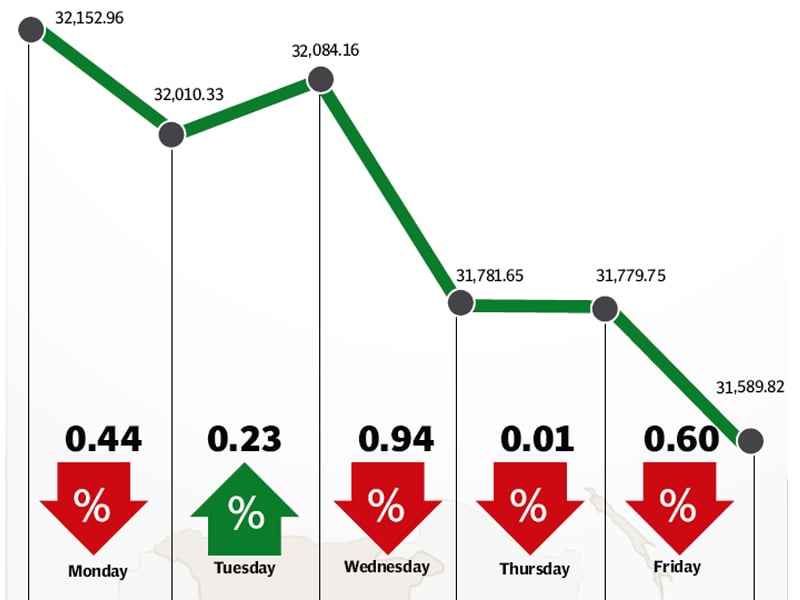

The stock market witnessed a volatile week as political unrest and declining oil prices shook investor confidence and resulted in the benchmark KSE-100 index falling 559 points (1.7%) to close at 31,589.

After closing at a record high of 32,148 points in the previous week, the mood turned sour as the opposition Pakistan Tehreek-e-Insaf party went ahead with its plans of protesting in the country’s major cities due to the government’s failure to properly investigate electoral rigging in the May 2013 elections.

The PTI’s calls, first in the industrial city of Faisalabad and then in Karachi, went ahead as planned. With a shutdown of Lahore planned for the coming Monday, tensions are expected to run high due to the city being a traditional stronghold of the ruling PML-N party.

During the week, global oil prices continued to decline and put pressure on the heavyweight oil and gas sector. Oil prices fell to as low as $60 per barrel during the week and are expected to fall further in the coming months, resulting in investors offloading shares in OGDC, PPL and POL, all of which ended the week in the red.

The political situation and declining oil prices did not sit down too well with foreign investors who continued to be net sellers, offloading a whopping $24 million worth of equity during the week as compared to net selling of $1.8 million in the previous week. The declining oil prices, however, did continue to have a positive impact on other sectors as the government announced a reduction in the electricity tariff during the week. The cement sector received the news well and was in the limelight throughout the week with DG Khan Cement, Maple Leaf Cement and Lucky Cement ending the week with gains of 11.8%, 11.2% and 5.2% respectively.

There was good news on the macro front as well with the country’s foreign exchange reserves shooting up to $13.9 billion after the receipt of fund from the $1 billion Sukuk sale in the previous week. Remittance figures were also encouraging with the first five months of the current fiscal year bringing in $7.4 billion, up 15.5% year-on-year.

Despite the political unrest and hiccups with the secondary offering of the OGDC, the government continued to pursue its privatisation programme and offloaded its stake in Allied Bank Limited during the week. The offering received a positive response and was oversubscribed by 1.4 times, reflecting investor confidence.

Average trading volumes plunged 32% and stood at a 237 million shares traded per day. While average daily values also fell 25% clocking in at Rs12.66 billion daily. The Karachi Stock Exchange’s market capitalisation stood at Rs7.20 trillion ($ 72 billion) at the end of the week.

Winners of the week

Kohinoor Textile

Kohinoor Textile Mills Limited produces textiles. The company weaves, dyes, and prints natural and synthetic fibers.

Shezan International

Shezan International Limited manufactures and sells juices, beverages, pickles, preserves, and flavourings which are all derived from fresh fruits and vegetables.

DG Khan Cement

DG Khan Cement Company Limited manufactures and sells portland cement.

Losers of the week

Abbott Laboratories

Abbott Laboratories manufactures, imports, and markets research based pharmaceutical, nutritional, diagnostic, hospital, and consumer products. The company’s key products include antibiotics for respiratory tract infections, peptic ulcer disease, and dental infections.

Searle Pakistan

Searle Company manufactures and sells pharmaceutical and healthcare products. The company also sells a range of food products and consumer items.

Mari Gas

Mari Gas Company Limited specialises in the drilling, production and selling of natural gas.

Published in The Express Tribune, December 14th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1719053250-0/BeFunky-collage-(5)1719053250-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ