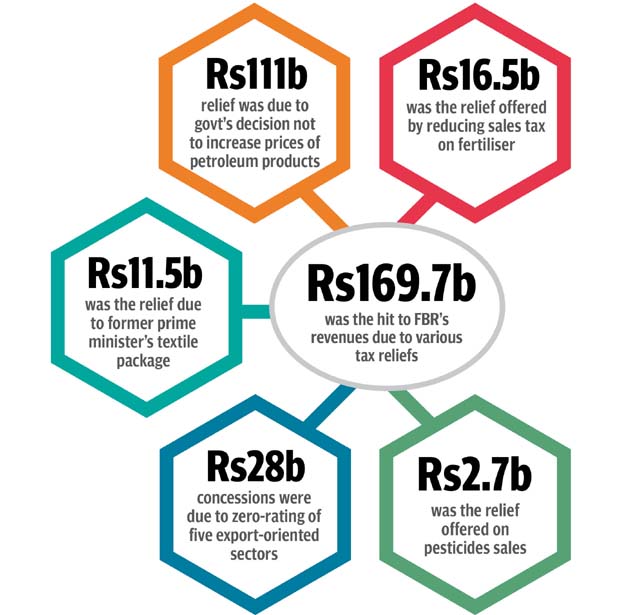

The FBR took a hit of Rs169.7 billion on its revenues due to various tax reliefs given by the government after the announcement of fiscal year 2016-17 federal budget, said Pasha while giving a briefing to the Senate Standing Committee on Finance. Pasha’s stance vindicates the position of the previous FBR management that had refused to take the blame for missing the annual tax collection target due to the same reasons.

Revenue shortfall: FBR misses tax collection target by over Rs250b

However, despite that, former FBR chairman Dr Irshad was subject to a harsh treatment during a meeting held at the finance ministry on July 1.

Against the parliament-approved tax collection target of Rs3.621 trillion, the FBR could collect Rs3.362 trillion till June 30, said Pasha. The tax machinery missed the target by a wide margin of Rs259 billion.

Pasha said the FBR took a hit of Rs111 billion due to the federal government’s decision not to increase prices of petroleum products. He said the federal government also gave a Rs16.5-billion relief by reducing sales tax on fertiliser, Rs11.5-billion relief due to former prime minister’s textile package, Rs28-billion relief due to zero-rating of five export-oriented sectors and Rs2.7-billion relief on pesticides.

“You are saying that it (missing the target) was the fault of the finance ministry,” Senator Saud Majid of the Pakistan Muslim League-Nawaz (PML-N) asked the FBR chairman.

To this, Pasha responded, “what I am saying is that it was not the fault of the finance ministry, but it was the relief that the government gave to the people.”

He said it was the maximum relief given by any government in a single year after the announcement of the budget.

The senators questioned the FBR chairman whether the finance ministry considered negative implications of the Rs169.7-billion tax relief while revising downwards the tax collection target to Rs3.521 trillion. Pasha replied “no”.

The FBR’s final revenue collection of Rs3.362 trillion was higher by 8% over the collections made in the preceding year, said Pasha.

The standing committee questioned the FBR’s performance keeping in view the fact that the 8% revenue growth was even lower than the nominal Gross Domestic Product (GDP) growth of 9.4% last year.

“How can growth in revenue collection fall below the nominal GDP growth rate when the FBR levied additional taxes last year,” said Senator Osman Saifullah of the Pakistan Peoples Party (PPP).

According to economists, the revenue growth should not be below the nominal GDP growth, which is calculated by taking into account the GDP growth and the inflation rate.

In the last fiscal year 2016-17, the estimated GDP growth stood at 5.3% and the inflation reading was 4.16%.

FBR proposes increase in minimum tax on firms, individuals

Any growth rate which is below the nominal GDP growth indicates huge slippages in revenue collection and administrative weaknesses.

The FBR collected Rs1.332 trillion in sales tax in the last fiscal year, which was only 2.3% or Rs29.6 billion higher than the previous year. There were huge revenue leakages under this head.

The direct tax collection stood at Rs1.344 trillion, up Rs127.2 billion or 10.4%. The committee members were of the view that this was primarily because of dozens of withholding taxes imposed by the FBR.

The FBR chairman admitted that the withholding tax collection was “automatic”, but said “it required monitoring” by the FBR officials.

The standing committee also questioned the FBR’s legal powers to enhance sales tax on petroleum products at a time where there was no federal cabinet in the country.

On Tuesday, the FBR notified an increase in sales tax on high-speed diesel from 33.5% to 40% and on petrol from 20.5% to 25% to deny the benefit of reduction in oil prices to the consumers.

The committee apprehended that the FBR could not legally justify its decision in the court of law.

Published in The Express Tribune, August 3rd, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1719053250-0/BeFunky-collage-(5)1719053250-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ