From July to December 2019, the country’s total debt and liabilities increased to Rs41 trillion, an addition of Rs770 billion or 2% as compared to the June 2019 position, reported the State Bank of Pakistan (SBP) on Monday.

PTI govt to freeze power tariff for a year

However, where the overall pace of increase in debt and liabilities slowed down, the servicing of debt and liabilities increased significantly in the first half due to the high policy rate of 13.25% set by the SBP.

In June 2019, the total debt and liabilities had increased to Rs40.2 trillion, which was equal to 104.3% of the gross domestic product (GDP). By December 2019, the ratio came down to 94.1% of the projected GDP for fiscal year 2019-20. But it is still at a dangerously high level and unsustainable.

Total debt and liabilities also include the public sector enterprises’ (PSEs) debt, non-governmental external debt and inter-company external debt from direct investors abroad.

The external debt and liabilities of Pakistan amounted to $111 billion as of December 2019, according to the central bank. There was an addition of $4.7 billion to the total external debt and liabilities in first half of the current fiscal year.

In the first year of the PTI government, the country’s total debt and liabilities had soared to Rs40.2 trillion, an increase of Rs10.3 trillion or 34.6%.

Cumulatively, the total debt and liabilities have increased by Rs11.1 trillion or 37% since the PTI came to power one and a half year ago.

The key reason behind the slow growth in Pakistan’s total debt and liabilities in the first half of FY20 was a stable exchange rate, which gave benefit of nearly Rs600 billion to the government.

Depreciation or appreciation of one rupee adds or reduces Rs111 billion from the public debt. In June 2019, the average exchange rate was Rs163 to a dollar, which appreciated to Rs154.8 by December 2019.

Similarly, a 1% increase in interest rate increases the cost of debt servicing by roughly Rs225 billion. This ultimately increased the borrowing requirement for the finance ministry. The PTI government had also built huge cash buffers before the start of IMF programme, which also caused an increase in public debt. Now, this policy of building buffers has also paused.

Debt level of loss-making enterprises did not increase in the first half of the current fiscal year. By the end of last fiscal year, the total debt of PSEs had surged to Rs1.62 trillion, which came down to Rs1.6 trillion by the end of first half of the current fiscal year.

Of the Rs41 trillion, the gross public debt, which was the direct responsibility of the government, stood at Rs33.7 trillion at the end of December 2019. There was an increase of Rs1 trillion or 3% in the gross public debt in first half of the current fiscal year.

Gross public debt was now equal to 77.3% of GDP, far higher than the 60% statutory limit set in the Fiscal Responsibility and Debt Limitation Act of 2005. But it was 84.8% in June 2019. In the last fiscal year, there was an increase of Rs3.7 trillion in the gross public debt, which was higher than the overall budget deficit recorded during the period.

One of the key reasons behind the higher debt was the increase in interest rate and depreciation of the rupee in the last fiscal year.

Excluding the liabilities, the country’s total debt swelled to Rs38.75 trillion, up Rs971 billion or 2.5% in six months.

PTI govt excludes PSM from CPEC framework

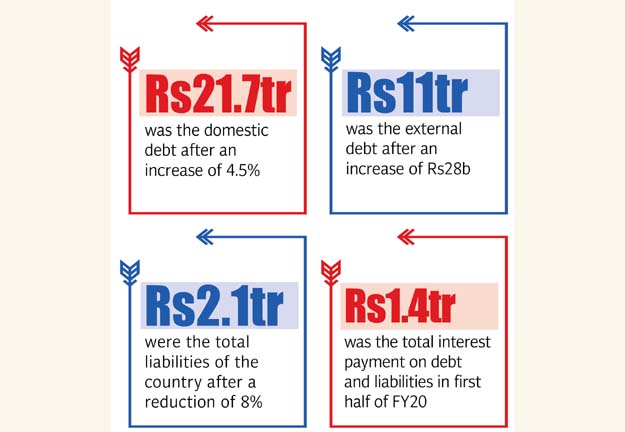

Government’s domestic debt increased to Rs21.7 trillion, an addition of Rs945 billion or 4.5% in the first six months of current fiscal year. The external debt rose by Rs28 billion to Rs11 trillion.

Total external debt and liabilities fell slightly to Rs17.2 trillion on the back of currency appreciation.

Debt taken by Pakistan from the IMF increased in rupee terms by Rs121 billion to Rs1.04 trillion due to the release of two loan tranches.

Total liabilities, which were indirectly the responsibility of the finance ministry, shrank Rs199 billion or 8% in six months of FY20 to Rs2.1 trillion.

Interest payment on debt and liabilities stood at Rs1.4 trillion in the first half of FY20.

Published in The Express Tribune, February 19th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ