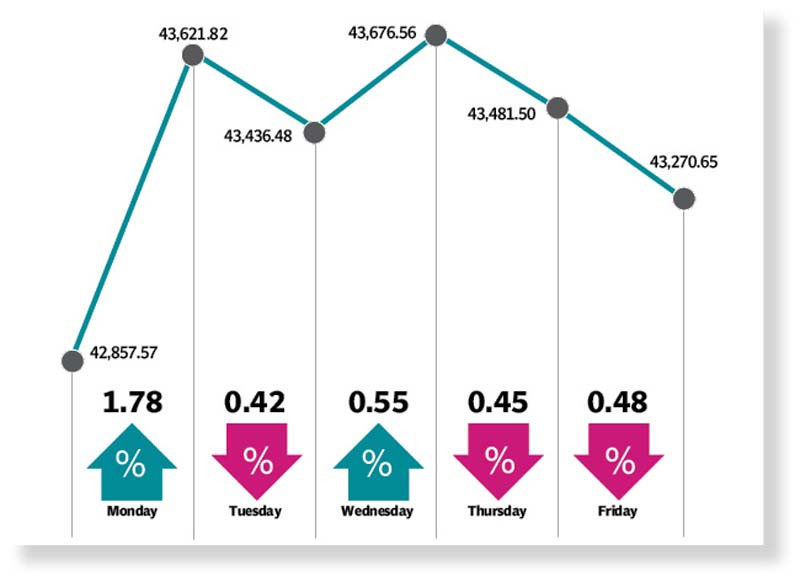

The Pakistan Stock Exchange experienced a range-bound trading week as the benchmark KSE-100 index swayed between positive and negative territories, driven by a mix of encouraging and discouraging developments, but managed to close the week in the green.

The week kicked off on a positive note, in line with the performance in the previous week, as news of $3 billion deposit by Saudi Arabia kept the market bullish, pushing the index above 43,000 points.

Investors remained optimistic on expectation of the revival of IMF loan programme soon. However, the announcement of oil price hike encouraged the bears to stage a comeback. Investors weighed the impact of the hike in petroleum product prices on Tuesday, which resulted in a lower close of the market.

The rupee broke its winning streak against the US dollar in the inter-bank market on Wednesday. Despite remaining under pressure and swaying between negative and positive territories, the KSE-100 index managed to notch up some gains.

Later, the lack of positive triggers kept the bulls at bay with the KSE-100 index enduring lifeless trading and investors avoiding taking fresh positions.

After remaining range bound in the last two trading days, the index failed to achieve the positive momentum. The approaching monetary policy announcement, scheduled for August 22 (Monday), played a prominent role in the bearish close of the market. Furthermore, the weekly Sensitive Price Indicator recorded a record high inflation that led to the bearish close of the stock market on Friday.

For the week, the market closed in the green zone at 43,270 points, up 413 points, or 0.96%. The week started on a positive note with the index gaining 764 points on Monday due to news of Saudi Arabia’s plan to deposit $3 billion along with a $100 million monthly support for purchase of petroleum products for the next 10 months, said JS Global analyst Muhammad Waqas Ghani. Trading volumes increased 51% week-on-week with an average of 519 million shares traded per day during the week.

PM Shehbaz Sharif and Saudi Crown Prince Muhammad bin Salman agreed on cooperation in the fields of investment, energy and trade, the analyst added.

Moreover, the prime minister is expected to propose a long-term LNG deal with Qatar during his visit to Doha next week.

Among other news, Pakistani rupee appreciated 0.6% against the US dollar whereas petrol prices were raised to cover fluctuations in the global crude market.

Large-scale manufacturing (LSM) output grew 11.7% year-on-year whereas textile exports declined 13% month-on-month in July 2022. Remittances for July 2022 were reported 8% lower year-on-year mainly due to fewer working days during the month.

Furthermore, the government announced the lifting of the ban on import of luxury items but with the caveat that such imports would be heavily taxed. State Bank of Pakistan’s (SBP) foreign currency reserves rose $67 million to $7.9 billion, the analyst added. Arif Habib Limited, in its report, said that the bulls dominated at the market’s opening bell in the week under review on news of Saudi Arabia renewing its $3 billion deposits along with provision of additional support worth $100 million per month in terms of petroleum procurement, which took the market above the 43,000 mark.

Furthermore, the LSM data showed a jump of 11.7% year-on-year in FY22. Profit-taking kicked in mid-week as planned imposition of Rs50 billion in taxes weakened market sentiment. Moreover, Pakistani rupee once again faced some depreciation against the US dollar.

In terms of sectors, positive contribution came from banks (164 points), cement (123 points), technology (94 points), power generation and distribution (45 points) and food and personal care products (38 points). Sectors that contributed negatively included E&P (74 points), OMCs (29 points) and automobile assemblers (23 points).

Stock-wise positive contributors were HBL (101 points), Lucky Cement (85 points), Engro (70 points), Meezan Bank (65 points) and Systems Ltd (61 points).

Selling by foreigners continued during the week, which came in at $2.78 million.

Published in The Express Tribune, August 21st, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1718870162-0/BeFunky-collage-(60)1718870162-0-405x300.webp)

1730504285-0/Martha-(1)1730504285-0-165x106.webp)

1719053250-0/BeFunky-collage-(5)1719053250-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ