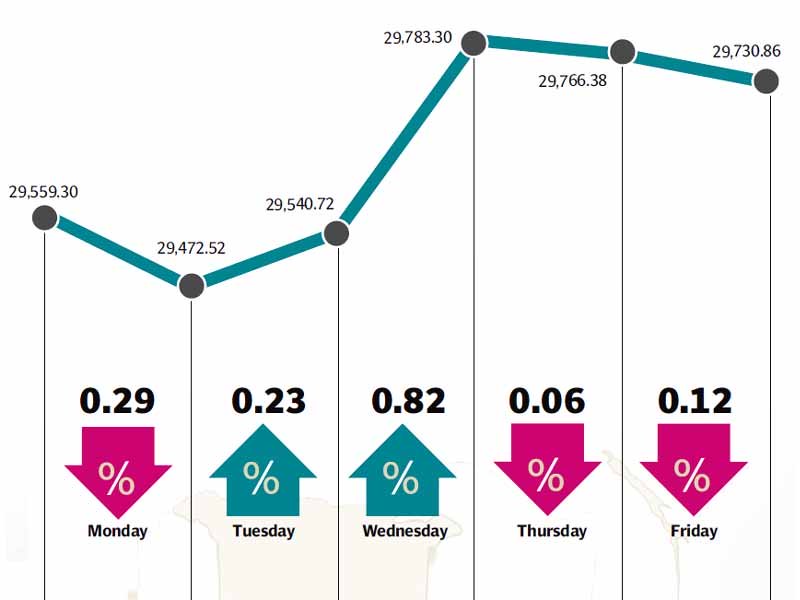

The stock market got back on course towards crossing the 30,000 barrier as the privatisation of United Bank Limited kept investors upbeat and aided the benchmark KSE-100 index in gaining 221 points (0.8%) to close at 29,731 during the week ended June 13.

The gains came despite the chaos in Karachi where a major terrorist attack took place. The city’s heavily-guarded international airport was attacked and received significant damage in an audacious attack which left security forces reeling and highlighting the precarious law and order in the country.

However, investors remained in an upbeat mood and reacted positively to the Secondary Public Offering of the government-held shares in United Bank Limited. The SPO was oversubscribed more than two times over and received significant interest from foreign buyers. It was the country’s first privatisation deal in over eight years.

The successful offering managed to raise Rs38.2 billion for the government and is the first in line of the government offloading its holdings in major public sector companies. The government intends to offload a 5% holding interest in Pakistan Petroleum Limited before the month’s end, followed by offerings of shares in the Oil and Gas Development Company and Habib Bank Limited.

Macroeconomic data also provided a boost to the market as the country’s foreign exchange reserves continued to grow and reaching $13.46 billion, according to the latest figures by the State Bank of Pakistan. The country’s finance minister also announced that reserves would reach $14 billion by the end of June after receipt of various payments.

The country’s trade deficit also shrunk 5.66% year-on-year to $17.67 billion for the 11-month period of the outgoing fiscal year. The decline was due to a 3.7% increase in exports while imports posted a marginal decline over the previous year.

Sector-specific news also played its part as the announcement of the World Bank providing a $700 million loan for the construction of the Dasu dam provided a boost for the cement sector. Pakistan Telecommunications attracted investor interest after news of the government reaching a resolution with Etisilat over the property dispute issue.

Foreign buying continued to be strong as foreigners were net buyers of $21.6 million worth of equity. Foreign participation in the UBL offering was also strong and had a positive impact on investor sentiment.

Average trading volumes took a downturn and stood at 215 million shares traded per day, falling 17% over the previous week. Average trading value also took a hit and stood at Rs10 billion, down 24% over last week. The market capitalisation of the Karachi Stock Exchange stood at Rs7.05 trillion at the end of the week.

Published in The Express Tribune, June 15th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1719053250-0/BeFunky-collage-(5)1719053250-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ