Pakistan’s external debt and liabilities mushroomed to nearly $113 billion at the end of June this year, an addition of $17.6 billion or 18.5% in the past two years, reported the State Bank of Pakistan (SBP) on Wednesday.

The external debt and liabilities - $112.8 billion to be precise - has been booked by both public and private sectors. However, 87% of the external debt and liabilities is the direct and indirect responsibility of the federal government.

Pakistan’s total external debt and liabilities as of June 2020 stood at $112.8 billion, higher by $17.6 billion or 18.5% from the level recorded two years ago, according to the external debt bulletin the central bank released on Wednesday.

When the Pakistan Tehreek-e-Insaf (PTI) government came to power, the total external debt and liabilities amounted to $95.2 billion.

In June 2018, the exchange rate was also Rs121.54 to a dollar, which depreciated to Rs162.2, stated the central bank. Within two years, the rupee lost its value by 38.4% against the greenback.

The country’s external debt and liabilities surged to current levels despite payment of $24.5 billion by Pakistan in interest and principal loans over the past two years. The growing debt level suggests that Pakistan has slipped into the debt trap and it is now taking new loans to pay back the old ones.

The alarming figures indicate the government’s inability to ensure enough non-debt creating inflows to meet the external account requirements. Owing to huge domestic and foreign borrowing, debt servicing is the largest expense in the federal budget.

Pakistan’s exports remained in the range of $22 billion to $24 billion over the past many years, which forced every government to borrow from external sources to remain afloat.

The external public debt, which stood at $75.4 billion two years ago, has risen to nearly $88 billion, an increase of $12.5 billion or 16.5% within two years.

Out of the total external public debt, the government’s direct obligations are equal to $70.2 billion, which exclude government-guaranteed and public sector enterprises’ debt.

The debt obtained through commercial loans increased to $8 billion by June this year, which also impacted the government’s average time-to-maturity indicator due to the shortening of external debt maturity tenor.

The rise in external debt comes at a time when the official foreign currency reserves remain low and the government has to take expensive foreign loans to keep the reserves in double digits.

In June 2018, the SBP’s foreign exchange reserves stood at $9.8 billion, which by June this year increased to $12.5 billion, purely due to loans.

Overall, the PTI government added Rs11.35 trillion to the public debt during the first two years in power, which was more than the total debt the previous government had taken in its five-year term.

The total public debt as of June 30, 2020 increased to 87% of gross domestic product (GDP), up from 72.5% two years ago.

In terms of size of the economy, the external public debt and liabilities also increased from 33.4% to 45.5% of GDP within two years.

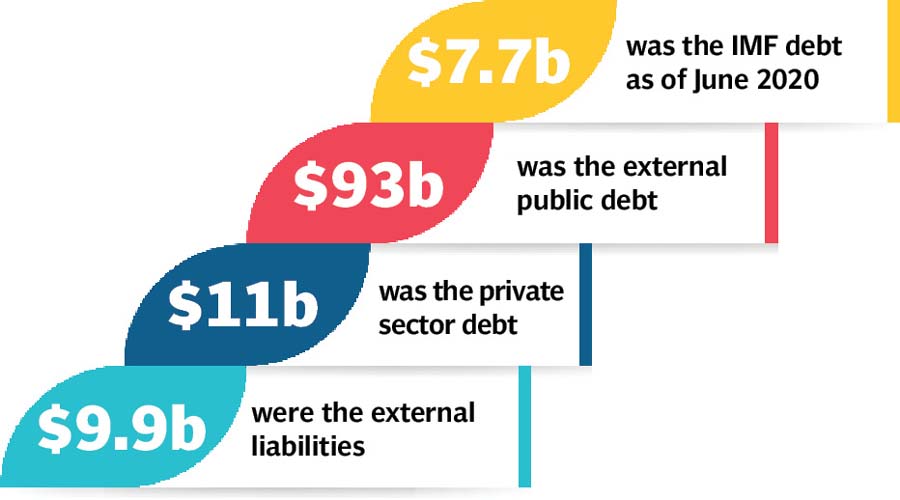

The IMF debt, which was $6 billion two years ago, increased to $7.7 billion by June this year, according to the SBP. There was an increase of $1.7 billion or 28% in the IMF debt.

Pakistan could not receive two loan tranches from the IMF, totalling $1 billion, after the programme derailed in February this year.

The external liabilities that amounted to $5.1 billion two years ago have also increased to $9.9 billion due to loans obtained from Saudi Arabia and the United Arab Emirates. The SBP’s liabilities were only $700 million two years ago that have now grown to $5.7 billion, according to the central bank’s figures.

The external debt of public sector enterprises that was $2.6 billion two years ago increased to $4.2 billion - a jump of 61% within two years.

The public external debt including PSEs liabilities was $78.2 billion in June 2018. It has increased to $93 billion by June this year -a surge of nearly 19%.

The private sector debt was $9.1 billion in June 2018 that jumped to $11 billion in two years.

The SBP data showed that in the last fiscal year 2019-20, the total external debt servicing stood $14.6 billion, including $3.2 billion cost of interest payments.

Published in The Express Tribune, August 27th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1719053250-0/BeFunky-collage-(5)1719053250-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ