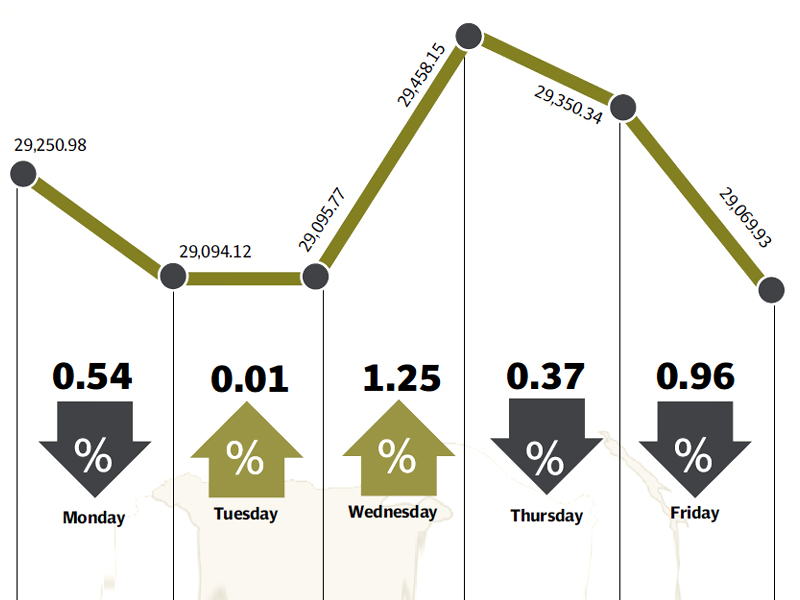

The stock market finally took a breather after three week of solid gains as the benchmark KSE-100 index fell 179 points (0.6%) to close at 29,069 during the week ended April 18.

The index had gained 2,484 points (7.9 %) in the last three weeks as heavy foreign buying along with a flurry of positive macroeconomic news pushed the market to unprecedented heights.

The declines came despite the start of the corporate earnings season which saw several industry heavyweights reveal their earnings for the quarter ended March 31. Selling in the all-important oil and gas sector along with a reduction in foreign inflows also contributed to the market’s losses.

The market opened on a negative note as a correction was witnessed in shares of heavyweight companies and pressure on textile stocks due to the rupee appreciation against the dollar. A mid-week rally was witnessed due to heavy buying in the banking sector and led to the index closing at a new record high of 29,458 points on Wednesday.

However, profit-taking and heavy selling in the Oil and Gas sector resulted in the index declining 1.4% in the final two sessions to close slightly above the 29,000 points barrier at 29,096 on Friday. The start of the Easter holidays also meant that foreign buying ($7.5 million for the week) was at a minimum and could not provide support to the index.

The earnings season kicked off in full gear this week with several industry heavyweights announcing their results for the period ended March 31. The results were by and large in-line (Attock Group Companies) or above (Engro Foods, KAPCO) market expectations and had a positive impact on the market.

The banking sector was the star performer of the week as heavy buying was witnessed in the sector as investors anticipate higher earnings on the back on increased Net Interest Margins following the latest PIB auction. Allied Bank, Askari Bank and United Bank Limited led the way with gains of 11.3%, 10.5% and 8.6% respectively during the week.

The Oil and Gas sector was the laggard of the week as profit-taking was witnessed in the sector. Oil and Gas Development Company, Pakistan Petroleum Limited, Pakistan Oilfields Limited and Pakistan State Oil all closed in the red and cumulatively contributed 257 points to the KSE-100’s decline.

On the macro front, there was more good news as the State Bank received the $2 billion from the Eurobond issue, helping boost the country’s foreign exchange reserves to $11.57 billion. The country’s Finance Minister also announced during the week that he expects reserves to climb to $16 billion by September 2014.

Average daily volumes shot up by 18% and stood 367 million shares traded per day. Average daily values were also up 8.5% and stood at Rs14 billion per day. The market capitalisation of the KSE fell to Rs6.98 trillion at the end of the week.

Winners of the week

Mari Gas Company Limited

Mari Gas Company Limited specialises in drilling, production and selling of natural gas.

Pakistan Services

Pakistan Services Limited is the holding company for Pearl Continental Hotels (Private) Limited, which constructs, operates and manages hotels. The Group also owns a number of smaller companies that provide car rental and

tour packages.

Pakistan International Container Limited

Pakistan International Container Terminal operates a container shipping facility in Karachi, Pakistan.

Losers of the week

National Refinery Limited

National Refinery Limited manufactures and distributes lube base oils and petroleum fuels. The Company markets its products to customers throughout Pakistan.

GlaxoSmithKline

GlaxoSmithKline Pakistan Limited manufactures and markets pharmaceuticals and animal health products.

Pakgen Power Limited

Pakgen Power Limited generates and distributes electricity. The company operates an oil-fired electricity generating plant in Mehmood Kot - Muzaffargarh, Punjab.

Published in The Express Tribune, April 20th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1719053250-0/BeFunky-collage-(5)1719053250-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ