenges

According to both the WB report and the EU paper, cryptocurrencies and blockchain technologies pose difficult challenges for policy makers around the world. As there is no regulatory framework for transfers made with cryptocurrencies or smart contracts, transfers occur outside anti-money-laundering compliance programmes, and smart contracts are not subject to consumer protection laws or financial oversight.

The WB report points out that if cryptocurrencies are not recognised by law as payment systems and are instead viewed as commodities, existing tax codes cannot cover them. “It is difficult to determine the geographic location of the value added created by cryptocurrency mining. Tax legislation therefore has to be adjusted to incorporate these new activities into direct and indirect tax systems.”

Another ambiguity for policy makers is whether these new activities should

be supported or constrained. “Should they be encouraged because of positive externalities and first-mover benefits? Or should they be constrained, because they crowd out investments with greater social return,” the WB report asks.

The EU paper also warns about the risks posed by the anonymity of cryptocurrency players and users, especially in light of issues like money laundering and terror-financing.

“The key issue that needs to be addressed in order to adequately capture cryptocurrencies and cryptocurrency players, particularly users, in legislation is to unveil the anonymity, varying from complete anonymity to pseudo-anonymity, that surrounds them,” it states. “The anonymity prevents cryptocurrency transactions from being adequately monitored, allowing shady transactions to occur outside of the regulatory perimeter, allowing criminal organisations to use cryptocurrencies to obtain easy access to ‘clean cash’.”

Pertinent to terror-financing risks is the case of Ali Shukri Amin, an American teen who provided instructions on Twitter on how to use Bitcoin to mask donations to the Islamic State.

Anonymity is also the major issue when it comes to tax evasion. “Entering into taxable cryptocurrency transactions without paying taxes is tax evasion. But, when a tax authority does not know who enters into the taxable transaction, because of the anonymity involved, it cannot detect nor sanction this tax evasion,” the EU paper warns. “This makes cryptocurrencies a very attractive means for tax evaders.”

Also read: India plans to ban all private cryptocurrencies

A way forward

While shying away from specific advice, the World Bank has proposed a set of general guidelines for dealing with cryptocurrency based on experiences with other digital technologies like e-commerce.

It advises governments to give the new technologies space, and avoid imposing restrictive legislation before initial ambiguities are resolved. “Even if these technologies are ultimately unsuccessful, the experiments can help develop entrepreneurial skills, put competitive pressure on more traditional activities, and trigger innovations in other sectors,” the WB report states. “A dynamic business climate should encourage innovations, experiments, and risk taking.”

The report also urges governments to make implicit subsidies explicit, and be clear about risks. “If activities are not yet covered by the tax code or are undertaken in special economic zones, the implicit subsidy and its temporary nature should be calculated and made public. Consumers should be warned about risks, such as the risks associated with volatile cryptocurrencies.”

According to WB, governments should also start planning for how they can level the playing field. “If these technologies become successful, they should be integrated into the formal economy. Tax codes and regulations should be adjusted, so that both old and new technologies operate on a level playing field.”

Finally it advises governments to innovate and explore how blockchain technologies can further digitise government services.

Discussing how cryptocurrency miners may be enjoying ‘implicit subsidies’ in some nations, the WB report highlights the outsized use of electricity in the mining process. “If mining companies pay a lower electricity price than the marginal cost of supplying more electricity, governments should consider raising tariffs or at least calculating the implicit subsidy,” it suggests. “The sharp increase in electricity demand might be an opportunity to develop an electricity market with intra-day price fluctuations, so that price differentiation reflects actual costs. Uncertainty about future electricity demand for cryptocurrency mining warrants a rethinking of contingent liabilities of governments where additional power plants are built by public-private partnerships.”

It adds that at some point, electricity tariffs for mining could be used as indirect taxation of the value added created by miners. “Although it is difficult to determine the geographic location of the output of these activities, it is easy to locate the inputs.” The report also states that when financial oversight finally covers cryptocurrencies, that process will be a gradual one of trial and error.