BUDGET 2020-21

As the Covid-19 pandemic delivers a brutal blow to an already bleak economy, the Imran Khan-led government announced what is being termed the 'corona budget' on June 12. Despite efforts to turn around the economy, the threat of a recession looms.

For the first time in 68 years, Pakistan’s economy is set to contract in the outgoing fiscal year due to adverse impact of the novel coronavirus coupled with economic stabilisation policies that had hit the industrial sector much before the deadly pandemic.

BUDGET 2020-21: GOVT TRIES TO APPEASE ALL STAKEHOLDERS

Budget sets a daunting task for FBR to collect Rs4.963 trillion revenue

Shahbaz Rana

ISLAMABAD

Industries Minister Hammad Azhar on Friday announced a Rs7.1 trillion budget in a bid to revive the stalled International Monetary Fund (IMF) programme, which both the opposition and experts termed unrealistic and full of internal contradictions.

The government proposed primary deficit target – the total revenues excluding interest payments –at only 0.5% of gross domestic product (GDP) or Rs249 billion under the IMF pressure. However, its internal working showed that the primary deficit would not be less than 1.2% of the GDP or Rs546 billion at least.

The proposed overall budget deficit target is 7% of the GDP or Rs3.2 trillion despite the government knows that the deficit cannot be less than 8.5% of the GDP in the next fiscal year.

“The Federal Board of Revenue’s (FBR) tax collection target will be Rs4.963 trillion,” said Azhar, while delivering his second budget speech in the National Assembly. Sources inside the FBR, however, told The Express Tribune that the FBR it can collect Rs4.5 trillion at the best.

“In my view, the FBR’s tax collection cannot be more than Rs4.2 trillion in the next fiscal year, excluding the impact of tax advances, said Ashfaq Tola, the renowned tax expert.

The proposed budget is only Rs307 billion or 4.4% higher than the revised budget estimates of Rs6.8 trillion in the outgoing fiscal year amid the government’s attempt not to antagonise the IMF.

In a rare move, the government could not announce increase in salaries and pensions of the federal government employees and pensioners after the IMF clearly warned about its consequences.

Due to the inability to introduce fiscal expansionary policies, the economic growth is expected to remain low at only 2.1% in next fiscal year 2020-21, while the inflation will ease to 6.5%.

Hammad Azhar emphasised the need for expansionary fiscal policies in the midst of coronavirus but in the same breath said that the government would adopt austerity.

The proposed size of the new budget is Rs101 billion or 1.4% higher than the original budget of the outgoing fiscal year. About 60% of the proposed budget will be consumed on paying interest on loans (41.2%) and on defence spending (18%), leaving very little for other expenditures. Another 13.3% of the proposed budget will be consumed in running the civil government and paying pensions.

But the real challenge will be the implementation of the budget, as its success hinges upon the FBR’s ability to achieve a challenging Rs4.963 trillion tax collection target, which is 27% higher than the estimated collection in the outgoing fiscal year.

The opposition parties raised loud slogans against Prime Minister Imran Khan who attended the budget session. They also thumped desks, while criticizing the government for its failure to crackdown against mafias and those, what they claimed, stealing the elections. Later, the opposition walked out of the House in protest.

However, there was big if on whether the government will be able to achieve its targets, particularly the budget deficit, the primary deficit and the FBR’s revenue collection.

There are internal contradictions in the budget documents and the budget is irrelevant from day one, said Saqib Sherani, former principal adviser to the finance ministry, while speaking during Express News’ primetime show, The Review.

Sherani said that the government would neither be able to revive economic growth and the IMF programme nor will it be able to manage taxes. The IMF may also adopt a wait-and-see policy for couple of months, he added.

The failure in achieving the proposed targets would mean reversing the first step that the government has taken towards addressing the core issue of high indebtedness.

Where did the government concede ground?

The government has proposed Rs1.29 trillion for defence spending, which is equal to 18% of the budget. However, the sources said that the military had demanded Rs1.493 trillion and the finance ministry had issued Rs1.340 trillion indicative budget ceiling. Subsequently, the government has proposed Rs51 billion less budget than the issued ceiling.

For running the civil government, the government had estimated the cost at Rs654 billion. The finance ministry had issued Rs501 billion ceiling and the proposed budget for running the civilian government is Rs476 billion.

For subsidies, there was a demand of Rs485 billion but the finance ministry issued Rs279 billion indicative budget ceiling. Subsequently, the proposed budget for subsidies is only Rs210 billion, according to the budget documents.

For pensions, the government had estimated the cost at Rs501 billion for next fiscal year and the finance ministry had given Rs489 billion ceiling. But the budget documents showed that Rs470 billion have been allocated for pensions for the next fiscal year.

For the Public Sector Development Programme, the finance ministry issued Rs530 billion ceiling against the demand of Rs750 billion. But it has proposed Rs650 billion for the next fiscal year.

The debt-servicing cost that has been estimated at Rs2.946 trillion for 2020-21 against the revised estimate of Rs2.7 trillion for the outgoing year. The debt-servicing would eat up 41% of the budget.

The budget does not immediately address the issues such as economic slowdown, growing unemployment rate and even the high budget deficit in the next year. However, the government has kept its focus on addressing the issue of debt trap by focusing on primary deficit.

The budget deficit is projected at a record 7% of GDP or Rs3.2 trillion. It is the second largest black hole in the federal budget after the outgoing year’s estimates of Rs3.8 trillion or 9.1% of the GDP.

The hole will be filled by taking Rs810 billion net foreign loans, Rs2.4 trillion domestic loans and Rs242 billion provincial cash surplus. The privatisation proceeds are estimated at only Rs100 billion that shows that the government does not have a plan to go for any major privatisation transaction.

After including the provincial cash surplus, the overall budget deficit has been projected at Rs3.2 trillion or 7% of the GDP, which is higher than the level left behind by the previous Pakistan Muslim League-Nawaz (PML-N) government.

Azhar claimed in his budget speech that no new tax has been imposed. But according to the Finance Bill-2020, the government has introduced Rs100,000 to Rs200,000 luxury tax on residential homes of more than two Kanals in Islamabad Capital Territory and also introduced luxury tax on farm houses from Rs25 per square foot to Rs80 per square foot.

But in technical briefing, the FBR’s Member Inland Revenue Policy said that the government gave net benefit of Rs49.5 billion to the taxpayers. This included Rs24.5 billion negative revenue impact of inland revenue measures and Rs25 billion net customs relief, he added.

The government has proposed Rs4.963 trillion tax collection target for the FBR which is 27% higher than anticipated and four-time downwardly revised collection of Rs3.908 trillion. The Rs3.9 trillion collection will be equal to 9.4% of the GDP, while for the next fiscal year the government has set the target at 10.9% of the GDP. It has proposed additional revenue measures for achieving this goal.

Some punitive measures have been proposed to discourage informal economy and forcing the manufacturers and registered persons to sell their products predominantly to only registered sales tax persons.

The permanent business establishments of foreign companies have been brought under the scope of tax law, which will bring all the Chinese companies in the tax ambit. The non-resident and resident companies now both will be subject to minimum 1.5% income tax, which will directly hit all foreign companies, including the Chinese.

Budget outlay

Azhar announced that the size of the budget will be Rs7.137 trillion – higher by Rs101 billion or 1.4% over the Rs7.036 trillion original size of the budget for the outgoing fiscal year. About 60% of the budget has been allocated for defence and debt servicing.

The development budget is Rs650 billion and Rs72 billion is allocated for other development expenditures. The government has proposed Rs1.290 trillion for regular defence budget, which is higher by Rs137 billion or 11.9% over the original budget of Rs1.152 trillion.

A sum of Rs323 billion has been given for the Armed Forces Development Programme and another Rs369 billion for military pensions. A sum of Rs93 billion has been proposed for other security packages.

The budget documents showed that the total defence budget is proposed at Rs2 trillion or 29% of the proposed Rs7.137 trillion total budget. Another amount of Rs2.946 trillion or 41% of the proposed budget has been earmarked for the debt serving.

PSDP cut as Covid-19 eats up resources

Interest payments to swallow Rs2.9tr

No major relief for export sector

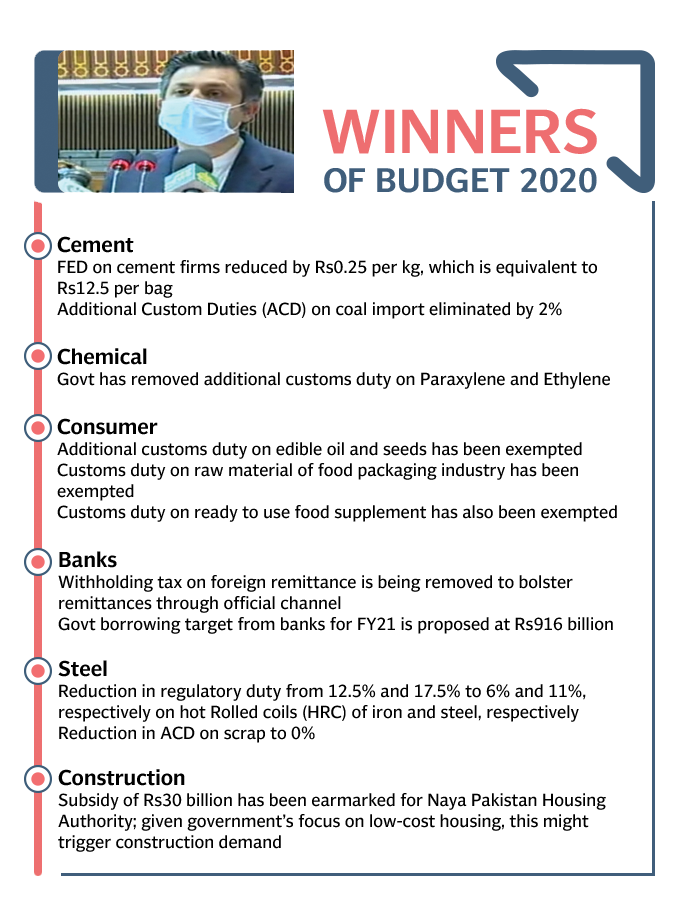

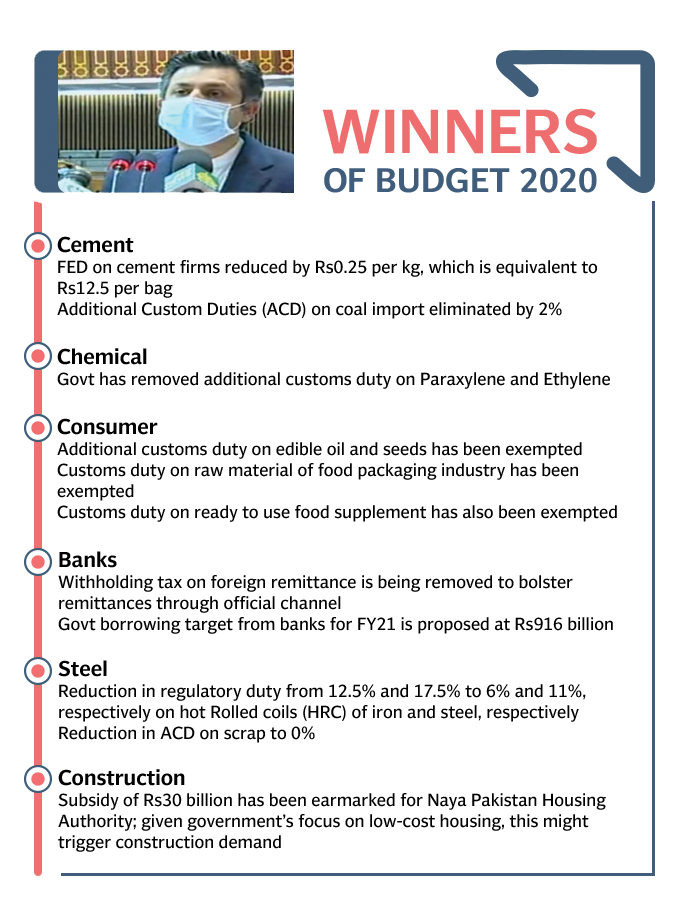

Real estate, construction sector wins relief

PTI govt aims to collect Rs588b revenue from oil, gas

PTI govt imposes Rs200b-worth of additional taxes

Budget 2020-21 Statement

PAKISTAN ECONOMIC SURVEY: RECESSION LOOMS AS GROWTH TUMBLES

Current account deficit cut only achievement; Dr Abdul Hafeez Shaikh blames previous govt, Covid-19

Shahbaz Rana

ISLAMABAD

The Pakistan Tehreek-e-Insaf (PTI) government on Thursday unwrapped the economic survey of its second year in power that showed almost all key economic targets were missed again, however, the government put the blame for some of its failures on its predecessor and the deadly pandemic.

While officially announcing a negative 0.38% gross domestic product (GDP) growth rate for fiscal year 2019-20 – the first recession in 68 years – Adviser to Prime Minister on Finance Dr Abdul Hafeez Shaikh started his presser with blaming the PML-N for the economic mess that he said it left behind.

Shaikh termed the steep reduction in current account deficit – the gap between external receipts and outflows – that narrowed down from $19 billion two years ago to $3.3 billion this year as the single biggest achievement of the ruling PTI.

But other than that he could not cite any hardcore economic number to portray economic performance of Prime Minister Imran Khan’s government during its two years in power, which officially began in August 2018.

The other achievements that Shaikh counted were Rs5 trillion repayments of loans but the actual debt burden of the government increased by over Rs11 trillion in two years. The country’s total debt is Rs35.2 trillion as of March 2020.

Shaikh said that the government did not borrow even a single “penny” from the central bank to tame the inflation yet the government remained the single-largest client of commercial banks.

The inflation is also projected to remain at 9.1% as against the official target of 8.5%, despite economic slowdown in the aftermath of the deadly coronavirus pandemic.

Shaikh said that the “people-centric policies” was the vision of Prime Minister Imran Khan but he did not share the figures that could show improvement in the living conditions of the masses and reduction in unemployment and poverty.

The Economic Survey of Pakistan 2019-20 carried the tale of missed targets, except the current account deficit and savings ratio. The government missed targets of economic growth, inflation, revenue collection, budget deficit, investments, exports and per-capita income, etc.

“We lost over Rs3 trillion of GDP value due to the coronavirus outbreak, which resulted in 0.38% contraction in the economy instead of expected growth rate of over 3%,” said the finance adviser.

Shaikh did not respond to a question about the planning ministry’s assessment that Pakistan’s economy was already in bad shape due to high interest rates, tough conditions of the International Monetary Fund programme, hot foreign money inflows and currency devaluation.

But the finance adviser defended the IMF, saying that it wanted economic stabilisation in Pakistan and showed leniency where possible like relaxations to traders and the construction industry.

The State Bank of Pakistan’s quest for hot foreign money has adversely hit the industries much before Covid-19 started, impacting the economy. In the end, neither the hot foreign money stayed in Pakistan nor the country achieved sustainable economic growth.

It is for the first time since 1951-52 that Pakistan’s economy contracted, although the pace of contraction was far lower than -1.5% growth rate predicted by the IMF and -2.6% by the World Bank.

To a question, Shaikh said that the World Bank and the government were using the same data but both were using different assumptions about the impact of Covid-19. He added that there was no conspiracy behind the negative growth.

The per-capita income in dollar terms has also dipped to $1,366 – a contraction of 6.1%, but it increased in rupee terms to Rs214,539.

The outgoing fiscal year’s economic results have confirmed that the country’s structural problems remained unaddressed. The size of the economy shrank to around $266 billion in dollar terms, down from $280 billion.

To another question, Shaikh said that the tax target fixed for the new fiscal year was “aspirational” but added that the government would not “aggressively” try to achieve it due to the current economic crisis caused by the pandemic.

Against the revised Rs4.8 trillion target, he said, the Federal Board of Revenue’s tax collection was expected to remain at Rs3.9 trillion this year. The fiscal deficit that the government had budgeted at 7.1% of the GDP is now projected to increase to 9.4% of the GDP – the highest ever.

But Shaikh said that turnaround was visible in the primary balance — fiscal balance net of interest payments on general government liabilities — which posted a surplus of Rs194 billion till end March compared to a deficit of Rs463 billion in the year-ago period.

Almost every sector of the economy witnessed negative growth. The provisional growth rate in the second year of the PTI was significantly lower than the pace needed to absorb the youth bulge. The government missed the growth targets set for the services, agriculture and industrial sectors with a wide margin.

Agriculture

After witnessing a 0.6% growth rate in the last fiscal year, the agricultural sector grew this time by 2.7%. But the government missed all its sub-sectoral targets, except forestry and other crops. The government had set a target of 3.5% growth in the agriculture sector for this fiscal year.

The production of major crops increased by 2.9% and other crops by 4.6%. Cotton ginning contracted by 4.6%, according to the National Advisory Committee. The livestock sector grew by 2.6% and the forestry sector by 2.3%. The fishing sector grew by only 0.6% against the 4% target.

Cotton production declined by 6.9% to 9.2 million bales.

The production of rice increased by 2.9% to 7.4 million metric tons but sugarcane production fell by 0.4% to 66.9 million metric tons.

The output of wheat grew by 1.7% to 24.94 million metric tons. The production of maize showed a growth of nearly 6% to 7.2 million metric tons.

Industries

The industrial sector is the worst-hit by Covid-19. Although there was a partial lockdown in the country, some industries kept running. The sector was already facing the brunt of the heavy taxation and unrealistically tight monetary policies that the SBP pursued against hot foreign money.

The government missed some key sectoral targets except for slaughtering, electricity generation, and construction. Against a target of 2.3%, the output in the industrial sector stood at -2.64%.

The output of large-scale manufacturing is projected to contract by 7.8% in this fiscal year while small-scale manufacturing grew 1.5% after the government adjusted the adverse impact of Covid-19.

The slaughtering sub-sector grew at a pace of 4.1%, electricity generation and distribution by 17.7% and mining and quarrying sub-sector registered a negative growth of 8.82%. The construction sector also posted a growth of 8% this year as against a negative growth of 16.7% in the previous year.

Services

The services sector, which accounts for 60.4% of the size of the economy, contracted by 0.6% against the target of 4.6%. The wholesale and retail trade sector posted a -3.4% growth against the target of 3.9%.

The transport, storage, and communications sub-sector saw a -7.1% growth rate. The finance and insurance sector marginally grew by 0.8%, housing services by 4%, general government services 3.9% and other private services 5.4%.

Structural problems

The investment-to-GDP ratio stood at just 15.4% against the target of 15.8%, according to the economic survey. The ratio was worse than last year’s revised rate.

The government’s inability to increase investment as a percentage of the total size of the national economy remains its biggest failure on the economic front, suggesting that the PTI government has not yet begun its journey towards addressing structural imbalances.

Private investment that had been recorded at 10.1% of the GDP in the last year has also slipped to 10%. Public investment also shrank to 3.8% of GDP — against the target of 4.1%, due to a steep cut in development spending by the federal and provincial governments.

Fixed investment remained at only 13.8% of the GDP in this fiscal year against the target of 14.2%. Savings increased to 13.9% of GDP – which was above the target because of reduction in the current account deficit.

Despite overall contraction, agri sector grows 2.7%

Corrective measures jolt manufacturing sector

Covid-19 shock may increase Pakistan's debt-to-GDP ratio

Pakistan’s exports on downward trajectory

Nearly Rs1.3tr wiped off PSX in Jul-Mar

Up to 19.1m jobs at risk because of lockdowns

FROM OUR ARCHIVE

We picked out must reads of our pre-budget coverage to give you a clearer picture of the state of Pakistan's economy and the fate of last federal budget.

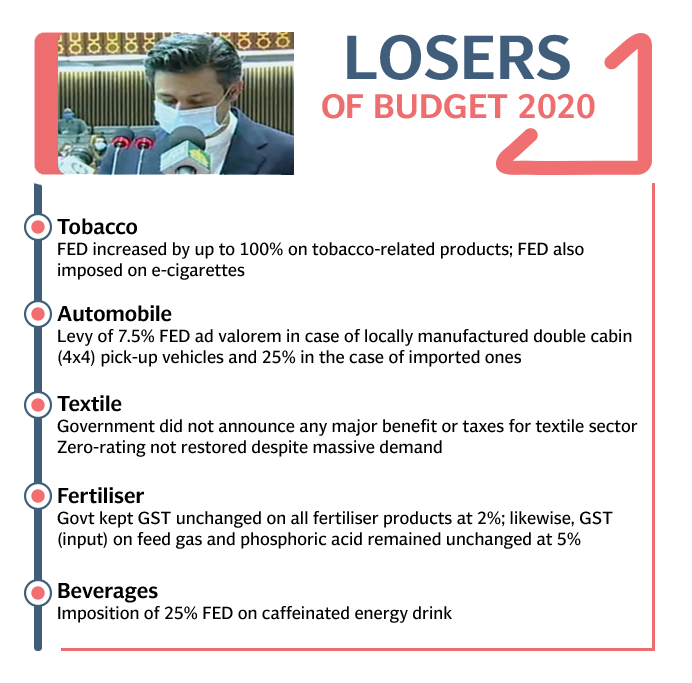

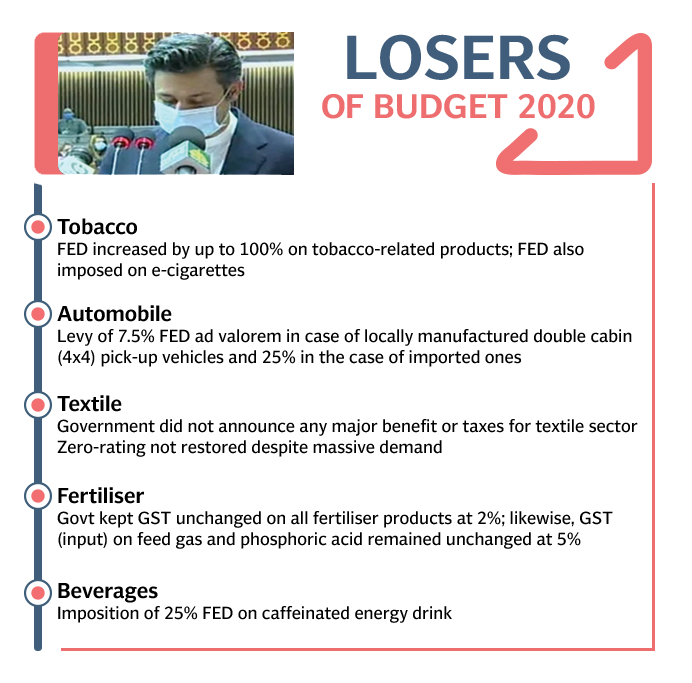

June 9: Govt may cut FED on soft drinks

The government may cut federal excise duty (FED) rates for beverages and cement production in the new budget after heavy taxation coupled with economic slowdown caused a reduction in their sales besides shortfall in the estimated tax revenue.

The government is also considering reducing the further general sales tax (GST) of 3% to either 2% or 1% for fiscal year 2020-21, starting July, said sources in the Federal Board of Revenue (FBR).

The 3% further tax is charged over and above the 17% standard GST from the buyers who are not registered with the FBR.

Read Shahbaz Rana’s full story here.

June 7: : PTI govt mulls Rs20 per litre GST

In what could be a major revenue spinner, the federal government may fix Rs20 per litre General Sales Tax (GST) rate for petroleum products in new budget aimed at protecting its revenues amid sliding oil prices in international market.

If the proposal gets the nod of Prime Minister Imran Khan, the consumers will pay minimum Rs50 per litre tax on account of Rs20 GST and Rs30 per litre petroleum levy, in addition to paying other charges like dealers and distribution companies’ margins.

At present, the government charges 17% GST on every litre of petrol, high speed diesel, kerosene oil, light diesel oil and other petroleum products. Due to slump in prices in global market and consequent reduction in domestic market, the government’s tax revenues from petroleum products have been adversely affected.

Read Shahbaz Rana’s full story here.

June 6: Govt may link NADRA data with FBR

In a major budget proposal, the government may integrate the National Database and Registration Authority’s (NADRA) databank with the Federal Board of Revenue (FBR) aimed at unearthing hidden assets of citizens to enhance revenue collection.

The budget proposal also includes getting real-time access to the data of provincial land and tax authorities, housing societies and telecommunication companies, sources in the FBR told The Express Tribune.

A rationale behind the proposal was to increase the number of income tax returns and wealth statements being submitted annually by the taxpayers, said the sources.

Read Shahbaz Rana’s full story here.

WATCH: President Karachi Chamber of Commerce and Industry Agha Shahab Ahmed presented his views regarding the upcoming Federal #Budget2020 where he requested government to focus upon 'relief, recovery and reforms'.#etribune

— Tribune Business (@TribuneBiz) June 11, 2020

For more: https://t.co/sLizSzyngW pic.twitter.com/25756xSKCh

June 5: Unemployment jumps to 8.53% in second year of PTI govt

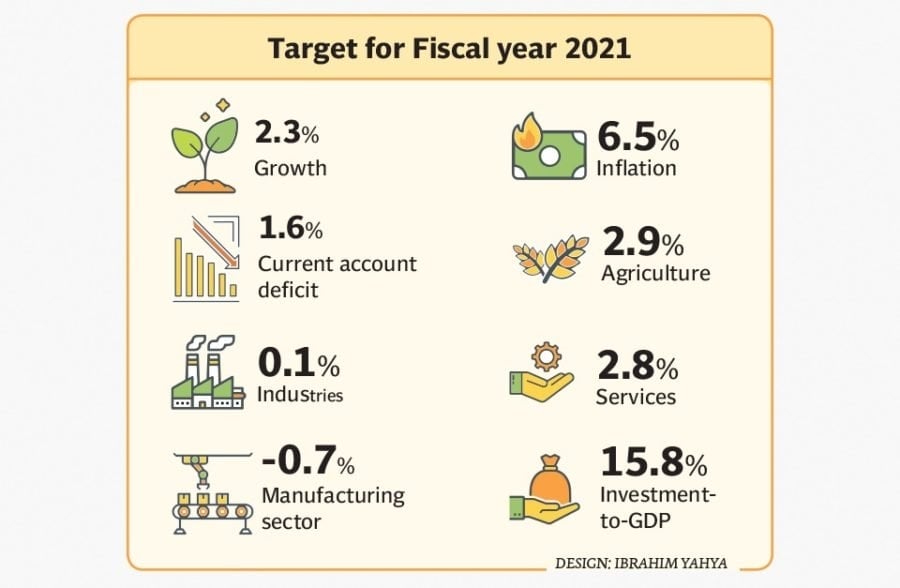

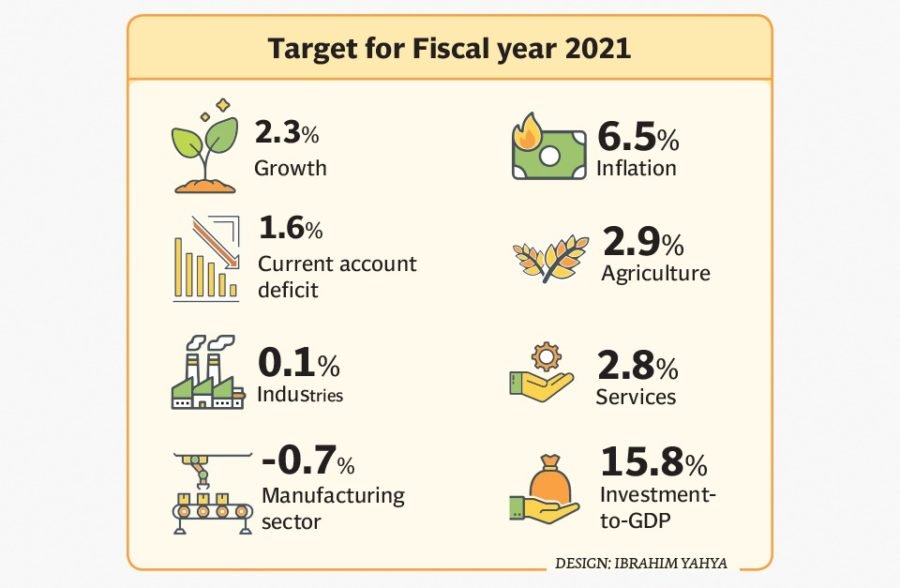

The Pakistan Tehreek-e-Insaf government (PTI) has proposed a target of 2.3% economic growth for its third year in power while admitting that growth prospects for the current year were “eclipsed by higher inflation and interest rates” much before Covid-19 hit the economy.

Worryingly, the unemployment rate that was 5.8% at the end of Pakistan Muslim League-Nawaz (PML-N) tenure has jumped to 8.53% by end of the current fiscal year 2019-20 – the second year of the PTI government, according to official figures of the Ministry of Planning and Development.

As compared to first year of the PTI government, the unemployment ratio surged to 8.53% as over one million people had become unemployed during the outgoing fiscal year.

Read Shahbaz Rana’s full story here.

June 5: APCC proposes Rs1.3tr development plan

The federal and four provincial governments have proposed Rs1.3 trillion for development spending in the next fiscal year, which is 18% less than the outgoing fiscal year’s original budget, underscoring the lack of fiscal space that will hamper economic growth.

The scarcity of funds has exposed the discontent between the Centre and federating units as Balochistan chief minister staged a walkout from the meeting called to endorse development budgets for fiscal year 2020-21. Sindh too raised objections over ignoring the province while distributing money among the federally funded projects.

The Annual Plan Coordination Committee (APCC) on Thursday recommended a Rs1.312-trillion National Development Budget for fiscal year 2020-21 to the National Economic Council (NEC). Over Rs233 billion will be borrowed from foreign lenders to finance the country’s development needs in the next fiscal year. The Planning Commission deputy chairman heads the APCC meeting. Budgetary allocations for the new fiscal year are lower by Rs292 billion as compared to the original allocation of Rs1.61 trillion for the outgoing fiscal year.

Read Shahbaz Rana’s story here.

June 4: Activists demand more taxes on cigarettes

Anti-tobacco activists have requested the government to raise the federal excise duty (FED) on cigarettes by at least Rs20 per pack in the upcoming budget for fiscal year 2020-21 in order to enhance revenue collection and discourage the use of tobacco.

The demand was made jointly by The Society for Protection of Rights of the Child (SPARC), Human Development Foundation and Pakistan National Heart Association.

Read the full story here.

VIDEO: Pakistan Business Council head Ehsan Malik advocates a budget for the lowest common denominator worst affected by #covid-19.#Budget2020 Pakistan #etribune

— Tribune Business (@TribuneBiz) June 11, 2020

Follow The Express Tribune’s live coverage of the Budget 2020 here: https://t.co/KFDAqeQ4WK https://t.co/JvpyMe2D4H pic.twitter.com/UagdRI8bPZ

June 2: Pakistan may end special tax system

Pakistan is considering ending preferential tax treatment for foreign companies working in the country aimed at bringing them on a par with domestic firms and getting an additional Rs22 billion in revenues from them in the next fiscal year.

The proposals are part of the measures shortlisted by the Federal Board of Revenue (FBR) for fiscal year 2020-21, starting July, highly placed sources told The Express Tribune. However, no final decision has been taken yet as there are some critical voices against the proposal, they added.

The FBR has proposed that the tax withheld from contractual payments to permanent establishments of non-resident companies should be treated as “minimum” withholding tax, the sources said.

Read Shahbaz Rana’s report here.

May 28: FBR seeks uniform tax on profit

The Federal Board of Revenue (FBR) has proposed a uniform income tax rate of 15% on profit earned by placing money in banks and giving loans but is facing resistance to the plan of withdrawing some tax concessions got by billionaires, who earn tax-free profit on foreign currency accounts.

The FBR’s proposal was aimed at ending distortion in the income tax regime that could also fetch about Rs26 billion in additional taxes in next fiscal year 2020-21, provided the government ended the preferential treatment given to a few people, sources told The Express Tribune.

However, the State Bank of Pakistan (SBP) is not in favour of changing the tax regime for foreign currency accounts and the money placed in Special Convertible Rupee Accounts (SCRA), which are being used to invest hot foreign money in Pakistan.

Read Shahbaz Rana’s report here.

May 20: Pakistan's investment ratio dips to 15.4%

Investment indicators have worsened further in the second year of Pakistan Tehreek-e-Insaf (PTI) government but savings ratio has improved on the back of improvement in the external account, showed official statistics.

The investment-to-gross domestic product (GDP) ratio further deteriorated to 15.4% in the outgoing fiscal year, according to estimates of the National Accounts Committee (NAC). The government missed the investment-to-GDP target for the second successive year.

However, savings that stood at 10.8% of GDP in the last fiscal year increased to 13.9% – over one-percentage-point higher than the government’s target. The savings-to-GDP ratio has been worked out on the assumption that the current account deficit will remain at only 1.5% of GDP in the current fiscal year.

Read Shahbaz Rana’s story here.

May 19: Pakistan's economy contracts for first time in 68 years

For the first time in 68 years, Pakistan’s economy has marginally contracted by 0.38% in the outgoing fiscal year due to adverse impacts of novel coronavirus coupled with economic stabilisation policies that had hit the industrial sector much before the deadly pandemic.

Except for the agriculture sector that grew 2.7%, the industrial and services sectors witnessed negative growth rates, pulling the overall growth rate down to negative 0.38% in the fiscal year 2019-20, ending on June 30. The per capita income in dollar terms has also dipped to 1,366 – a contraction of 6.1%, but it increased in rupee terms to Rs214,539.

Read Shahbaz Rana’s report here.

May 19: PTI govt to drop unapproved projects from PSDP

The federal government has decided to drop unapproved projects from the Public Sector Development Programme (PSDP) in the next budget, which will now be unveiled on June 12.

The $9.2-billion or Rs1.5-trillion Mainline-I (ML-1) project of the China-Pakistan Economic Corridor (CPEC) is also among the unapproved projects. But the government still has two weeks to approve the ML-1 scheme or else it will be delayed for yet another year.

Read Shahbaz Rana’s report here.

May 8: Govt mulls zero-rated facility for dairy sector

The government has set up a committee to review a budget proposal seeking zero sales tax on milk products as blindsided taxation policies of the previous government have caused heavy losses to dairy companies due to increase in cost of doing business.

The increase in interest rate during the Pakistan Tehreek-e-Insaf (PTI) government also adversely affected their balance sheets.

The committee would be chaired by the finance secretary and would analyse financial statements of dairy firms aimed at evaluating claims of business losses due to the withdrawal of zero-rated sales tax facility by the previous Pakistan Muslim League-Nawaz (PML-N) government.

Read Shahbaz Rana’s story here.

May 6: FBR may relax CNIC condition

The Federal Board of Revenue (FBR) may propose relaxation in the Computerised National Identity Card (CNIC) condition for goods purchase worth Rs50,000 in the next budget as Pakistan’s largest business chamber says the government’s failure to implement the condition has created doubts about its abilities.

The FBR, which is currently in the process of shortlisting budget proposals, is planning to recommend an increase in the exemption limit for documentation to Rs100,000 worth of purchases, according to sources.

Read Shahbaz Rana’s full report here.

May 6: Textile sector seeks zero-rated facility

Textile exporters – who earned 60% of total export earnings in Pakistan – have proposed to the government to restore zero-rated sales tax regime for the five major export-oriented sectors – textile, carpet, leather, sports and surgical goods – in the budget for 2020-21.

The government imposed a refundable 17% sales tax on exports of these sectors in the budget for 2019-20, which blocked their working capital and hindered growth in exports. The restoration of zero-rating would help revive exports and earn the much-needed foreign exchange, keeping in view the projected contraction in the national economy, which is expected to shrink for the first time in 68 years due to Covid-19.

Read Salman Siddiqui’s story here.

April 30: Pakistan Stock Exchange seeks tax incentives

Pakistan Stock Exchange (PSX) – where listed firms lost over one-fourth or a cumulative Rs2.3 trillion (over $14 billion) of their market value primarily due to the coronavirus pandemic – has sought a relief package from the government to restore investor confidence, mobilise new investment and sail through testing times.

The stock market has sought new investment into shares from government’s pension funds and tax incentives to encourage new listings as well as reduce the cost of shareholding and trading for shareholders.

Read Salman Siddiqui’s report here.

April 29: Finance ministry plans Rs600b PSDP for next fiscal

The finance ministry has indicated an allocation Rs600 billion for the Public Sector Development Programme (PSDP) for the next budget that will keep the planning ministry walking a tightrope to meet the financing needs of ongoing projects as well as funding the new initiatives.

The finance ministry has started sending indicative budget ceilings to various departments as the government is considering announcing the budget on June 5. However, no final decision has been made about the budget date as the country is dealing with the coronavirus pandemic.

The government has also decided to shorten the approval process of the development budget and the Priorities Committee meetings might not take place this year.

Read Shahbaz Rana’s story here.

April 29: Economy faces first-ever contraction since 1951

For the first time in nearly seven decades, Pakistan’s economy is expected to post a negative growth rate of about 1.6% this fiscal year, the finance ministry said on Tuesday, confirming the recession forecasts by leading global financial institutions because of the coronavirus pandemic.

The ministry warned against relaxing the ongoing lockdown in the country, which is in its sixth week. It cautioned that this could increase the infection rate and put unbearable burden on the already exhausted health system.

Read Shahbaz Rana’s full story here.

April 16: Pakistan's budget deficit may hit record high due to coronavirus

Pakistan’s budget deficit is expected to rise to the highest level in history to 9.2% of the size of national economy or Rs4 trillion in current fiscal year due to the impact of deadly contagion on revenues and expenses, says a new report of the International Monetary Fund (IMF).

In the Middle East and Central Asia Regional Economic Outlook (REO) Update released on Wednesday, the global lender also urged Pakistani authorities to ramp up spending on the health sector that remained the lowest in the region. Fiscal expansion is expected in all countries as the fight against the virus and its economic effects is scaled up, stated the report.

Pakistan’s budget deficit that in pre-Covid-19 situation had been projected at 7.3% of gross domestic product (GDP), may increase to 9.2%, according to the report. In absolute terms, the deficit will be equal to Rs4 trillion, higher by Rs800 billion than previous estimates.

Read Shahbaz Rana’s full report here.

April 14: Punjab to undertake Rs100b worth of schemes in FY21

Punjab Finance Minister Makhdoom Hashim Jawan Bakht has said that the province is looking to introduce Rs100 billion worth of schemes through the next budget to mitigate the economic impact of Covid-19.

He called for reducing fiscal deficit constraints under the International Monetary Fund (IMF) loan programme, adding that Punjab had to provide economic stimulus alongside more spending on health and social protection.

The stimulus includes provision of relief to businesses to neutralise the pandemic’s economic impact.

Read Shahram Haq’s full report here

PRODUCED BY: MAIDAH HARIS & NIHA DAGIA

CREATIVE IMAGES: IBRAHIM YAHYA

PHOTOS: EXPRESS & REUTERS