The Pakistan Stock Exchange closed the last trading session of FY22 with a recovery of 243 points in a volatile trading session.

Value buying by investors sent the benchmark KSE-100 index above the 41,500-point mark.

Investors’ sentiment remained positive amid approval of Rs9.6 trillion federal budget and the Finance Bill by the National Assembly, which aided the bullish close of the market as the investors purchased stocks at attractive valuations.

Continuous rupee appreciation against the US dollar in recent days boosted the market players’ confidence.

Many investors opted to remain on the sidelines as they saw no major positive triggers and in the wake of concerns about the fate of International Monetary Fund (IMF) loan programme.

Earlier, the trading session opened on a positive note and after a minor dip it maintained the positive momentum.

However, the KSE-100 index touched an intra-day low at 41,220.49 points.

Value buying towards the final hour lifted the index, which closed the day in the green zone.

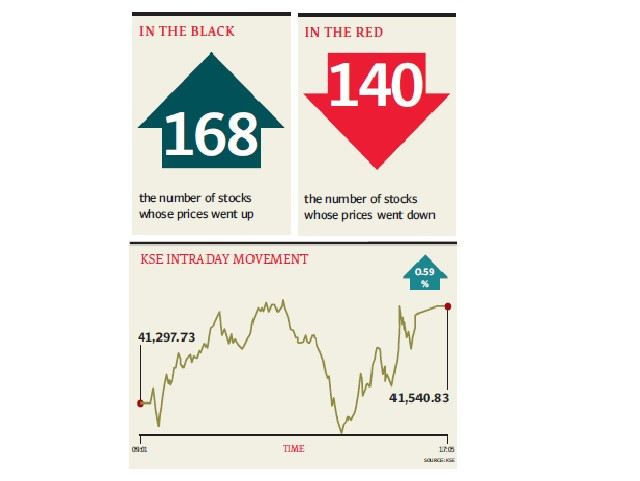

At close, the benchmark KSE-100 index recorded an increase of 243.10 points, or 0.59%, to settle at 41,540.83 points.

Topline Securities, in its report, said that lacklustre activity was observed on the last trading session of the month as the index traded sideways with low volumes for most part of the day.

However, some buying was observed before close as investors came in to accumulate at attractive valuations.

Major contribution to the index came from Hub Power Company, Engro Corporation, United Bank, Bank AL Habib and Systems Limited as they cumulatively contributed 121 points to the index.

Traded volume and value for the day stood at 192m shares and Rs6.76b respectively.

K-Electric was today’s volume leader with 17.5m shares.

A report of Arif Habib Limited stated that the PSX witnessed a positive session today as Pakistani rupee continued to extend gains against the US dollar and cut-off yields on 3M and 6M T-bills fell by two basis points and 15 basis points respectively compared to the previous auction.

The benchmark KSE-100 index stayed mostly in the green territory as investors opted for value hunting due to clarity in the finance bill amendment approved by the National Assembly.

Volumes continued to remain dull, on the contrary 3rd tier stocks remained in the limelight.

The Index closed at 41,540.83 points, up by 243.10 points (+0.59% DoD).

Sectors contributing to the performance include Banks (+111.5pts), E&P’s (+58.8pts), Power (+26.9pts), Technology (+24.9pts) and Cement (23.2pts).

Volumes increased from 142.2m shares to 192.9m shares (+35.7% DoD).

Average traded value also increased by 26.9% to reach $33.1m as against $26.1m.

Stocks that contributed significantly to the volumes are K-Electric, Agritech Limited, Fauji Cement Company, Worldcall Telecom and Pakistan Refinery.

JS Global analyst Sara Saeed said that the local bourse witnessed another volatile session where it closed at 41,541, gaining 243 points day-on-day.

A total of 193m shares were traded where K-Electric (-1.6%), Agritech Limited (+17.7%), Fauji Cement Company (-1.8%), Worldcall Telecom (-2.2%) and Pakistan Refinery (-1.2%) were the major contributors.

Market is expected to remain range-bound due to current political scenario and finalisation of deal with the IMF, Saeed added.

“Going forward, we recommend investors to stay cautious but avail any downside as a buying opportunity,” the analyst said.

Overall trading volumes increased to 192.8 million shares compared with Wednesday’s tally of 142.2 million.

The value of shares traded during the day was Rs6.78 billion.

Shares of 337 companies were traded. At the end of the day, 168 stocks closed higher, 140 declined and 29 remained unchanged.

K-Electric was the volume leader with 17.4 million shares, losing Rs0.05 to close at Rs3.04.

It was followed by Agritech Limited with 13.7 million shares, gaining Rs1 to close at Rs6.65 and Fauji Cement with 13.1 million shares, losing Rs0.26 to close at Rs14.17.

Foreign institutional investors were net buyers of Rs73.7 million worth of shares during the trading session, according to data compiled by the National Clearing Company of Pakistan.

1719053250-0/BeFunky-collage-(5)1719053250-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ