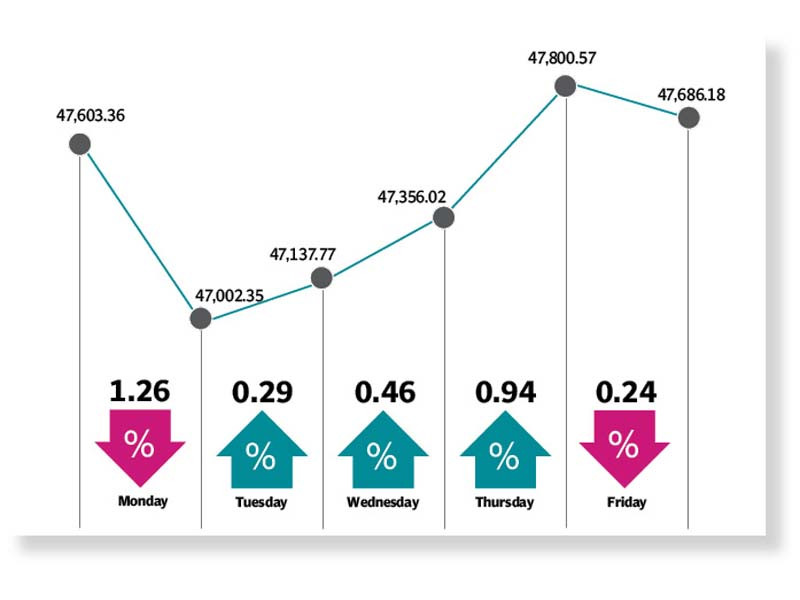

Bulls staged a comeback at the Pakistan Stock Exchange (PSX) following two weeks of bearish trade as the benchmark KSE-100 finished the first week of FY22 with a meagre gain of 83 points or 0.2% to settle at 47,686.18 points.

Interest in selected stocks kept the market buoyant as sector-specific developments spurred buying interest. The index maintained an upwards momentum on the back of approval of federal budget for fiscal year 2021-22. The market finished three of the five sessions in the green.

The week began with the KSE-100 index diving downwards as dismal economic data dented investor sentiment. Current account figures released by the State Bank of Pakistan (SBP), which showed a deficit of $632 million in May 2021, coupled with the decision taken by the Financial Action Task Force (FATF) to keep Pakistan in its grey list and warning of a fourth wave of Covid-19 impacted investors sentiment.

In a dramatic turnaround, the following sessions witnessed a rally as the investors welcomed the new fiscal year in high spirits. The upbeat mood was observed in the wake of approval of finance bill in the parliament. Furthermore, market players were optimistic about improvement in economic indicators as they anticipated that the positive momentum would continue in the new financial year.

However, after posting gains for three successive sessions, the stock market reversed its trend on Friday as optimism faded and the index retreated to the red zone.

A continuous rally over the past few sessions encouraged investors to offload their stockholdings on account of soaring inflation, which accelerated to nearly 9%, significantly higher than the official target of 6.5% in fiscal year 2020-21.

“Going forward, we expect the market to perform well in FY22 on account of robust earnings growth forecast of cement, steel and allied sectors amid strong cyclical demand driven by historic high PSDP allocation and focus on Naya Pakistan Housing scheme,” stated AHL Research in a report.

“Moreover, expectation of an auto and refinery policy, coupled with downwards sticky oil prices supporting the exploration and production sector, and commencement of monetary tightening which should once again garner interest in commercial banks, will support market,” the report added.

Average daily traded volume dropped 10% week-on-week to 622 million shares while average daily traded value declined 4% week-on-week to settle at $107 million. In terms of sectors, positive contributions came from technology (105 points), pharmaceuticals (68 points), food and personal care (51 points), tobacco (22 points) and insurance (14 points).

On the other hand, sectors that contributed negatively included commercial banks (46 points), power generation and distribution (44 points), oil and gas exploration companies (39 points), oil and gas marketing companies (36 points) and refinery (18 points).

Scrip-wise, positive contributors were TRG Pakistan (88 points), AGP (54 points), Lucky Cement (41 points), Unity Foods (37 points) and Meezan Bank (25 points). On the flip side, major losers were HBL (67 points), Hubco (65 points), Hubco (38 points), UBL (38 points), Oil and Gas Development Company (35 points) and Hascol Petroleum (34 points).

Foreign selling continued this week clocking-in at $8.4 million compared to a net sell of $7.9 million last week. Major selling was witnessed in all commercial banks ($3.2 million) and other sectors ($1.4 million). On the local front, buying was reported by individuals ($13.6 million) followed by companies ($13.4 million).

Among other major news of the week; FBR surpassed FY21 tax collection target, PIBs attracted net inflow of $256 million in 12 months, current account balance was in surplus during 11MFY21 compared to a deficit in 11MFY20, the government raised prices of petroleum products and inflows in the Roshan Digital Account exceeded $1.5 billion.

Published in The Express Tribune, July 4th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1732882586-0/Express-Tribune-(7)1732882586-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ