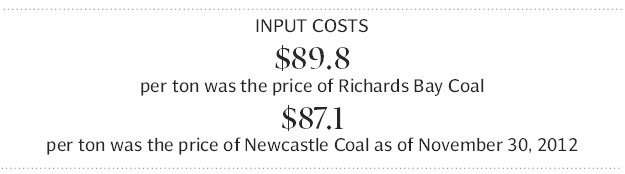

As of November 30, 2012, Richards Bay Coal (FOB) stood at $89.8 per ton while Newcastle stood at $87.1 per ton, according to an AKD Securities research note.

In this regard, with exports slowing down on the broader scale and the rising share of domestic dispatches, the impact of costlier coal as a result of rupee depreciation escalated. said Yawaruz Zaman, investment analyst at Shajar Capital. In recent weeks, manufacturers have increased prices in the Rs5-Rs10 per bag range following the increase in coal prices.

Local cement prices have recorded a healthy increase of 23% during the last year, providing a buffer not only against higher coal prices but also against slower exports and rupee depreciation, said Zaman.

So far, mainstream companies posted a healthy increase in gross margins during the first quarter of fiscal 2013 as a result of better pricing as well as materialisation of cost controlling measures.

While the adverse coal movement will have negligible or even impact on earnings in the second quarter of fiscal 2013, profitability in the next quarter can potentially come in on the lower end of the spectrum should coal costs continue to rise.

Increased demand due to the winter season of coal is believed to be the major reason behind the rising prices. However, going forward upward pressure on prices will be arrested due to demand slowdown globally and production of cheaper alternatives such as shale gas.

Local cement numbers clocked in an encouraging 6.8% growth to 9.5 million tons in the five months of fiscal 2013 with November’s sales particularly impressive at 1.96 million tons, an increase of 19.6%. While cumulative exports decreased 4.4% to 3.6 million tons, November numbers alone surprised with an increase of 11.7% to 0.69 million tons on the back of improved Afghan exports – Pakistan’s biggest individual export market.

Published in The Express Tribune, December 7th, 2012.

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1719053250-0/BeFunky-collage-(5)1719053250-0-270x192.webp)

Very strange article as all other sources are saying coal prices are going down.