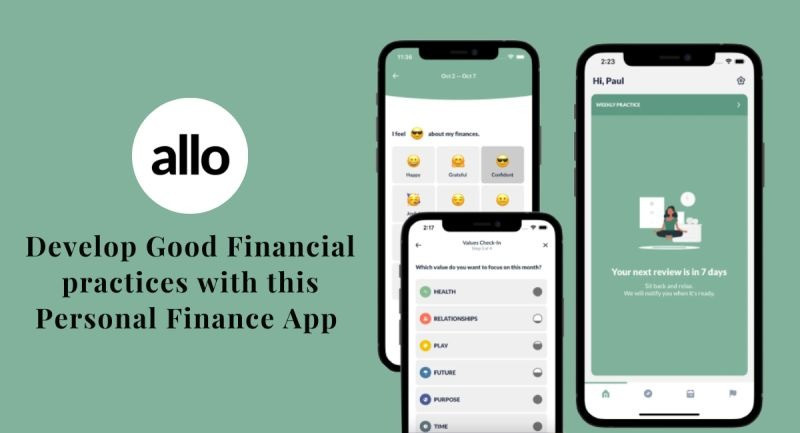

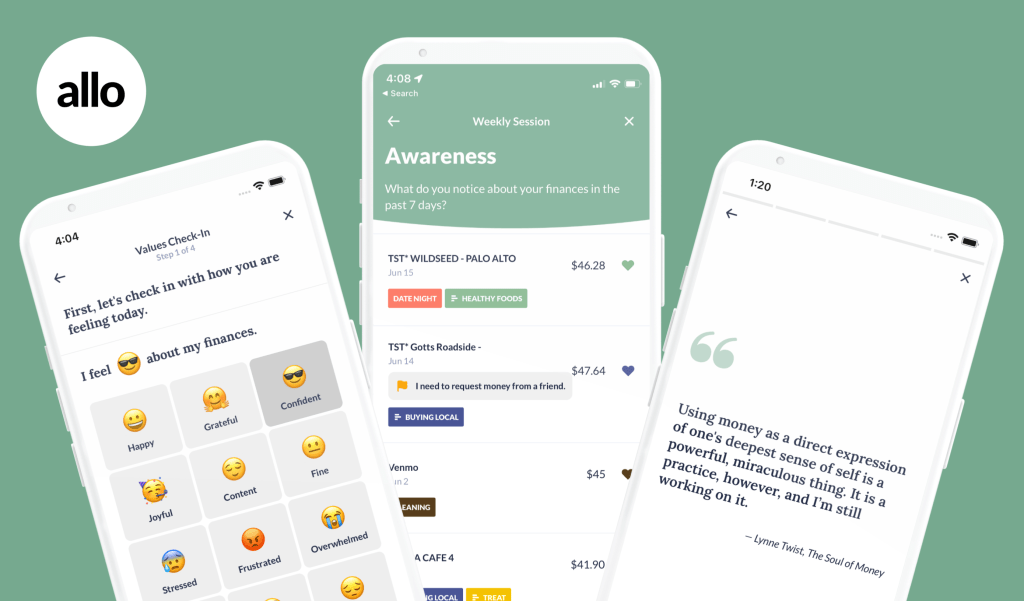

Allo is a relatively new financial app, similar to Headspace but for finances, aiming to help users meaningfully engage with their finances without becoming overwhelmed with numbers and spending. Allo creates a mindful money practice that lets users deal with earnings, spending, saving, investing and giving easily.

Allo will not only help you with your finances but will also make aware of not only your numbers but personal values and priorities. Unlike a cliche budgeting app, Allo focuses on spending categories such as bills, insurance and transportation, including nature, family, giving, working out and healthy eating. You can decide if you wish to have a daily, weekly, or monthly check-in with the app to become aware of your finances.

One of the Allo founders, Montoy-Wilson, told Tech Crunch that budgeting apps can make people feel guilty, which can lead them to avoid their finances altogether.

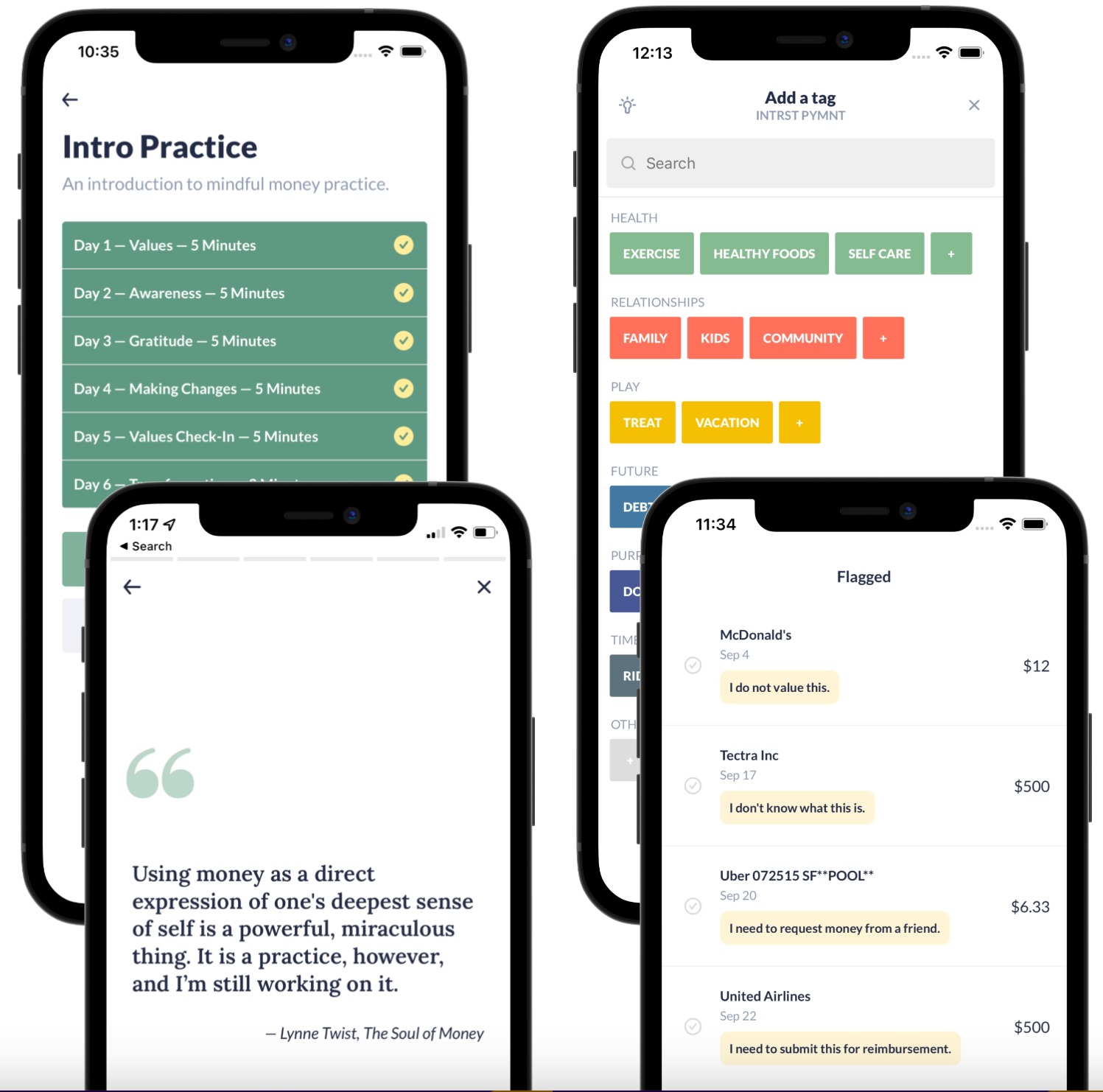

To begin using Allo, you will need to complete an introductory course and learn from experts on how to feel more peaceful, confident and grateful when it comes to money. The app will ask you to select a few values that you may want to focus on like health, being generous, exercise and kids. These values can be used later to tag different transactions made.

The app is designed to make you appreciate the things in life by reflecting on the transactions that have been made and what good came out of them. Allo will also help you to reflect on the transactions that you don't feel great about and want to follow up. This will help you make a mental note not to spend on that item/service again and instead use it for something good.

For the next check-in, you can choose the values you want to focus on for your next transactions and not worry about your finances until your next check-in.

1732347751-0/Express-Tribune-(1)1732347751-0-270x192.webp)

1732264554-0/Copy-of-Untitled-(68)1732264554-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ