The country’s stock market remained in consolidation mode as corporate earnings failed to impress, resulting in the benchmark KSE-100 index falling by 287 points (1.1 percent) during the week ended February 14.

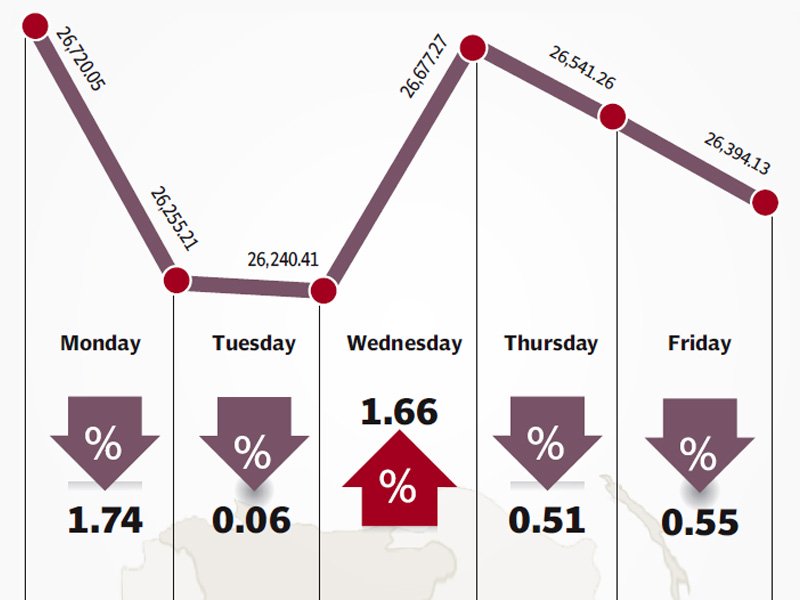

The deteriorating law and order situation in Karachi coupled with declining foreign exchange reserves and an outflow of foreign investment in the bourse resulted in the KSE-100 index closing in the red for the third consecutive week. The index managed to close in the green only once, on Wednesday, and ended the week at 26,394 points.

The index has been in constant decline since hitting an all-time high of 27,104 last month, as it failed to sustain itself above the 27,000-point barrier. The drop has come about as a result of foreigners offloading their investments in emerging markets around the world.

The ongoing earnings season failed to impress investors as a number of blue-chip companies announced their full-year earnings during the week. MCB Bank led the way with below expectations earnings per share (EPS) of Rs21.24 and a final payout of Rs3.5 per share. The company did manage to attract investor’s attention after it announced its plans to acquire Burj Bank towards the end of the week.

Engro Corporation was next with its full year earnings for 2013. The company posted EPS of Rs16.01, a jump of more than 500 percent year-on-year. However, it disappointed with its dividend In Specie of Engro Fertilizer shares in the ratio of 1 EFert share for every 10 Engro shares. Investors had anticipated a bonus share issue from the company.

With the earnings failing to generate interest in the bourse and lack of any significant triggers, the KSE-100 index fell prey to a sell-off towards the end of the week. Investors’ fears of foreign selling materialised this as foreigners were net sellers of $5.56 million worth of equity during the week.

The country’s foreign exchange reserves position also took a hit as the total forex reserves declined to $7.6 billion, while the reserves of the State Bank of Pakistan also fell to $2.8 billion after the repayment of $147 million to the IMF.

The situation, however, is likely to improve in the coming weeks after the receipt of $352 million under the Coalition Support Fund from the US and the release of an IMF tranche of $550 million in early March after the successful conclusion of talks between the government and the IMF in Dubai.

Average trading volumes dropped by 10.2 percent and stood at 254.7 million shares traded per day, while average daily values also dropped slightly by 2.5 percent and stood at Rs8.69 billion traded per day. The market capitalisation of the KSE fell 0.8 percent and stood at Rs6.43 trillion at the end of the week.

Winners of the week

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Rafhan Maize

Rafhan Maize Products Company produces corn oil, industrial starches, liquid glucose, dextrin, gluten meals, and other corn related products. The company also produces a wide range of co-products such as gluten feeds, meals, and hydrol.

Dawood Hercules

Dawood Hercules Corporation produces urea fertilisers. The company also produces anhydrous ammonia for manufacturers of soda ash, fructose, and other chemicals.

Losers of the week

NetSol Technologies

NetSol Technologies Limited provides information technology solutions and services. The company’s services include custom software development, technology outsourcing, systems integration, application development, and business intelligence consulting.

Murree Brewery

Murree Brewery Company specialises in the manufacture of beer and Pakistani made foreign liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

JDW Sugar

JDW Sugar Mills produces and sells crystalline sugar. The company is located in Rahimyar Khan, and was formerly named United Sugar Mills Limited.

Published in The Express Tribune, February 16th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ