Corporate results” Fatima Fertilizer closes the year Rs6 billion richer

Fertiliser producer manages to double revenues, announces Rs2 per share dividend.

The astounding growth in the top-line was mainly due to the rebounding fertiliser sales in the final quarter of year.

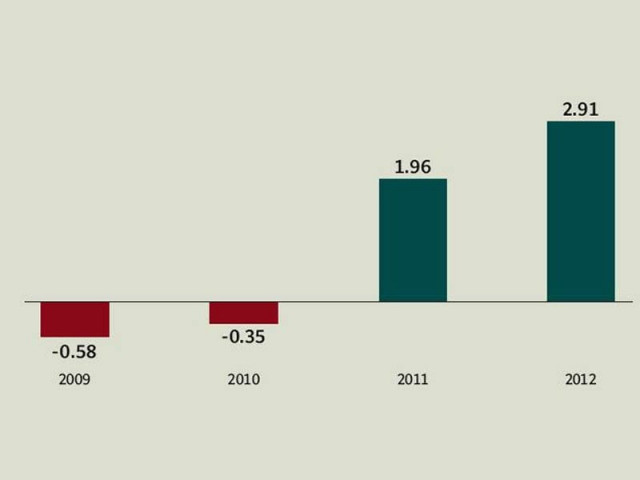

Fatima Fertilizer Company – a joint venture between the Fatima Group and the Arif Habib Group – reported a profit of Rs6.1 billion for 2012, up 48% from Rs4.116 billion a year earlier. The board of directors in their meeting held in Karachi also announced a final cash payout of Rs2 per share. The results were below analyst expectations.

Though the results are satisfactory, but higher than expected sales discounts, lower than forecasted margins and effective tax rate, 40% for the fourth quarter, were major factors behind earnings missing market expectations.

However during the year, the fertiliser producer managed to double its revenue to Rs29.519 billion from Rs14.833 billion. The astounding growth in the top-line was mainly due to the rebounding fertiliser sales in the final quarter of year. Urea off-take for the October to December period increased 2.47 times to 131,000 tons, whereas Calcium Ammonium Nitrate (CAN) and Nitrophos (NP) off-take jumped 67% and 80% respectively.

Moreover, the fact that the Pak Arab Fertilizer plant – also part of Fatima group’s fertiliser wing and the largest producer of NP in the country – remained closed due to gas shortfall on the Sui network also boded well for Fatima Fertilizer’s NP off-take and the revenue.

Fatima sold a record 50,000 tons of NP in November, offsetting dismal urea off-take during the year, taking total NP sales for the year to 296,000 tons, up 174%, according to an AKD Securities research note.

Gross margins declined 10 percentage points to 58.5% in 2012 on aggressive price discounts on nitrogen fertilisers –urea and CAN. The company started a price war through its discount strategy in a bid to boost product sales, which were subdued throughout the year. Moreover, the fertiliser producers brand building campaigns also helped in increasing acceptance of the product which is highlighted by the NP’s growing market share. Low gas pricing arrangement (feed gas) and exemption from the gas infrastructure development surcharge (GIDS) supported the company to sustain its margins.

Furthermore, despite partial repayment of long-term debts and refinancing at a lower mark up rate, finance costs increased to Rs5.8 billion against Rs3.1 billion, diluting the company’s bottom-line, which could have been higher as per market’s expectations.

Overall, the results were up to the mark for Fatima Fertilizer Company.

Outlook

As speculation over urea price reduction dies down and the GIDS cut looks bleak for now, performance of the company are likely to remain intact. Moreover, resolution of technical issues at the plant has resulted in higher production levels which combined with approval of clean development mechanism (CDM) may help improve profitability.

Furthermore, an article in the Washington Times reported that the Fatima Group had been granted approval by the Indiana Finance Authority for issuance of $1.27 billion in tax-exempt bonds for Midwest Fertilizer Corporation – a subsidiary of the Fatima Group – to build a nitrogenous fertiliser manufacturing plant in Indiana, United States. In this regard, the company through the 2008 federal disaster relief law was capitalising on a provision to obtain favourable financing (2% less interest) through Indiana’s municipal bond market.

Published in The Express Tribune, January 31st, 2013.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ