“Pakistan stocks traded green throughout the session however late selling pulled the KSE-100 to close marginally below 22,000.” said Jawwad Aboobakar of Elixir Securities, however adding that “the IMF clarification contradicting the Ministry of Finance claim of successful negotiation over new loan kept investors cautious at highs.”

“The market will remain sensitive to the discussions between the two parties and any more uncertainty over the conclusion could invite panic.” said Ovais Ahsan of JS Global Capital.

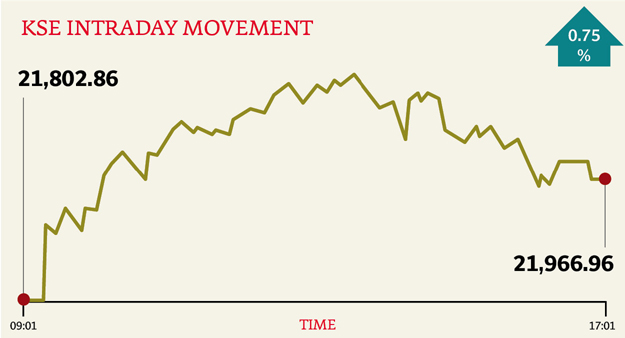

The Karachi Stock Exchange’s (KSE) benchmark 100-share index gained 0.75% or 164.10 points to end at the 21,966.96 points level. Trade volumes surged to 318 million shares, compared with Wednesday’s tally of 239 million shares. The value of shares traded during the day was Rs11.09 billion.

Media Times was the volume leader with 23.33 million shares, gaining Rs1.00 to finish at Rs4.49. It was followed by Pakistan Telecommunication Company with 20.83 million shares, gaining Rs0.06 to close at Rs23.90; and Maple Leaf Cement with 16.77 million shares, gaining Rs0.48 to close at Rs24.42.

“The market continued to climb to close near 22,000 points mark with increasing volumes making it 4.5% total gain in a four-day rally. Local institutional support coupled with re-entry into a new IMF program kept the interest alive.” Said Senior Manager Equity Sales Samar at Topline Securities (Pvt) Ltd. Samar Iqbal. Foreign institutional investors were buyers of Rs860.08 million and sellers of Rs1.03 billion worth of securities, according to data maintained by the National Clearing Company of Pakistan Limited.

“The market closed into the green zone driven by Engro Corporations (+3.1%). The banking sector was led by UBL (+2.0%) which gained on rumours of the minimum deposit rate of 6% being reduced. Karachi’s utility giant KESC (+4.4%) was also among the leading gainers for the day. Hub Power (+1.4%) led the independent power producers,” said Ovais Ahsan of JS Global Capital.

Published in The Express Tribune, July 5th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ