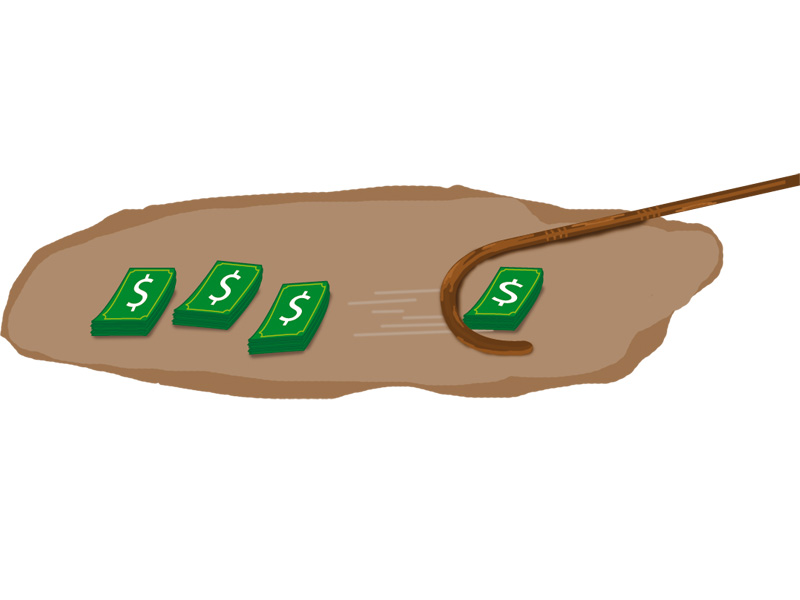

Our foremost objection is on pricing. The interest rate being paid by the government on the 10-year US-dollar denominated bond is going to be 8.25 per cent, which does not compare favourably to the 6.875 per cent the government was able to pay on the last time it issued a similar bond in 2007. And interest rate conditions have not worsened during that time. Benchmark interest rates in the United States have declined from 5.25 per cent in 2007 to around 0.25 per cent today. The premium being paid by the government above US treasury bonds has multiplied manifold. Getting international investors to invest in Pakistan on the basis of price alone is a bad strategy, one that risks permanently damaging the country’s reputation. It is bad enough that the global rating agencies have labelled Pakistani government debt as junk. It is even worse when the government appears to have largely accepted that statement as fact and stated to the global bond markets that Pakistani debt will be available to invest in on the cheap. That is a high price to pay for success at something so ephemeral as increasing the foreign exchange reserves.

If anything, the interest rate the government will be paying is a damaging indictment of the government’s fiscal policy: contrary to Finance Minister Ishaq Dar’s pronouncements, the market has spoken and it is not impressed with his management of the Pakistan’s national exchequer and is thus demanding a higher interest rate to compensate for the greater risk. This is the price we must pay for our leaders’ continued willingness to delude themselves and the nation.

Published in The Express Tribune, April 14th, 2014.

Like Opinion & Editorial on Facebook, follow @ETOpEd on Twitter to receive all updates on all our daily pieces.

COMMENTS (4)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1719053250-0/BeFunky-collage-(5)1719053250-0-270x192.webp)

ET you never fail to disappoint, and this time you've sunk to a new low - plagiarism. way to drive seasoned contributors away for good. keep it up.

So much for freedom of expression! Anyone who points out ET's unethical practices will get barred from commenting! Bravo!

Spot on editorial.