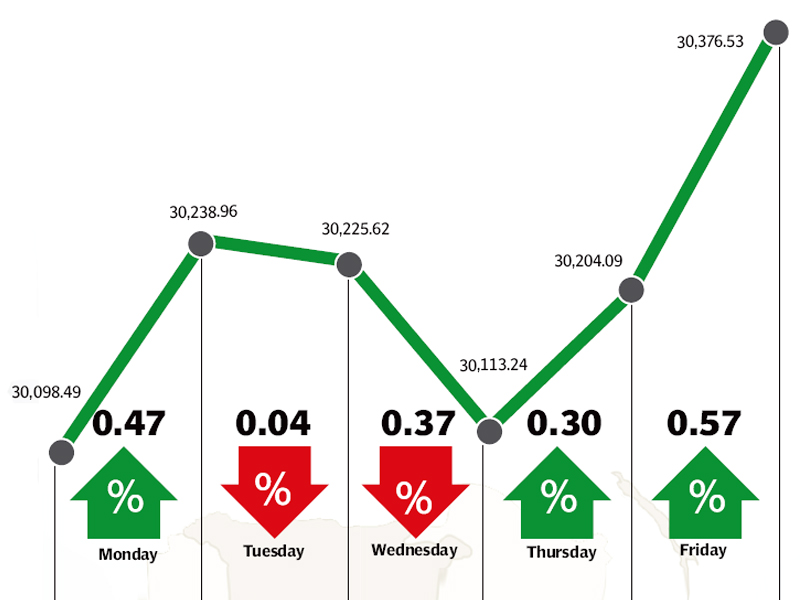

The stock market maintained its upward momentum on the back of strong corporate earnings as the benchmark KSE-100 index rose 278 points (0.9%) to close at 30,376 points during the week ended October 31.

Investors overlooked declining oil prices and continued sell-off by foreign investors to aid the index in cementing its position above the 30,000-point barrier. Sector-specific activity was witnessed throughout the week as the KSE-100 index made marginal gains in four out of the five sessions of the week.

Corporate earnings announcements were catalysts for the index’s gains this week as the earnings for the quarter ended September 30, 2014 came to a conclusion during the week. The banking, power and auto sectors shared the limelight and were major contributors to the index’s growth.

The banking sector dominated trading activity for the majority of the week after United Bank Limited announced better-than-expected earnings for the nine-month period of 2014. The company’s earnings grew 22% year-on-year and resulted in its share price shooting up 5% and contributing 84 points to the KSE-100’s gains during the week.

The power sector was up next with the country’s two largest independent power producers (IPPs), Kapco and Hubco announcing their earnings. Kapco’s earnings were above market expectations while Hubco also matched market expectations, resulting in activity in the sector. The former’s share price grew 8.8% and contributed 48 points to the KSE’s gains. The auto sector’s strong performance at the bourse continued with Pak Suzuki Motor Company (PSMC) announcing earnings above market expectations. The company’s share price shot up 11% during the week and was closely followed by Honda Atlas Cars, which also attracted a lot of investor interest.

Towards the end of the week, Oil Marketing Companies (OMCs) came into the limelight after the Economic Coordination Committee approved the increase in OMC margins in a meeting on October 30.

Market sentiment was also strengthened by the improving macro outlook of the country with low inflation numbers expected for October. The country’s prime minister is also expected to embark on a trip to China and attract foreign investment in the country’s ailing power sector in the coming weeks.

The oil sector remained a key laggard during the week as global crude oil prices continued to fall. The heavyweight dragged the index downwards with the Oil and Gas Development Company alone contributing 84 points to its decline.

Foreigners also continue to be net sellers and sold $7.84 million worth of equity during the week. Selling was witnessed in the first four days of the week, but net buying was witnessed on the final trading day of the week.

Average trading volumes remained steady at 172 million shares, up 4.4% over the previous week. However, average trading values shot up by 28.6% and stood at Rs10 billion per day. The KSE’s market capitalization stood at Rs7.03 trillion at the end of the week.

Winners of the week

Soneri Bank

Soneri Bank Limited provides banking services.

Searle Pakistan

The Searle Company Limited manufactures and sells pharmaceutical and healthcare products. The company also sells a range of food products and consumer items.

Pak Suzuki Motors

Pak Suzuki Motor Company Limited manufactures, assembles and markets Suzuki cars, pickups, vans and 4 X 4 vehicles.

Losers of the week

Nishat Mills

Nishat Mills manufactures and sells yarn and fabric. The company operates spinning, weaving, dyeing, and finishing units.

Attock Refinery

Attock Cement Pakistan Limited manufactures and sells cement and related products. The company is also part of the Pharaon group, which in addition to investments in the cement industry also owns interests in the oil and gas sector.

Pace Pakistan Limited

Pace Pakistan Limited develops real estate in both the residential and commercial sectors. The company develops and constructs shopping malls, supermarkets, and apartments.

Published in The Express Tribune, November 2nd, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1719053250-0/BeFunky-collage-(5)1719053250-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ