The impact of the restriction, which was removed in the mini-budget announced on Wednesday, is reflected in the financial results announced by Honda Atlas Cars on Thursday.

Despite multiple price hikes, Honda’s third-quarter (Oct-Dec 2018) earnings came below market expectations, with earnings per share of Rs4.2, down 58% compared to Rs9.92 in the same quarter of previous year. Honda’s after-tax profit dropped to Rs601.6 million in Oct-Dec 2018 compared to Rs1.4 billion in the corresponding quarter of previous year.

“Profit of the company was dragged down by both lower sales as well as lower gross profit margins,” commented Syed Daniyal Adil, an analyst at Topline Securities, while talking to The Express Tribune.

Even though the company raised vehicle prices four times since December 2017, its net sales fell 2% year-on-year due to 11% fall in volumes in the Oct-Dec quarter.

The company along with other two local manufacturers of vehicles - Pak Suzuki Motor Company and Indus Motor - has faced almost 35% decline in vehicle bookings, according to Pakistan Association of Automotive Parts and Accessories Manufacturers (Paapam) former chairman Aamir Allawala.

“Rupee depreciation has also played a greater role in the lower sales,” said Hammad Tariq, an analyst at Shajar Capital. The rupee weakness forced the automakers to increase prices of vehicles, which discouraged the consumers eager to purchase new models.

Year-on-year, the decline in volumes was led by 61% lower sales of BR-V variant in the Oct-Dec 2018 quarter while sales of City and Civic variants showed 6% growth in the same period.

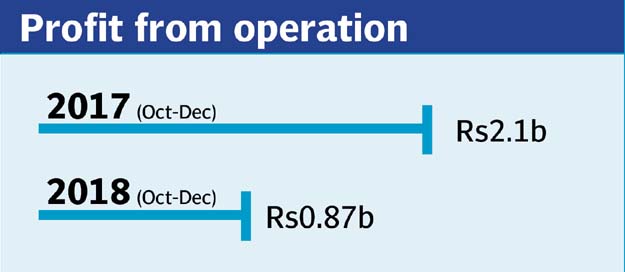

Moreover, the gross profits fell 29% year-on-year due to 1% increase in the cost of sales despite 11% reduction in unit sales. Gross margins fell 280 basis points to 7.7% in the quarter under review.

The primary reason for the falling gross margins was 32% rupee depreciation from December 2017 to December 2018, which led to increase in the cost of both local and imported parts.

According to Topline Securities, a 50% decline in other income of the company hurt the bottom-line. “The decline in other income is a result of lower cash and short-term investments due to reduced advances from customers,” Topline said in its report.

In nine months (Apr-Dec 2018), Honda’s earnings fell 48% year-on-year due to a 450-basis-point decline in gross margins. Other operating cost went up 28% and other income fell 26%.

“A further unfavourable movement in the exchange rate and commodity prices, regulatory changes, increased competition from existing and new players and disruption in operations of the principal company are key risks for the company,” said Topline.

Published in The Express Tribune, January 25th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1719053250-0/BeFunky-collage-(5)1719053250-0-270x192.webp)

COMMENTS (2)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ