The total outlay of the budget is Rs7.022 trillion, focusing on fiscal consolidation, revenue mobilisation and austerity measures. The Money Bill included a new stringent fiscal law that it added to the Finance Act at the last minute.

The treasury benches rejected almost all the amendments to the finance bill moved by the opposition members after there was a discussion on them by both sides, whereas amendments moved by Minister for Finance and Revenue Hammad Azhar were adopted by the house.

At the start of the proceedings, Azhar moved the motion to present the finance bill before the house for consideration and voting. After voice voting on the motion to introduce the bill, the opposition challenged the vote and asked the Speaker for a head count.

One hundred and seventy-six (176) members of the treasury benches favoured the motion while 146 members of opposition opposed it. After the passage of the motion with majority vote, the minister introduced the finance bill which was passed by the house with the majority vote.

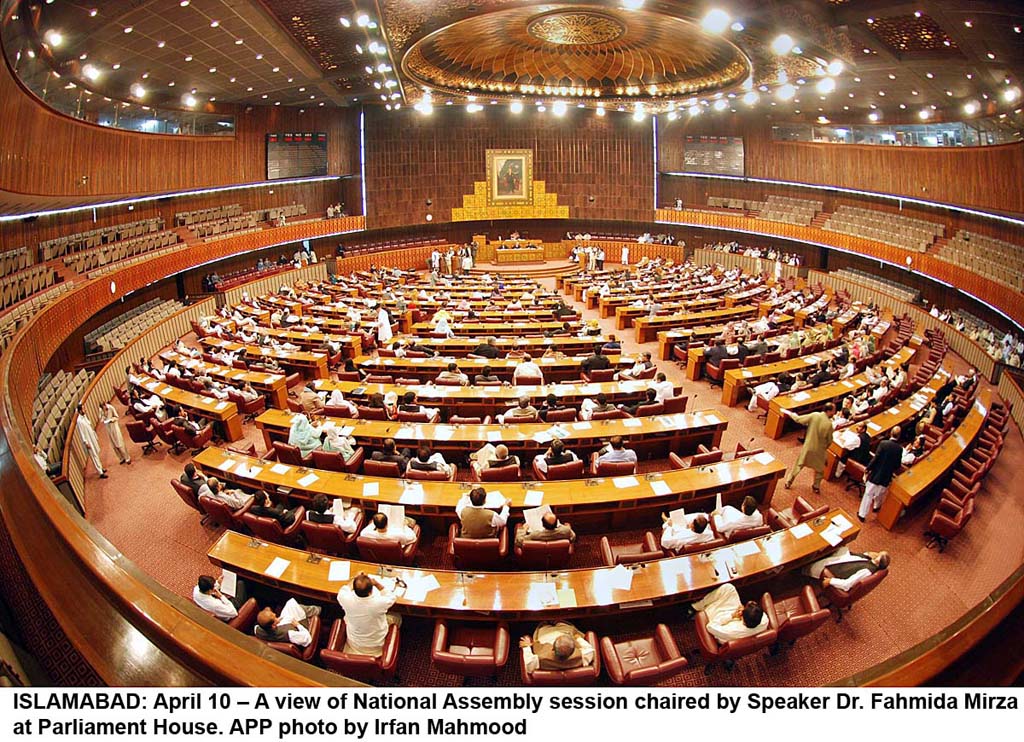

Federal budget sails through National Assembly

The house proceedings remained largely smooth until the minister proposed to include the Public Finance Management Act 2019 in the Finance Act. The approval of the Public Finance Management Act was a pre-condition set by the International Monetary Fund (IMF).

The lower house of parliament passed the Finance Act 2019 through the majority vote during clause-by-clause reading, giving effect to minimum Rs516 billion worth of new taxes. Most of the clauses were approved with the majority vote of 176 to 146.

The new taxes have been imposed to achieve Rs5.550 trillion tax collection target during the next fiscal year.

PML-N’s Rana Tanveer Hussain offered the government that the opposition would stop calling Prime Minister “selected”, if the government achieves Rs5.550 trillion tax target in the next fiscal year.

The National Assembly also approved certain amendment in the Tax Amnesty law, allowing people to deposit cash in banks beyond June 30; however, the government kept the last date of availing the tax amnesty scheme unchanged at June 30.

The assembly also approved to slap 17% sales tax on biscuits, tiles and auto parts, which was not part of the original Finance Bill.

The new budget will come into force from July, but the controversial Public Finance Management Act (PFMA) would come into force immediately in order to meet the condition of the IMF.

The moment Hammad Azhar proposed to include the PFMA in the Finance Act, opposition members rose at their seats to protest the government action.

The government was trying to get a new law approved through an amendment, which is not only illegal but tantamount to bulldozing the assembly’s proceedings, said PPP’s Syed Naveed Qamar.

Public Finance Management Act

The law has been enacted to strengthen management of public finances, improve implementation of the fiscal policy and clarify institutional responsibilities related to financial management and budgetary management.

Through the new law, the government has provided a new legal regime to regulate custody of the Federal Consolidated Fund, payment of moneys into the fund, withdrawal of moneys from the FCF, the custody of other moneys received on behalf of the government and to give effect to Articles 78 to 88, 118 to 127 and 160 to 171 of the Constitution.

In future, all revenues, loans and receipts of the federal government will be placed only in the FCF. The new law will also regulate payments to all constitutional offices and constitutional office-holders of Pakistan.

The PFMA has also given effect to the constitutional concept of finance committees, which is provided in Article 88 of the Constitution.

The Public Finance Management Act will also have a bearing on the National Finance Commission, as its scope also includes Article 160. The receipts of natural gas and hydropower will also be regulated under the new law.

The federal government will be legally bound to approve the Budget Strategy Paper containing quantified macroeconomic and fiscal projections by March 15 of every year.

Unlike the past, the federal government will be legally bound to include contingent liabilities in the Annual Budget Statement that will be presented before the National Assembly for approval.

In order to cut tax breaks to the rich and bring them in public knowledge, details of the tax expenditures will be laid before the National Assembly.

In case of supplementary budget, the federal government will have to lay details of such expenditures before the National Assembly as Excess Budget Statement, which the National Assembly will have to approve. Currently, the government gets the National Assembly approval after spending the money.

The ministries will be legally bound to surrender their savings 25 days before the presentation of the new budget.

In a bid to stop wastage of funds, development projects can only be approved as core projects in national infrastructure and sectoral projects. Only those projects will be allocated funding that have technically been vetted by the Planning Commission.

After the passage of the law, all government ministries, divisions, attached departments and subordinate offices will immediately remit their funds in the FCF. All foreign loans will be remitted in the FCF.

The unspent budget would automatically lapse on the close of the fiscal year.

If the excess expenditures are incurred without the approval of the National Assembly and the Public Accounts Committee does not regularise the illegality, the money can be recovered from public servants. The government will be legally bound to take disciplinary action against those officers responsible for the wastage.

All special purpose funds, approved by the National Assembly, will be subject to the audit by the Auditor General of Pakistan.

Tax Amnesty

The National Assembly approved to allow people to deposit cash in the bank accounts beyond June 30 by paying 2% additional tax but the declaration for the tax amnesty has to be filed by June 30. Effectively, the government has not given extension in the tax amnesty scheme but facilitated people to deposit cash in banks, which is a pre-requisite to declare cash under the scheme.

The cash can be deposited on account of immovable property or investment but the person will have to disclose the particulars of the immovable property and investment in business by June 30.

The National Assembly also approved to declare gold as stock in trade to jewelers, which was not in the original tax amnesty ordinance.

The government has given another relaxation in the tax amnesty scheme. At the time of launching of the tax amnesty, if a person misrepresents or suppresses the facts his declaration under the law will be considered void. Now, only disclosure of that particular asset where the facts have been changed will be considered as void and the rest of the declaration will be treated as lawful.

Income Tax Amendments

The National Assembly approved to impose Rs10 million fine in case a person conceals his/her offshore assets but reduced imprisonment period from seven to three years. On not responding to a tax notice on concealment of offshore assets, the National Assembly approved to impose 2% fine of the value of undeclared assets and two years of penalty on such a person.

The government has given a concession to the real estate sector and exempted the Capital Gains Tax after ten years instead of the budget proposal of ten years on sales of open plots. But it is still better than the pre-budget limit of three years. For constructed property, the Capital Gains Tax exemption limit has been allowed on sale after four years as against the budget proposal of five years.

The National Assembly also approved to change the Capital Gains Tax on immovable property. It approved 5% CGT rate where the gain is not more than Rs5 million, where the gain exceeds Rs5 million but is below Rs10 million, the rate will be 10%, on up to Rs15 million gain, the CGT rate will be 15%, and where the gain is above Rs15 million, the tax rate will be 20%.

The government cut the minimum tax rates for dealers and sub-dealers of sugar, cement and edible oil to 0.25% from 0.75% of the gross amount of payments, respectively.

The National Assembly also approved to relax the condition of nonresident Pakistani from 90 days stay in Pakistan to 120 days.

The government also addressed a lacuna that allowed the real estate sector to escape the tax net by paying only 4% income tax. It has inserted a proviso in the law that states, “provided that the provision of Section 111 shall be applicable in unexplained income, asset or expenditure in access of imputed income treated as concealed income under this rule and”.

The FBR has also made it mandatory that such person will also file the wealth statement.

The Express Tribune has pointed out a new realty sector tax amnesty scheme given in the budget.

Customs Act

The government also modified its budget proposal about misdeclaration of value for illegal transfer of funds by understating the value of exports and overstated value of imports. Against the earlier proposal of sending such person a notice within two months, now the FBR can send such notice in two years from the date of detection of misdeclaration.

The government also reduced the fine for misdeclaration of goods from Rs200,000 to Rs100,000 and the imprisonment term has been reduced from the proposed ten years to five years. The Senate Standing Committee on Finance had recommended to relax the punishment.

The government also agreed to withdraw the proposal of giving powers to the prime minister to appoint judges of the appellate tribunals.

The FBR has been bound to constitute a committee for alternate dispute resolution within one month.

NA unanimously passes defence budget

Sales Tax amendments

The government has also imposed 17% sales tax on the retail prices of biscuits, tiles and auto parts. But it withdrew 2% value addition sales tax on silver and gold in the final budget. The assembly also approved reducing the sales tax rate on registered retailers of textiles and garments from 15% to 14%. But it is still higher than 6% rate before the budget.

The government also reduced sales tax on the processed frozen sausages, poultry and meat products from the proposed 17% to 8%.

The house also approved relaxing the condition of obtaining CNIC or NTN of the buyer to the extent that the transaction value does not exceed Rs50,000, if the sale is made to an ordinary person for his own consumption. This is a big relaxation that the government has conceded to industrialists.

It has delayed the implementation of the CNIC condition for one month to August 1, 2019 aimed at giving time to industrialists. It also approved that if a buyer provides wrong CNIC, it will not be the responsibility of the seller.

The FBR has also obtained powers that all tier 1, big-sized retailers that are required to be registered with the FBR will be bound to integrate their retail outlets with the board’s computerised system.

The federal government also obtained legal powers to impose fees and service charges through gazette notification on any service or control mechanism -- including public-private partnerships.

ICT Law amendment

The government has withdrawn 16% sales tax that it has proposed to impose on property dealers involved in the sale and purchase of property within the jurisdiction of the Islamabad Capital Territory.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ