The days of making deposits and withdrawals at the bank counter are long gone. People now prefer carrying out every single banking activity at the tip of their fingers. As the demand for accessible and efficient financial services rises, banks are investing in digital platforms to meet these expectations. In Pakistan, forward-thinking banks like United Bank Limited (UBL) are leading the digital banking revolution.

Let’s explore key factors driving digital transformation and the benefits these digital reforms offer.

1. Changing Consumer Preferences

The growing use of smartphones and the internet in Pakistan has shifted consumer expectations toward convenience and speed. With a young population that is increasingly tech-savvy, digital banking has become anecessity rather than a luxury. Millennials and Gen Z in Pakistan preferbanking that fits into their lifestyle, leading to the expansion of mobile andonline banking solutions.

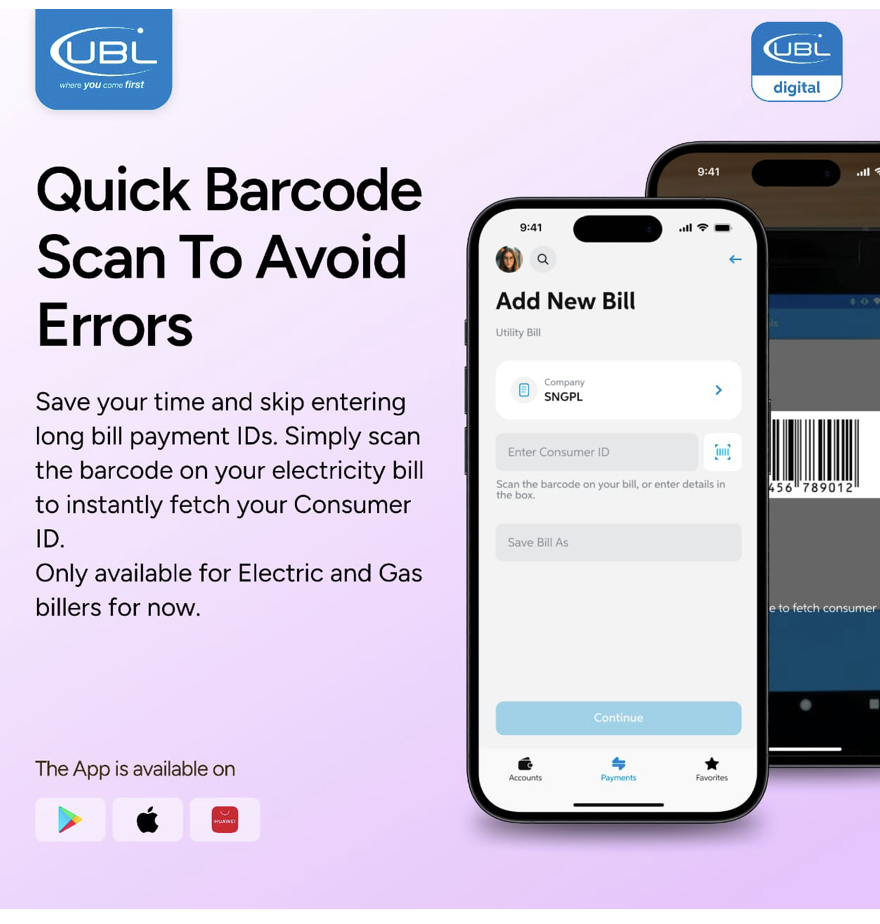

UBL has responded to these trends by offering seamless digital services, with its mobile app that enables instant and secure transactions. UBL's commitment to integrating banking services with wearable technology ensures that customers remain connected to their finances at all times.

1732611244-5/WhatsApp-Image-2024-11-14-at-17-05-12-(1)1732611244-5.jpeg)

2. Government Initiatives and Policy Support

The Pakistani government and regulatory authorities, like the State Bank of Pakistan (SBP), are promoting digital financial inclusion. Initiatives like the National Financial Inclusion Strategy and regulations supporting digital banking frameworks have catalysed transformation in the sector. These policies encourage banks to enhance digital access and promote financial services, even in remote areas. UBL and other banks are playing a crucial role in supporting these initiatives, thereby expanding banking services to previously underserved populations.

3. Fintech Collaboration and Open Banking

Pakistan’s financial ecosystem is witnessing increased collaboration between traditional banks and fintech companies. Open banking, involving sharing data via secure APIs, allows banks to create more integrated and personalised customer experiences. UBL is one such bank that has capitalised on this trend by forming strategic partnerships to deliver innovative digital solutions while ensuring data security and compliance. This collaborative approach allows for a broader range of services that meet evolving customer needs.

4. Financial Inclusion and Digital Payment Systems

One of the most important aspects of digital transformation in Pakistan is financial inclusion. Digital banking platforms enable millions of unbanked and underbanked individuals to access financial services. Mobile wallets, branchless banking, and digital payment systems have revolutionised how Pakistanis handle money. UBL, with its extensive digital offerings, is working to bridge the financial inclusion gap, providing easy access to banking services for rural and urban populations alike.

5. Security and Trust in Digital Platforms

As more consumers shift to digital banking, security has become a top priority. Cybersecurity concerns and the need to protect user data have led banks to implement advanced measures like multi-factor authentication and AI-driven fraud detection. UBL, for instance, ensures the safety of its digital platforms with cutting-edge security technologies. The bank’s commitment to security reassures customers that their financial data is safe, fostering trust in digital banking.

Utilising digital transformation to reap benefits

As banking becomes increasingly digital, it opens up new opportunities for enterprises of all sizes and enables banks to provide more customer-centric banking solutions. Banks have benefited enormously from digital transformation in the following ways.

1. Accessibility and Convenience

Digital banking has made it easier for Pakistanis to manage their finances from anywhere, at any time. Digital payment options streamline transactions, reduce the risks associated with physical cheques, such as loss or fraud, and save time. UBL's offering of cheque deposit via mobile app is particularly advantageous for businesses that rely on quick, secure payment methods to maintain their cash flow.

2. Enhanced User Experience

By simplifying processes and offering intuitive interfaces, digital banking platforms such as UBL have significantly improved the customer experience. UBL's mobile app, for example, focuses on improving customer satisfaction. The app's intuitive interface allows users to navigate various banking services effortlessly, from fund transfers to bill payments.

3. Operational Efficiency

Automation, digital channels, and advanced analytics reduces the need for manual labor and minimises errors, allowing banks to operate more efficiently.

4. Evolving Customer Expectations

In today’s digital-first world, consumers expect banking services that are quick, efficient, and accessible. Traditional banking methods requiring physical visits and lengthy processes are no longer acceptable to customers who are accustomed to the immediacy of digital experiences in other sectors.

Banks that offer seamless, tech-driven solutions, such as mobile banking apps, electronic signatures, and on-the-go loan approvals, are able to retain and expand their customer base effectively. New innovative technological developments allow banks like UBL to strengthen customer engagement with personalised offerings.

5. Data-Driven Decision Making

Data is at the heart of strategic decision-making in the modern banking landscape. By digitizing processes, banks like UBL gain access to real-time, consolidated data that helps them make well-informed decisions. This capability allows institutions to predict market trends, assess risks more accurately, and tailor their services to meet customer needs. In an industry where data quality and speed are paramount, digital transformation enables banks to move from intuition-based to data-driven management.

6. Cost Reduction and Long-Term Savings

One of the most compelling advantages of digital transformation is cost efficiency. Automating transactions and adopting digital solutions significantly lower expenses associated with traditional banking methods. For example, online, cashless transactions reduce reliance on expensive physical infrastructure and intermediary channels. As a result, banks can allocate more resources to innovation and customer service, rather than maintaining costly legacy systems.

7. Flexibility and Scalability

The banking sector has witnessed a surge in mergers and acquisitions, leading to a need for adaptable and scalable IT solutions. Legacy systems often struggle with compatibility issues, complicating the integration of merged entities. In contrast, cloud-based platforms facilitate smooth digital consolidation, enabling banks to scale operations seamlessly. This flexibility is crucial for banks aiming to respond swiftly to market shifts and business expansions.

8. Simplification and Standardization of Processes

Traditional banking systems are often a patchwork of disparate technologies that hinder efficient data flow and complicate maintenance. Digital transformation allows banks to centralise data and simplify technology stacks. This shift results in fewer time-consuming data conversion processes, improved data accuracy, and easier compliance with regulatory standards. Additionally, simplified systems lower maintenance costs and streamline operations, contributing to a more agile banking environment.

The Road Ahead for Banking

Digital transformation in banking is no longer a mere trend but a strategic imperative. Financial institutions must invest in digital capabilities to remain competitive and meet the evolving demands of customers. The benefits—ranging from increased efficiency and customer satisfaction to reduced costs and improved compliance—underscore the long-term value of embracing digital change.

As the industry navigates global dynamics and advances in block chain, cloud, biometrics, big data, AI and ML, banks are recognising (or must recognise) that change is inevitable. Banks like UBL, which leverage state of the art solutions, are helping institutions harness the potential of digital transformation to thrive in this fast-paced environment. Ultimately, the future of banking belongs to those who are agile, innovative, and prepared to embrace digital disruption.

1733045455-0/zombie-(1)1733045455-0-165x106.webp)

1733044033-0/diddy-(1)1733044033-0-165x106.webp)

1732866359-0/BeFunk_§_]__-(71)1732866359-0.jpg)

1726644416-0/TikTok-(2)1726644416-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ