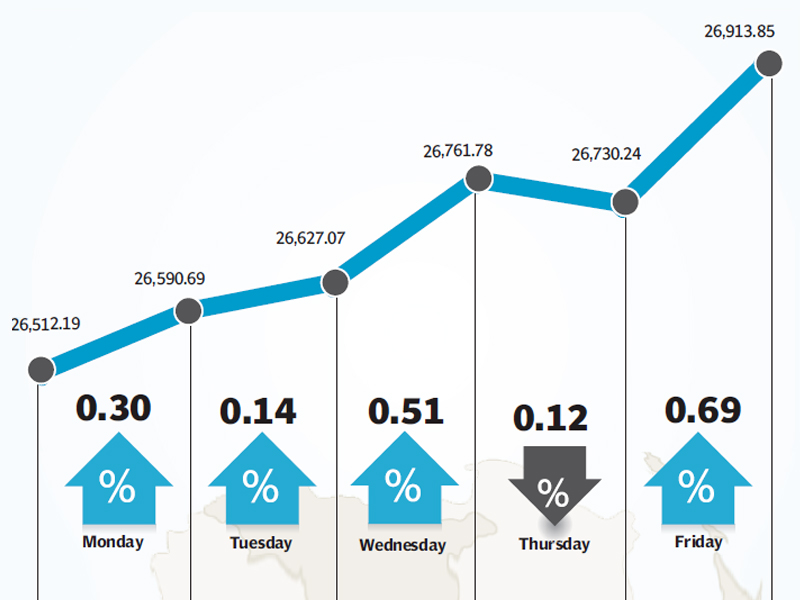

The stock market continued on its record-breaking run and hit a new all-time high as the benchmark KSE-100 index gained 425 points (1.6%) to close just shy of the 27,000 barrier during the week ended January 17.

The market’s gain came despite a slight decline in volumes as investors adopted a wait-and-see approach in the run up to the monetary policy announcement due at the end of the week. The KSE-100 index made steady progress throughout the week and closed at a new record-high of 26,913 points on Friday.

The fertiliser sector headlined news flows throughout the week with Engro being the major beneficiary of announcements, while foreign buying in oil companies also factored in the index’ growth. An improvement was also witnessed in macro-economic data which also improved investor sentiments.

The week started off slowly and volumes were low as investors awaited the announcement of the monetary policy by the State Bank. It was widely expected that a discount rate hike was on the cards, until December inflation figures were reported in single figures.

The surprisingly low inflation figures created confusion in investor’s minds making the policy announcement all the more important. The State Bank of Pakistan (SBP) did announce the monetary policy at the end of the week and chose to keep the discount rate unchanged at 10%. The announcement should have a positive impact in the coming week.

The fertiliser sector remained in the news throughout the week. Firstly, during a meeting between government officials and stakeholders of the fertiliser sector, it was decided to reduce urea prices by Rs114 per bag to partially reverse the Rs178 per bag price hike announce two weeks ago after the imposition of the Gas Infrastructure Development Cess on the sector.

Then, towards the end of the week, the Economic Coordination Committee announced that the government will honour its agreement of providing gas at a concessionary rate of $0.7 per mmbtu to Engro Fertilizer’s new plant and also announced a hike in the price of imported urea to match the price of locally manufactured urea.

The announcements were welcomed by market participants and Engro Corporation was the major beneficiary as it ended the week outperforming the market by 6.2%. Engro Fertilizer was also listed on the stock market on Friday and ended its opening day at the upper circuit breaker, up by 5%.

Foreigners returned to the fore and participated actively in the market and snatched up shares of oil companies. Net foreign buying stood at $7.6 million for the week.

Macro-economic figures reported during the week revealed that the country’s trade deficit for the first half of fiscal year 2014 had declined 8.75% year-on-year to $9.03 billion. The country’s foreign exchange reserves also improved by $267 million to $8.32 billion, according to latest SBP figures.

Average trading volumes dropped slightly by 7.3% and stood at 269 million shares traded per day. Average daily value similarly fell 9.7% and stood at Rs9.36 billion traded per day.

Winners of the week

Murree Brewery

Murree Brewery Company specialises in the manufacture of beer and Pakistan Made Foreign Liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

Jahangir Siddiqui and Company

Jahangir Siddiqui and Company is an investment company offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Feroze 1888 Mills

Feroze 1888 Mills Ltd manufactures and sells a wide range of cotton towels and fabrics.

Losers of the week

Shell Pakistan Limited

Shell Pakistan Limited markets petroleum and petrochemical products. The company also blends and markets different types of lubricating oils.

Javedan Corporation Limited

Javedan Corporation Ltd manufactures Portland cement, blast furnace slag cement and sulphate resisting cement.

Bank of Punjab

The Bank of Punjab (Pakistan) operates under the status of a scheduled bank in Pakistan. The bank provides commercial bank services.

Published in The Express Tribune, January 19th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ