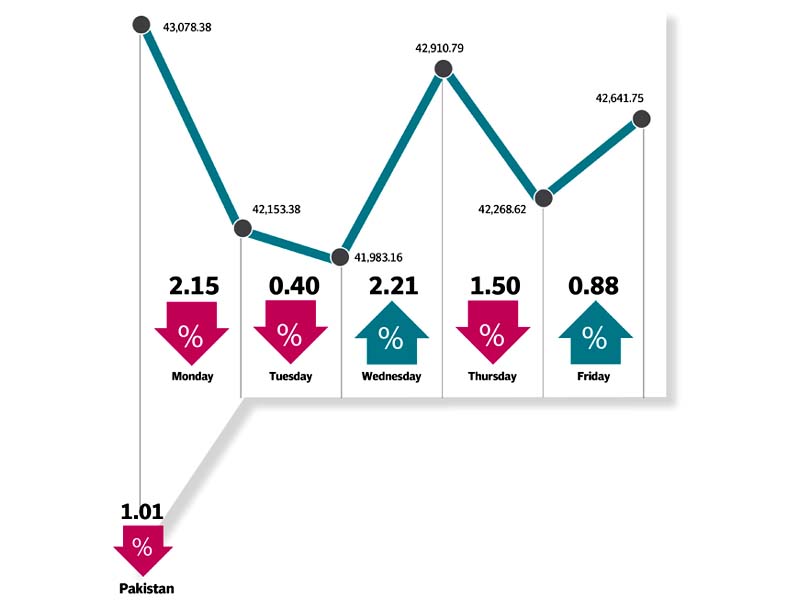

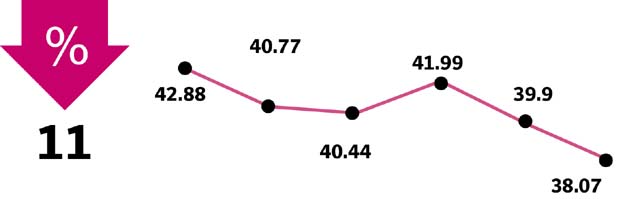

KARACHI: What started as another volatile week, threatening to touch new lows, made a promising comeback and closed the week just 437 points down (1% week-on-week) to settle at 42,641.75 points.

It appeared that investors may have overplayed the volatile elements at play. Monday kicked-off on a bearish note with the index tanking 1,000 points in intra-day trading. Tuesday continued from where the last session left off and plunged a further 1,000 points, to close at 41,983.16 - the all-time low of 2017.

Weekly review: KSE-100 Index loses 885 points, down 1.96%

Continuing from the previous week, the four-day losing streak finally came to an end on Wednesday, as the KSE-100 Index posted a massive recovery surging close to 1,000 points in intra-day trading on the back of oversold cement, automobile and oil stocks with attractive valuations.

The Pakistan Stock Exchange has remained under pressure due to political uncertainty, the ever-increasing current account deficit, Afghan-US diplomatic ties, Pak-US relationship and the anticipation over possible devaluation in the rupee.

These factors took a toll on the stock market, leading the index to revisit the red zone on Thursday, declining over 600 points. However, Friday saw a turn of events as the KSE-100 once again surged to close positive.

The KSE-100 index is down 19% from its all-time high level of 52,876 points on May 24, 2017. Earnings have also failed to spur any interest, with most being inline or missing while beats have been due to one-offs or reversals.

Volatility was further instilled by the cement sector as major scrips took a beating owing to the cut in cement prices in the north zone by Rs20-25/bag, thus pulling the index down 261 points. Other sectors that followed were fertilisers (84 points) and technology and communication (56 points) that dragged the index down.

OMCs shed 3% likely on the notion that reducing POL consumption/imports may arrest the sliding deficit, E&Ps and banks held their ground as potential currency depreciation and monetary tightening may bode well for the sectors.

Major trading volume was witnessed in small cap stocks led by Azgard Nine (ANL: 74.7m shares), Aisha Steel (ASL: 41.6m shares) TRG Pakistan (TRG: 74.8m shares) and Bank of Punjab (BOP: 41.8m shares).

Participation remained dull with average volumes declining 2.1% to 180 million, while value traded was down 1.4% to $92 million.

Stock-wise, HBL, UBL and Bank AL Habib, contributed 192 points to the KSE-100 index. Pakistan Petroleum, Pakistan Oilfields also continued to defy the broader market direction and added to their gains as local investors opted to hedge their investment portfolios with dollar-hedged stocks.

Weekly review: KSE-100 gains 1.1% amid upcoming MSCI inclusion

On the other hand, Lucky Cement and DG Khan Cement dragged the benchmark index by 160 points as both companies are exposed to risk of possible cement price attrition in the southern region; owing to substantial upcoming capacity addition of 5.25mntpa (61% of existing capacity).

Foreign investors again demonstrated their uneasiness over expected devaluation of the exchange rate with further offloading of $9.7 million worth of equities during the week.

Most of this selling was absorbed by local financial institutions such as banks (net buying of $12.5m) and mutual funds (net buying of $3.2m), to scoop up value plays at dirt cheap multiples.

Major selling was witnessed in cements ($5.45 million) and E&Ps ($2.77 million), whereas buying was settled in telecom sector at $0.78 million.

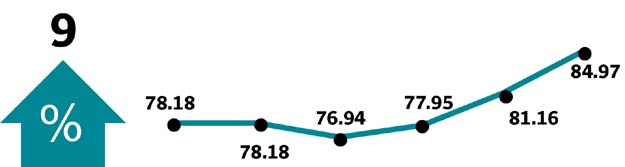

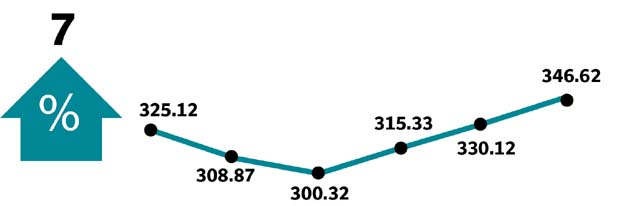

Winners of the week

Philip Morris

Philip Morris Pakistan Limited manufactures and sells tobacco and cigarettes.

Feroze 1888

Feroze 1888 Mills Ltd manufactures and sells a wide range of cotton towels and fabrics.

Ferozsons Laboratories

Ferozsons Laboratories Ltd manufactures and sells pharmaceuticals products.

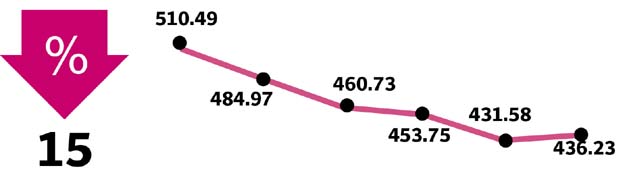

Losers of the week

Service Industries

Service Industries Limited specialises in manufacturing tires and tubes for motorcycles, bicycles, rickshaws and trollies. The company also produces footwear.

Shell Pakistan

Shell Pakistan Limited markets petroleum and petrochemical products. The company also blends and markets different types of lubricating oils.

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centres and offices located in Pakistan and elsewhere throughout the world.

Published in The Express Tribune, August 27th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1713421519-0/BeFunky-collage-(4)1713421519-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ