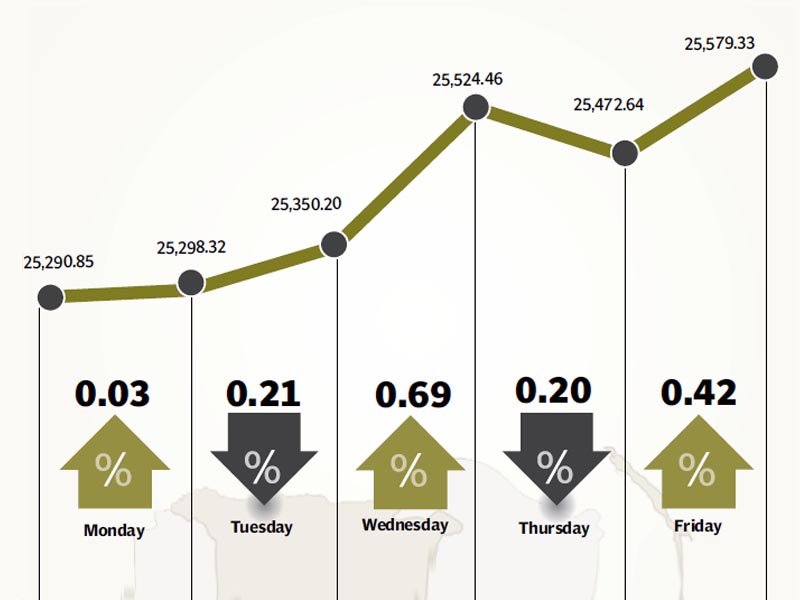

The country’s stock market continued to defy all odds and showed no signs of slowing down as the benchmark KSE-100 index posted another gain of 322 points (1.3%) to close at an all-time high of 25,579 points during the week ended December 20.

This was the fifth consecutive gain for the bourse and was surprising for market analysts, who believe that a market correction is long overdue. It has been an extremely impressive year for the KSE-100 index as it has shot up from 16,107 points in January to its current level of 25,579 points, a gain of 58%.

The week saw broad-based activity in almost all sectors and volumes jumped up by 27% as sector-specific news continued to flow. The index made steady gains throughout the week on its way to hitting the new record high at the end of trading on Friday.

The bulk of activity was recorded in banking, oil marketing, fertiliser, cement and textile sectors as positive news flow lured investors into buying their stocks.

The banking sector attracted interest on the government’s announcement that it would offload its stakes in two commercial banks by offering shares to the market. The possibility of a discount rate hike in January also attracted investors and several commercial banks posted gains.

The oil marketing sector also performed well as the Pakistan Institute of Development Economics (PIDE) recommended an increase in the margins of OMCs. The fertiliser sector also garnered interest as fertiliser prices are expected to be bumped up with the start of 2014.

Similarly, the cement sector performed strongly after Lucky Cement announced a price hike in Karachi.

The textile sector was not far behind with the continuing momentum from the European Union’s decision to award the GSP Plus status to Pakistan. During the week, the Economic Coordination Committee announced that it would redirect 85 mmcfd of gas to the textile sector to take advantage of the opportunity presented by the GSP Plus status.

On the macro level, there was good news in the form of the rupee appreciating against the dollar along with the State Bank of Pakistan managing to shore up its foreign exchange reserves.

The SBP’s forex reserves jumped up by $500 million to $3.46 billion by the end of the week, State Bank’s latest figures showed.

Foreigners were net sellers during the week and offloaded $4.3 million worth of equity.

Average trading volumes were up by 26.9% and stood at 267.9 million shares per day. Average daily value also improved by 16% and stood at Rs10.24 billion. The market capitalisation stood at Rs6.13 trillion at the end of the week.

Winners of the week

Soneri Bank

Soneri Bank Limited provides banking services.

Shifa International Hospital

Shifa International Hospitals Limited establishes and runs medical centers and hospitals in Pakistan. The Company’s clinical services include medicine, pediatrics, surgical, obstetric and gynaecology, dentistry, rehabilitation services and ophthalmology. Shifa also runs diagnostic services include specialised diagnostics, radiology and clinical laboratory.

JS Bank

JS Bank Limited is a full service commercial bank. The Bank provides a wide range of banking products and services including retail and consumer, treasury, corporate and commercial, and investment banking.

Losers of the week

Mari Gas

Mari Gas Company Limited specialises in the drilling, production and selling of natural gas.

Abbott Laboratories

Abbott Laboratories (Pakistan) Limited manufactures, imports, and markets research based pharmaceutical, nutritional, diagnostic, hospital, and consumer products. The Company’s key products include antibiotics for respiratory tract infections, peptic ulcer disease, and dental infections.

Azgard Nine

Azgard Nine Limited manufactures and exports textile products such as denim fabrics, and apparel. The Company also manufactures and sells urea and phosphatic fertilisers from its fertiliser plants.

Published in The Express Tribune, December 22nd, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS (2)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

Govt has done remarkable job so far. They need to keep their noses straight though.